SUSTAINABILITY | ASML Annual Report 2024 | 3 |

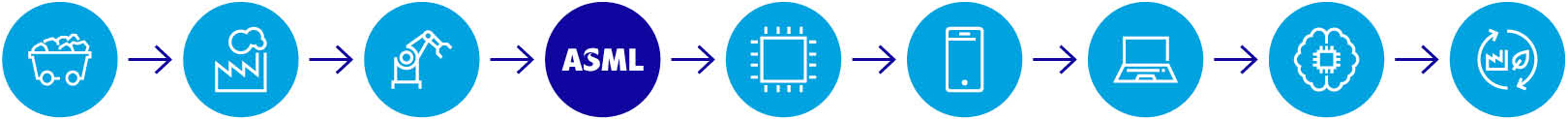

Our technology drives faster, more powerful and energy- efficient microchips that help society tackle important challenges. This continuous innovation can only be achieved through the strong partnerships we build with our various stakeholders, working together to create solutions for a more sustainable future for everyone. | |||||||||

Powering technology forward | |||||||||

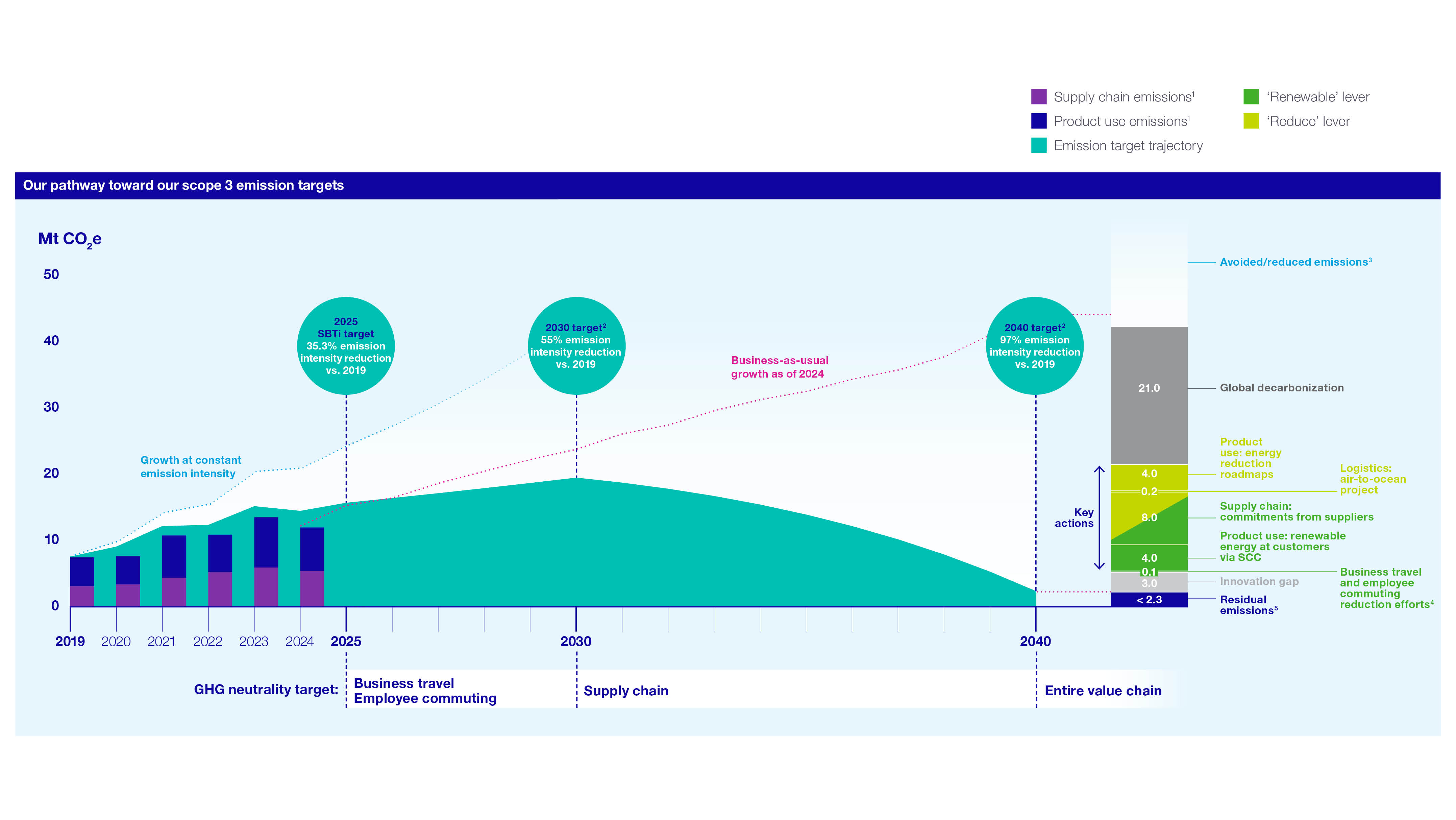

with local communities | |||||||||

with customers | with our people | with suppliers | with partners | ||||||

SUSTAINABILITY | ASML Annual Report 2024 | 4 |

1. Strategic report | ||||||

Forward-looking statements | Our business strategy | |||||

At a glance | Our business model | |||||

In conversation with our CEO | Engaged stakeholders | |||||

| Performance and risk | |||||

Message from our CFO | ||||||

| ||||||

Our business | ||||||

Our holistic approach to lithography | ||||||

Our products and services | Financial performance | |||||

Supporting our customers | Risk | |||||

Driving innovation | Corporate conduct | |||||

Our marketplace | ||||||

2. Corporate governance | |||||

Corporate governance | Meetings and attendance | ||||

Board of Management | Supervisory Board committees | ||||

Supervisory Board | Financial statements and profit allocation | ||||

Other Board-related matters | |||||

AGM and share capital | Remuneration report | ||||

Financial reporting and audit | Message from the Chair of the Remuneration Committee | ||||

Compliance with corporate governance requirements | |||||

Remuneration at a glance | |||||

Supervisory Board report | Remuneration Committee | ||||

An interview with our Chair of the Supervisory Board | Board of Management remuneration | ||||

Supervisory Board remuneration | |||||

Supervisory Board focus in 2024 | Other information | ||||

3. Sustainability statements | |||||

Limited assurance report of the independent auditor on the Sustainability statements | Environmental | ||||

Energy efficiency and climate action | |||||

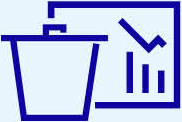

General disclosures | Circular economy | ||||

Basis for preparation | EU Taxonomy | ||||

ESG sustainability governance | Social | ||||

ESG sustainability at a glance | Attractive workplace for all | ||||

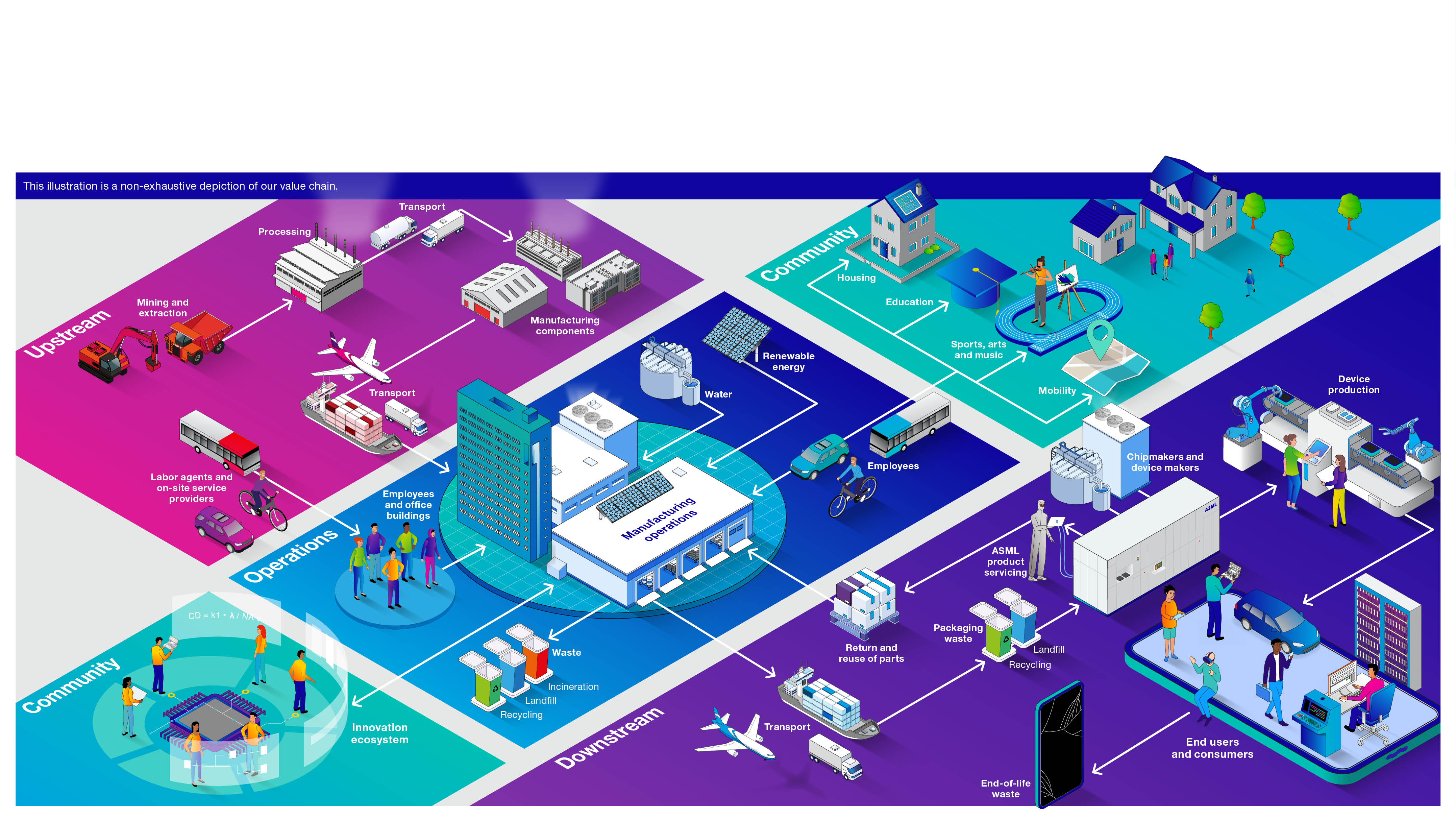

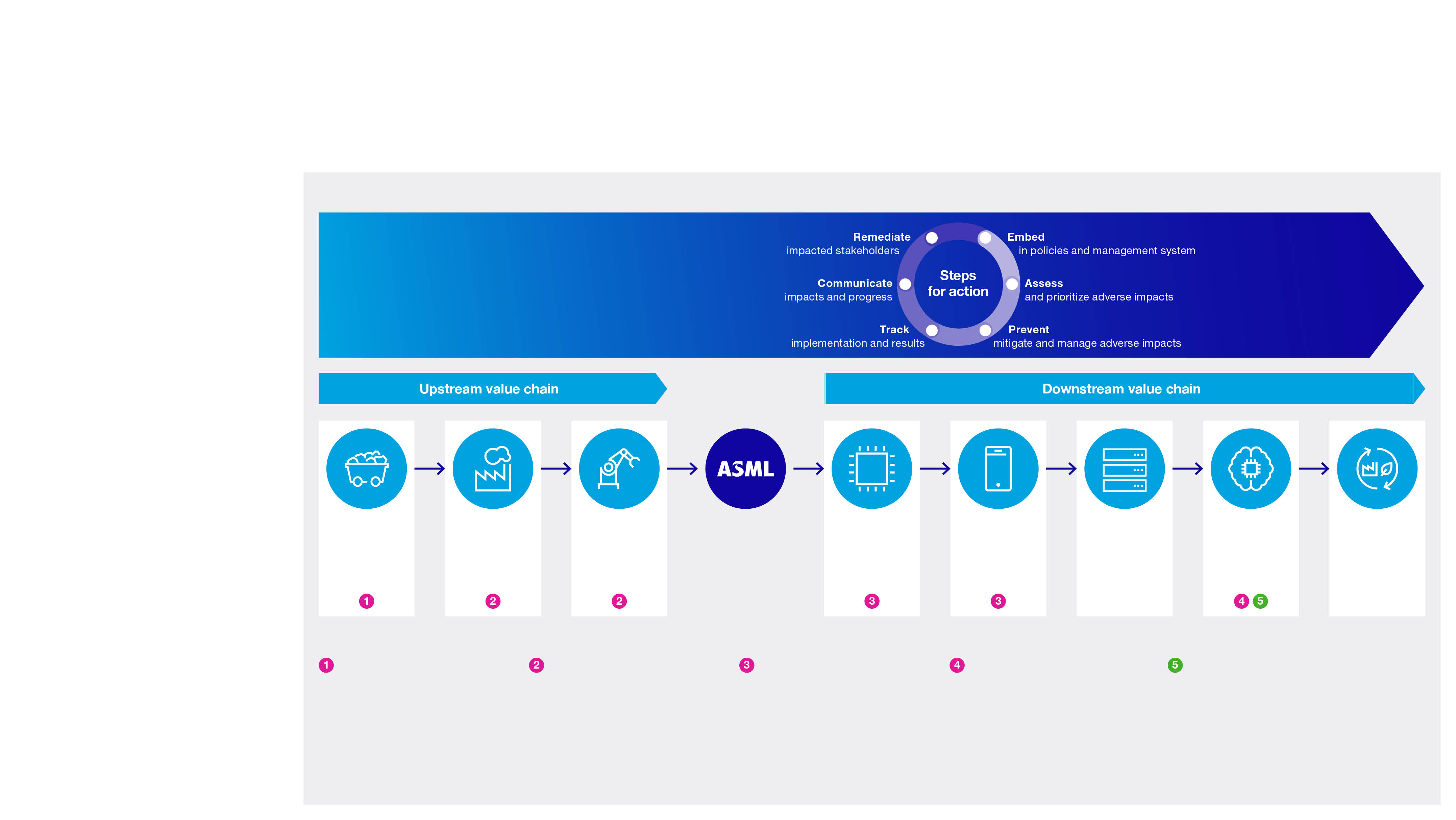

Our value chain overview | Responsible value chain | ||||

Impact, risk and opportunity management | Innovation ecosystem | ||||

Valued partner in our communities | |||||

Contributing to the UN's SDGs | Governance | ||||

Metrics | ESG integrated governance | ||||

Reference table | |||||

4. Financial statements | |||||

Consolidated financial statements | Consolidated statements of cash flows | ||||

Report of independent registered public accounting firm | |||||

Notes to the Consolidated financial statements | |||||

Consolidated statements of operations | |||||

Consolidated statements of comprehensive income | Other appendices | ||||

Definitions | |||||

Consolidated balance sheets | Exhibit index | ||||

Consolidated statements of shareholders’ equity | |||||

A definition or explanation of abbreviations, technical terms and other terms used throughout this Annual Report can be found in the Definitions section. In some cases, numbers have been rounded for readers’ convenience. This report comprises regulated information within the meaning of articles 1:1 and 5:25c of the Dutch Financial Markets Supervision Act (Wet op het Financieel Toezicht). The sections Strategic report, Corporate governance, Supervisory Board report and Sustainability statements (except for the Limited assurance report of the independent auditor on the Sustainability statements) together form the Management Report. | In this report the name ‘ASML’ is sometimes used for convenience in contexts where reference is made to ASML Holding NV and/or any of its subsidiaries, as the context may require. References to our website and/or video presentations in this Annual Report are for reference only and none nor any portion thereof are incorporated by reference in this report. © 2024, ASML Holding NV. All Rights Reserved. |

SUSTAINABILITY | ASML Annual Report 2024 | 5 |

SUSTAINABILITY | ASML Annual Report 2024 | 6 |

Why we exist – our purpose | What we try to achieve – our vision | What we uniquely do – our mission | ||||||||||||||||||

As one of the leading innovators in the semiconductor industry, ASML has been helping chipmakers push technology to new limits and solve some of society’s toughest challenges since 1984. Together, our hardware, software and services provide a holistic lithography approach to mass- producing the patterns of microchips. We design and integrate lithography systems with computational tools, metrology and inspection systems, and process control software solutions – helping chipmakers achieve their highest yields and best performance. | ||||||||||||||||||||

Unlocking the potential of people and society by pushing technology to new limits. | We enable groundbreaking technology to solve some of humanity’s toughest challenges. | Together with our partners, we provide leading patterning solutions that drive the advancement of microchips. | ||||||||||||||||||

|  |  | ||||||||||||||||||

We live by our values to drive success | ||||||||||||||||||||

We challenge | We collaborate | We care | ||||||||||||||||||

By questioning the status quo and pushing boundaries, keeping technology moving forward. | By tapping into the collective potential of our ecosystem of customers, suppliers, partners and stakeholders, creating better solutions. | By acting with integrity and respect, and providing a safe, inclusive and trusting environment where our people can learn and grow. | ||||||||||||||||||

SUSTAINABILITY | ASML Annual Report 2024 | 7 |

€28.3bn |

Total net sales |

€22.4bn Asia €4.5bn US €1.3bn EMEA |

583 |

Net system sales (in units) |

5,150 |

Total suppliers |

1,600 in the Netherlands 750 in EMEA (excl. NL) 1,400 in North America 1,400 in Asia |

€4.3bn |

R&D costs |

We innovate across our entire product portfolio through strong investment in R&D |

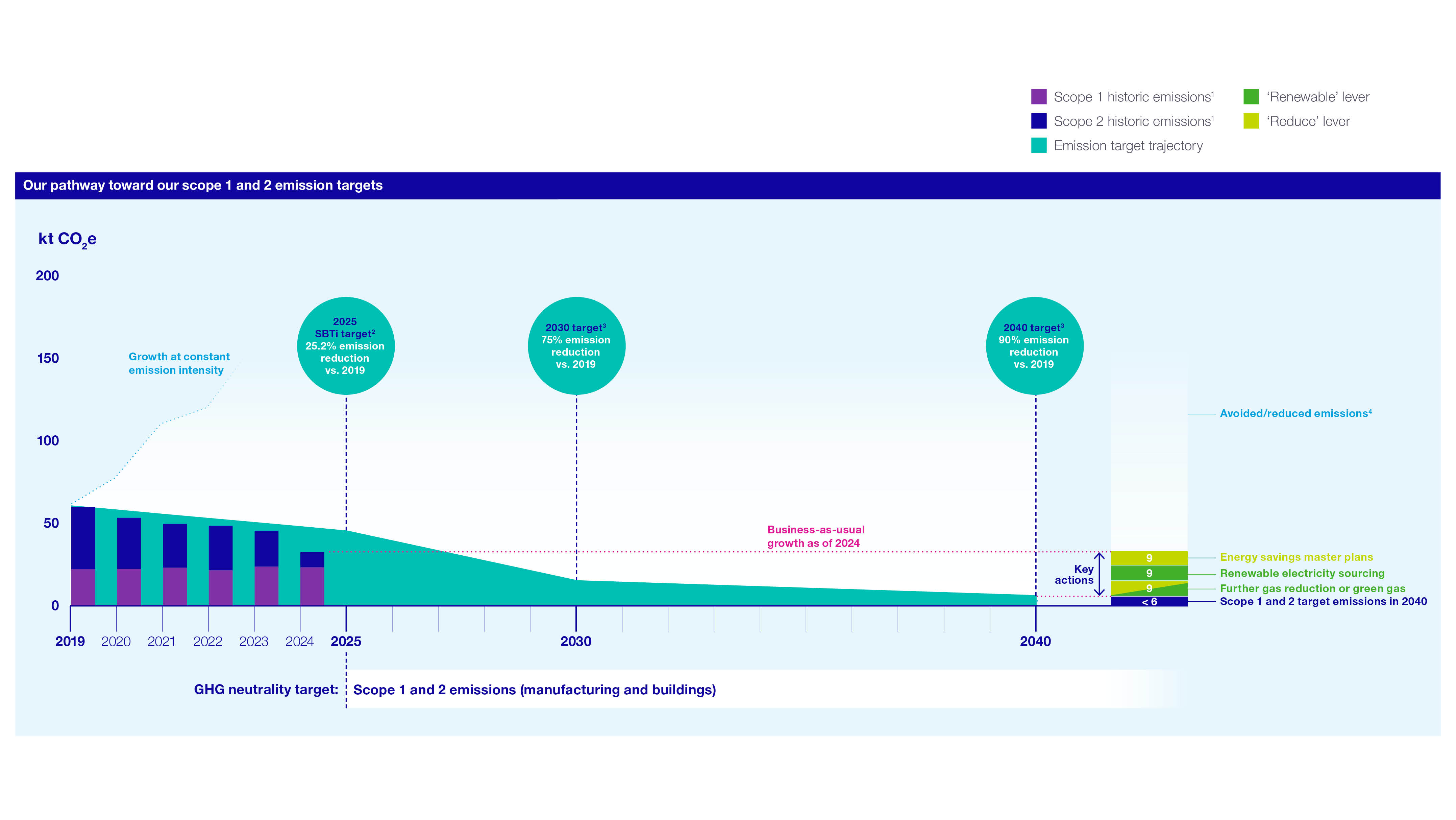

32.8 kt |

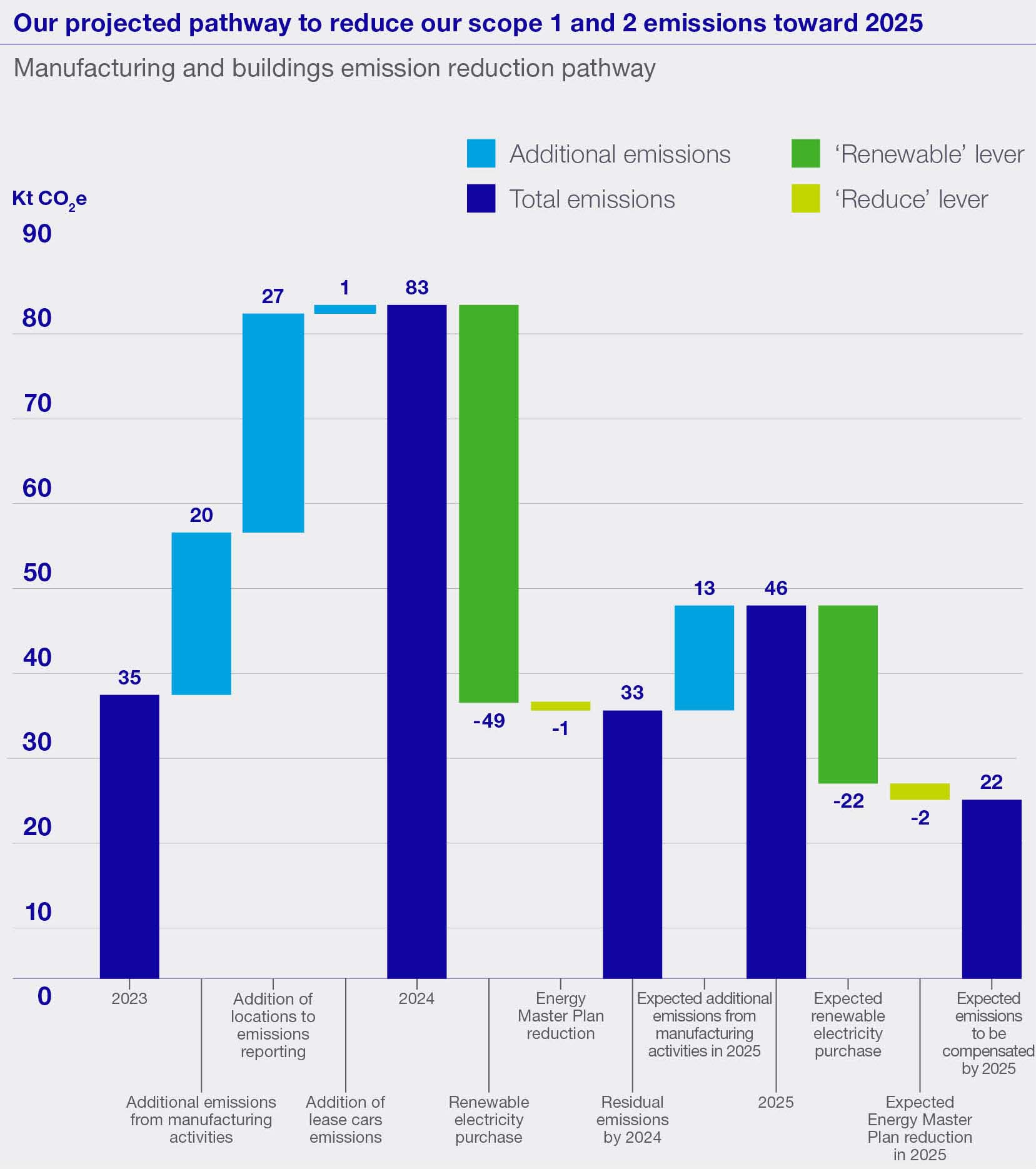

Scope 1 and 2 CO2e emissions |

12.0 Mt |

Scope 3 CO2e emissions |

88% |

Reuse rate of parts returned from field and factory |

51.3% |

Gross margin |

60+ |

Locations |

3 |

Continents |

148 |

Nationalities |

21% | |

Women in entire workforce (headcount) | |

€1,084 |

Amount invested per employee, including employee giving |

SUSTAINABILITY | ASML Annual Report 2024 | 8 |

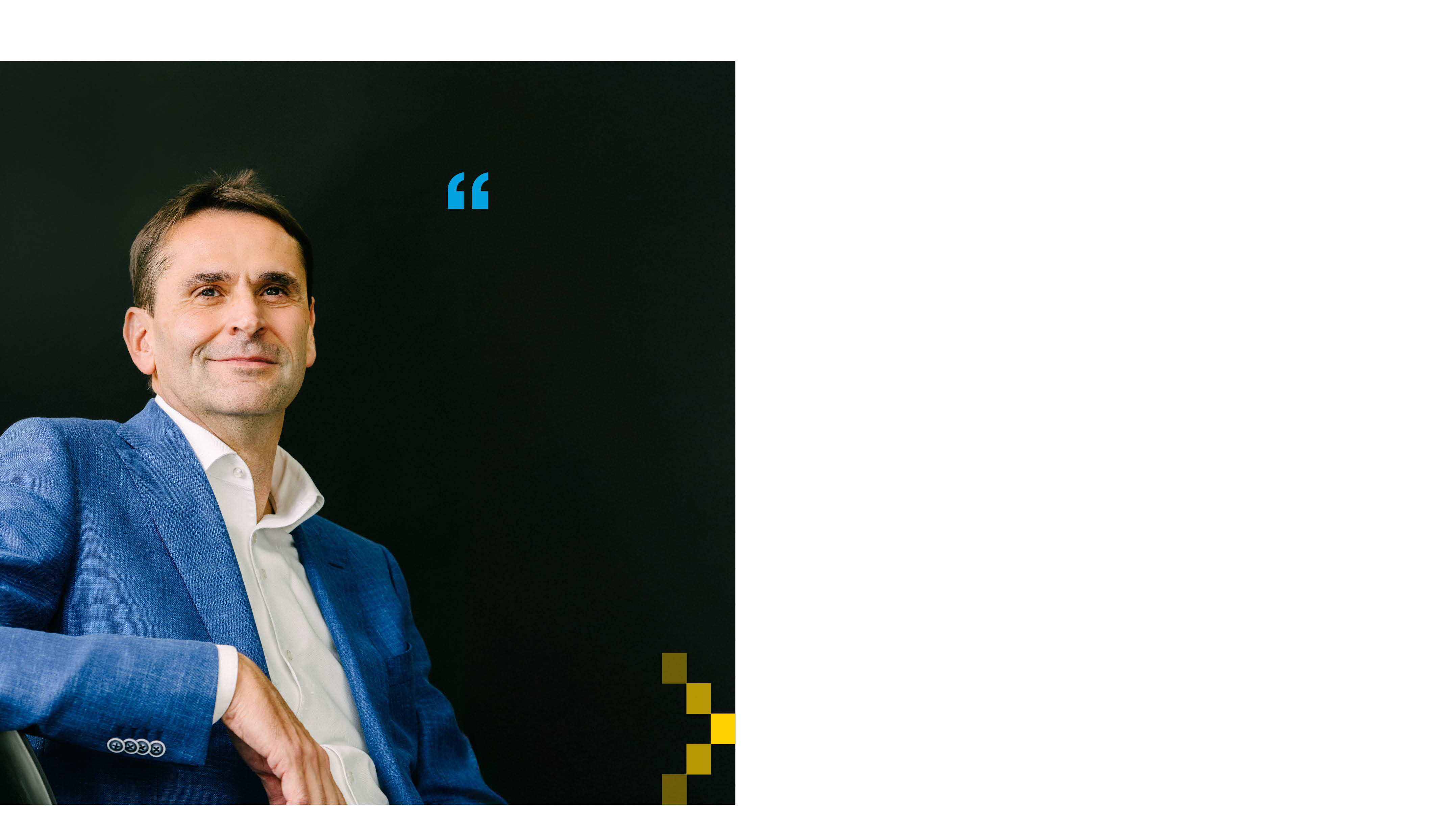

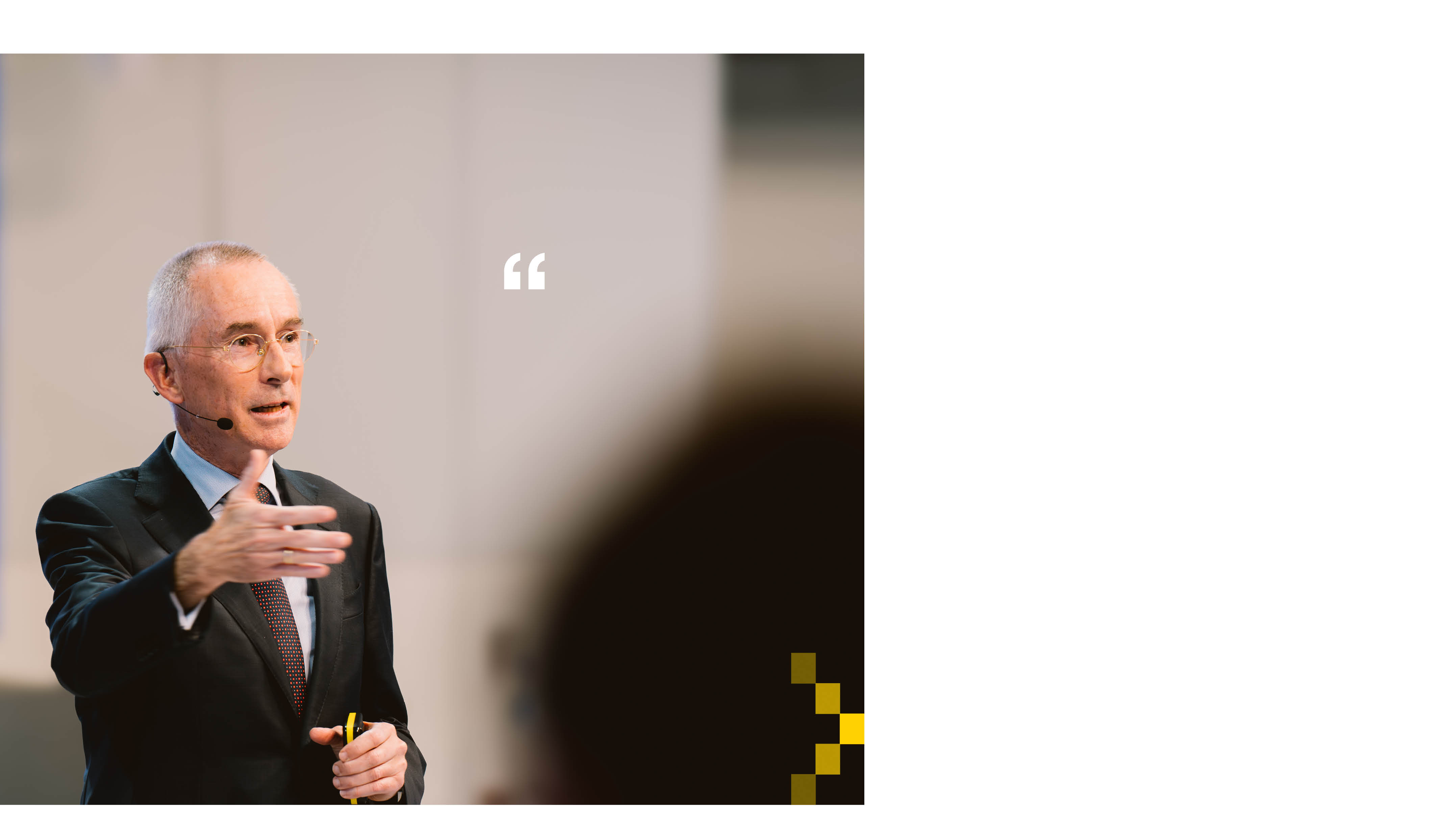

We are committed to powering people and technology forward with you.” | |

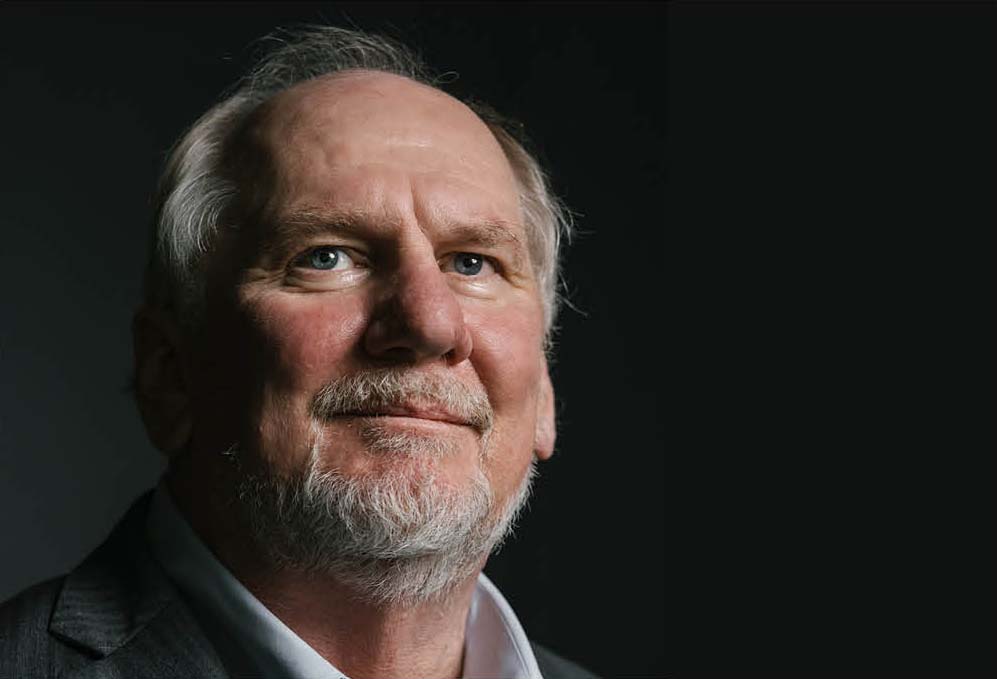

Christophe Fouquet | |

President, Chief Executive Officer and Chair of the Board of Management |

At the 2024 AGM, Christophe Fouquet was appointed President, Chief Executive Officer and Chair of the Board of Management of ASML, succeeding Peter Wennink and Martin van den Brink. In this Q&A session, Christophe outlines the key achievements of the last 12 months, his priorities as the company continues to grow rapidly, and his expectations for the years ahead. | ||||

Q | Looking back at the year, what were the standout moments? | In 2024, we celebrated the 40th anniversary of ASML, and while this was a moment for us to come together to reflect on the past, it was also an opportunity to look ahead. ASML was once a small, obscure company that nobody had heard of, but its role in our industry and in society has changed dramatically over the last four decades. Driven by our strong relationships with our customers, who are always our top priority, we have grown to become an undeniably important global company – but of course, ASML cannot and will not stand still. There is always more that can and must be done. As we expected, 2024 was a year of transition – not only in terms of the leadership team, but also from a market point of view. The business again performed very well, as we explain in detail elsewhere in this report, growing sales to €28.3 billion, up by 2.6% over 2023. Our gross margin was 51.3%, similar to last year and we paid dividends totaling €2.5 billion, while our backlog stands at around a healthy €36 billion. | ||

There were many! This was a period when we installed the industry’s first High NA extreme ultraviolet (EUV) lithography system, achieved financial performance in line with expectations, delivered on our environmental, social and governance (ESG) commitments and continued to lay down plans that will ensure that ASML maintains and extends its standing as one of the world’s great technology companies. As many stakeholders have told me, the transition from Peter and Martin to me was as smooth as a Formula One pit stop, and I thank them both for their support. Great credit is due for their astonishing legacy of innovation which is helping the world rise to its biggest challenges, from climate change and the energy transition to unleashing the full benefits of artificial intelligence (AI). | ||||

| ||||

Celebrating the 40th anniversary of ASML | ||||

SUSTAINABILITY | ASML Annual Report 2024 | 9 |

Q | What were the major innovations that helped ASML push technology forward? |

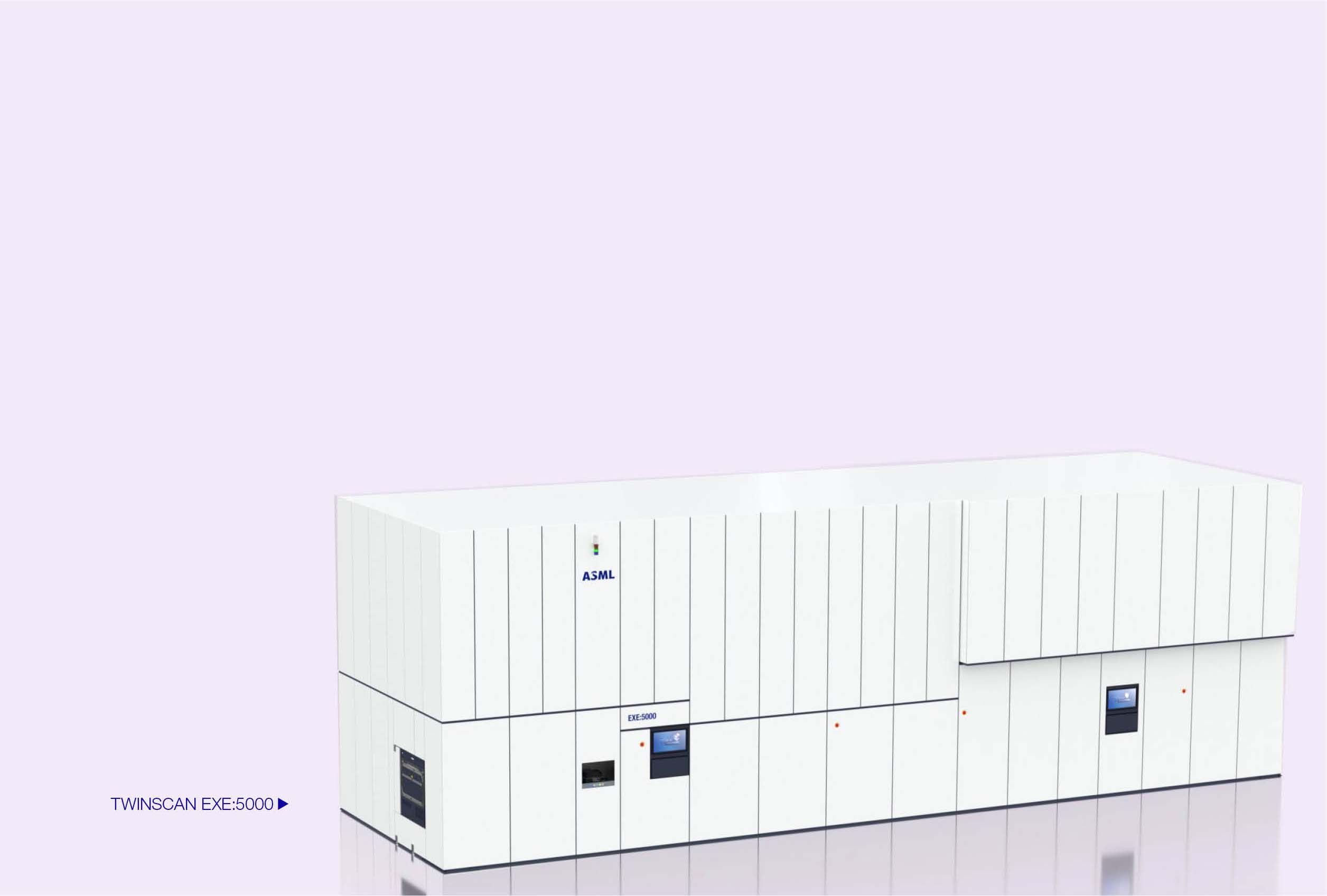

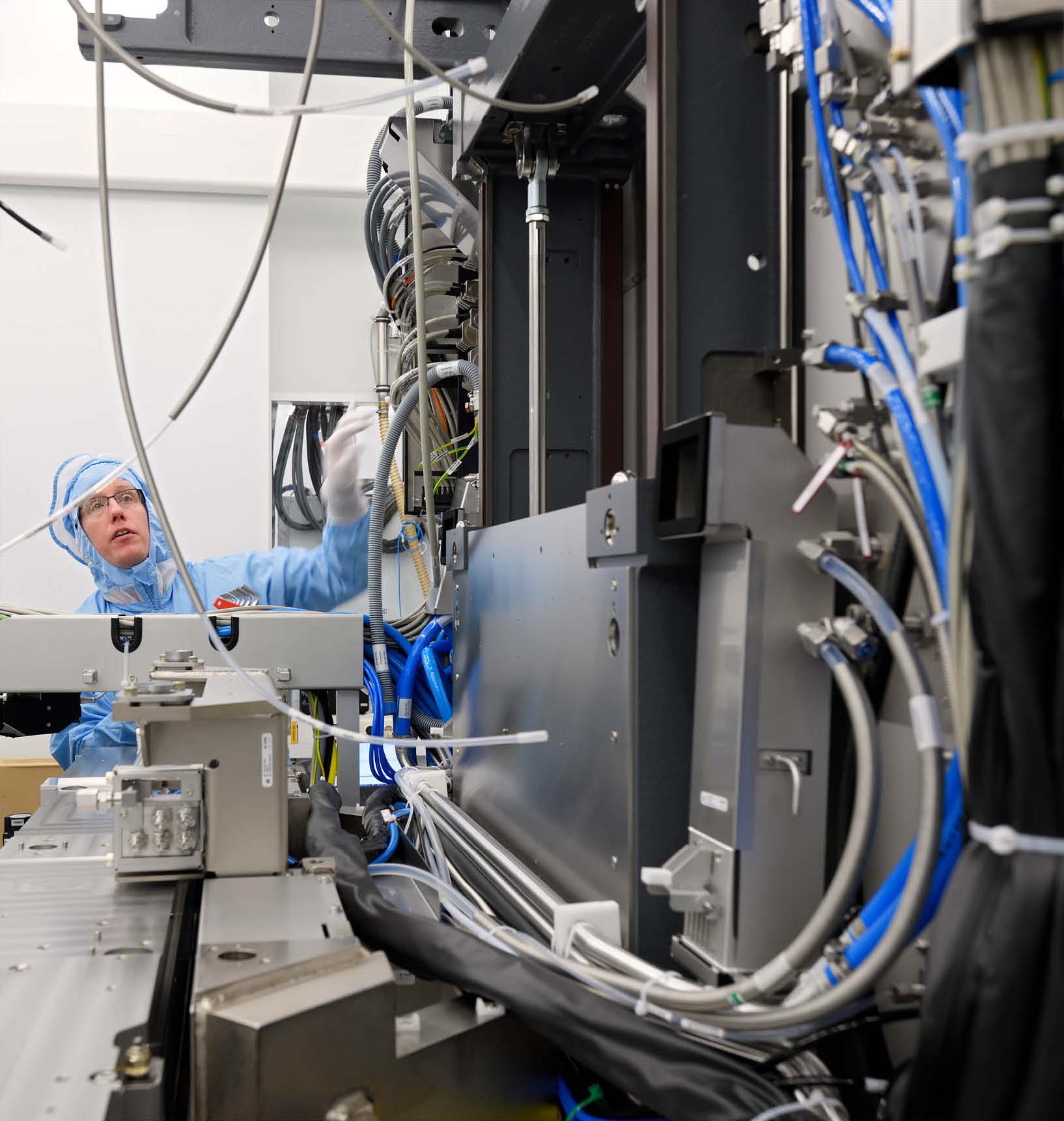

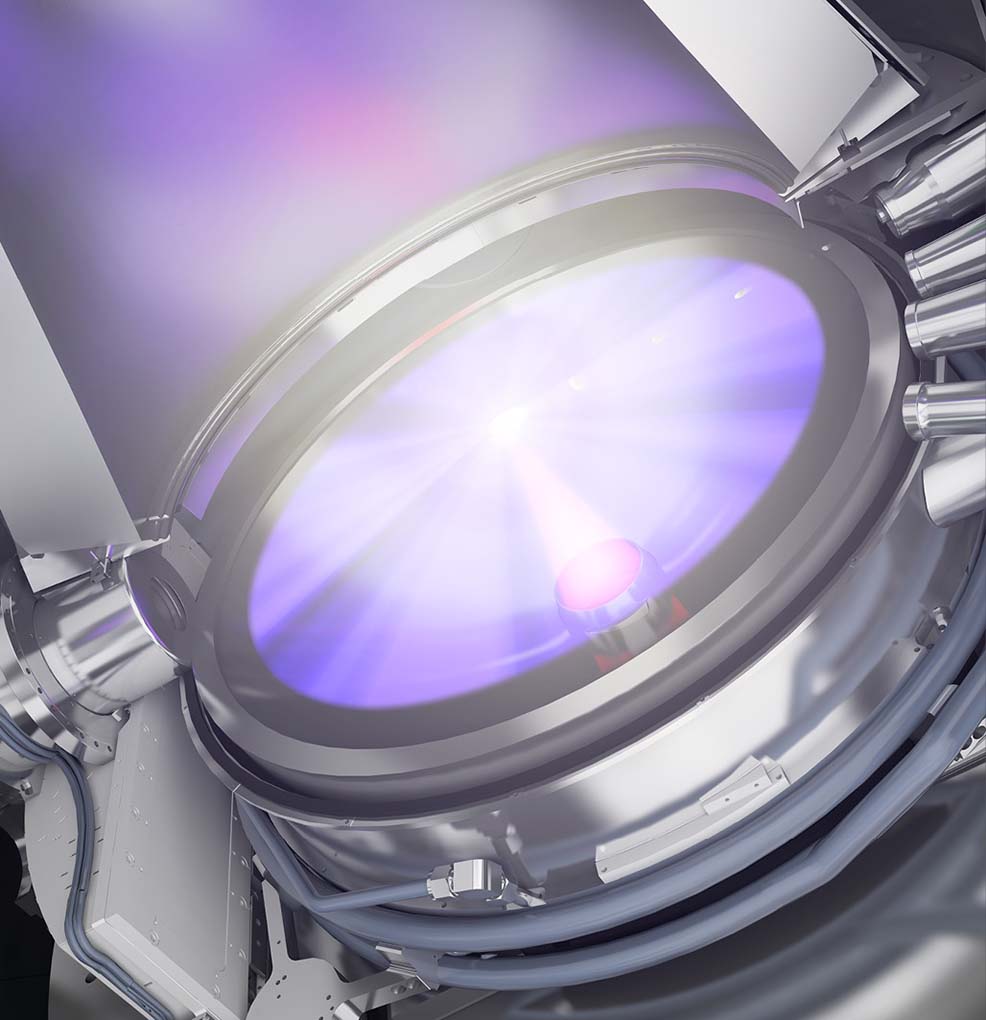

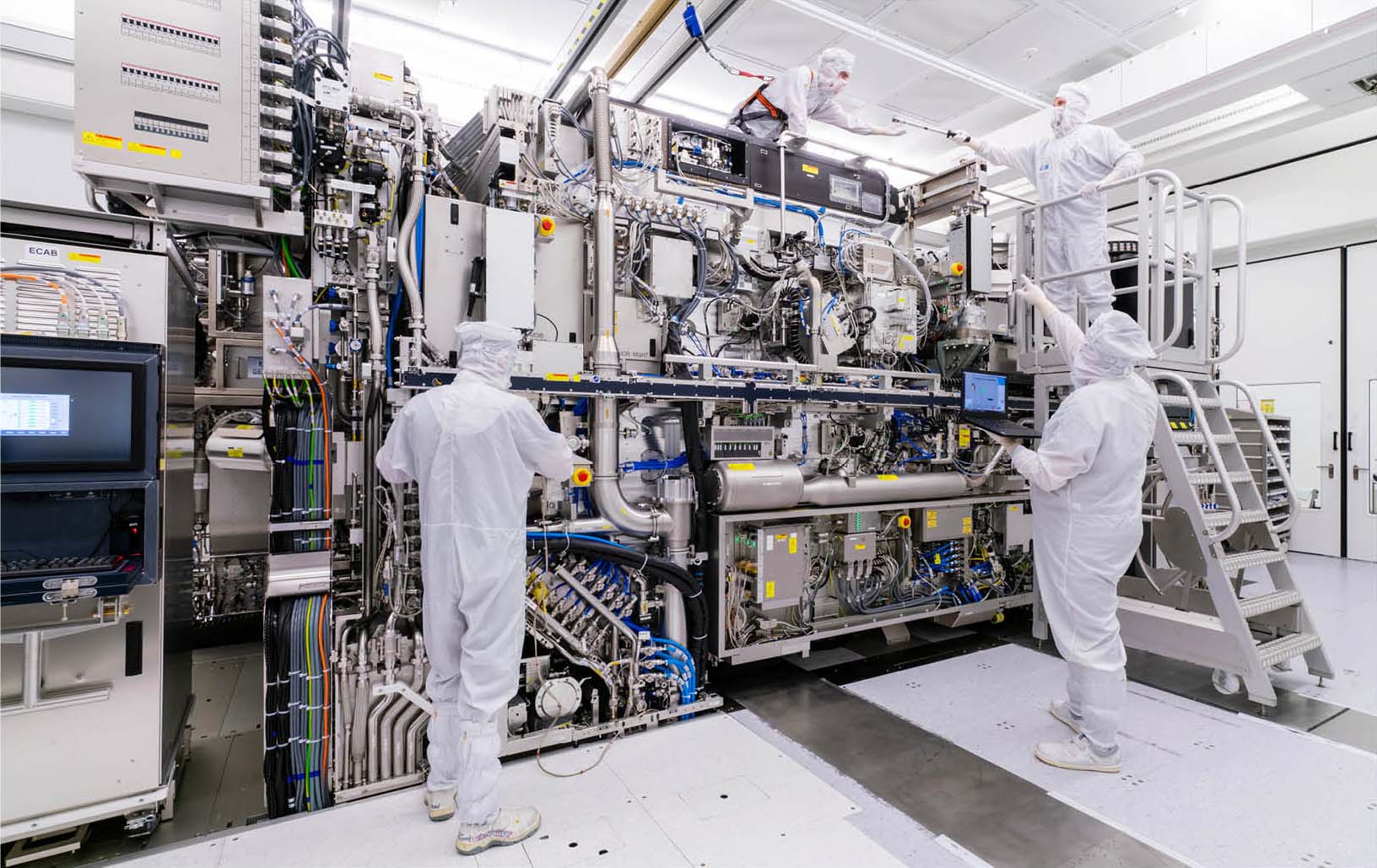

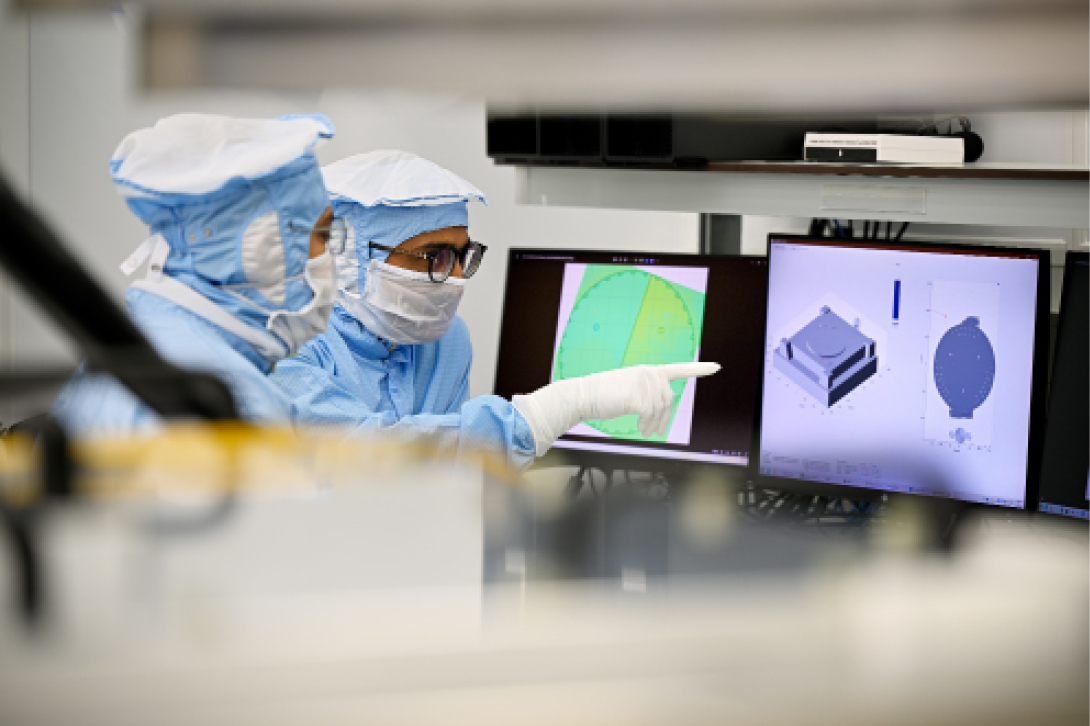

Innovation is the heartbeat of our company, and in 2024 it was very pleasing to finalize the first installation of our High NA EUV system (TWINSCAN EXE:5000) at one of our major customers. Ten years in the making, High NA EUV (EUV 0.55 NA) has been a huge investment for ASML and demanded seamless collaboration with partners and customers who have invested in the next generation of tools. We are very happy that High NA EUV is now operational and playing its part in moving Moore’s Law forward. | |

| |

We’ll continue to enable many of the solutions that are transforming our planet.” | |

Christophe Fouquet | |

President, Chief Executive Officer and Chair of the Board of Management | |

However, serving customers well requires more than just the latest and greatest products – it also means focusing on all the other essential yet less newsworthy innovations that are so important to our customers. It gave us real satisfaction to ship the first TWINSCAN NXE:3800E, increasing productivity by more than 35% as compared to its predecessor, the TWINSCAN NXE:3600D, and also to take a major step in deep ultraviolet (DUV) with the shipment of the first TWINSCAN NXT:870B, which delivers major progress on productivity, overlay and cost per exposure compared to its predecessor, the TWINSCAN NXT:870. There are many other examples of how our innovations are continuing to deliver demonstrable improvements for our customers – in areas from immersion lithography systems to metrology, control solutions and multibeam technology. | ||||

Q | Where do you see future growth coming from? | |||

As we shared at the 2024 Investor Day, during the last 12 months AI has come to life and proved itself to be a major force. It is going to drive new applications and growth in the next five to ten years – there’s no doubt about this, and a lot of our peers in the industry have also expressed similarly bullish views about the opportunity ahead. Today, its impact is mainly evident in the sales of very advanced servers and high-power computing. But we expect that there is a lot more to come – we don’t know exactly in what form, or when and how, but it will for sure be a very important factor for our industry, with transformational and positive consequences for ASML and for society. | ||||

SUSTAINABILITY | ASML Annual Report 2024 | 10 |

| |

The more diverse the people we welcome to ASML, the more opportunities we have to enrich what we do every day.” | |

Christophe Fouquet | |

President, Chief Executive Officer and Chair of the Board of Management | |

| |

If I look at the future growth of ASML, then of course lithography remains one of the key drivers of Moore’s Law, and we believe this will continue to be true for many, many years. At the same time, as we realized several years ago, 2D shrink is becoming more and more difficult. This is not necessarily because of limitations in lithography, but because we have almost reached the limitations of the transistors that our Logic and Memory customers are using. In order to continue to make progress on 2D shrink, we need architecture and device innovation. That means 3D front-end integration, which will in turn present a growth opportunity for us – because 3D integration depends on bonding and this requires holistic lithography. I think that 3D integration is set to be an increasingly important complementary technology, or set of technologies, to 2D shrink. | ||||

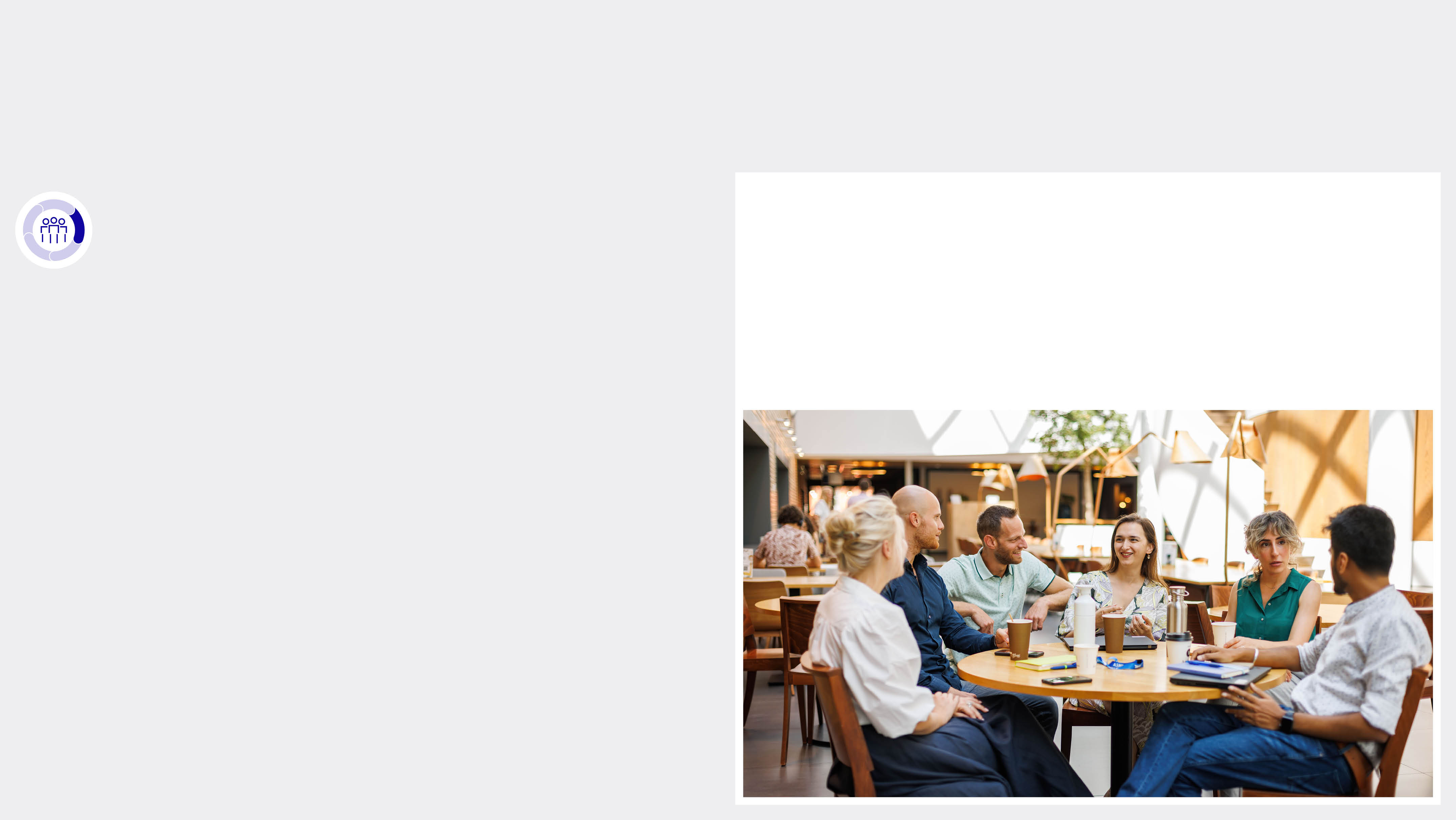

Q | Stakeholders are integral to ASML’s success. How do you engage and collaborate with them? | |||

Our stakeholder relationships – with customers, employees, suppliers, shareholders and society – are incredibly important to us and we work hard to create and maintain strong relationships with them. Trust is an essential part of partnership, and while we’ve successfully focused on building trust with our customers, we are now striving to extend that notion to all of our stakeholders. That means sharing our future vision, being transparent about what comes next and how a particular stakeholder can play a role. | ||||

| |

Regular customer engagement helps us to understand our customers’ needs and can shape our technology development to meet them – fostering collaboration that not only enhances customer satisfaction but also supports our market position. We could not meet customer needs without the support of our suppliers, who provide essential components and materials, and help us maintain the high quality and reliability of our products. Strong partnerships with suppliers also promote innovation, enabling us to develop cutting-edge solutions together. Ultimately, the success of our customers and the strength of our supply chain are intertwined, making both groups absolutely central to our business strategy. | |

Engagement with broader society, including local communities and governments in the regions around the world we operate in, is equally important. For example, we are engaging and investing proactively in the region around our Veldhoven headquarters, working hand in hand with the community. In fact, there has been a significant discussion this year about strengthening the industry in the Brainport Eindhoven region and the Netherlands, through partnerships and funding from authorities and industry that are designed to create societal solutions and fuel future economic growth in a responsible way. By collaborating with the Brainport Eindhoven community, we can build a future that works for ASML as well as for the broader society. We also want to partner with the government in order to address some of the complex geopolitical questions that we face. As a global company that is also a Dutch and European champion, we need to work alongside our government to help us move forward, to ensure our interests are represented and to shape an outcome that is good for Europe, for the Netherlands and for ASML. | |||

SUSTAINABILITY | ASML Annual Report 2024 | 11 |

Q | Sustainability is an important topic for all stakeholders. How is ASML performing? | |||

The technology sector can fundamentally support other industries and society to achieve critical ESG targets. For example, the industry will require major innovation to reduce cost and energy consumption related to AI – this will drive collaborative advancements that benefit the entire ecosystem. We have the chance to contribute in ways beyond what we do here at ASML. Some of these ways are showcased in case studies throughout this report, and they are a real source of pride and motivation for a lot of our people. I’m pleased with the progress we have made on scope 1, 2 and 3 emissions. I believe our environmental programs are strong and meaningful, and put us and our industry well ahead of many other industries. For the first time, we shipped a DUV system and a metrology system via sea instead of air in 2024. This is a relatively minor example of how we’re addressing ESG, but it shows how wide we cast the net when looking for ways to make a difference. For us, ESG has never been a fad or a fleeting fashion. It is simply the right thing to do – not only for ASML, but for everybody else too. As you can see from the extensive Sustainability statements section in this Annual Report, the ASML team has done a tremendous job preparing for the newly announced ESRS (European Sustainability Reporting Standards) reporting requirements. We are reporting as of this year in accordance with those ESRS requirements – an extraordinary achievement. | ||||

| |

The technology sector can fundamentally support other industries and society to achieve critical ESG targets.” | |

Christophe Fouquet | |

President, Chief Executive Officer and Chair of the Board of Management | |

Q | What are your top priorities for 2025 and beyond? |

A key priority is to continue to align with our customers’ roadmaps. Our customers face a lot of difficult choices in the next few years – and they have to make sure that the technology they choose can deliver the outcomes they need. We’re aware that the move to the next technology in our lithography systems could potentially come with very high costs for our customers. Our task – and our opportunity – is to understand how we can help them, and to develop products and services that will enable them to achieve their quality goals at the lowest possible risk and the lowest possible cost. For me this is crucial, and it is a key priority on the technology side. As always, we focus on our people, and specifically on how we can help them to take ASML to new levels. In recent months, I’ve stressed the importance of everybody at ASML taking ownership of what they do. I’ve also explained that to enable people to own their actions, we need greater simplification. | |

These two threads have become a crusade that will be increasingly evident in the months ahead. The combination of ownership and simplification is a powerful engine that will help our people innovate better and more. Another important mission is to make sure that everybody feels that ASML is a place where they can realize their full potential. This has been a challenge in the last few years due to our rapid growth and the huge increases in headcount. But now we’re redoubling our efforts – we’re committed to making sure that ASML is somewhere that talented people have space to be creative, where they can collaborate with highly skilled colleagues and take us to the next level of innovation. | ||||

Q | How can the ASML culture support you in achieving those aims? | |||

Without doubt, it has a major role to play. A lot has changed over the last 40 years. The industry has moved on, customer expectations have ramped up, and the opportunities for technology have exploded. And while our culture and diverse workforce has been instrumental in getting us to where we are today, we need to constantly raise the bar and make sure it is totally aligned with the task ahead. | ||||

SUSTAINABILITY | ASML Annual Report 2024 | 12 |

Over the next few pages we share how we’re powering technology |

forward. |

Q | What’s the business outlook for 2025? | |||

Looking at the big picture, the long-term outlook for our industry is very strong despite the continuing geopolitical tensions, with semiconductors playing a major role as mission-critical enablers of multiple megatrends in society. Although the rest of the market is recovering more slowly than anticipated, the emergence of AI is a significant opportunity. We expect that global semiconductor sales will grow by 9% compound annual growth rate over the period 2025 to 2030 and passing the $1 trillion mark in 2030. The industry will require major innovations to address the need to improve cost and energy consumption on AI, and this will require further boosting the industry roadmap. | ||||

SUSTAINABILITY | ASML Annual Report 2024 | 13 |

We’ve transformed our business to get closer to our customers – increasing their voice throughout the business, creating a cross-functional team empowered to make decisions quickly in the field, and improving the performance of our installed base. Read more about what we hope to achieve – and how we’re balancing innovation with delivering quality – in this Q&A with Jim Koonmen, Executive Vice President and Chief Customer Officer at ASML. | |

Read now | |

SUSTAINABILITY | ASML Annual Report 2024 | 14 |

with | |||||

With the semiconductor industry projected to grow to $1 trillion in sales by 2030, ASML will need to grow to meet customer and market demand – and our new people strategy sets out how we’ll do that. Read more about how we’re setting ourselves up for future success – without losing the essence of what made us the company we are today – in this Q&A with Cristina Monteiro, Head of Human Resources & Organization at ASML. | |||||

Read now | |||||

SUSTAINABILITY | ASML Annual Report 2024 | 15 |

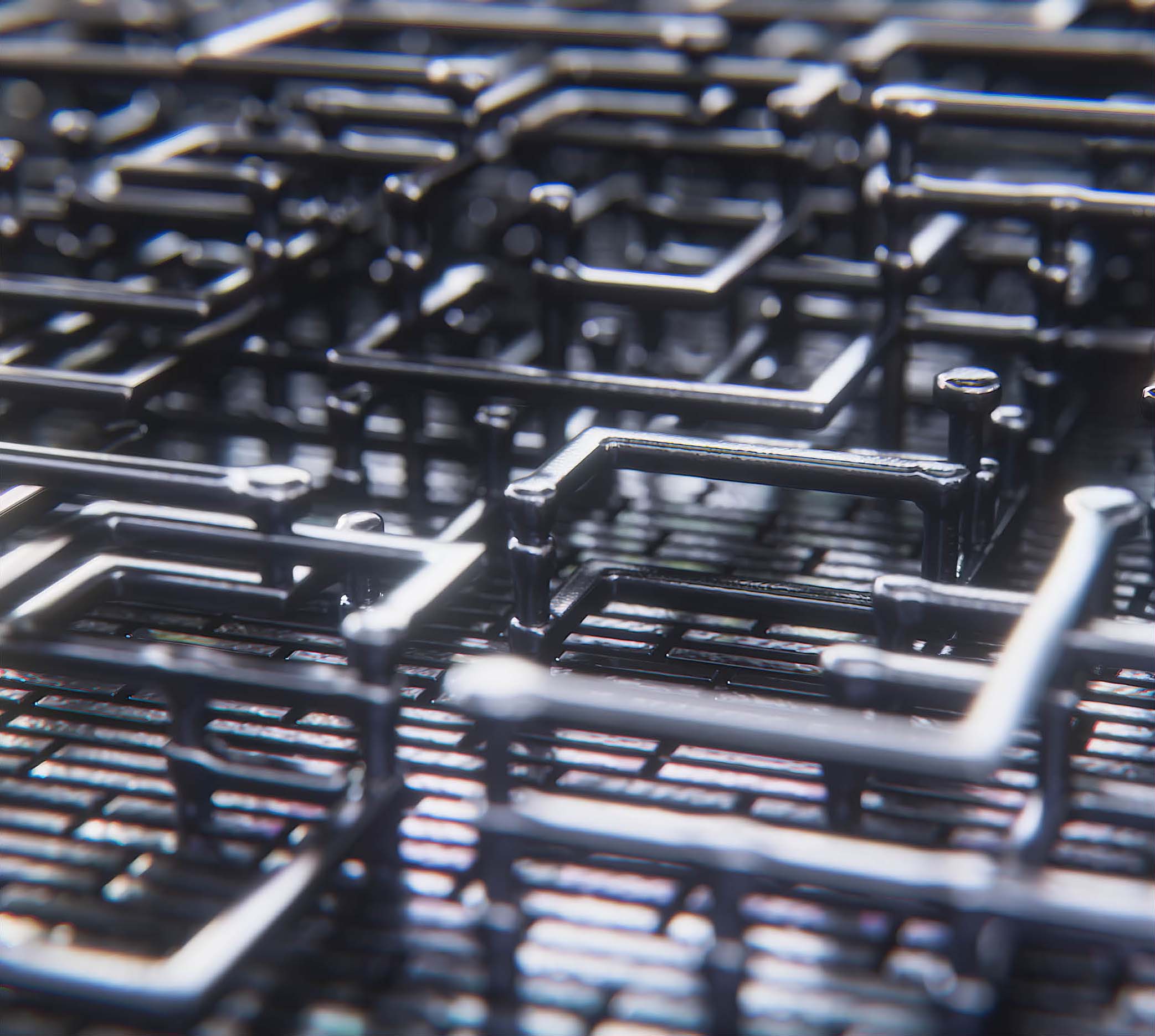

Our systems comprise thousands of parts, most of which come from our suppliers – they are an essential part of our innovation ecosystem. Read more about how we’re better aligning with our suppliers – ensuring they can keep pace with our growth trajectory, while supporting their own – in this Q&A with Wayne Allan, Executive Vice President and Chief Strategic Sourcing & Procurement Officer at ASML. | |

Read now | |

SUSTAINABILITY | ASML Annual Report 2024 | 16 |

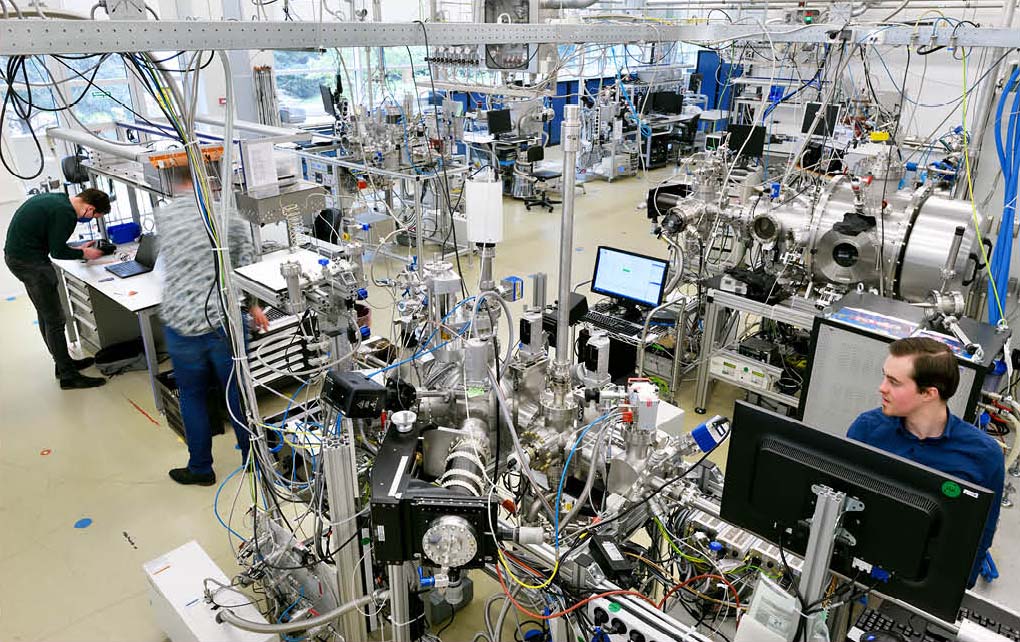

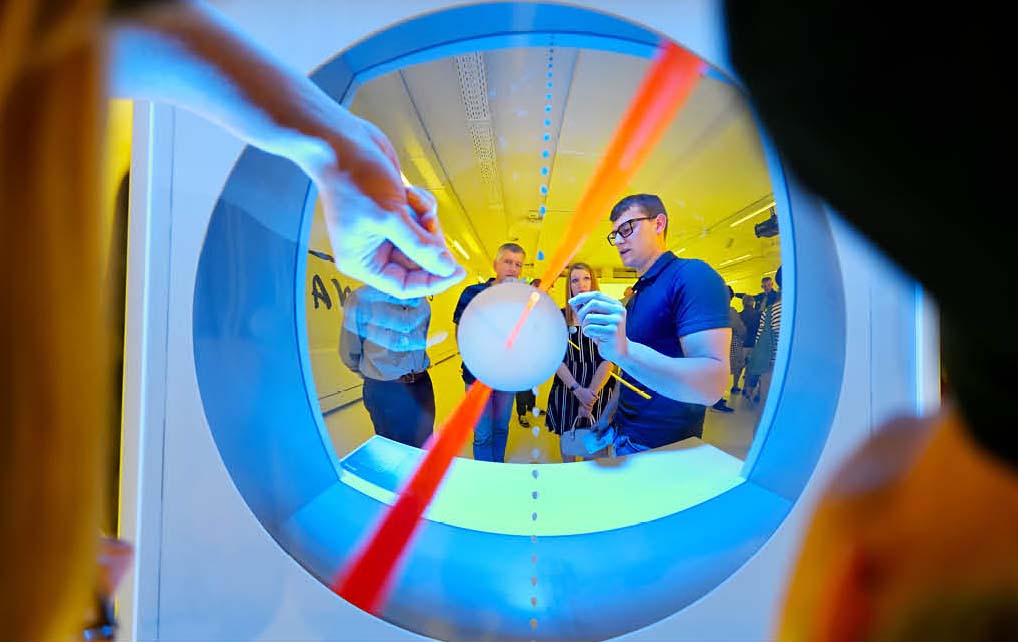

In 2024, imec, a world-leading research and innovation hub in nanoelectronics and digital technologies, and ASML opened the High NA EUV Lithography Lab in Veldhoven, the Netherlands, which is jointly run by ASML and imec. It marks a milestone in preparing High NA EUV lithography for accelerated adoption in mass manufacturing. | |

Read now | |

SUSTAINABILITY | ASML Annual Report 2024 | 17 |

We value the support and contribution of the communities we’re part of, and we feel a responsibility and a desire to give back to them. True to our mantra – Small acts. Big impact. Thrive together – ASML employees worldwide are playing a vital role in making an impact. Watch how we’re providing technical training for people with refugee backgrounds in the Netherlands, supporting food banks in Taiwan, and mentoring young people in the US. | |

Watch now | |

SUSTAINABILITY | ASML Annual Report 2024 | 18 |

SUSTAINABILITY | ASML Annual Report 2024 | 19 |

What is edge placement error (EPE)? | ||

Creating a microchip involves the patterning of tiny features in precise locations. EPE is the difference between the intended and the printed features of the layout of a microchip. Take, for example, a line with right and left edges – on a microchip, this line and its edges must be precise and placed in exact locations. Any deviation, no matter how slight, can result in misalignment, or an EPE. If one or more EPE issues crop up in the microchip production flow, the device is subject to shorts, which could cause the entire chip to fail. |

SUSTAINABILITY | ASML Annual Report 2024 | 20 |

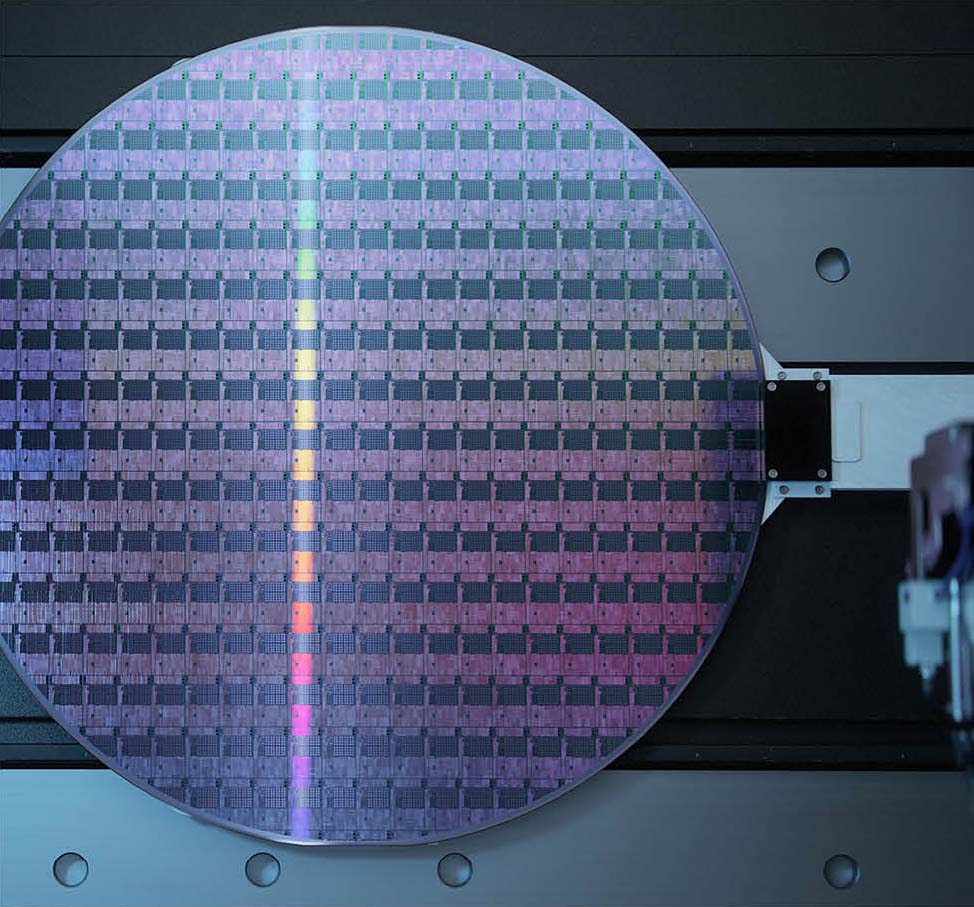

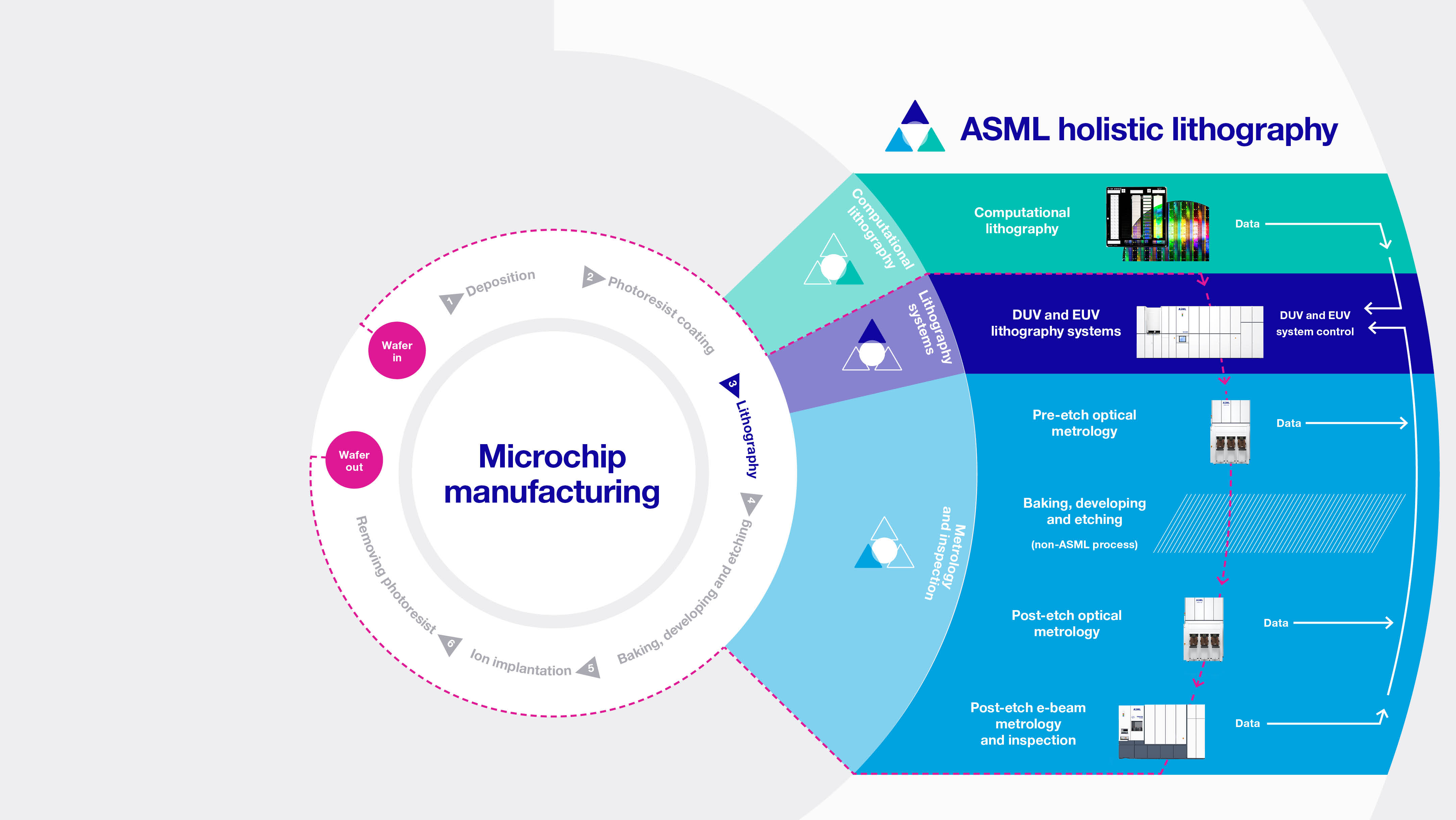

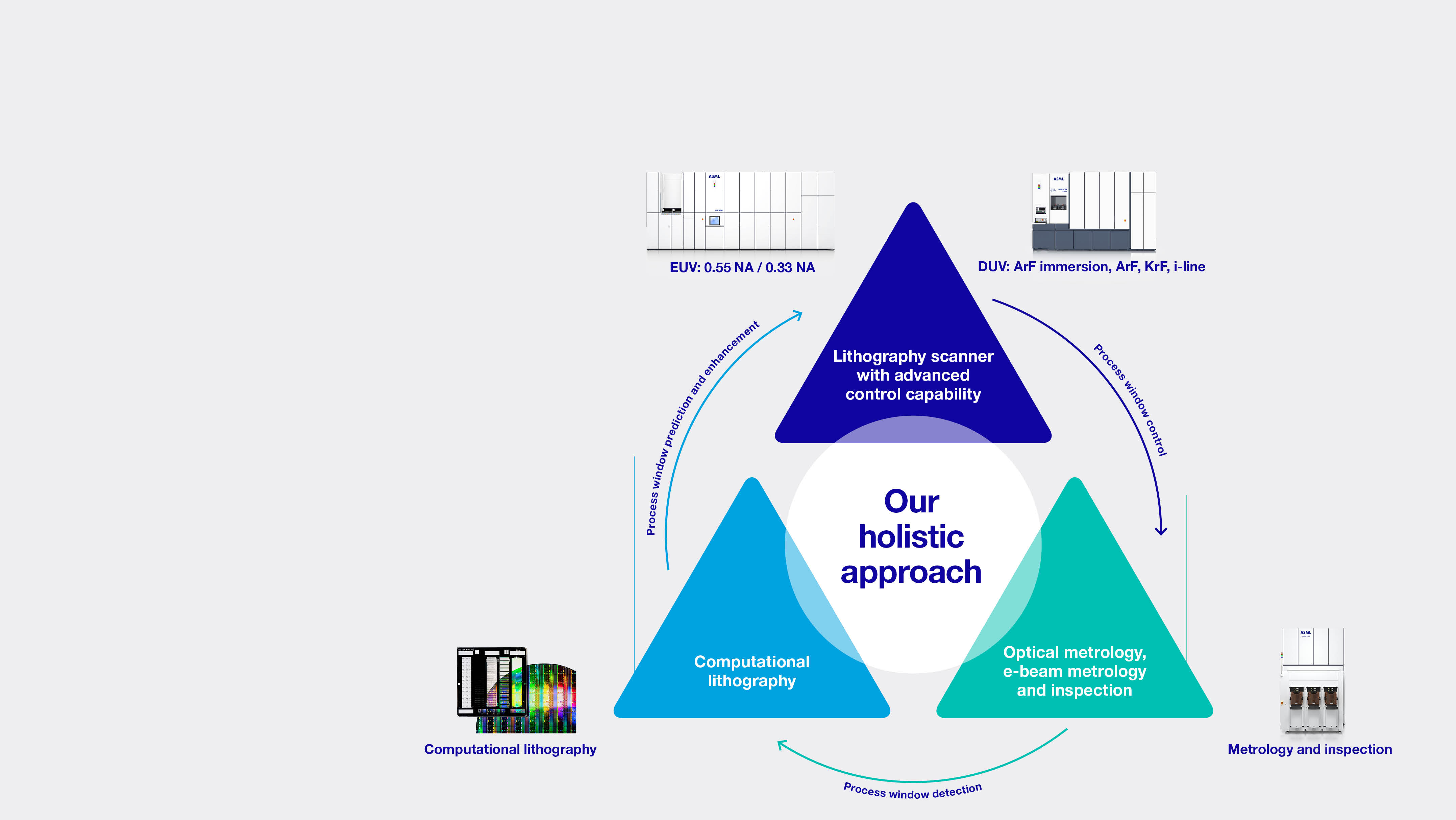

Creating value in our customers’ fabs | ||

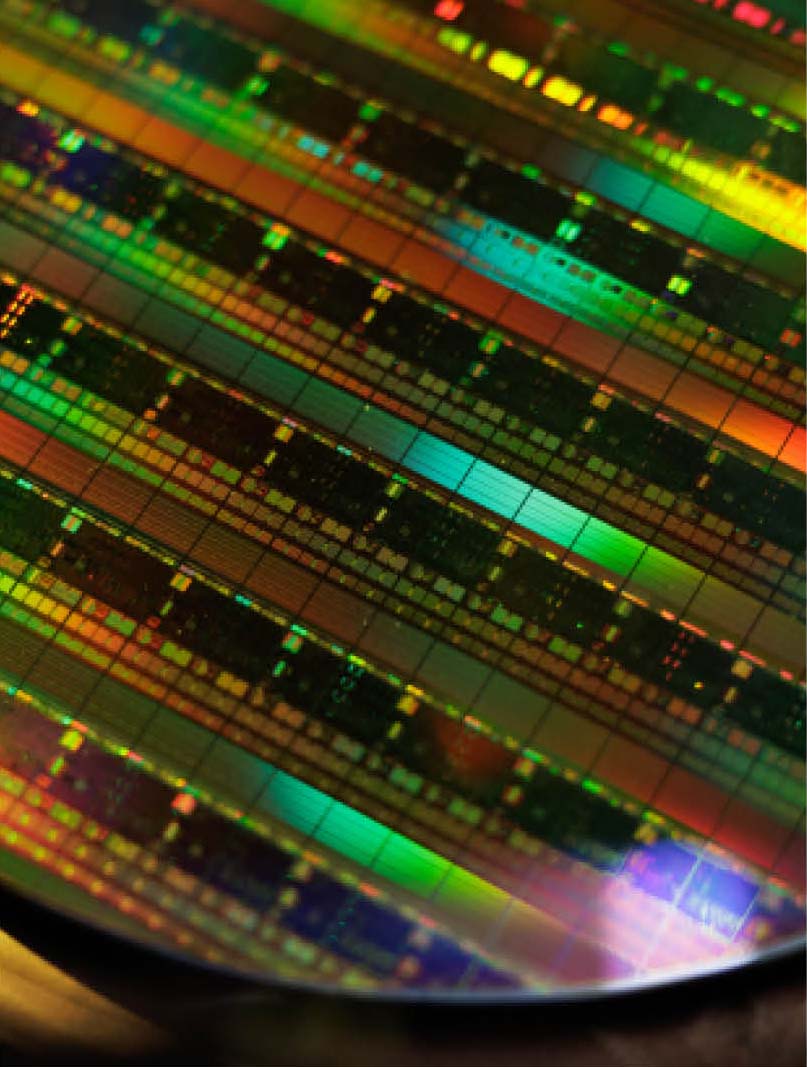

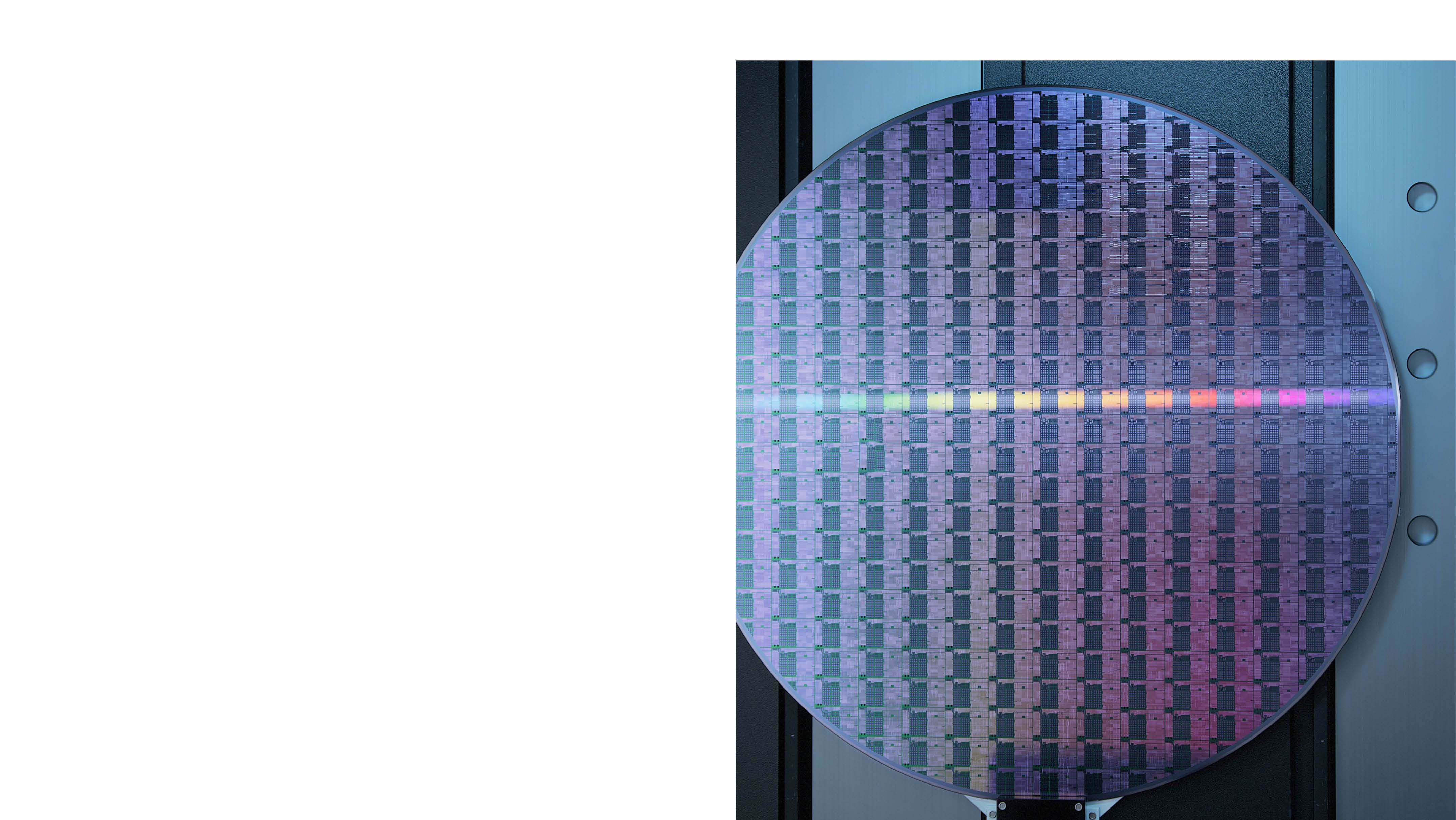

Because lithography is a critical step in the chip manufacturing process where the wafer is processed die by die – and therefore has a greater impact on performance than any other – ASML’s technology is pivotal in our customers’ semiconductor fabrication plants (or ‘fabs’). Our holistic approach helps increase lithography systems’ availability, reduce overall costs, and optimize yield for our customers. | ||

Steps in the microchip manufacturing process: | ||

1.Deposition – The first step is typically to deposit different materials – such as metals/conductors, insulation films and semiconductors – onto a silicon wafer. 2.Photoresist coating – The wafer is then coated with a light-sensitive layer called a photoresist. 3.Lithography – Light is projected onto the wafer through a reticle. Optics shrink and focus the reticle pattern. This pattern is then printed onto the wafer when the resist layer is exposed to light. 4.Baking, developing and etching – The wafer is baked and developed to make the pattern permanent, with a pattern of open spaces. Reactive gases are used to etch away material from the open spaces, leaving a 3D version of the pattern. 5.Ion implantation – The wafer may be bombarded with positive or negative ions to tune the semiconductor properties. 6.Removing photoresist – After the layer is etched or ionized, the remainder of the photoresist coating that was protecting areas not to be etched is removed. The entire microchip manufacturing process – from start to tested and packaged device, ready for shipment – can take half a year, depending on the complexity of the microchip. | ||

SUSTAINABILITY | ASML Annual Report 2024 | 21 |

Maximizing the process window | ||

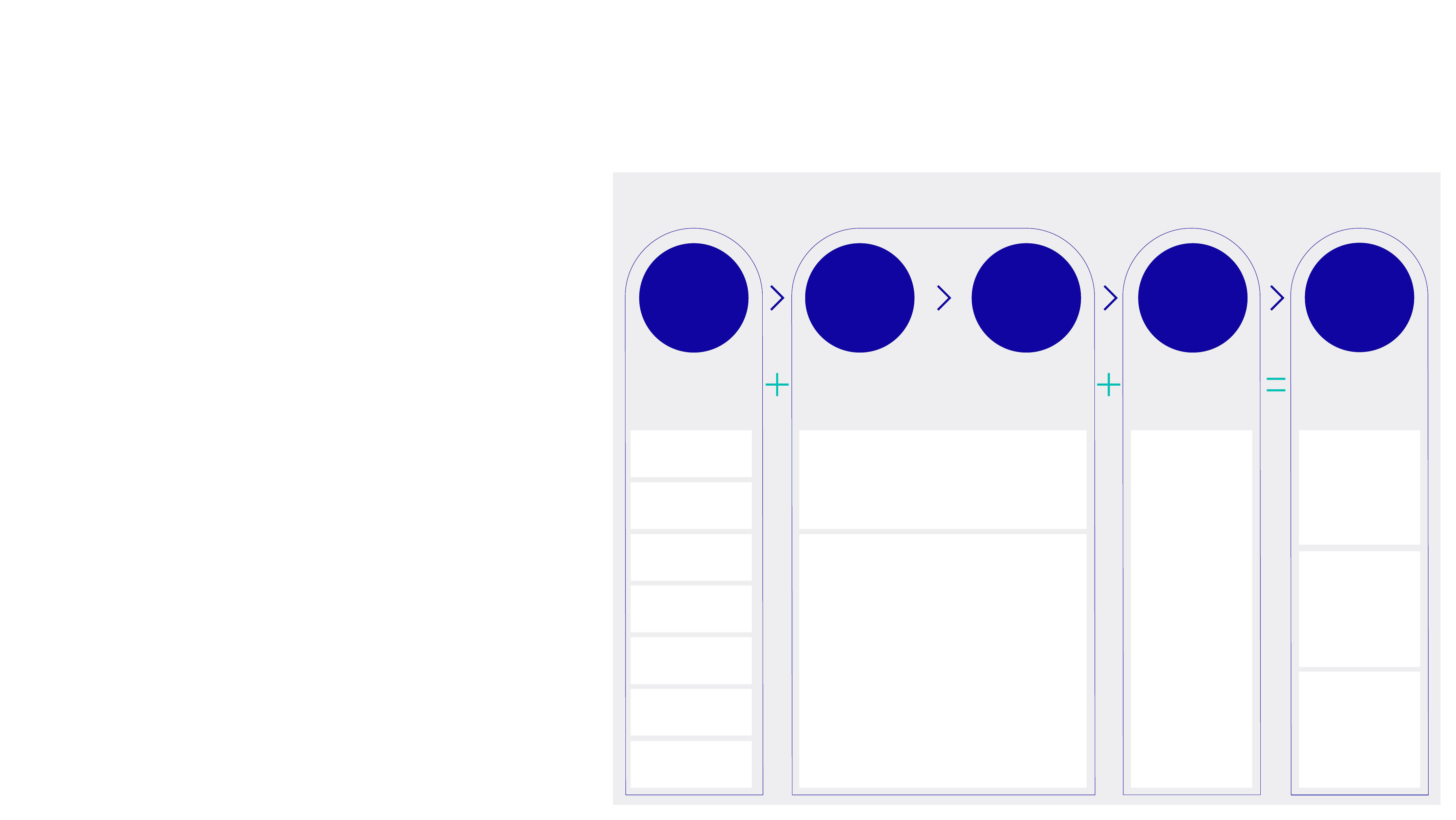

Our holistic approach to lithography integrates a set of products – enabling chipmakers to develop, optimize and control the semiconductor production process. | ||

Lithography and all other stages in the microchip manufacturing process must be closely aligned for an optimal result. Within lithography, the process window is the collection of acceptable variations of process parameters that allow a microchip to be manufactured and to operate under desired specifications. By incorporating computational lithography, metrology and inspection, ASML’s holistic lithography portfolio enables customers to maximize the process window – keeping lithography systems stable in a high-volume manufacturing setting, which leads to a higher yield with more good wafers per day. Lithography is the only step in the microchip manufacturing process in which in-line adjustments can be made to optimize performance. It would be impossible for our lithography systems to manufacture chips at such increasingly small dimensions without the software we develop. Our system and process control software products enable automated control loops to maintain optimal operation of lithography processes and therefore maximize yield. As a result, our lithography systems are a hybrid of high-tech hardware and advanced software. Our development teams work across a range of coding practices, providing innovative solutions to the intricate problems affecting the chipmaking systems at the heart of the semiconductor industry. | ||

SUSTAINABILITY | ASML Annual Report 2024 | 22 |

Extreme ultraviolet (EUV) lithography systems |

New for 2024: Our new NXE:3800E system boosts productivity and reduces error | ||

In 2024, we installed the first TWINSCAN NXE:3800E systems. This system is the successor to the TWINSCAN NXE:3600D and includes a higher-power light source, a new wafer handler and faster wafer stages. | It increases productivity by more than 35% – up to 220 wafers per hour (wph), compared to 160 wph using the NXE:3600D – while driving consistent overlay accuracy across different tools (matched machine overlay) down to 0.9 nm, compared to 1.1 nm with the NXE:3600D. | |

SUSTAINABILITY | ASML Annual Report 2024 | 23 |

Extreme ultraviolet (EUV) lithography systems |

New for 2024: High NA EUV success with our TWINSCAN EXE:5000 |

SUSTAINABILITY | ASML Annual Report 2024 | 24 |

Deep ultraviolet (DUV) lithography systems |

New in 2024 |

SUSTAINABILITY | ASML Annual Report 2024 | 25 |

Deep ultraviolet (DUV) lithography systems |

New in 2024 |

Refurbished systems |

New in 2024: NXT refurbishment | ||

In 2023, after years of refurbishing PAS and XT systems, we expanded our refurbished systems portfolio by adding NXT systems. We shipped the first refurbished NXT 1980Di system from our TWINSCAN factory to a customer in 2024, addressing a specific market segment that requires it. While we continue to produce new NXT systems, the NXT 1980Di refurbishment represents an impressive enhancement to our portfolio, utilizing a new industrialized approach for volume, efficiency, quality and cost. |

SUSTAINABILITY | ASML Annual Report 2024 | 26 |

Metrology and inspection systems |

New in 2024 |

SUSTAINABILITY | ASML Annual Report 2024 | 27 |

Metrology and inspection systems |

New in 2024 |

SUSTAINABILITY | ASML Annual Report 2024 | 28 |

System and process control software |

Computational lithography |

Managing our installed base system |

New in 2024 | ||

Computational lithography is advancing rapidly, focusing on enhancing the performance of lithography processes used in semiconductor manufacturing. Recent developments include improved algorithms for optical proximity correction (OPC) and source-mask optimization (SMO), which enhance pattern fidelity and resolution. Machine-learning techniques are increasingly being applied to predict and mitigate manufacturing variations, leading to better yield and efficiency. | ||

SUSTAINABILITY | ASML Annual Report 2024 | 29 |

Where we operate – more than 60 locations across 3 continents | ||||||

| Asia | |||||

China Japan Malaysia Singapore South Korea Taiwan | ||||||

| North America | |||||

Arizona California Colorado Connecticut Idaho Massachusetts | New Mexico New York Oregon Texas Utah Virginia | |||||

| EMEA | |||||

Belgium France Germany Ireland Israel Italy Netherlands United Kingdom | ||||||

SUSTAINABILITY | ASML Annual Report 2024 | 30 |

Using the Rayleigh criterion to drive innovation | ||||||

At ASML, we optimize the Rayleigh criterion equation to reduce the critical dimension so our lithography systems can print ever-smaller features. | ||||||

Wavelength (lambda, λ) | Numerical aperture (NA) | k1 factor | ||||

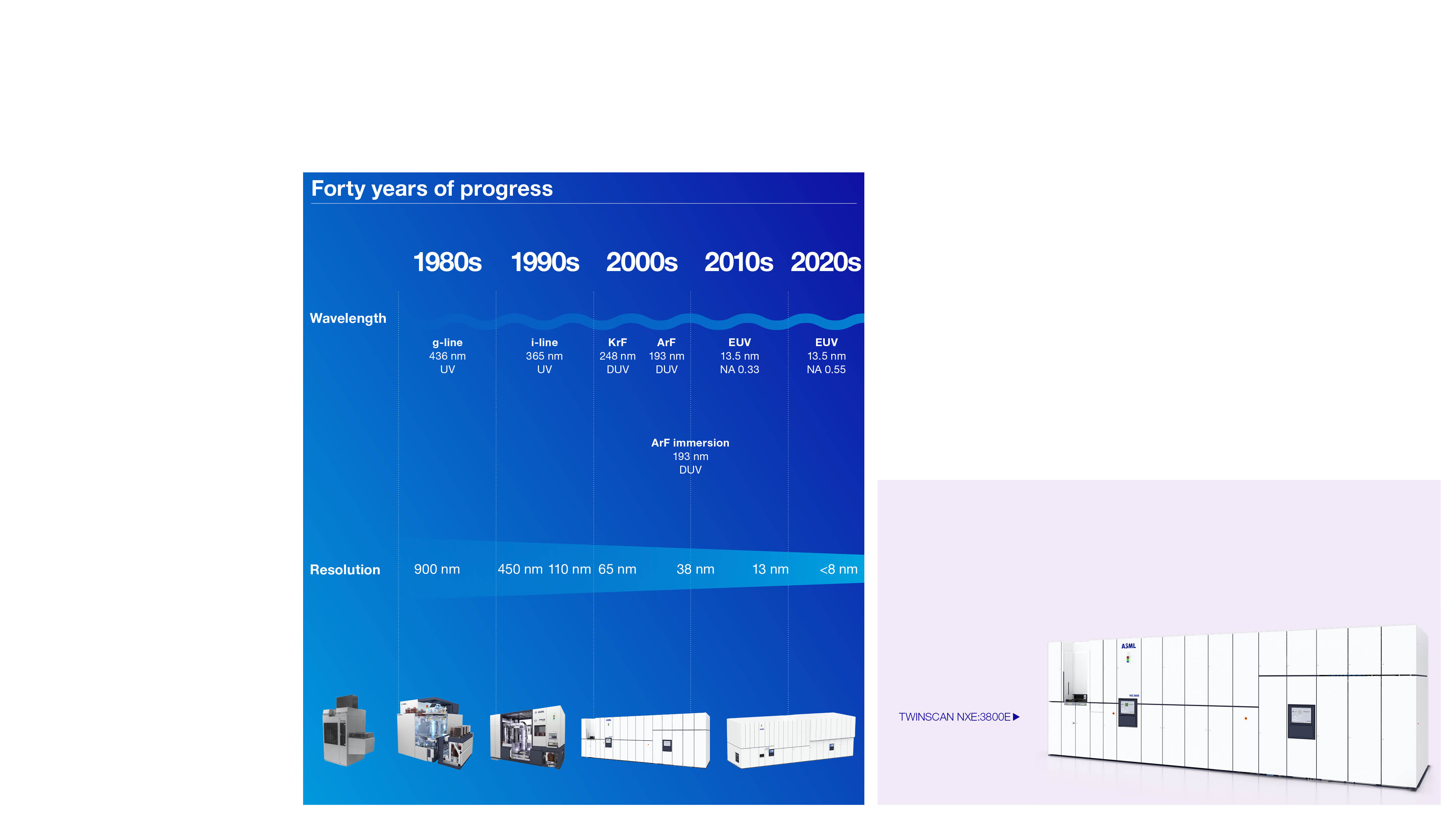

Over the years, ASML’s lithography systems have used shorter wavelengths of light to shrink chip features. We started with i-line systems using 365 nm ultraviolet (UV) light and added deep ultraviolet (DUV) systems with 248 nm light (KrF) and, later, 193 nm light (ArF). With the addition of our extreme ultraviolet (EUV) systems that use light with a wavelength of 13.5 nm – almost x-ray range – we enabled a significant leap in resolution. | One way that we increase NA – and therefore shrink chip features – is by using larger lenses and mirrors in our lithography systems. Another way is by using a technique called immersion. Our ArF immersion systems (DUV) leverage water’s higher refractive index by maintaining a thin layer of water between the last lens element and the wafer to increase the system’s NA. | Together with our computational lithography and patterning control software solutions, we provide the control loops for our customers to optimize their mask designs and illumination conditions. | ||||

Over the past 40 years, we’ve improved the resolution (critical dimension) of our systems by two orders of magnitude by making improvements to wavelength, NA and k1. | ||||||

Moore’s Law | ||||||

Why are we so focused on using the Rayleigh criterion to shrink chip features? In 1965, Intel co- founder Gordon Moore predicted that the number of transistors in an integrated circuit (IC) would double every year for the next decade. In 1975, he revised the prediction to every two years. His prediction has proved to be true – or, as some argue, a self-fulfilling prophecy. In the years that followed, this exponential growth led to significant increases in computing power and reductions in cost, driving rapid advances in technology and innovation in the semiconductor industry. Today, although physical limitations are making it more challenging to shrink transistors further, the semiconductor industry continues to boost performance using what Moore called ‘circuit and device cleverness’. Innovative chip designs, new materials, advanced packaging and complex 3D structures are sustaining the industry’s progress. ASML's lithography products play a crucial role in the affordable mass production of these advanced designs that are ensuring the continuation of Moore's Law and enabling future technological innovations. | ||||||

Rayleigh criterion |

The resolution of our lithography systems is crucial for shrinking the size of transistors on microchips. To be able to print sharper, finer details, we live by the Rayleigh criterion – the resolution equation that determines just how small the features that can be printed on a chip are. |

SUSTAINABILITY | ASML Annual Report 2024 | 31 |

SUSTAINABILITY | ASML Annual Report 2024 | 32 |

Filling the innovation funnel | |||||||||

We encourage our researchers to build wide networks in the broader technology space. This supports the constant stream of new ideas into the technology pipeline that flows through what we call our ‘innovation funnel’. Based on our fundamental understanding of our markets and the needs of our customers, we select new ideas with the potential to advance our products and their customer application. | |||||||||

Research teams | Development and engineering teams | ||||||||

Our research teams focus on generating and exploring exciting new ideas and demonstrating their feasibility. They scout for new ideas, which are then taken through the proof-of-concept stage. Those that pass the feasibility assessment and have a favorable value proposition are transferred to our development and engineering teams. | Guided by our product generation process, our engineers create new components, subsystems and applications, integrating them into a functional system, while ensuring we innovate with a strong focus on time to market. | ||||||||

|  |  |  | ||||||

This starts with a holistic lithography solutions roadmap, which maps out the entire lithography product and services solutions space for the future. This in turn is broken down into product modules or technical building blocks, as well as service needs. For some of the building blocks, we need to pursue a technology feasibility study to ensure that the technology addresses our customers’ demands in terms of performance, cost and timing. | ||

ASML Fellowship Program | ||

We recognize and honor our technical experts because we know that our company’s success is built on technology leadership. One of the ways we do this is through the ASML Fellowship Program, which awards employees who make an outstanding technical contribution to ASML and are recognized both inside and outside the company as a top technical authority. In 2024, three new ASML Fellows were appointed and one of our current Fellows was promoted to the title of Senior Fellow. Former Chief Technology Officer Martin van den Brink was appointed Honorary Fellow, a special award honoring 40 years of his technical leadership. | ||

| ||

SUSTAINABILITY | ASML Annual Report 2024 | 33 |

How we innovated in 2024 | ||

Our strategy is to give customers the products and capabilities they need to deliver on technology’s potential to make a positive contribution to society. As well as creating some of the most advanced machines in the world, this includes an increased focus on sustainability through parts commonality and reuse, and improvements in the performance and energy efficiency of our products to reduce costs and waste. A number of innovation achievements over the last 12 months include significant improvements in metrology solutions, enhancing the accuracy and speed of measurements with reference to currently available metrology solutions (YieldStar). We are further increasing the EUV source power in order to accommodate our customers’ dose requirements, while improving the conversion efficiency (energy used per photon output) and creating various options to increase the robustness and durability of our wafer tables. | ||

High NA EUV lithography: Inspired by the film industry | ||||

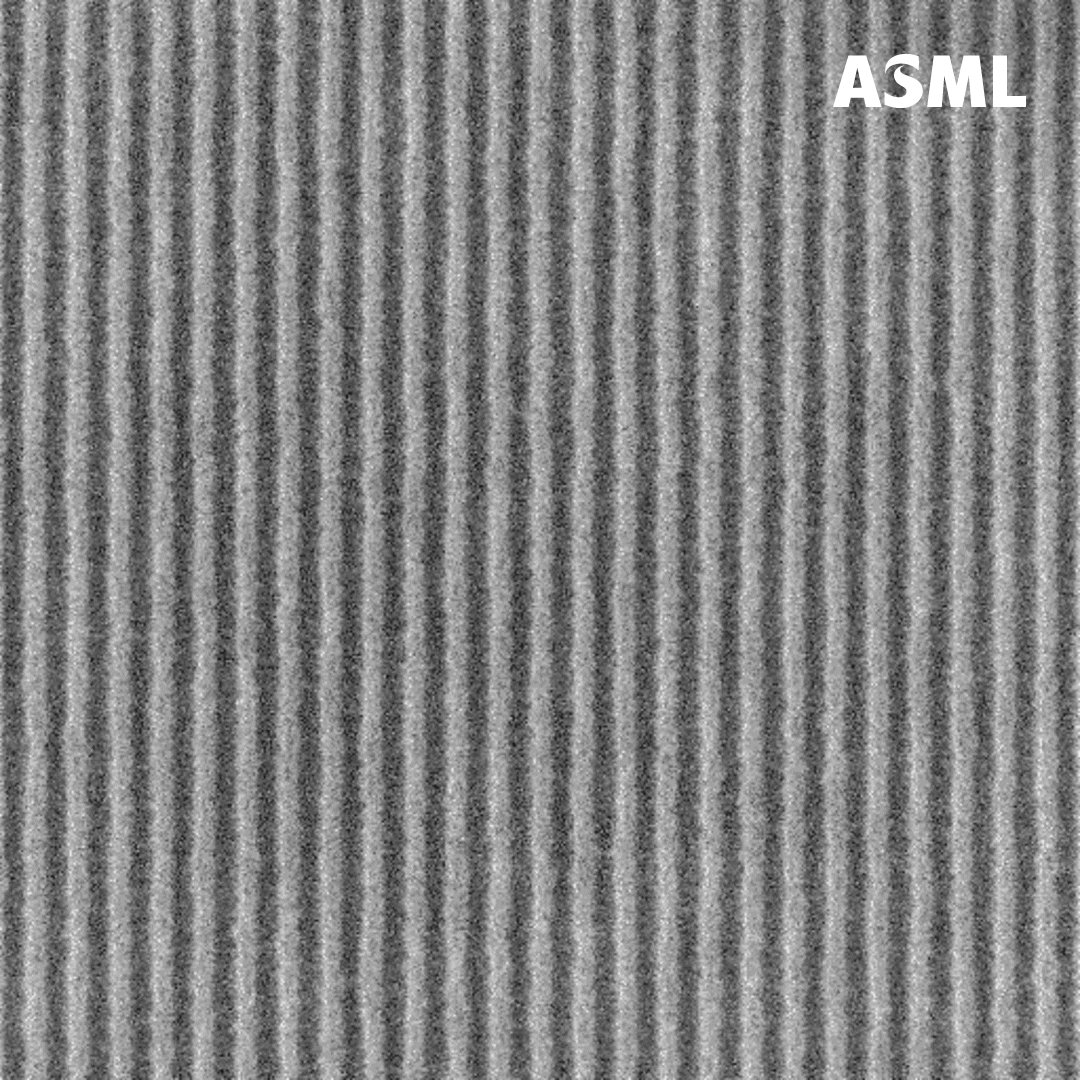

The anamorphic optics in our High NA EUV (0.55 NA) lithography systems are a unique solution to an intriguing problem: delivering the highest-resolution imaging without compromising on productivity. In lithography, light first hits a reticle with the blueprint of a chip layer. Projection optics then focus that light, now with the blueprint encoded in it, onto a photosensitive silicon wafer. Our High NA EUV lithography system requires larger mirrors to achieve its 8 nm resolution – but the size of the mirrors was initially causing imaging issues. Increasing the image's demagnification from 4x to 8x could have solved the problem, but would have required chipmakers to switch to larger reticles if they wanted to avoid slowing down production. | Instead, we teamed up with our long-time strategic partner ZEISS Semiconductor Manufacturing Technology to find a way to minimize High NA EUV’s impact on the semiconductor ecosystem. And we found our answer in the film industry. In cinematography, anamorphic cameras squeeze recorded images in one direction, so they can capture widescreen images at full resolution on standard-sized film. Anamorphic projectors then stretch the image to display it properly on movie screens. Using this approach as inspiration, together with ZEISS we developed anamorphic optics for lithography – giving chipmakers fast, High NA EUV imaging while still using the industry-standard reticle size. | |||

SUSTAINABILITY | ASML Annual Report 2024 | 34 |

We work closely with private partners to develop and deliver research and innovation projects subsidized by the EU and its member states. | |

SUSTAINABILITY | ASML Annual Report 2024 | 35 |

Globally: the major election year 2024 did see easing inflation and the real GDP growth was above 3%*. A strong US GDP growth was partly offset by lower growth in Europe and Japan. Geopolitical tensions continued to be high, while AI dominated the headlines in the semiconductor ecosystem. | |||||

The semiconductor market recovered from the 2023 downturn, but significant differences emerged among end markets and product groups. While the Memory market rebounded, industrial and automotive semiconductors faced corrections in 2024 and high inventory levels. The lithography market remained strong, with lower demand from key customers offset by increased shipments to China, supported by a high backlog built over previous years. After fulfilling this backlog, we anticipate a shift to more normalized sales levels to China moving forward. | We have strong confidence that the semiconductor ecosystem will continue to innovate and grow at a high single-digit compound annual growth rate. Factors that may impact our business – as explained in more detail over the next few pages – include: | ||||

1. | Macroeconomic and geopolitical trends | ||||

2. | Megatrends | ||||

3. | Semiconductor industry market | ||||

*Source: IMF World Economic Outlook, October 2024 | |||||

1. | Macroeconomic and geopolitical trends | ||||||||

Economic outlook | Global geopolitics – technological sovereignty | ||||||||

Description Analysts expect GDP growth to continue to stay above 3% for 2025 and 2026 with a recovery in Europe and Japan and a slight slowdown of growth in the US and China compared to 2024. This typically offers a good foundation for a positive semiconductor market trend. The 2024 market growth was dominated by AI which led to a surge in demand for AI-related Memory – both DDR (double data rate) and HBM (high-bandwidth memory) – and specific advanced Logic chips. This trend is expected to continue in 2025. The PC and smartphone markets are expected to continue to stay on the gradual growth trajectory while industrial and automotive semi markets, which did see a correction in 2024, are expected to pick up in the course of 2025. | What it means for ASML Our EUV business saw shifts in demand timing, predominantly driven by a lack of end-market demand and readiness of fabs. After the inventory correction in 2023, our customers started ramping up fabs again. The digestion of all inventory took longer than initially anticipated, delaying the need for new equipment – and meaning ASML saw a slight shift in demand timing. For DUV, demand was higher than we could deliver, particularly in China and for specific models. We are working closely with our customers and suppliers to optimize our output capability, ride out the uncertainty and manage the risks. | Description With the strategic importance of the semiconductor industry only likely to grow, semiconductors are crucial to the economic and strategic development of countries and regions. Many are pushing for ‘technological sovereignty’ to ensure security of supply, resilience and technological leadership in semiconductor technologies and applications – fueling capital expenditure in new regions. What it means for ASML As governments increasingly see semiconductor manufacturing as strategically significant, chips acts are incentivizing our customers to build manufacturing facilities in the US, Europe and Asia. As well as sharing our views with governments on semiconductor manufacturing, we work closely with our customers to build the semiconductor manufacturing ecosystem in these new regions, while retaining our focus on supporting incumbent regions. External factors such as the timing of subsidies and the risk of restrictions make forecasting market demand less predictable. | |||||||

SUSTAINABILITY | ASML Annual Report 2024 | 36 |

1. | Macroeconomic and geopolitical trends (continued) | |||||||

Global geopolitics – export controls | ||||||||

Description On June 24, 2024, the EU Council adopted the 14th package of restrictive measures against Russia – aiming to maximize the impact of existing sanctions by closing loopholes and emphasizing the EU’s goal to stop dual-use technology flowing to Russia. The regulation entered into force on June 25, 2024, with some measures focused on circumvention of the sanctions as well as the prohibition on transferring intellectual property rights with respect to dual-use goods taking effect on December 26, 2024. ASML is not involved in export to Russia or Belarus but undertakes continuous efforts to strengthen its robust risk assessment and due diligence processes as well as its policies, controls and procedures to mitigate and manage effectively the risks of indirect exportation to Russia and Belarus. On September 6, 2024, the Dutch government published an updated license requirement regarding the export of immersion DUV semiconductor equipment. As a result of the updated license requirements, and in line with US Export Administration Regulation, ASML needs to apply for export licenses with the Dutch government rather than the US government | for shipments of its TWINSCAN NXT:1970i and 1980i DUV immersion lithography systems. The Dutch export license requirement is already in place for the TWINSCAN NXT:2000i and subsequent DUV immersion systems. Sales of ASML’s EUV systems are also subject to license requirements. The updated license requirement published by the Dutch government came into effect from September 7, 2024. The Japanese regulations were also brought in line with the US and Dutch regulations on September 8, 2024. On December 2, 2024, the US authorities published an updated version of the advanced computing and semiconductor manufacturing equipment rule, imposing additional restrictions on suppliers for the export of chip manufacturing technology. These regulations became effective immediately with a delayed compliance date of December 31, 2024 for some of the changes.The updated export control regulations contain additions to the list of restricted technologies including metrology and software. In addition, further fab locations, mainly in China, were added to the US list of restrictions. | What it means for ASML ASML is fully committed to complying with all applicable laws and regulations including export control legislation in the countries in which we operate, while we continue to develop our technology and serve our customers to the best of our ability. ASML will continue to work with its worldwide customers to deliver lithography and metrology systems not impacted by the global export control restrictions and/ or sanctions. We continue to educate governments on the semiconductor manufacturing process and ecosystem to foster understanding of the potential impacts of current and future regulatory measures. | ||||||

2. | Megatrends | ||||||

The world is changing fast and semiconductors are a key enabler to help solve some of society's toughest challenges. In 2024, we have seen a strong growth in artificial intelligence (AI) technology, enabled by leading-edge semiconductor solutions, both in Advanced Logic as well as AI-related DRAM. AI is expected to further stimulate semiconductor solutions to tackle these big challenges and increase overall GDP growth. The continuing convergence of wireless communication, telecoms, media and cloud technology via connected devices is driving demand for advanced semiconductors across the globe. Growing populations, urbanization, the energy transition and electrification to support smart mobility are increasing demand for advanced electronic devices. AI requires leading-edge high- performance processor chips and a significant increase in DRAM memory chips compared to traditional compute architectures. It also stimulates the mainstream market, as AI requires large amounts of data collected via sensors which can be used to further drive robotics and workflow automation. | |||||||

Connected world | |||||||

•Internet of things •Hyperconnectivity •Cloud infrastructure •Edge computing | |||||||

Climate change and resource scarcity | |||||||

•Energy transition •Electrification, smart mobility •Agricultural innovation •Smarter use of limited resources | |||||||

Social and economic shifts | |||||||

•Working, learning remotely •Healthcare medical tech •Technological sovereignty •Automation | |||||||

SUSTAINABILITY | ASML Annual Report 2024 | 37 |

Connected world | |||

With the IoT, smart, connected networks of more energy-efficient devices seamlessly communicate over powerful 5G networks – unleashing the power of unprecedented data volumes better and faster than ever. In combination with AI, this provides people with more innovative functionalities and applications, improves human-to-machine interactions, and enhances data management and analytics. | |||

| |||

2. | Megatrends (continued) |

Internet of things | |

Semiconductors are increasingly present in the world around us. Many of the products with semiconductors are directly or indirectly connected to the internet to maximize the benefits offered with the added silicon. AI further reinforces the value offered by these internet- connected devices as it allows them to capture data and use it to enhance the value of the device itself and also of other internet-connected devices. | |

Hyperconnectivity | |

5G enables a new kind of network designed to connect almost everyone and everything around the world – including machines, objects and devices. Person-to-person, person-to-machine and machine-to- machine communication are fueling large increases in bandwidth demand and changes in communications because of the complexity, diversity and integration of new applications and devices using the network. | |

Cloud infrastructure | |

To enable cloud computing – the on- demand availability of computer system resources, especially data storage and computing power – a cloud infrastructure is required. This includes hardware, software, storage and network resources. | |

Edge computing |

We are moving fast toward edge computing, which focuses on processing data closer to its source rather than in centralized data centers. The current era of mobile computing – where you bring the computer with you – is moving us into an immersive world of ubiquitous computing, with computing power available everywhere, driven by AI. What it means for ASML Moore’s Law is the guiding principle for the semiconductor industry and the motor behind its transition from mobile to ubiquitous computing. This transition continues to expand, driving the three main elements in computing – applications, data and algorithms – that feed each other in a virtuous cycle: applications generate data, which fuels new algorithms, which again leads to new applications that generate new data. The vast amounts of data and insights people can access are expected to fuel semiconductor business growth and the digital transformation. |

Climate change and resource scarcity | |

With an urgent collective response needed to limit global warming to 1.5°C, climate change is a crucial matter for governments, companies and individuals worldwide. | |

Energy transition | |

The shift to renewables is helping deliver the clean, affordable energy the world needs to counter climate change. Semiconductors are harnessing, converting, transferring and storing energy from sources such as solar and wind as electricity – and ensuring national power grids are both responsive and robust. They are at the core of smart (home) devices and play an important role in reducing overall energy consumption. | |

| |

Electrification and smart mobility |

Automotive is one of the fastest-growing market segments – driven by electrification, autonomy and other megatrends. Integrated automotive systems consist of a full range of scalable, flexible computing solutions that require advanced and mature semiconductor devices. Advanced driver- assistance systems enabled by electronics and semiconductors – considered ‘supercomputers on wheels’ – are also expected to contribute to the growth of the automotive segment in the semiconductor industry. In addition, across the world, people are changing their views about personal transport. Instead of owning expensive and environmentally harmful vehicles, they’re seeking car-sharing, ride-sharing, ride-hailing, micro-mobility (using small, low-speed, human- or electric-powered transportation devices) and micro-transit (on-demand shared private or semi-public transport). The technologies underpinning this move to smart mobility, such as mobile apps, are all enabled by semiconductors. |

SUSTAINABILITY | ASML Annual Report 2024 | 38 |

Climate change and resource scarcity (continued) | |

Agricultural innovation | |

Farmland in remote locations, particularly those with emerging economies, can be vulnerable to climate change. With access to mobile devices increasing, local farmers are using their smartphones in combination with smart sensors to improve agricultural knowledge and decision-making. The results are better crops and greater, more sustainable food security – enabled by smaller, more affordable microchips. | |

Smarter use of limited resources | |

The semiconductor industry can also play an important role by reducing its own climate impacts. The semiconductor manufacturing process consumes large volumes of energy and water, and driving Moore’s Law to enable shrink and improve computing power and storage capacity fuels demand for these vital resources. Innovative architectures and a new way of looking at the entire ecosystem will be required to enhance the industry’s energy and water resource efficiency. |

2. | Megatrends (continued) |

What it means for ASML Semiconductors play an important role in addressing climate change across various sectors. In the automotive industry, a shift toward electric vehicles and autonomous driving is expected to significantly increase the number of semiconductor components in cars. Additionally, the integration of digital technologies to support the energy transition and agricultural innovations relies on semiconductor solutions to enable smart grids and enhance agricultural practices. By advancing our EUV productivity roadmap, we help customers simplify complex multiple-patterning layers into a single exposure, thereby reducing resource consumption in the semiconductor manufacturing process. |

Read more in Sustainability statements – |

Social and economic shifts | |

Digital technologies are driving transformative change. They create new opportunities for a more prosperous future, but at the same time pose new challenges. | |

Working and learning remotely | |

Since the emergence of the COVID-19 pandemic, remote and hybrid working and learning have become increasingly prevalent. | |

Healthcare and medical tech | |

Predictive analysis of health data from multiple sources, combined with machine learning and AI, is being harnessed to improve healthcare services and patient outcomes. Semiconductor technology has allowed the creation of innovative products that can effectively detect, diagnose and treat various medical conditions. | |

Automation |

A new generation of lightweight robots connected to a wide network and fitted with smart sensors enable humans and machines to safely and efficiently work side by side, supported by AI. In addition, smart industry devices use real-time data analytics and machine-to-machine sensors to optimize processes, predict bottlenecks, and prevent errors and injuries. |

|

What it means for ASML The ongoing digitalization of various sectors such as healthcare and manufacturing keeps on driving the need for semiconductors. The integration of digital technologies in these industries requires robust semiconductor solutions to enable efficient data processing, real-time analytics and connectivity. |

SUSTAINABILITY | ASML Annual Report 2024 | 39 |

3. | Semiconductor industry market |

SUSTAINABILITY | ASML Annual Report 2024 | 40 |

3. | Semiconductor industry market (continued) | |||||||||||||||||||||||||

Smartphone | Personal computing | Consumer electronics | Automotive | Industrial electronics | Wired and wireless infrastructure | Servers, data centers and storage | ||||||||||||||||||||

|  |  |  |  |  |  | ||||||||||||||||||||

Key driver | ||||||||||||||||||||||||||

Continued refresh of all semiconductor content including image sensors and edge AI processors | High-end compute and Memory, fast conversion to solid-state drive (SSD), edge AI processors | Both low-power and high-bandwidth connectivity, sensors | High-end processors for autonomous driving and power electronics for engine electrification | Connectivity, edge processors, sensors, power (control) electronics for the energy transition, and high- end processing for robotics | Continued innovation to increase bandwidth and reduce latency, requiring high-end processing | AI requiring high-end processing and DRAM, and cloud processing requiring advanced processing, NAND and DRAM | ||||||||||||||||||||

2025 estimated market size ($bn) | Total | |||||||||||||||||||||||||

149 | 92 | 70 | 76 | 84 | 53 | 156 | 679 | |||||||||||||||||||

2030 estimated market size ($bn) | ||||||||||||||||||||||||||

192 | 112 | 83 | 114 | 120 | 70 | 361 | 1,051 | |||||||||||||||||||

Outlook CAGR 2025–2030 (%) | ||||||||||||||||||||||||||

5% | 4% | 3% | 9% | 7% | 6% | 18% | 9% | |||||||||||||||||||

Source: Based on ASML analysis | ||||||||||||||||||||||||||

SUSTAINABILITY | ASML Annual Report 2024 | 41 |

Our business strategy consists of six priorities that will drive long-term growth | ||||||||||

Deepen customer trust | Extend our technology and holistic product leadership | |||||||||

1 | 2 | |||||||||

| ||||||||||

•Innovate on our entire portfolio to continue to provide critical, differentiated and cost-effective solutions to our customers •Enable chipmakers in their pursuit of more powerful, smaller, cheaper, more integrated and more energy- efficient chips, with an affordable and holistic lithography roadmap across the entire ASML portfolio •Place cost and energy consumption reduction at the core of value creation for customers by continuing to simplify process flows, ensuring the highest transistor density at all process steps, and promoting technologies that scale improved productivity, lower costs of technology for customers and reduce emissions •Maximize good printed transistors from lithography by: a.Maximizing yield with AI-based process control, metrology and inspection b.Optimizing resolution with our DUV and EUV portfolio c.Enhancing productivity with system throughput and efficiency improvements d.Improving accuracy with solutions for overlay, critical dimension uniformity and EPE e.Support our customers’ front end 3D integration with holistic lithography |  | |||||||||

•Deepen customer trust and satisfaction through increased value creation, focused on innovation, cost, quality, sustainability and response time •Strengthen partnerships with customers based on even deeper understanding and anticipation of their needs and product roadmaps •Increase the bandwidth, responsibility and accountability of our customer teams to deliver on customer requirements and carry the customer voice throughout the entire organization | •Simultaneously optimize total lithography cost by: a.Improving system cost with increased platform commonality b.Increasing system extendibility and improve lifetimes c.Reducing service and utility costs | |||||||||

Our market opportunity | ||

Based on different market scenarios shared during our 2024 Investor Day, we presented an opportunity to achieve the following: | ||

2030 | ||

€44–60bn | ||

Annual revenue | ||

56–60% | ||

Gross margin |

SUSTAINABILITY | ASML Annual Report 2024 | 42 |

3 | Strengthen ecosystem relationships | ||

•Foster even closer relationships with our suppliers and broader ecosystem, based on shared goals and responsibility for cost, quality and sustainability outcomes | |||

| |||

4 | Create an exceptional workplace | ||

•Build a workplace that works for everyone: Fostering inclusion, diversity and belonging •Invest in people effectiveness and development •Strengthen our leadership: Accelerating development and building our future pipeline as of today | |||

| |||

5 | Drive operational excellence | ||

| |||

•Create a learning organization that drives a culture of continuous improvement with fast feedback loops and a sustainable impact on our safety, quality, cost and delivery performance •Drive cross-company business performance improvements to reduce cost, cycle times, improve quality and secure on-time delivery •Optimize our industrial footprint to have market, talent and technology access while protecting our know-how and our business •Secure a successful ERP migration to enable scaling and drive improvements in cost, quality and compliance •Protect and defend ASML interests and reputation by driving a culture of integrity and compliance, including for products, information security, cyber resilience and export controls | |||

Deliver on our ESG sustainability mission and responsibilities | ||||

6 | ||||

Environmental Continue to expand computing power but with minimal waste, energy use and emissions Social Ensure that responsible growth benefits all our stakeholders Governance Act on our responsibilities and aim to fully anchor them in the way we do business through our focus on integrated governance, engaged stakeholders and transparent reporting | ||||

| ||||

SUSTAINABILITY | ASML Annual Report 2024 | 43 |

People and culture | Manufacturing facilities | |||||||||

Manufacturing facilities | ||||||||||

| We depend on more than 44,000 talented, dedicated and motivated employees who live our values of challenge, collaborate and care. Every day, our colleagues in R&D, manufacturing, customer support, sourcing and supply chain, and support functions take on the exciting challenge of building and maintaining the most advanced lithography, metrology and inspection systems in the world. |  | We have eight factories in Europe, the US and Asia that provide high-precision, highly controlled environments where we assemble, test and deliver our complex lithography and metrology and inspection portfolio, from prototype to final product. | |||||||

Capital | Innovation | |||||||||

| We have strong capital reserves, underpinned by a robust balance sheet. Total shareholder equity at the end of 2024 amounts to €18.5 billion on a consolidated balance sheet total of €48.6 billion and net cash provided by operating activities of €11.2 billion in 2024. |  | In 2024, we spent a total of €4.3 billion in R&D. But we do not innovate alone – our almost 16,000 R&D employees collaborate closely within an innovation ecosystem of key partners in the value chain. Our lithography solutions are the result of strong partnerships based on trust, respect, and shared risks and incentives to compete and drive innovation. | |||||||

SUSTAINABILITY | ASML Annual Report 2024 | 44 |

Our position as a leading supplier of holistic lithography enables us to create value across the entire value chain. Our holistic lithography portfolio – based on the intelligent integration of lithography systems, computational lithography, metrology and inspection, and process control software solutions – keeps the scaling of microchips affordable for our customers. At ASML the customer always comes first – and our solutions are based on their input. We help our customers generate the greatest value per silicon wafer, creating microchips that are more powerful, faster and more energy-efficient. | ||

Holistic lithography |

Helping our customers generate the greatest value per silicon wafer, creating microchips that are more powerful, faster and more energy-efficient. |

SUSTAINABILITY | ASML Annual Report 2024 | 45 |

|  |  |  |  | |||||||||||||||||||

Customers | Employees | Suppliers | Shareholders | Society | |||||||||||||||||||

Our world-leading lithographic systems enable our customers to develop ever-more powerful and energy-efficient chips for new applications and devices. At the same time, we help our customers reduce costs and their environmental footprint. | ASML is a growth business providing employment opportunities around the world. We invest in people’s career development and well-being, and aim to provide a diverse and inclusive environment where they can achieve their full potential. | Our suppliers help deliver our innovations and are critical to our value chain and our ambition to be a sustainable leader in the semiconductor industry. Long- term relationships, close collaboration, transparency and a commitment to sustainability with our suppliers are key to our success. | The effective and disciplined investment of cash flow drives the profitable growth of our company, and delivers solid financial performance and a healthy financial position. This underpins our ability to return cash to shareholders through growing dividends and share buybacks. | We play an active role in the communities where we operate – recognizing that, when the community thrives, so do we. We believe our collaborative ecosystem nurtures innovation and benefits society. For example, we share our expertise with universities and research institutes, support young | tech companies and promote science, technology, engineering and mathematics (STEM) education worldwide. We are also committed to creating sustainable value by reducing our environmental footprint – both from our operations and during the use of our products and services. | ||||||||||||||||||

€28.3bn | 78.9% | 5,150 | €11.2bn | €1,084 | 88% | ||||||||||||||||||

Total net sales | Employee engagement score (three-year rolling average) | Number of suppliers | Net cash provided by operating activities | Amount invested per employee, including employee giving | Reuse rate of parts returned from field and factory | ||||||||||||||||||

583 | 21% | 91% | €6.40 | €18.9m | 32.8 kt | ||||||||||||||||||

Net system sales (in units) | Women in entire workforce (headcount) | Responsible Business Alliance (RBA) self-assessment completed (in %) | Proposed annualized dividend per share | Contribution to EU research projects | Emissions from manufacturing and building (scopes 1 and 2) | ||||||||||||||||||

86% | 3.8% | 100% | €0.5bn | 12.0 Mt | |||||||||||||||||||

Customer satisfaction survey score | Attrition rate | Suppliers with overall high risk evaluated and follow-up agreed (in %) | Share buyback | Indirect emissions from total value chain (scope 3) | |||||||||||||||||||

SUSTAINABILITY | ASML Annual Report 2024 | 46 |

We listen to our stakeholders – customers, employees, suppliers, shareholders and society – and work with them to make the right decisions. | |||

Our stakeholders – and our interaction with them – is fundamental to the long-term success of our business. By regularly engaging with them, we can better understand our impact on them, and their respective needs and expectations. | |||

> | |||

SUSTAINABILITY | ASML Annual Report 2024 | 47 |

Customers | At each stage of the customer relationship we aim to foster trust, advocacy and continuous engagement – with the goal of achieving high customer satisfaction and loyalty. As customer requirements become more complex, it takes longer to align with a shared vision, so we seek to start earlier in the process. By placing our customer relationship at the center of our work, we can leverage our innovations and develop even more sophisticated solutions alongside them. | |

At ASML, we focus on our customers’ needs |  | ||||||

There are thousands of ASML systems installed in customer fabs across the globe. Our customers want to keep these machines running 24 hours a day, seven days a week, 365 days a year. With around 10,000 customer support employees, including service engineers and applications specialists, we work round the clock to make sure our systems in our customers’ fabs are running smoothly. | |||||||

Our customers are why we exist. We collaborate with customers at all levels of the organization – from CEO-to-CEO interaction right through to on-the-ground support at individual fabs – to help them achieve their goals and ensure our solutions perfectly fit their requirements.” | |||||||

86% | |||||||

Jim Koonmen | |||||||

Executive Vice President and Chief Customer Officer | |||||||

Customer satisfaction score | |||||||

| |||||||

SUSTAINABILITY | ASML Annual Report 2024 | 48 |

Employees | We strive for engaged employees who are proud to work for ASML and committed to our vision and ambitions. Innovation thrives in an environment where everyone is empowered to contribute. By creating an exceptional workplace that fosters inclusivity, we aim to enable everyone to unlock their full potential and drive our collective success. | |

| |||

We have exceptional talent and need an exceptional workplace where our talent can achieve great things, to move ASML to our next success.” | |||

Cristina Monteiro | |||

Head of Human Resources & Organization | |||

87% | 54% | |||

of new colleagues starting in 2024 indicated they had a positive onboarding experience | of our employees have been in the company less than five years | |||

29% | ||||

of our employees today are not nationals of the country they work in | ||||

SUSTAINABILITY | ASML Annual Report 2024 | 49 |

Suppliers | We engage with our suppliers to help deliver our innovations. They are critical to our value chain and our ambition to be a sustainable leader in the semiconductor industry. | |

Working with our suppliers |  | |||

By partnering closely with and supporting our suppliers, we aim to ensure that they’re prepared to work with us for years to come – and to weather the changes that the chip industry is known for, including periods of rapid growth and business-cycle fluctuations. | ||||

Enabling our supply chain to grow with us toward our 2030 targets calls for an evolution in how we work with our suppliers.” | ||||

Wayne Allan | ||||

Executive Vice President and Chief Strategic Sourcing & Procurement Officer | ||||

The top 35 of our 5,150 suppliers make up 80% of our total sourcing spend | ||||

| ||||

SUSTAINABILITY | ASML Annual Report 2024 | 50 |

Shareholders | We aim to help shareholders – as well as financial and ESG sustainability analysts – understand our long-term investment strategy. We communicate with them about our financial growth strategies and opportunities, our financial and ESG sustainability performance, our outlook and our shareholder returns. | |

Positioned for significant growth | Our continued investments in technology leadership have created significant shareholder value. | |||

Expected growth in semiconductor end markets and increasing lithography spending on future nodes fuel demand for our products and services. We will continue to invest in our business and expect to return significant amounts of cash to our shareholders through growing dividends and share buybacks. | ||||

€3.0 billion | ||||

Returned to shareholders through dividends and share buybacks. | ||||

| ||||

SUSTAINABILITY | ASML Annual Report 2024 | 51 |

Society | We know that our actions and activities have an impact beyond ASML – on the environment, for example, and on the world around us in its broadest sense, which is how we define society. We engage with organizations, communities and other bodies in society on a wide range of issues – from reducing our environmental footprint to regulatory matters and fulfilling our commitment to playing an active role in the communities where we operate. | |

Building community connections | ||||

At our first community conference (ASML Maatschappelijke Conferentie 2024), we strengthened ties with the local community in the Brainport Eindhoven region. | Around 200 representatives from local government and social organizations in the field of education, sports, arts and culture joined us to discuss key issues, such as inequality, labor shortages and housing, as well as the ambition and coherence of our society investment programs. The insights gained will guide our future agenda and approach. | |||

| ||||

SUSTAINABILITY | ASML Annual Report 2024 | 52 |

SUSTAINABILITY | ASML Annual Report 2024 | 53 |

A year of transition and preparation, ahead of the upturn to come | ||||||

Message from our Executive Vice President and Chief Financial Officer | ||||||

Roger Dassen | ||||||

We delivered on our expectations in spite of the challenges.” |

SUSTAINABILITY | ASML Annual Report 2024 | 54 |

“ |

We believe that the years ahead will see a significant uptick in the market.” |

Roger Dassen |

Executive Vice President and Chief Financial Officer |

€28.3bn |

Total net sales |

51.3% |

Gross margin |

€3.0bn |

Returned to shareholders |

SUSTAINABILITY | ASML Annual Report 2024 | 55 |

We aim to balance our growth with social responsibility, ensuring that we share our success while addressing the challenges that come with it.” |

Roger Dassen |

Executive Vice President and Chief Financial Officer |

SUSTAINABILITY | ASML Annual Report 2024 | 56 |

Sales | Profitability | Liquidity | ||||||

Total net sales | Gross profit | % of total net sales | Cash and cash equivalents and short-term investments (year end) | |||||

€28.3bn | €14.5bn | 51.3% | €12.7bn | |||||

2023: €27.6bn | 2023: €14.1bn | 2023: 51.3% | 2023: €7.0bn | |||||

Net system sales | Income from operations | Net cash provided by operating activities | ||||||

€21.8bn | €9.0bn | 31.9% | €11.2bn | |||||

2023: €21.9bn | 2023: €9.0bn | 2023: 32.8% | 2023: €5.4bn | |||||

Net service and field option sales | Net income | Free cash flow2 | ||||||

€6.5bn | €7.6bn | 26.8% | €9.1bn | |||||

2023: €5.6bn | 2023: €7.8bn | 2023: 28.4% | 2023: €3.2bn | |||||

Sales of lithography systems (in units)1 | Earnings per share | |||||||

418 | €19.25 | |||||||

2023: 449 | 2023: €19.91 | |||||||

EUV systems recognized (in units) | ||||||||

44 | ||||||||

2023: 53 | 1. | Lithography systems do not include metrology and inspection systems. | ||||||

2. | Free cash flow is a non-GAAP (generally accepted accounting principles) measure and is defined as net cash provided by operating activities (2024: €11,166.2 million and 2023: €5,443.4 million) minus purchase of property, plant and equipment (2024: €2,067.2 million and 2023: €2,155.6 million) and purchase of intangible assets (2024: €15.9 million and 2023: €40.6 million). We believe that free cash flow is an important liquidity metric for our investors, reflecting cash that is available for acquisitions, to repay debt and to return money to our shareholders by means of dividends and share buybacks. Purchase of property, plant and equipment and purchase of intangible assets are deducted from net cash provided by operating activities in calculating free cash flow because these payments are necessary to support the maintenance and investments in our assets to maintain the current asset base. | |||||||

SUSTAINABILITY | ASML Annual Report 2024 | 57 |

Operating results of 2024 compared to 2023 |

Year ended December 31 (€, in millions) | 2023 | %1 | 2024 | %1 | % Change |

Net system sales | 21,938.6 | 79.6 | 21,768.7 | 77.0 | (0.8) |

Net service and field option sales | 5,619.9 | 20.4 | 6,494.2 | 23.0 | 15.6 |

Total net sales | 27,558.5 | 100.0 | 28,262.9 | 100.0 | 2.6 |

Cost of system sales | (10,151.0) | (36.8) | (10,406.9) | (36.8) | 2.5 |

Cost of service and field option sales | (3,271.4) | (11.9) | (3,364.0) | (11.9) | 2.8 |

Total cost of sales | (13,422.4) | (48.7) | (13,770.9) | (48.7) | 2.6 |

Gross profit | 14,136.1 | 51.3 | 14,492.0 | 51.3 | 2.5 |

Research and development (R&D) costs | (3,980.6) | (14.4) | (4,303.7) | (15.2) | 8.1 |

Selling, general and administrative (SG&A) costs | (1,113.2) | (4.0) | (1,165.7) | (4.1) | 4.7 |

Income from operations | 9,042.3 | 32.8 | 9,022.6 | 31.9 | (0.2) |

Interest and other, net | 41.2 | 0.1 | 19.8 | 0.1 | (51.9) |

Income before income taxes | 9,083.5 | 33.0 | 9,042.4 | 32.0 | (0.5) |

Income tax expense | (1,435.8) | (5.2) | (1,680.6) | (5.9) | 17.0 |

Income after income taxes | 7,647.7 | 27.8 | 7,361.8 | 26.0 | (3.7) |

Profit from equity method investments | 191.3 | 0.7 | 209.8 | 0.7 | 9.7 |

Net income | 7,839.0 | 28.4 | 7,571.6 | 26.8 | (3.4) |

For a comparison of ASML’s operating results for the year ended December 31, 2023, with the year ended December 31, 2022, please see Financial performance – Performance KPIs – Operating results of 2023 compared with 2022 of ASML’s Annual Report on Form 20-F for the year ended December 31, 2023. The preparation of our Consolidated financial statements in conformity with US Generally accepted accounting principles (GAAP) requires management to make estimates and assumptions. See Note 1 General information / summary of general accounting policies to the Consolidated financial statements for detailed information on critical accounting estimates. |

Net sales growth |

(in billions) |

2.6% |

Net sales |

(0.8)% |

Net system sales |

15.6% |

Net service and field option sales |

SUSTAINABILITY | ASML Annual Report 2024 | 58 |

Net sales |

(in millions) |

Gross profit and gross margin |

(in millions) |

Research and development costs |

(in millions) |

SUSTAINABILITY | ASML Annual Report 2024 | 59 |

Selling, general and administrative costs |

(in millions) |

Income taxes |

(in millions) |

Net income and earnings per share |

(in millions) |

SUSTAINABILITY | ASML Annual Report 2024 | 60 |

Year ended December 31 (€, in millions) | 2023 | 2024 |

Cash and cash equivalents, beginning of period | 7,268.3 | 7,004.7 |

Net cash provided by (used in) operating activities | 5,443.4 | 11,166.2 |

Net cash provided by (used in) investing activities | (2,689.3) | (2,609.3) |

Net cash provided by (used in) financing activities | (3,003.9) | (2,832.1) |

Effect of changes in exchange rates on cash | (13.8) | 6.4 |

Net increase (decrease) in cash and cash equivalents | (263.6) | 5,731.2 |

Cash and cash equivalents, end of period | 7,004.7 | 12,735.9 |

Short-term investments, end of period | 5.4 | 5.4 |

Cash and cash equivalents and short-term investments | 7,010.1 | 12,741.3 |

Purchases of property, plant and equipment and intangible assets | (2,196.2) | (2,083.1) |

Free cash flow1 | 3,247.2 | 9,083.1 |

SUSTAINABILITY | ASML Annual Report 2024 | 61 |

SUSTAINABILITY | ASML Annual Report 2024 | 62 |

Long-term models as presented at 2024 Investor Day | |||||||

| |||||||

Total sales opportunity (in €bn) | |||||||

2022 Investor Day | 2024 Investor Day | ||||||

Sales 2030 | Sales 2030 | ||||||

High scenario | C M | ||||||

EUV sales | 32 | 32 | |||||

Non-EUV sales (litho and M&I*) | 15 | 15 | |||||

Installed base management** | 13 | 13 | |||||

Total | 60 | 60 | |||||

Moderate scenario | |||||||

EUV sales | Not reported at 2022 Investor Day | 26 | |||||

Non-EUV sales (litho and M&I*) | 14 | ||||||

Installed base management** | 12 | ||||||

Total | 52 | ||||||

Low scenario | 6 | ||||||

EUV sales | 22 | 22 | |||||

Non-EUV sales (litho and M&I*) | 11 | 11 | |||||

Installed base management** | 11 | 11 | |||||

Total | 44 | 44 | |||||

* M&I: Metrology and inspection. ** Installed base management equals our net service and field option sales. | |||||||

SUSTAINABILITY | ASML Annual Report 2024 | 63 |

The purpose of risk management is to maximize the probability of achieving business objectives responsibly. |

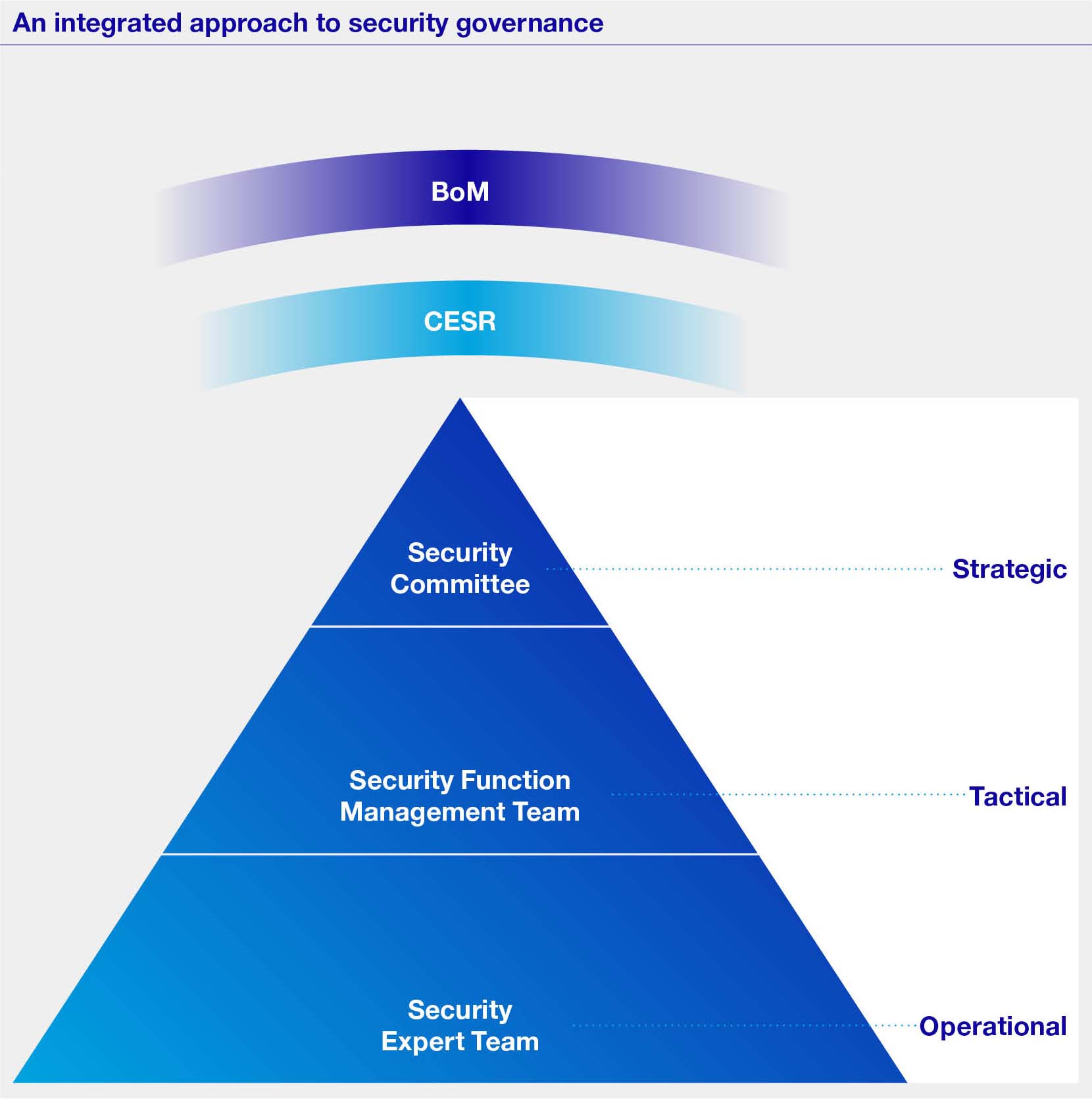

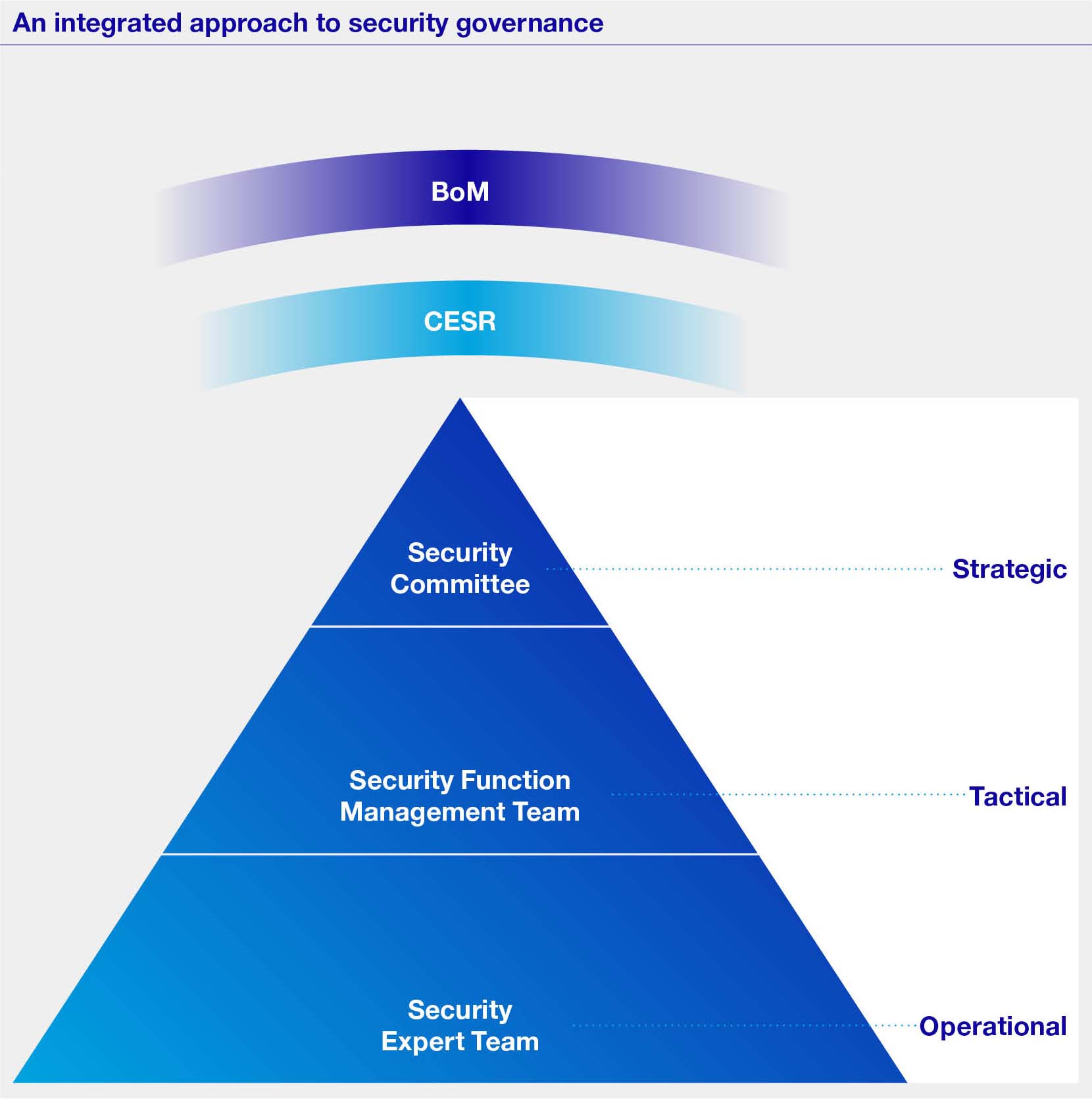

Risk management governance structure | |||||||||

Supervisory Board | Audit Committee | ||||||||

|  | ||||||||

Request to investigate specific risk topics | •Bi-annual risk review •Risk topics feedback | •Assertion on control effectiveness •Quarterly progress reporting | |||||||

Board of Management | |||||||||

Compliance, Ethics, Security and Risk Committee (CESR) Risk oversight | Disclosure Committee Internal Control Committee | ||||||||

|  | ||||||||