Nokia Annual Report on Form 20-F 2024

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | No ☐ | |

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. | Yes ☐ | |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | No ☐ | |

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). | No ☐ | |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” or “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one): |

Accelerated filer ☐ | |

Non-accelerated filer ☐ | Smaller reporting company ☐ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | |

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | |

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). | ☐ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing: |

U.S. GAAP ☐ | |

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. | Item 17 ☐ | Item 18 ☐ |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). | Yes ☐ |

Form 20-F Item Number | Form 20-F Heading | Section in Document | |

ITEM | 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS | N/A |

ITEM | 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | N/A |

ITEM | 3 | KEY INFORMATION | |

3A | [Reserved] | ||

3B | Capitalization and Indebtedness | N/A | |

3C | Reasons for the Offer and Use of Proceeds | N/A | |

3D | Risk Factors | Operating and financial review and prospects—Risk factors | |

ITEM | 4 | INFORMATION ON THE COMPANY | |

4A | History and Development of the Company | Cover page; Business overview; Introduction and use of certain terms; Business overview—Our history; Operating and financial review and prospects—Liquidity and capital resources; Operating and financial review and prospects—Shares and shareholders—Shares and share capital; General facts on Nokia—Alternative performance measures; Operating and financial review and prospects—Significant subsequent events; Other information—Investor information | |

4B | Business Overview | Business overview—Nokia in 2024; Business overview—Our strategy; Business Overview—Business groups; Operating and financial review and prospects— Operating and financial review—Results of segments; Financial statements—Notes to the consolidated financial statements—Note 1.1. Corporate information; Financial statements— Notes to the consolidated financial statements—Note 2.2. Segment information; Financial statements—Notes to the consolidated financial statements—Note 2.6. Discontinued operations; General facts on Nokia—Government regulation | |

4C | Organizational Structure | Business overview—Nokia in 2024; Financial statements—Notes to the consolidated financial statements—Note 1.1. Corporate information; Financial statements—Notes to the consolidated financial statements—Note 2.2. Segment information; Financial statements—Notes to the consolidated financial statements—Note 2.6. Discontinued operations; Financial statements—Notes to the consolidated financial statements—Note 6.2. Principal Group companies; Financial statements—Notes to the consolidated financial statements—Note 6.3. Significant partly-owned subsidiaries | |

4D | Property, Plants and Equipment | Financial statements—Notes to the consolidated financial statements—Note 4.2. Property, plant and equipment; Financial statements—Notes to the consolidated financial statements—Note 4.3. Leases; Business overview—Supply chain, sourcing and manufacturing | |

4A | UNRESOLVED STAFF COMMENTS | None | |

ITEM | 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | |

5A | Operating Results | Business overview—Our strategy; General facts on Nokia—Government regulation; Financial statements—Notes to the consolidated financial statements—Section 2. Results for the year; Financial statements—Notes to the consolidated financial statements—Note 5.4. Financial risk management; Operating and financial review and prospects— Operating and financial review | |

5B | Liquidity and Capital Resources | Operating and financial review and prospects—Liquidity and capital resources; Financial statements—Notes to the consolidated financial statements—Note 5.2. Financial assets and liabilities; Financial statements—Notes to the consolidated financial statements—Note 5.3. Derivative and firm commitment assets and liabilities; Financial statements—Notes to the consolidated financial statements—Note 6.1. Commitments, contingencies and legal proceedings; Financial statements—Notes to the consolidated financial statements—Note 5.4. Financial risk management | |

5C | Research and Development, Patents and Licenses etc. | Business overview—Our strategy; Business overview—Business groups—Nokia Technologies; Operating and financial review and prospects—Results of operations; Operating and financial review and prospects—Results of segments | |

5D | Trend Information | Business overview—Nokia in 2024; Business overview—Our strategy | |

5E | Critical Accounting Estimates | N/A | |

ITEM | 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | |

6A | Directors and senior management | Corporate governance—Corporate Governance Statement | |

6B | Compensation | Corporate governance—Remuneration; Financial statements—Notes to the consolidated financial statements—Note 6.4. Related party transactions; Financial Statements— Notes to the consolidated financial statements—Note 3.2. Remuneration of key management; Financial statements—Notes to the consolidated financial statements—Note 3.3. Share-based payments | |

6C | Board Practices | Corporate governance—Corporate governance statement; Corporate governance—Remuneration—Remuneration governance | |

Form 20-F Item Number | Form 20-F Heading | Section in Document | |

6D | Employees | Business Overview—Nokia in 2024; Operating and financial review and prospects—Operating and financial review—Results of operations—Cost savings program; Financial statements—Notes to the consolidated financial statements— Note 3.1. Summary of personnel expenses | |

6E | Share Ownership | Corporate governance—Remuneration—Remuneration Report 2024; Corporate governance—Corporate governance statement; Financial statements—Notes to the consolidated financial statements—Note 3.3. Share-based payments | |

6F | Disclosure of a registrant’s action to recover erroneously awarded compensation | N/A | |

ITEM | 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | |

7A | Major Shareholders | Operating and financial review and prospects—Shares and shareholders | |

7B | Related Party Transactions | Financial statements—Notes to the consolidated financial statements—Note 6.4. Related party transactions | |

7C | Interests of Experts and Counsel | N/A | |

ITEM | 8 | FINANCIAL INFORMATION | |

8A | Consolidated Statements and Other Financial Information | Financial statements; Reports of independent registered public accounting firm; Operating and financial review and prospects—Shares and shareholders—Dividend and share buybacks; Financial statements—Notes to the consolidated financial statements—Note 6.1. Commitments, contingencies and legal proceedings | |

8B | Significant Changes | Operating and financial review and prospects—Significant subsequent events; Financial statements—Notes to the consolidated financial statements—Note 6.5. Subsequent events | |

ITEM | 9 | THE OFFER AND LISTING | |

9A | Offer and Listing Details | Operating and financial review and prospects—Shares and shareholders; Financial statements—Notes to the consolidated financial statements—Note 1.1. Corporate information; Other information—Investor information—Stock exchanges | |

9B | Plan of Distribution | N/A | |

9C | Markets | Operating and financial review and prospects—Shares and shareholders; Financial statements—Notes to the consolidated financial statements—Note 1.1. Corporate information; Other information—Investor information—Stock exchanges | |

9D | Selling Shareholders | N/A | |

9E | Dilution | N/A | |

9F | Expenses of the Issue | N/A | |

ITEM | 10 | ADDITIONAL INFORMATION | |

10A | Share capital | N/A | |

10B | Memorandum and Articles of Association | Operating and financial review and prospects—Articles of Association; Other information—Exhibits | |

10C | Material Contracts | N/A | |

10D | Exchange Controls | General facts on Nokia—Controls and procedures—Exchange controls | |

10E | Taxation | General facts on Nokia—Taxation | |

10F | Dividends and Paying Agents | N/A | |

10G | Statement by Experts | N/A | |

10H | Documents on Display | Other information—Investor information—Documents on display | |

10I | Subsidiary Information | N/A | |

10J | Annual Report to Security Holders | N/A | |

ITEM | 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | Business overview—Our strategy; Operating and financial review and prospects—Risk factors—Financial and tax-related uncertainties; Financial statements—Notes to the consolidated financial statements—Note 5.4. Financial risk management; Financial statements—Notes to the consolidated financial statements—Note 4.5. Trade receivables and other customer-related balances |

ITEM | 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | |

Form 20-F Item Number | Form 20-F Heading | Section in Document | |

12A | Debt Securities | N/A | |

12B | Warrants and Rights | N/A | |

12C | Other Securities | N/A | |

12D | American Depositary Shares | General facts on Nokia—American Depositary Shares; Introduction and use of certain terms | |

ITEM | 13 | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | None |

ITEM | 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS | None |

ITEM | 15 | CONTROLS AND PROCEDURES | Corporate governance—Corporate governance statement—Risk management, internal control and internal audit functions at Nokia; General facts on Nokia—Controls and procedures; Reports of independent registered public accounting firm |

ITEM | 16 | [Reserved] | |

16A | AUDIT COMMITTEE FINANCIAL EXPERT | Corporate governance—Corporate governance statement—Board of Directors—Committees of the Board of Directors | |

16B | CODE OF ETHICS | Corporate governance—Corporate governance statement—Regulatory Framework; Operating and financial review and prospects—Business integrity; Other information— Exhibits | |

16C | PRINCIPAL ACCOUNTANT FEES AND SERVICES | Corporate governance—Corporate governance statement—Auditor fees and services; Corporate governance—Corporate governance statement—Audit Committee pre- approval policies and procedures | |

16D | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | None | |

16E | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS | Operating and financial review and prospects—Shares and shareholders—Purchases of equity securities by the Company and affiliated purchasers Corporate Governance—Remuneration | |

16F | CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT | N/A | |

16G | CORPORATE GOVERNANCE | Corporate governance—Corporate governance statement—Regulatory framework | |

16H | MINE SAFETY DISCLOSURE | None | |

16I | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS | N/A | |

16J | INSIDER TRADING POLICIES | Corporate governance—Corporate governance statement—Main procedures relating to insider administration; Other information—Exhibits | |

16K | CYBERSECURITY | Corporate governance—Corporate Governance Statement—Risk management, internal control and internal audit functions at Nokia; Corporate governance statement—Main corporate governance bodies of Nokia—Board of Directors—Board oversight of cybersecurity; Operating and financial review and prospects—Risk factors— Risks impacting our competitiveness | |

ITEM | 17 | FINANCIAL STATEMENTS | Financial statements |

ITEM | 18 | FINANCIAL STATEMENTS | Financial statements |

ITEM | 19 | EXHIBITS | Other information—Exhibits |

Contents | 1 | ||||||||||||

Environment | |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 2 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 3 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 4 | |||||||

Dividends paid | Share buyback program executed |

EUR 714m | EUR 680m |

For the year ended 31 December | |||

EURm | 2024 | 2023 | 2022 |

Net sales | 19 220 | 21 138 | 23 761 |

Gross profit | 8 864 | 8 546 | 10 101 |

Gross margin | 46.1% | 40.4% | 42.5% |

Operating profit | 1 999 | 1 661 | 2 299 |

Operating margin | 10.4% | 7.9% | 9.7% |

Profit from continuing operations | 1 711 | 649 | 4 202 |

Profit for the year | 1 284 | 679 | 4 259 |

Free cash flow(1) | 2 021 | 665 | 873 |

EUR | |||

Earnings per share from continuing operations, diluted | 0.31 | 0.11 | 0.74 |

Earnings per share, diluted | 0.23 | 0.12 | 0.75 |

Proposed dividend per share(2) | 0.14 | 0.13 | 0.12 |

At 31 December | |||

EURm | 2024 | 2023 | 2022 |

Net cash and interest-bearing financial investments(1) | 4 854 | 4 323 | 4 767 |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 5 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 6 | |||||||

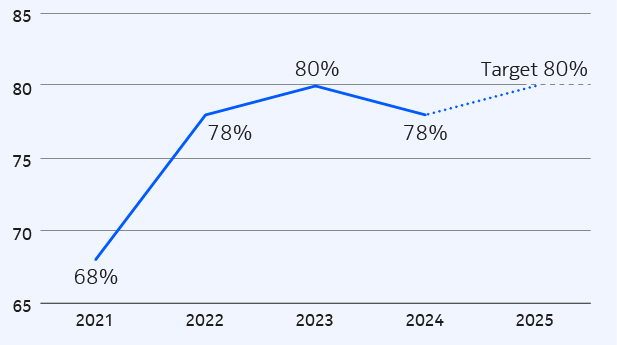

Share of suppliers achieving a satisfactory sustainability score(1) from supplier performance evaluation(2) % | ||

| ||

(1)Based on aggregated weighted share. (2)Based on Corporate Responsibility onsite audit programs, EcoVadis, CDP, Conflict minerals. | ||

ESG Rankings and ratings | Score | Latest result | |

| Recognized as one of the 2025 World’s Most Ethical Companies(1) | 2025 Mar | |

| Prime, B (A+/D-) | 2025 Feb(2) | |

Clean200™ | 31st out of 200 | 2025 Feb(2) | |

| #44 | 2025 Jan(2) | |

| 11.1 (Low risk of experiencing material financial impacts from ESG factors) | 2024 Oct | |

| AAA (AAA/CCC) | 2024 Aug | |

| ESG Score 4.9/5.0 | 2024 Jun | |

| Top 1% - Platinum | 2024 May | |

| A-(3) | 2024 Feb(3) | |

| 22 out of 60 companies | 2024 Jan | |

(1) “World’s Most Ethical Companies” and “Ethisphere” names and marks are registered trademarks of Ethisphere LLC. (2) Refers to 2024 result, received in January/February 2025. (3) 2024 final score pending, expected in April 2025. | |||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 7 | |||||||

Network Infrastructure | ||||

Network Infrastructure delivers fixed access, IP routing and optical transport for business-critical and mission-critical applications for CSP, enterprise and webscale customers. | ||||

Segment net sales (EURm) | ||||

-6% | ||||

Segment operating margin | ||||

-300 bps | ||||

READ MORE ON PAGES 21 TO 22 → | ||||

Mobile Networks | ||||

Mobile Networks creates products and services covering all 3GPP mobile technology generations. Its portfolio includes products for radio access networks (RAN) and microwave radio links for transport networks, solutions for network management, as well as network planning, optimization, network deployment and technical support services. | ||||

Segment net sales (EURm) | ||||

-21% | ||||

Segment operating margin | ||||

-210 bps | ||||

Cloud and Network Services | ||||

Cloud and Network Services provides open, secure, automated and scalable software and solutions that accelerate the journey of service providers and enterprises to autonomous networks and new value creation. | ||||

Segment net sales (EURm) | ||||

-6% | ||||

Segment operating margin | ||||

+30 bps | ||||

Nokia Technologies | ||||

Nokia Technologies is responsible for managing Nokia’s patent portfolio and monetizing Nokia’s intellectual property, including patents and technologies. | ||||

Segment net sales (EURm) | ||||

+78% | ||||

Segment operating margin | ||||

+1 090 bps | ||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 8 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 9 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 10 | |||||||

1 | Communications service providers (CSPs) |

2 | Enterprises |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 11 | |||||||

3 | Licensees |

1 | 2 | 3 | |||||||||||

CSPs | Enterprise | Licensees | |||||||||||

Focus on connectivity strengths and using cost optimization via automation and asset carve outs to fund both fiber and 5G investments. Favoring cloud strengths in vendor and partner ecosystem. Network monetization targeting enterprise and edge use cases. | Enterprise verticals Digitalization and automation of operations in industrial segments. Transition to software-centric operations and adoption of industrial operational technology (OT) edge and on-premise clouds. Energy and manufacturing as early adopters of private wireless and automation solutions. Federal, state government and cities network modernization acceleration. | Patent portfolio with long lifetime The vast majority of Nokia’s patents still in force in ten years’ time. New inventions every year In 2024, we filed patent applications on a record number of more than 3 000 new inventions in areas such as 5G and upcoming 6G networks, Wi-Fi connectivity, next- generation video coding, and more. Annual number of patent filings expected to grow due to continued investments in R&D and standardization. Entire industries powered by our fundamental cellular and multimedia inventions providing us with the opportunity to expand our licensing coverage; we are making good progress in our growth areas of consumer electronics, automotive and IoT. | |||||||||||

Webscalers Edge computing as a growth engine – industrial automation workloads across on-premise, edge, public cloud. Partnering with CSPs to co-locate edge stacks and building an ecosystem for low-latency apps. Targeting telco and network workloads to run on their cloud infrastructure. Collaborating with CSPs in the transformation of network operations. | |||||||||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 12 | |||||||

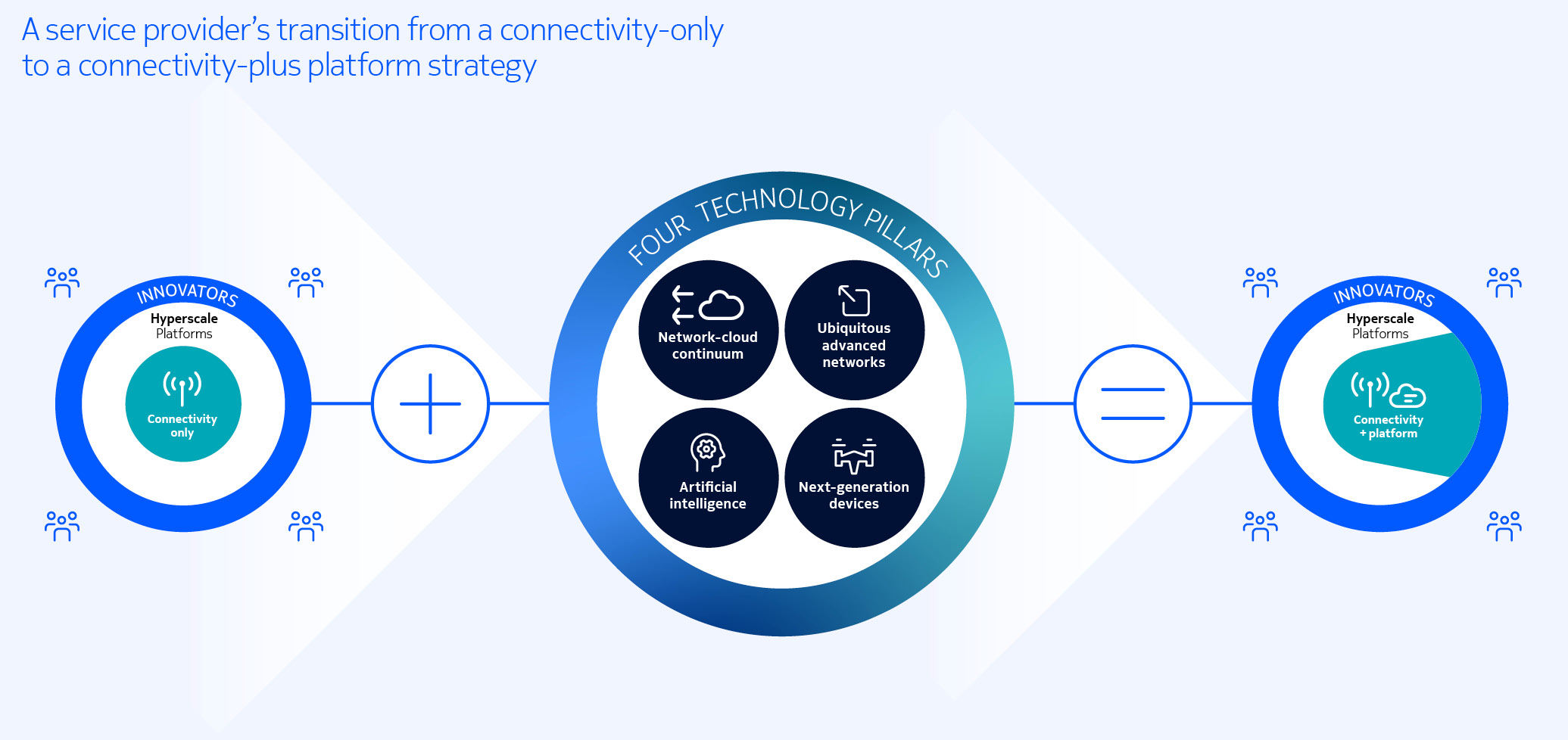

1 | Grow CSP business faster than market | 2 | Expand the share of enterprise in our business | 3 | Actively manage our portfolio | 4 | Secure business longevity in Nokia Technologies | 5 | Build new business models | 6 | Develop ESG into a competitive advantage | |||||||||||||||||

CSPs will continue to be our biggest customer segment. We will leverage our strong technological position, investment in technology leadership and emerging opportunities to grow our share in key markets, with geopolitical considerations supporting this ambition. | Enterprise verticals and webscalers are deploying campus networks, wide area private wireless networks, enterprise physical networks and data centers at an accelerated rate to digitalize their operations. Being a technology leader in all these domains, we pursue these opportunities to grow our enterprise business. | Maintaining our portfolio segments at number one or number two position, through several routes including active portfolio management, is critical for a profitable and sustainable business. There may be cases where a leadership position is not possible, and for these cases, we will consider alternatives. | We are investing to ensure the sustained competitiveness of our patent portfolio. We will continue to pursue opportunities from sectors outside mobile devices, such as automotive, consumer electronics, IoT and video services. | To broaden our customer base and change our margin profile, we see potential in new platform business models within the broader ecosystem. We engage with service providers, webscalers, industrial giants and emerging players, like app developers and start-ups, to drive the creation of new products, services, and solutions, and to explore new business models including Cloud RAN, Network as Code and as-a-Service. | ESG is increasingly important for customers, investors, regulators, partners and Nokia employees. There is space in our industry to become the ‘trusted provider’ and Nokia aims to claim this position. Our ESG strategy lays out how we will do this and our specific areas of focus. | |||||||||||||||||||||||

The six pillars are underpinned by four enablers: | ||||||||||||||

1 | Develop future-fit-talent | 2 | Invest in long-term research | 3 | Digitalize our own operations | 4 | Refresh our brand | |||||||

We have launched and are executing a new people strategy focused on growth, skills and development. We build the right future skills for our employees in the technical domains identified in our technology vision and strategy, and the commercial skills to support our expansion into new domains. | Sustained technology leadership is a key driver of our success: it requires us to anticipate, shape and invest in the next technology waves and breakthroughs. We continue to invest in long-term research to ensure a leadership position in line with our Technology Vision 2030. We are also deeply engaged in leading and influencing standards and developing standard essential patents. | We are increasing the digitalization of our own operations to lead by example with a set of ambitious, company-wide strategic initiatives to increase the company’s performance and competitiveness, focused on efficiency, productivity and agility in internal operations, customer experience and R&D. | To ensure Nokia is recognized as a B2B technology innovation leader, we refreshed our brand in 2023. Our new visual identity is emblematic of an energized, dynamic and modern Nokia. | |||||||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 13 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 14 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 15 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 16 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 17 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 18 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 19 | |||||||

Over 150 years of innovation | Nokia has been adapting to the needs of an ever-changing world for over 155 years. |

Key = Innovation | 1982 Introduced both the first fully digital local telephone exchange in Europe and the world’s first NMT car phone 1991 Enabled the first GSM call using a Nokia phone over the Nokia-built network of Finnish communications service provider Radiolinja 1998 Became technology leader and the world’s largest manufacturer of mobile phones 2001 Invented MIMO (Multiple-Input and Multiple-Output), a key element of a large number of modern wireless systems that allows for greater throughput without increasing bandwidth requirements* | 2006 Developed Softrouter, a routing architecture permitting the development of a programmable, open network infrastructure to allow easier deployment of new services that make use of exposed network capabilities* 2007 Entered a joint venture with Siemens, combining mobile and fixed-line phone network equipment businesses and creating Nokia Siemens Networks (NSN) 2011 Entered a strategic partnership with Microsoft to address increasing competition from iOS and Android operating systems Acquired the wireless network equipment division of Motorola | ||||||||||||||

1947 Developed the transistor, a tiny device that revolutionized the entire electronics industry* 1954 Created the solar cell, enabling the conversion of the sun’s energy into electricity* 1958 Developed the laser, creating the foundation for fiber optics* | 1960s Nokia became a conglomerate comprising rubber, cable, forestry, electronics and power-generation businesses 1962 Launched the first communications satellite, Telstar 1, into orbit, enabling the first ever broadcast of live television between the US and Europe* 1969 Developed UNIX, the software system that made the large-scale networking of diverse computing systems and the internet practical* | |||||||||||||||

1865 Founded as a single paper mill operation | 1926 Brought sound to motion pictures* | |||||||||||||||

1865 | 1960 | 2006 | ||||||||||||||

*Bell Telephone Laboratories (1925-1984). Following its acquisition by Nokia in 2016, it was renamed Nokia Bell Labs. | ||||||||||||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 20 | |||||||

2017 Developed Probabilistic Constellation Shaping, an innovative technology to get the most out of each fiber, irrespective of its length and capabilities Additional acquisitions enhancing our technology leadership: Deepfield, the US-based leader in real-time analytics for IP network performance management and security, and Comptel, a Finland- based telecommunications software company 2018 Acquired Unium, a Seattle-based software company that specializes in solving complex wireless networking problems for use in mission-critical and residential Wi-Fi applications 2019 Opened the world’s first live end-to- end 5G lab, the Future X Lab in Murray Hill, New Jersey, US | 2020 Selected by NASA to build and deploy the first end-to-end LTE solution on the lunar surface Enabled commercial deployment of the world’s first 5G liquid cooling solution Set the 5G speed world record Acquired Elenion, a US-based company focusing on silicon photonics technology 2021 Developed the Resh programming language to take control of and manage a fleet of robots 2022 Showcased the first 100Gb/s fiber broadband technology in the US Launched the Advanced Security Testing and Research (ASTaR) lab in Dallas – the first end-to-end 5G testing lab in the US focused solely on cybersecurity Introduced the 6 pillars of Responsible AI | 2023 Renewed the Nokia brand to establish a clear position for Nokia as a B2B technology innovation leader Achieved two key 6G technological milestones: the implementation of AI and machine learning into the radio air interface, and proof-of-concept of 6G joint communication and sensing capability Continued to actively manage its business portfolio, e.g., through the agreed sale of its Device Management and Service Management Platform businesses, and the divestment of its VitalQIP products. Announced the acquisition of Fenix Group Added our 10th Nobel Prize for work completed at Bell Labs, with the Nobel Prize in Chemistry awarded to our alumnus Louis Brus World-record 2.4 Tb/s optical transmission over a single wavelength | |||||||||||

2013 Purchased Siemens’ stake in NSN 2014 Sold the Devices and Services business to Microsoft Developed XG-FAST technology, enabling service providers to generate fiber-like speeds of more than 10Gbps over short distances using existing copper infrastructure 2016 Acquired Alcatel-Lucent, including Bell Labs, creating an innovation leader in next-generation technology and services | 2024 Divested our Submarine Networks business and announced our plans to acquire Infinera, a leader in optical networks Made the world’s first immersive voice and audio call over a cellular network using a codec which enables 3D spatial sound in real-time Partnered with Axiom Space to enable high-speed cellular network capabilities in next- generation lunar spacesuits | ||||||||||||

2013 | 2020 | 2024 |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 21 | |||||||

8 500km distance between London and Chicago covered by the Colt, Windstream and Nokia ultra-fast 800GbE trial | 2024 in brief In 2024, Network Infrastructure’s net sales declined by 6% from 2023. We faced challenges across our business units in the first half of the year, with a strong return to year-on-year growth in the fourth quarter. Against this backdrop, focused cost management contributed to a segment operating margin of 11.7%. ■Divested our Submarine Networks business, and announced our plans to acquire Infinera – a leader in optical networks with a complementary geographical and customer segment fit. ■Strengthened our role as a key supplier for Microsoft Azure’s cloud infrastructure with a new five-year deal in support of the customer’s ongoing footprint expansion to manage surging demand for general compute. ■Signed a strategic deal with AT&T to accelerate future-ready fiber broadband growth. ■Launched Event-Driven Automation platform: the most modern data center platform in the industry, built for the AI era. ■Introduced a toolkit to boost the Corteca developer ecosystem. ■Launched a new portfolio of application-optimized optical network solutions. | |||

40% potential reduction in operational effort enabled by the new Event-Driven Automation platform | ||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 22 | |||||||

| ||

↗ EDA – a data center platform for the AI era. | ||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 23 | |||||||

12 new CSP RAN customers in 2024 | 2024 in brief In 2024, Mobile Networks net sales declined 21% year-on-year to EUR 7.7 billion. Despite the lower net sales, we delivered a segment operating margin of 5.3% driven by favorable business and market mix as well as improved cost competitiveness, cost control measures and strong execution. We also concluded an agreement with AT&T which decided to continue with another RAN vendor for commercial reasons, leading to an accelerated revenue of EUR 150 million offsetting higher variable pay. ■We now have 334 commercial 5G deals and more than 850 private wireless customers, with 193 in 5G. ■Expanded our AirScale portfolio with new market-leading, energy- efficient Massive MIMO radios to support mobile traffic growth and accelerate mass 5G rollouts. ■Collaborated with Nvidia, T-Mobile and SoftBank to steer the AI transformation and develop AI-RAN to leverage platform synergies. ■Closed the acquisition of Fenix Group in the US for addressing tactical wireless communication in the defense segment. | |||

334 commercial 5G deals | ||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 24 | |||||||

| ||

↗ Small cells complement the macro coverage of CSP networks and fulfill the specific requirements of industrial and office environments. | ||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 25 | |||||||

Nokia had the most CSP customers of 5G Standalone Core in the industry, with 123 at the end of 2024 | 2024 in brief Our net sales decreased by 6% year-on-year while our segment operating margin slightly increased. These results were accompanied by a host of customer wins and deployments, including the following key developments: ■Partnered with Infobip to enable the global developer community to better leverage network APIs. ■Acquired Rapid’s technology and R&D unit to strengthen development of Nokia network API solutions and ecosystem. ■Deployed 5G standalone core with O2 Telefónica Germany on Amazon Web Services in the cloud. ■Strengthened Vodafone Idea’s network security with Nokia NetGuard Endpoint Detection and Response. ■Collaborated with Swisscom Broadcast to deploy the largest Drones-as-a-Service network in Switzerland. ■Announced a strategic partnership with Dell to advance network cloud transformation and private 5G. | |||

Nokia continued to have marketplace leadership in private wireless networking with 850 customers, of which 182 are 5G | ||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 26 | |||||||

| ||

↗ Our private wireless solutions ensure secure, high-performance connectivity tailored to industrial needs. | ||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 27 | |||||||

7 000+ patent families declared as essential to the 5G standard | 2024 in brief Net sales for the full year increased 78% to EUR 1 928 million and segment operating profit increased 106% to EUR 1 514 million. The smartphone license renewal cycle was completed and significant progress was made in patent licensing growth areas: ■Drove innovation, filing over 3 000 new inventions, and reaching 7 000 patent families declared as essential to the 5G standard. ■Signed around 40 new patent license agreements and completed our smartphone license renewal cycle. ■Signed first agreements with direct-to-consumer video streaming platforms. ■Made significant progress in China, signing our first two deals in automotive and with a point-of-sales (POS) manufacturer PAX. ■Made the world’s first immersive voice and audio call using the new 3GPP Immersive Voice and Audio Services (IVAS) codec. ■Signed an agreement with HP covering the use of our video technologies while courts in Germany and Brazil ruled in our favor in our dispute with Amazon. | |||

~40 new patent licensing deals signed | ||||

’3 000+ new patent applications filed | ||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 28 | |||||||

| ||

↗ In June 2024, Nokia made the world’s first immersive voice and audio call over a cellular network using the IVAS codec, which enables 3D spatial sound in real time. | ||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 29 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 30 | |||||||

Country | Location and products(1) | Productive capacity, net (m2)(2) |

Finland | Oulu: base stations | 10 000 |

India | Chennai: base stations, radio controllers and transmission systems, fixed networks | 15 500 |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 31 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 32 | |||||||

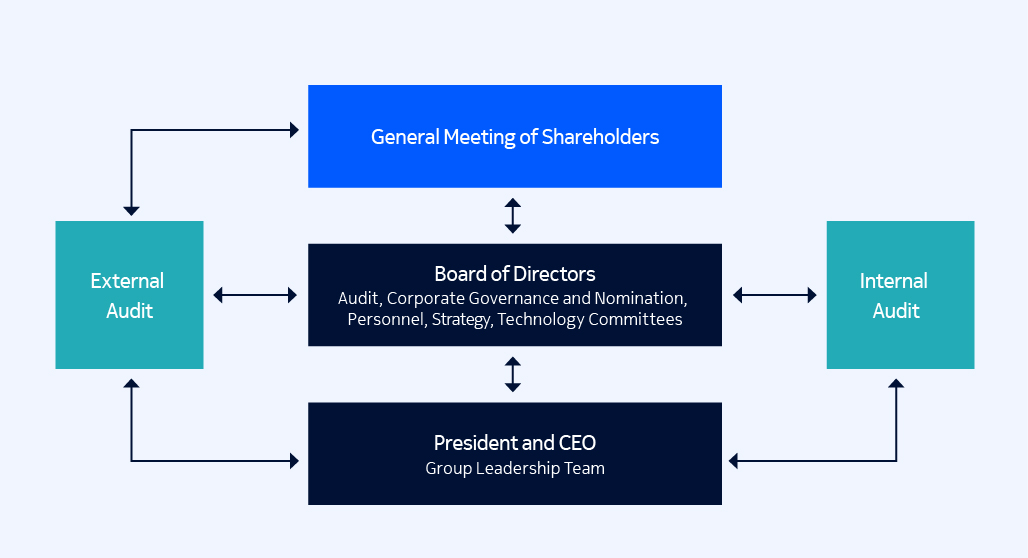

Select highlights in our corporate governance during 2024 ■At the 2024 Annual General Meeting our shareholders continued to show remarkably strong support for the Board’s proposals. We continued applying the individual director election method, and for the first time, our shareholders elected a sustainability reporting assurer, in line with the regulation implementing the EU Corporate Sustainability Reporting Directive. ■The Board established a new Strategy Committee for the purpose of assisting the Board with respect to various strategic initiatives related to developing our corporate and business strategies and capturing the strategic opportunities identified under them. ■To ensure the innovative and responsible use of AI, we established a comprehensive AI governance framework at Nokia in 2024, including a central steering committee and a separate AI governance board for the group-level policies and procedures, incident reporting, coordination and for related communications. ■During the year, we had the pleasure to host several meetings with our largest shareholders to discuss Nokia’s approach to sustainability, remuneration and governance, and their expectations in these areas. | ||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 33 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 34 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 35 | |||||||

Gender | Year of Birth | Nationality | Tenure(1) | Independent of the company and major shareholders | Shares(2) | ADSs(2) | |

Sari Baldauf (Chair) | Female | 1955 | Finnish | 6 | Independent | 343 568 | |

Søren Skou (Vice Chair) | Male | 1964 | Danish | 5 | Independent | 114 397 | |

Timo Ahopelto | Male | 1975 | Finnish | 1 | Independent | 45 350 | |

Elizabeth Crain | Female | 1964 | American | 1 | Independent | 47 843 | |

Thomas Dannenfeldt | Male | 1966 | German | 4 | Independent | 144 948 | |

Lisa Hook | Female | 1958 | American | 2 | Independent | 59 558 | |

Mike McNamara | Male | 1964 | Irish | 0 | Independent | 23 932 | |

Thomas Saueressig | Male | 1985 | German | 2 | Independent | 56 928 | |

Carla Smits-Nusteling | Female | 1966 | Dutch | 8 | Independent | 160 475 | |

Kai Öistämö | Male | 1964 | Finnish | 2 | Independent | 59 086 | |

(1)Terms as Nokia Board member before the Annual General Meeting on 3 April 2024. (2)The number of shares or ADSs includes shares and ADSs received as director compensation as well as shares and ADSs acquired through other means. Stock options or other equity awards that are deemed as being beneficially owned under the applicable SEC rules are not included. | |||||||

Business Exec. role with P&L responsibility | External boardroom roles/ Governance | Finance and accounting | Legal/Public policy/ Compliance | Communications service provider market segment | Enterprise market segment | Technology | Cybersecurity | Environmental/ Social issues | |

Current Board members | |||||||||

Sari Baldauf | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

Søren Skou | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

Timo Ahopelto | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

Elizabeth Crain | ✔ | ✔ | ✔ | ✔ | |||||

Thomas Dannenfeldt | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

Lisa Hook | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

Mike McNamara | ✔ | ✔ | ✔ | ✔ | ✔ | ||||

Thomas Saueressig | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

Carla Smits-Nusteling | ✔ | ✔ | ✔ | ✔ | |||||

Kai Öistämö | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | |||

Proposed new Board members | |||||||||

Pernille Erenbjerg | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ✔ | ||

Timo Ihamuotila | ✔ | ✔ | ✔ | ✔ |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 36 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 37 | |||||||

|  |  |  | ||||

Chair Sari Baldauf | Vice Chair Søren Skou | Timo Ahopelto | Elizabeth Crain | ||||

b. 1955 | b. 1964 | b. 1975 | b. 1964 | ||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 38 | |||||||

|  |  | ||||||

Thomas Dannenfeldt | Lisa Hook | Mike McNamara | ||||||

b. 1966 | b. 1958 | b. 1964 | ||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 39 | |||||||

|  |  | ||||||

Thomas Saueressig | Carla Smits-Nusteling | Kai Öistämö | ||||||

b. 1985 | b. 1966 | b. 1964 | ||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 40 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 41 | |||||||

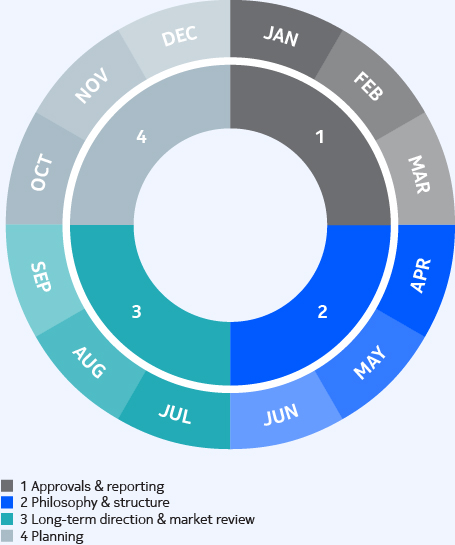

January | February/March | April | May | June/July | September/October | November/December | |

Board | –Business and financial reviews –Q4 and 2023 financials –Strategy execution update –Annual General Meeting (AGM) proposals, including. profit distribution –Annual Policy and Charter review –Board evaluation –Review of CEO’s performance, remuneration and targets | –Annual report and 20-F –Remuneration Report 2023 | –AGM and appointing Board Chair, Vice Chair and Committee members –Business and financial reviews –Strategy execution update –Q1 financials | –Business and financial reviews –Strategy execution update –Geopolitical update –Macroeconomics update –Product and customer security update –Shareholder activism preparedness update –Litigation and compliance update | –Business and financial reviews –Q2 financials –Strategy execution update –Annual sustainability review | –Annual strategy meeting –Business and financial reviews –Geopolitical update –Innovation framework –People update –Q3 financials | –Business and financial reviews –Long-range forecast and annual target setting –Key risks review –Investors’ feedback on governance, remuneration and sustainability –Digitalization and security update –Geopolitical update |

Corporate Governance and Nomination Committee | –AGM proposals on Board composition and remuneration –Independence review –Corporate governance statement | –Committee compositions –Annual Clock and discussion on Committee work –Future Board composition | –Future Board composition –Management succession planning | –Corporate governance developments in regulation –Future Board composition –Board evaluation approach –Management succession planning | –Board remuneration review and benchmarking –Annual assessment of director commitments –Future Board composition –Annual Charter review | ||

Personnel Committee | –Incentive achievements for 2023 –CEO and GLT performance –Incentive targets and objectives for 2024 –Long-term Incentive Plan (LTI) grant proposal for 2024 –Remuneration Report 2023 | –AGM shareholder feedback –GLT remuneration –Culture update –Succession planning | –Remuneration Policy 2025 –LTI performance update –Human capital risk review, including physical safety –Committee adviser’s market and benchmarking update –Succession planning | –Incentive Compensation Clawback Policy –Independent adviser review –LTI design for 2025 –Remuneration Policy 2025 including shareholder consultation –Workforce demographics | –LTI budget for 2025 –2025 incentive targets –Investor feedback –Planning of Remuneration Report for 2024 –Succession planning –Executive shareholding assessment –Annual Charter review | ||

Audit Committee | –Q4 and 2023 financials –Auditor reporting –Ethics and compliance, internal audit, treasury and internal controls updates –AGM proposals to the Board –Information and service security update –Annual Charter and Policy review | –Annual report and 20-F for 2023, including sustainability reporting –Auditor reporting –Internal controls update –Double materiality assessment | –Q1 financials –Auditor reporting –Ethics and compliance, internal audit and internal controls updates –Tax update –Treasury update –Conflict Minerals Report | –Q2 financials –Auditor reporting –Ethics and compliance, internal audit and internal controls updates | –Q3 financials –Auditor reporting –Ethics and compliance, internal audit and internal controls updates –ESG disclosure and reporting developments, processes and controls –Information and service security updates –Finance IT and digitalization update | –Treasury update –Pensions update –Audit, internal audit and internal controls updates –Privacy and cybersecurity update –Annual Charter and Policy review | |

Technology Committee | –Updates on innovation and technology trends –Review of strategic technology initiatives | –Updates on innovation and technology trends –Review of strategic technology initiatives | –Sustainability technology strategy –Updates on innovation and technology trends –Review of strategic technology initiatives –Product and customer security | –Updates on innovation and technology trends including AI –Review of strategic technology initiatives –Product and customer security and AI updates |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 42 | |||||||

Board meeting attendance | Board and Committee meeting attendance(1) | ||||

Member | Meetings | % | Meetings | % | |

Sari Baldauf (Chair) | 20/20 | 100% | 38/38 | 100% | |

Søren Skou (Vice Chair) | 19/20 | 95% | 31/33 | 94% | |

Timo Ahopelto | 18/20 | 90% | 28/30 | 94% | |

Elizabeth Crain | 20/20 | 100% | 34/34 | 100% | |

Thomas Dannenfeldt | 20/20 | 100% | 37/38 | 97% | |

Lisa Hook | 20/20 | 100% | 37/37 | 100% | |

Jeanette Horan (until 3 April 2024) | 3/4 | 75% | 5/7 | 71% | |

Mike McNamara (as of 3 April 2024) | 17/17 | 100% | 24/24 | 100% | |

Thomas Saueressig | 20/20 | 100% | 24/24 | 100% | |

Carla Smits-Nusteling | 17/20 | 85% | 28/31 | 90% | |

Kai Öistämö | 20/20 | 100% | 29/29 | 100% | |

Average attendance (%) | 95% | 95% | |||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 43 | |||||||

Attendance | ||

Member | Meetings | % |

Carla Smits-Nusteling (Chair) | 6/6 | 100% |

Timo Ahopelto (until 3 April 2024) | 2/2 | 100% |

Elizabeth Crain (until 3 April 2024) | 2/2 | 100% |

Thomas Dannenfeldt | 6/6 | 100% |

Lisa Hook (as of 3 April 2024) | 4/4 | 100% |

Jeanette Horan (until 3 April 2024) | 2/2 | 100% |

Mike McNamara (as of 3 April 2024) | 4/4 | 100% |

Average attendance (%) | 100% | |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 44 | |||||||

Attendance | ||

Member | Meetings | % |

Søren Skou (Chair) | 5/5 | 100% |

Sari Baldauf | 5/5 | 100% |

Lisa Hook | 5/5 | 100% |

Carla Smits-Nusteling | 5/5 | 100% |

Kai Öistämö | 5/5 | 100% |

Average attendance (%) | 100% | |

Attendance | ||

Member | Meetings | % |

Thomas Dannenfeldt (Chair) | 5/5 | 100% |

Timo Ahopelto (as of 3 April 2024) | 4/4 | 100% |

Sari Baldauf | 5/5 | 100% |

Elizabeth Crain (as of 3 April 2024) | 5/5 | 100% |

Lisa Hook (until 3 April 2024) | 1/1 | 100% |

Søren Skou (until 3 April 2024) | 1/1 | 100% |

Average attendance (%) | 100% | |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 45 | |||||||

Attendance | ||

Member | Meetings | % |

Elizabeth Crain (Chair) | 7/7 | 100% |

Sari Baldauf | 7/7 | 100% |

Thomas Dannenfeldt | 6/7 | 86% |

Lisa Hook | 7/7 | 100% |

Søren Skou | 6/7 | 86% |

Average attendance (%) | 94% | |

Attendance | ||

Member | Meetings | % |

Kai Öistämö (Chair) | 4/4 | 100% |

Timo Ahopelto | 4/4 | 100% |

Sari Baldauf (until 3 April 2024) | 1/1 | 100% |

Jeanette Horan (until 3 April 2024) | 0/1 | 0% |

Mike McNamara (as of 3 April 2024) | 3/3 | 100% |

Thomas Saueressig | 4/4 | 100% |

Average attendance (%) | 83% | |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 46 | |||||||

Summary of changes in the Group Leadership Team in 2024 The following members stepped down from the Group Leadership Team: ■Amy Hanlon-Rodemich, Chief People Officer, as of 28 March 2024; ■Ricky Corker, Chief Customer Experience Officer, as of 13 June 2024; ■Jenni Lukander, President of Nokia Technologies, as of 18 October 2024; and ■Melissa Schoeb; Chief Corporate Affairs Officer, as of 18 October 2024. Further, on 10 February 2025 Nokia announced that the current President and CEO Pekka Lundmark will step down on 31 March 2025. | The Group Leadership Team was complemented with four new appointments: ■Lorna Gibb, Chief People Officer, effective 13 June 2024; ■Louise Fisk, Chief Communications Officer, effective 18 October 2024; ■Patrik Hammarén, Acting President of Nokia Technologies, effective 18 October 2024 (President of Nokia Technologies as of 22 January 2025); and ■Mikko Hautala, Chief Geopolitical and Government Relations Officer, effective 1 November 2024. Further, on 10 February 2025 Nokia announced Justin Hotard’s appointment as President and CEO, effective 1 April 2025. |

Name | Position | Gender | Year of birth | Nationality | On GLT since | Shares |

Pekka Lundmark | President and CEO | Male | 1963 | Finnish | 2020 | 1 573 826 |

Nishant Batra | Chief Strategy and Technology Officer | Male | 1978 | Indian | 2021 | 335 869 |

Louise Fisk | Chief Communications Officer | Female | 1976 | British | 2024 | 37 070 |

Lorna Gibb | Chief People Officer | Female | 1976 | British | 2024 | 16 477 |

Federico Guillén | President of Network Infrastructure | Male | 1963 | Spanish | 2016 | 480 262 |

Patrik Hammarén | Acting President of Nokia Technologies | Male | 1982 | Finnish | 2024 | 21 955 |

Mikko Hautala | Chief Geopolitical and Government Relations Officer | Male | 1972 | Finnish | 2024 | 2 800 |

Esa Niinimäki | Chief Legal Officer | Male | 1976 | Finnish | 2023 | 49 903 |

Raghav Sahgal | President of Cloud and Network Services | Male | 1962 | American | 2020 | 618 318 |

Tommi Uitto | President of Mobile Networks | Male | 1969 | Finnish | 2019 | 268 619 |

Marco Wirén | Chief Financial Officer | Male | 1966 | Finnish/Swedish | 2020 | 321 441 |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 47 | |||||||

|  |  |  | |||||

Pekka Lundmark | Nishant Batra | Louise Fisk | Lorna Gibb | |||||

b. 1963 | b. 1978 | b. 1976 | b. 1976 | |||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 48 | |||||||

|  |  |  | |||||

Federico Guillén | Patrik Hammarén | Mikko Hautala | Esa Niinimäki | |||||

b. 1963 | b. 1982 | b. 1972 | b. 1976 | |||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 49 | |||||||

|  |  | ||||||

Raghav Sahgal | Tommi Uitto | Marco Wirén | ||||||

b. 1962 | b. 1969 | b. 1966 | ||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 50 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 51 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 52 | |||||||

EURm | 2024 | 2023 |

Audit fees(1) | 18.5 | 20.2 |

Audit-related fees(2) | 2.5 | 1.7 |

Tax fees(3) | 0.2 | 0.4 |

All other fees(4) | 0.1 | 0.3 |

Total | 21.3 | 22.6 |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 53 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 54 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 55 | |||||||

Delivering the next year’s step in the strategic plan – STI | |

Comparable Operating Profit 60%(1) | Cash Release 20% |

Continued focus on profitability | Achieve a strong cash position |

Health & Safety 10% – Lost Time Injury Frequency Rate (with a fatality modifier) | Women in leadership 5% Women in workforce 5% |

Deliver on our focus on the continued health and safety of our employees | Deliver on our commitment to become a more diverse employer |

Delivering sustainable value – LTI | |

50% relative TSR, 40% cumulative reported EPS (adjusted for impairments and M&A), 10% carbon emission reduction (scope 1, 2 and 3) | |

A more rounded and balanced approach reflecting performance over the long term in growing the business and in delivering shareholder value whilst working towards our 2030 goal of 50% carbon emission reduction | |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 56 | |||||||

Year | Aggregate remuneration of the Board of Directors (EUR)(1) | President and CEO actual remuneration (EUR)(2) | Average salaries and wages (EUR)(3)(5) | Net sales (EURm)(5) | Total shareholder return (rebased to 100 at 31 Dec 2019)(4) |

2020 | 2 016 000 | 3 587 781 | 65 787 | 21 852 | 95.60% |

2021 | 1 821 000 | 4 908 244 | 70 411 | 22 202 | 169.11% |

2022 | 2 280 000 | 4 316 606 | 74 241 | 23 761 | 132.96% |

2023 | 2 503 000 | 3 738 560 | 69 096 | 21 138 | 96.68% |

2024 | 2 511 000 | 3 988 250 | 78 576 | 19 220 | 140.28% |

(1)Aggregate total remuneration paid to the members of the Board during the financial year as annual fee and meeting fee, as applicable, and as approved by general meetings of shareholders. The value depends on the number of members elected to the Board for each term as well as on the composition of the Board committees and travel required. During the term that began from the Annual General Meeting 2021, the Board had eight members only, compared to ten members during the following terms. (2)The President and CEO actual remuneration represents the aggregate total of the two President and CEOs in 2020. (3)Average salaries and wages are based on average employee numbers and their total salaries and wages as reported in the Company’s financial statements. (4)Total shareholder return on last trading day of the previous year. (5)In June 2024, Nokia classified its Submarine Networks business as a discontinued operation. The comparative amounts for 2023 and 2022 have been recast accordingly. | |||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 57 | |||||||

ABB | IBM |

Adobe | Infineon Technologies |

Airbus | Juniper Networks |

ASML | Kone |

Atos | Motorola Solutions |

BAE Systems | NXP Semiconductors |

Capgemini | Oracle |

Ciena | Philips |

Cisco Systems | SAP |

Corning | Siemens Healthineers |

Dell Technologies | VMware |

Ericsson | Vodafone Group |

Hewlett Packard Enterprise | Wärtsilä |

HP |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 58 | |||||||

Board remuneration for the term that began at the Annual General Meeting held on 3 April 2024 and ends at the close of the Annual General Meeting in 2025 consisted of the following fees. |

Annual fee | EUR |

Chair | 440 000 |

Vice Chair | 210 000 |

Member | 185 000 |

Chair of Audit Committee | 30 000 |

Member of Audit Committee | 15 000 |

Chair of Personnel Committee | 30 000 |

Member of Personnel Committee | 15 000 |

Chair of Strategy Committee | 20 000 |

Member of Strategy Committee | 10 000 |

Chair of Technology Committee | 20 000 |

Member of Technology Committee | 10 000 |

Meeting fee(1) | EUR |

Meeting requiring intercontinental travel | 5 000 |

Meeting requiring continental travel | 2 000 |

The following table outlines the total annual remuneration paid in 2024 to the members of the Board for their services, as resolved by the shareholders at the Annual General Meeting. |

Annual fees (EUR) | Meeting fees (EUR)(1) | Total remuneration paid (EUR) | 60% of annual fees and all meeting fees paid in cash (EUR) | 40% of annual fees paid in shares (EUR) | Number of shares (approximately 40% of the annual fee) | |

Sari Baldauf (Chair) | 465 000 | 10 000 | 475 000 | 289 000 | 186 000 | 52 993 |

Søren Skou (Vice Chair) | 220 000 | 14 000 | 234 000 | 146 000 | 88 000 | 25 072 |

Timo Ahopelto | 210 000 | 10 000 | 220 000 | 136 000 | 84 000 | 23 932 |

Elizabeth Crain | 220 000 | 12 000 | 232 000 | 144 000 | 88 000 | 25 072 |

Thomas Dannenfeldt | 240 000 | 14 000 | 254 000 | 158 000 | 96 000 | 27 351 |

Lisa Hook | 210 000 | 14 000 | 224 000 | 140 000 | 84 000 | 23 932 |

Jeanette Horan (until 3 April 2024)(2) | — | — | — | — | — | — |

Mike McNamara (as of 3 April 2024) | 210 000 | 14 000 | 224 000 | 140 000 | 84 000 | 23 932 |

Thomas Saueressig | 195 000 | 14 000 | 209 000 | 131 000 | 78 000 | 22 223 |

Carla Smits-Nusteling | 215 000 | 9 000 | 224 000 | 138 000 | 86 000 | 24 502 |

Kai Öistämö | 205 000 | 10 000 | 215 000 | 133 000 | 82 000 | 23 362 |

Total | 2 390 000 | 121 000 | 2 511 000 | 1 555 000 | 956 000 | 272 371 |

(1)Meeting fees include all meeting fees paid for the term that ended at the Annual General Meeting held on 3 April 2024 and meeting fees accrued and paid in 2025 for the term that began at the same meeting. (2)Stepped down at the Annual General Meeting on 3 April 2024 and received no annual or meeting fees in 2024. | ||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 59 | |||||||

EUR | 2024 | Pay mix(1) | 2023 | Pay mix(1) |

Salary | 1 410 500 | 36% | 1 322 750 | 36% |

Short-term incentive(2) | 1 824 834 | 46% | 1 079 695 | 30% |

Long-term incentive | 697 872 | 18% | 1 240 359 | 34% |

Other remuneration(3) | 55 044 | 95 756 | ||

Total | 3 988 250 | 3 738 560 |

Metric | Weight | Target | 2024 performance outcome | 2024 STI outcome (% of target) |

Comparable operating profit(1) | 60% | EUR 2 782 million | EUR 2 619m | 83% |

Cash release | 20% | EUR -1 115 million | EUR 1 149m | 225% |

Diversity | 10% | Female percentage of global external hires of 29% | 28% | 25% |

Health & safety | 10% | ■Employee lost time injury frequency rate (LTIFR) of 0.089 ■Fatality modifier (downward discretion in the event of fatalities) | LTIFR of 0.085 with 8 fatalities | 62% |

Total STI outcome | 100% | 104% |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 60 | |||||||

Performance share awards(1) (2) | Units awarded | Grant date face value(3) (EUR) | Grant date | Vesting |

2024 LTI performance shares | 834 600 | 3 012 906 | 5 July 2024 | Q3 2027 |

Performance share awards | Units awarded | Grant date face value(1) (EUR) | Grant date | Vesting |

2024 eLTI matching performance shares | 1 704 530 | 6 289 716 | 16 August 2024 | Q3 2027 |

Share awards vesting during the year | Units awarded | Target share price (EUR) | Share price achievement (EUR) | Vesting outcome (% of target) | Units vested | Value of vested award(1) (EUR) |

2021 LTI performance shares | 769 200 | 4.47 | 3.66 | 12.0% | 92 304 | 297 219 |

Share awards vesting during the year | Units awarded | Target share price (EUR) | Share price achievement (EUR) | Vesting outcome (% of target) | Units vested | Value of vested award(2) (EUR) |

2021 eLTI matching performance shares | 962 180 | 4.47 | 3.66 | 12.0% | 115 462 | 400 653 |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 61 | |||||||

Pekka Lundmark | Units | Value(1) (EUR) |

Beneficially owned shares at 31 December 2024 | 1 573 826 | 6 720 237 |

Unvested shares under outstanding Nokia equity plans(2) | 3 718 730 | 15 878 977 |

Total | 5 292 556 | 22 599 214 |

Termination by | Reason | Notice | Compensation |

Nokia | Cause | None | The President and CEO is entitled to no additional remuneration and all unvested equity awards would be forfeited after termination. |

Nokia | Reasons other than cause | Up to 12 months | The President and CEO is entitled to a severance payment equaling up to 12 months’ remuneration (including annual base salary, benefits, and target short- term incentive) and unvested equity awards would be forfeited after termination, unless the Board determines otherwise. |

President and CEO | Any reason | 12 months | The President and CEO may terminate his service agreement at any time with 12 months’ notice. The President and CEO would either continue to receive salary and benefits during the notice period or, at Nokia’s discretion, a lump sum of equivalent value. Additionally, the President and CEO would be entitled to any short- or long-term incentives that would normally vest during the notice period. Any unvested equity awards would be forfeited after termination, except in the event of death, permanent disability and retirement, and unless the Board determines otherwise. |

President and CEO | Nokia’s material breach of the service agreement | Up to 12 months | In the event that the President and CEO terminates his service agreement based on a final arbitration award demonstrating Nokia’s material breach of the service agreement, he is entitled to a severance payment equaling up to 12 months’ remuneration (including annual base salary, benefits and target incentive). Any unvested equity awards would be forfeited after termination. |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 62 | |||||||

Fees | Fees consist of annual fees and meeting fees. Approximately 40% of the annual fee is paid in Nokia shares purchased from the market on behalf of the Board members or alternatively delivered as treasury shares held by the Company. The balance is paid in cash, most of which is typically used to cover taxes arising from the paid remuneration. Meeting fees are paid in cash. |

Incentives | Non-executive directors are not eligible to participate in any Nokia incentive plans and do not receive performance shares, restricted shares or any other equity-based or other form of variable compensation for their duties as members of the Board. |

Pension | Non-executive directors do not participate in any Nokia pension plans. |

Share ownership requirement | Members of the Board shall normally retain until the end of their directorship such number of shares that corresponds to the number of shares they have received as Board remuneration during their first three years of service on the Board (the net amount received after deducting those shares needed to offset any costs relating to the acquisition of the shares, including taxes). |

Other | Directors are compensated for travel and accommodation expenses as well as other costs directly related to Board and Committee work. These are paid in cash. |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 63 | |||||||

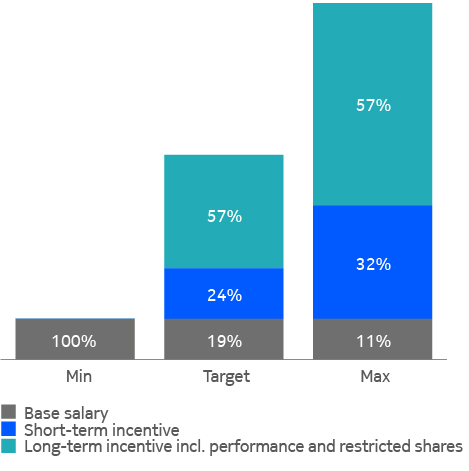

Remuneration elements | Purpose and link to strategy | Operation including maximum opportunity | Performance metrics |

Base salary | To attract and retain individuals with the requisite level of knowledge, skills and experience to lead our businesses | Base salary is normally reviewed annually taking into consideration a variety of factors, including, for example, performance of the Company and the individual, remuneration of our global peer group, changes in individual responsibilities and employee salary increases. | Whilst there are no performance targets attached to the payment of base salary, performance is considered as context in the annual salary review. |

Pension | To provide retirement benefit aligned with local country practice | Pension arrangements reflect the relevant market practice and may evolve year on year. The President and CEO may participate in the applicable pension programs available to other executives in the country of employment. Details of the actual pension arrangement will be shown in the annual Remuneration Report. In Finland, the President and CEO participates in the Finnish statutory Employee’s Pension Act (TyEL), and there is no supplementary pension plan. | N/A |

Other benefits | To provide a competitive level of benefits and to support recruitment and retention | Benefits will be provided in line with local market practice in the country of employment and may evolve year on year. Benefits may include, for example, a company car (or cash equivalent), risk benefits (for example life and disability insurance) and employer contributions to insurance plans (for example medical insurance). Additional benefits and allowances may be offered in certain circumstances such as relocation support, expatriate allowances, and temporary living and transportation expenses aligned with Nokia’s mobility policy. The President and CEO is also eligible to participate in similar programs which may be offered to Nokia’s other employees such as the voluntary all-employee share purchase plan. | N/A |

Short-term incentive (STI) | To incentivize and reward performance against delivery of the annual business plan | STI is based on performance against one-year financial and non-financial targets and normally paid in cash. Minimum payout is 0% of base salary. Target opportunity is 125% of base salary. Maximum opportunity is 281.25% of base salary. The malus and clawback conditions apply in accordance with Company clawback policies. | Performance measures, weightings and targets for the selected measures are set annually by the Board to ensure they continue to support Nokia’s short- term business strategy. These measures can vary from year to year to reflect business priorities and may include a balance of financial, key operational and non-financial measures (including but not limited to strategic, customer satisfaction, employee engagement, environmental, social, governance or other sustainability-related measures). Although the performance measures and weighting may differ year to year reflecting the business priorities, in any given year, a minimum of 60% of measures will be based on financial criteria. Targets for the short-term incentives are set at the start of the year, in the context of analyst expectations and the annual plan, selecting measures that align to the delivery of Nokia’s strategy. The performance metrics and weightings are disclosed retrospectively in the annual Remuneration Report. |

Long-term incentive (LTI) – performance share award | To reward for delivery of sustainable long-term performance, align the President and CEO’s interests with those of shareholders, and aid retention | Long-term incentive awards may be made annually in performance shares, vesting normally after three years dependent on the achievement of performance conditions measured over a three-year period. Target award level is 200% of base salary at the date of grant, with maximum vesting of 400% of base salary. The malus and clawback conditions apply in accordance with Company clawback policies. | Performance measures, weightings and target metrics for the selected measures are set by the Board to ensure they continue to support Nokia’s long-term business strategy and financial success. Targets are set in the context of Nokia’s long-term plans and analyst forecasts, ensuring that they are considered both achievable and sufficiently stretching. The Board may choose different measures and weightings each year based on the business plan. The measures consist of at least 60% financial and/or share price-related measures. The Performance metrics and weightings are disclosed retrospectively in the annual Remuneration Report. |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 64 | |||||||

Remuneration elements | Purpose and link to strategy | Operation including maximum opportunity | Performance metrics |

Long-term incentive (LTI) - restricted share award | To incentivize longer-term decision making for sustainable shareholder value creation and to aid retention | Restricted share awards of up to 100% of base salary may be granted, vesting after at least three years, subject to financial underpins and continued service. The malus and clawback conditions apply in accordance with Company clawback policies. | Financial underpins are determined by the Board to ensure alignment with underlying company performance and shareholder experience. The Board may choose different financial underpins for each grant based on the business plan and strategic priority. |

Enhanced LTI (eLTI) – co-investment arrangement | To further align the President and CEO’s interests with Nokia’s long-term success and shareholder interests | Unlike the LTI performance share award, this is not an annual award and is only granted in exceptional circumstances. The President and CEO may be invited, at the discretion of the Board, to purchase investment shares of up to 200% of base salary, and in return, receive two matching shares for every one investment share purchased. The matching shares are delivered in the form of performance shares, typically subject to the same performance conditions as for the LTI performance share award, with a three-year performance and vesting period. The minimum vesting of the matching shares is 0% of base salary and maximum vesting is two times grant level. The malus and clawback conditions apply in accordance with Company clawback policies. | The performance metrics, targets and weightings for the matching shares are typically the same as those for LTI performance shares granted in the same year. |

Shareholding requirement | Align the President and CEO’s interests with those of shareholders and ensure any decisions made are in the long- term interest of the Company | The President and CEO is required to build and maintain a shareholding equivalent to 300% of base salary, to be achieved normally within five years of appointment. | N/A |

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 65 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 66 | |||||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 67 | |||||||

At the end of 2024, the Group Leadership Team consisted of 11 persons split between Finland, other European countries and the United States. For information regarding the current Group Leadership Team composition, refer to the Corporate Governance Statement. |

Name | Position in 2024 | Appointment date |

Pekka Lundmark | President and CEO | 1 August 2020 |

Nishant Batra | Chief Strategy and Technology Officer | 18 January 2021 |

Louise Fisk | Chief Communications Officer | 18 October 2024 |

Lorna Gibb | Chief People Officer | 13 June 2024 |

Federico Guillén | President of Network Infrastructure | 8 January 2016 |

Patrik Hammarén | Acting President of Nokia Technologies | 18 October 2024 |

Mikko Hautala | Chief Geopolitical and Government Relations Officer | 1 November 2024 |

Esa Niinimäki | Chief Legal Officer | 25 January 2023 |

Raghav Sahgal | President of Cloud and Network Services | 1 June 2020 |

Tommi Uitto | President of Mobile Networks | 31 January 2019 |

Marco Wirén | Chief Financial Officer | 1 September 2020 |

Remuneration of the Group Leadership Team members in 2024 Remuneration of the Group Leadership Team (excluding the President and CEO) in 2023 and 2024, in the aggregate, was as follows: |

EURm⁽¹⁾ | 2024 | 2023 |

Salary, short-term incentives and other compensation(2) | 11.3 | 10.8 |

Long-term incentives(3) | 3.9 | 2.5 |

Total | 15.2 | 13.3 |

(1)The values represent each member’s time on the Group Leadership Team. (2)Short-term incentives represent amounts earned in respect of 2024 performance. Other compensation includes mobility-related payments, local benefits and pension costs. (3)The amounts represent the equity awards that vested in 2024 and 2023. | ||

The members of the Group Leadership Team (excluding the President and CEO) were awarded the following equity awards under the Nokia equity program in 2024: |

Award | Units awarded(1) | Grant date fair value (EUR) | Grant date | Vesting |

Performance share award(2) | 7 445 257 | 27 462 512 | 5 July 2024, 16 August 2024, 16 December 2024 | Q3 & Q4 2027 |

Restricted share award(3) | 151 467 | 626 551 | 5 July 2024, 11 October 2024, 16 December 2024 | Q4 2025, Q4 2026, Q3 2027 |

(1)Includes units awarded to persons who were Group Leadership Team members during 2024. (2)The 2024 performance shares have a three-year performance period based on 50% relative total shareholder return, 40% three-year cumulative EPS and 10% carbon emission reduction scope 1, 2 and 3 targets. The maximum payout is 200% subject to maximum performance against the performance criteria. Vesting is subject to continued employment. (3)Vesting of each tranche of the restricted share awards is conditional on continued employment. | ||||

Business overview | Corporate governance | Operating and financial review and prospects | General facts on Nokia | Financial statements | Other information | 68 | |||||||

Shares receivable through performance shares at grant | Shares receivable through performance shares at maximum(4) | Shares receivable through restricted shares | |

Number of equity awards held by the Group Leadership Team(1) | 10 292 949 | 20 567 565 | 753 517 |

% of the outstanding shares(2) | 0.19% | 0.38% | 0.01% |