11

Title of each class | Trading symbol(s) | Name of each exchange on which registered |

New York Stock Exchange(i) | ||

þ | Accelerated Filer | ☐ | Non-Accelerated Filer | ☐ | Emerging growth company |

† | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

U.S. GAAP ¨ | Other ¨ | |||

as issued by the International Accounting Standards Board | ☑ |

5 | Cross reference to Form 20-F | |

7 | Introduction | |

10 | Strategic report | |

10 | Financial performance | |

13 | Our business today | |

15 | Market overview and investment case | |

17 | Chair's statement | |

20 | Chief Executive's statement | |

23 | Business model | |

25 | Our Growth ambition | |

26 | Our strategic enablers | |

38 | Key performance indicators | |

43 | Group financial review | |

43 | Chief Finance Officer introduction | |

44 | Operating results 2024 compared with 2023 | |

68 | Liquidity and capital resources | |

74 | Operating results 2023 compared with 2022 | |

97 | 'Spirit of progress' | |

132 | Cautionary statement concerning forward-looking statement | |

134 | Risk factors | |

145 | Non-financial and sustainability information statement | |

148 | Governance | |

148 | Letter from the Chairman | |

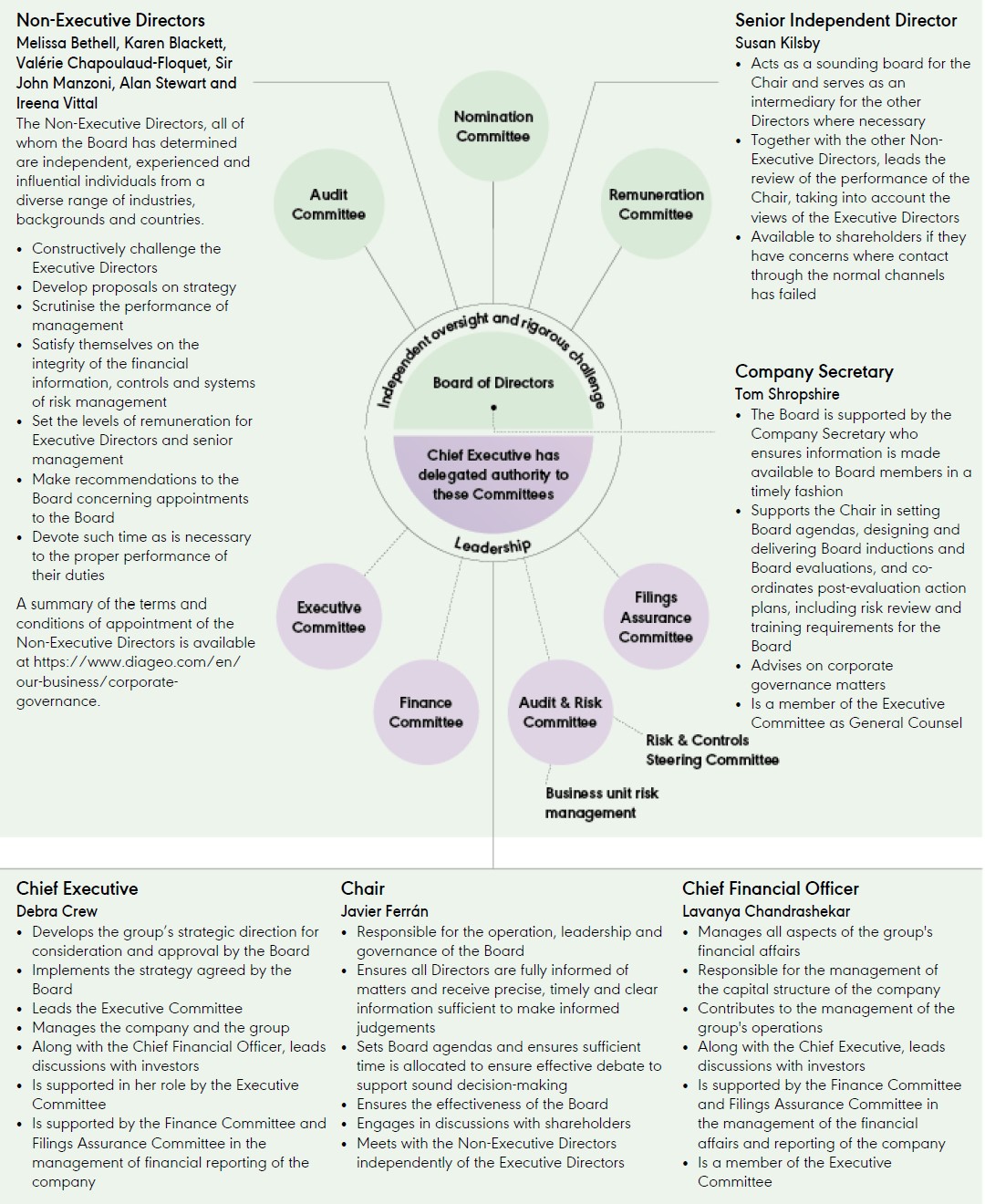

153 | Corporate Governance Structure | |

154 | Board of Directors | |

156 | Executive Committee | |

178 | Audit Committee report | |

188 | Nomination Committee report | |

192 | Directors’ remuneration report | |

225 | Directors’ report | |

230 | Financial statements | |

230 | Report of Independent Registered Public Accounting Firm - PCAOB ID | |

233 | Consolidated income statement | |

234 | Consolidated statement of comprehensive income | |

235 | Consolidated balance sheet | |

236 | Consolidated statement of changes in equity | |

237 | Consolidated statement of cash flows | |

238 | Notes to the consolidated financial statements | |

238 | Accounting information and policies | |

241 | Results for the year | |

260 | Operating assets and liabilities | |

284 | Risk management and capital structure | |

303 | Other financial statements disclosure | |

311 | Unaudited financial information | |

322 | Reporting boundaries and methodology | |

344 | Additional disclosures | |

351 | Additional information for shareholders | |

353 | Exhibits | |

355 | Signature | |

356 | Glossary of terms and US equivalents | |

Item | Required item in Form 20-F | Page(s) |

Part I | ||

1. | Identity of directors, senior management and advisers | Not applicable |

2. | Offer statistics and expected timetable | Not applicable |

3. | Key information | |

A. [Reserved] | — | |

B. Capitalisation and indebtedness | Not applicable | |

C. Reason for the offer and use of proceeds | Not applicable | |

D. Risk factors | 134-144 | |

4. | Information on the company | |

A. History and development of the company | 7-8, 17, 64-65, 93-94, 158-159, 225, 260-264, 344-345, 351 | |

B. Business overview | 7-8, 17, 20-24, 48-59, 61-62, 75-76, 80-89, 91-92, 102-103, 114-119, 135-139, 144, 158-159, 241-245, 264-271, 344-346 | |

C. Organisational structure | 309 | |

D. Property, plant and equipment | 49, 76, 269-272, 344-345 | |

4A. | Unresolved staff comments | Not applicable |

5. | Operating and financial review and prospects | |

A. Operating results | 17, 20-22, 38-40, 43-96, 132-135, 137-138, 141-142, 238-250, 252-253, 311-312 | |

B. Liquidity and capital resources | 38-40, 46-47, 68-73, 79, 281-294, 316-317 | |

C. Research and development, patents and licenses, etc. | 250, 345 | |

D. Trend information | 17, 20-24, 43, 48-65, 74-76, 80-94, 132-133 | |

E. Critical Accounting Estimates | 186, 238-239 | |

6. | Directors, senior management and employees | |

A. Directors and senior management | 153-160 | |

B. Compensation | 96, 192-221, 274-280, 309 | |

C. Board practices | 18, 148-162, 176-179, 184-185, 192-194 | |

D. Employees | 48, 75, 105-107, 251, 346 | |

E. Share ownership | 192-223, 301-302 | |

F. Disclosure of a registrant’s action to recover erroneously awarded compensation | Not applicable | |

7. | Major shareholders and related party transactions | |

A. Major shareholders | 226 | |

B. Related party transactions | 308-309 | |

C. Interests of experts and counsel | Not applicable | |

8. | Financial information | |

A. Consolidated statements and other financial information | 233-310 | |

B. Significant changes | 10, 186, 238-239, 316, 318 | |

9. | The offer and listing | |

A. Offer and listing details | 158, 226-227, 347-348 | |

B. Plan of distribution | Not applicable | |

C. Markets | 158, 226-227 | |

D. Selling shareholders | Not applicable | |

E. Dilution | Not applicable | |

F. Expenses of the issue | Not applicable |

Item | Required item in Form 20-F | Page(s) |

10. | Additional information | |

A. Share capital | Not applicable | |

B. Memorandum and articles of association | 158-159, 225-229 | |

C. Material contracts | 72, 225, 345 | |

D. Exchange controls | 351 | |

E. Taxation | 255-259, 346-350 | |

F. Dividends and paying agents | Not applicable | |

G. Statement by experts | Not applicable | |

H. Documents on display | 351 | |

I. Subsidiary information | Not applicable | |

11. | Quantitative and qualitative disclosures about market risk | 284-294 |

12. | Description of securities other than equity securities | |

A. Debt securities | Not applicable | |

B. Warrants and rights | Not applicable | |

C. Other securities | Not applicable | |

D. American depositary shares | 226-227, 347-350 | |

Part II | ||

13. | Defaults, dividend arrearages and delinquencies | Not applicable |

14. | Material modifications to the rights of security holders and use of proceeds | Not applicable |

15. | Controls and procedures | |

A. Disclosure controls and procedures | 177 | |

B. Management’s report on internal control over financial reporting | 185 | |

C. Attestation report of the registered public accounting firm | 230-232 | |

D. Changes in internal control over financial reporting | 185 | |

16A. | Audit committee financial expert | 183 |

16B. | Code of ethics | 159, 183 |

16C. | Principal accountant fees and services | 180-182, 251 |

16D. | Exemptions from the listing standards for audit committees | Not applicable |

16E. | Purchases of equity securities by the issuer and affiliated purchasers | 236, 297-302 |

16F. | Change in registrant’s certifying accountant | Not applicable |

16G. | Corporate governance | 158-164, 173-190 |

16H. | Mine safety disclosure | Not applicable |

16I. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | Not applicable |

16J. | Insider trading policies | 183 |

16K. | Cybersecurity | 187 |

Part III | ||

17. | Financial statements | Not applicable |

18. | Financial statements | 230-310 |

19. | Exhibits | 353-354 |

Additional information | ||

Glossary of terms and US equivalents | 356-357 | |

Volume (equivalent units) | Net sales(2) | Operating profit | ||||||||

EU230.5m | $20,269m | $6,001m | ||||||||

(2023: EU243.4m) | (2023: $20,555m) | (2023: $5,547m) | ||||||||

Reported movement | (5)% | Reported movement | (1)% | Reported movement | 8% | |||||

Organic movement(1) | (4)% | Organic movement(1) | (1)% | Organic movement(1) | (5)% | |||||

Net cash from operating activities | Earnings per share (eps) | Total recommended dividend per share(3) | ||||||||

$4,105m | 173.2c | 103.48c | ||||||||

(2023: $3,636m) | (2023: 196.3c) | (2023: 98.55c) | ||||||||

2024 free cash flow(1) | $2,609m | Reported movement | (12)% | Increase | 5% | |||||

2023 free cash flow(1) | $2,235m | Eps before exceptional items movement(1) | (9)% | |||||||

Positive drinking | Inclusion and diversity | Water efficiency - across the company | Greenhouse gas emissions | |||||||||||

2.2m | 44% | (15.6)% | (23.8)% | |||||||||||

(2023: 1.9m) | (2023: 44%) | (2023: (12.3)%) | (2023: (14.7)%) | |||||||||||

Number of people educated on the dangers of underage drinking through a Diageo supported education programme | Percentage of female leaders globally | Percentage change in water efficiency compared to fiscal 20 baseline | Percentage change in total direct and indirect greenhouse gas emissions (market/net based) compared to fiscal 20 baseline | |||||||||||

46% | ||||||||||||||

(2023: 43%) | ||||||||||||||

Percentage of ethnically diverse leaders globally | ||||||||||||||

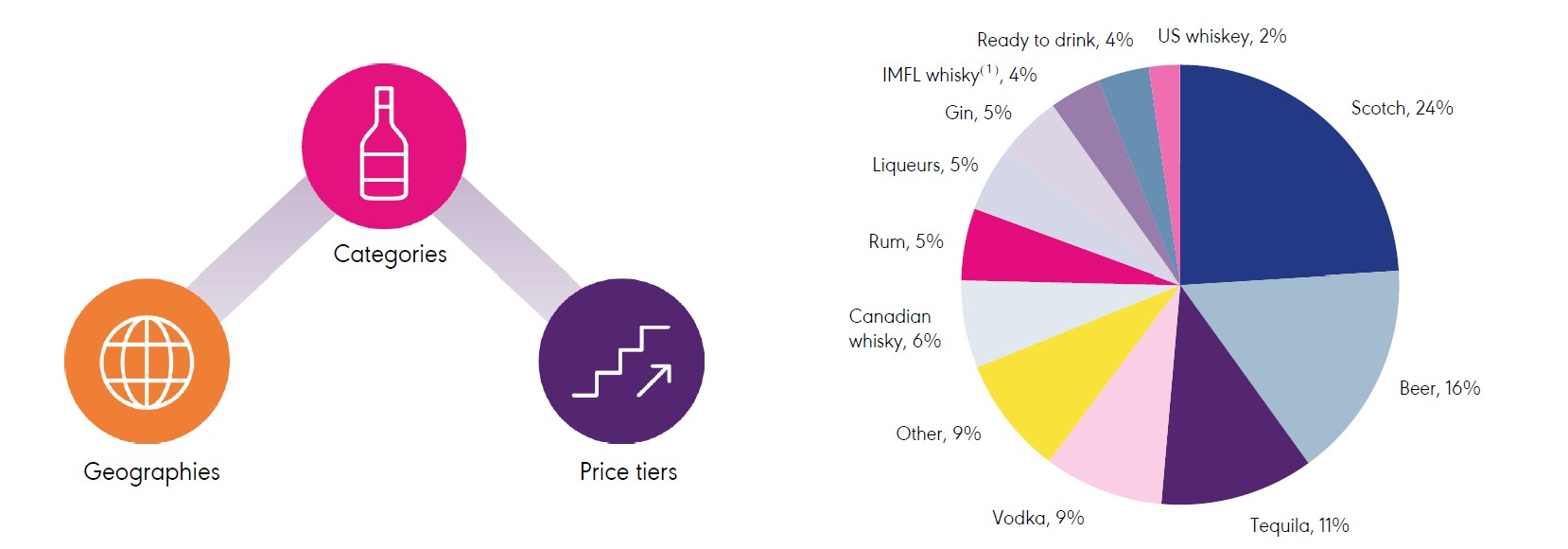

Advantaged portfolio: reach and scale | Diageo reported net sales | |

(by category, fiscal 24) |

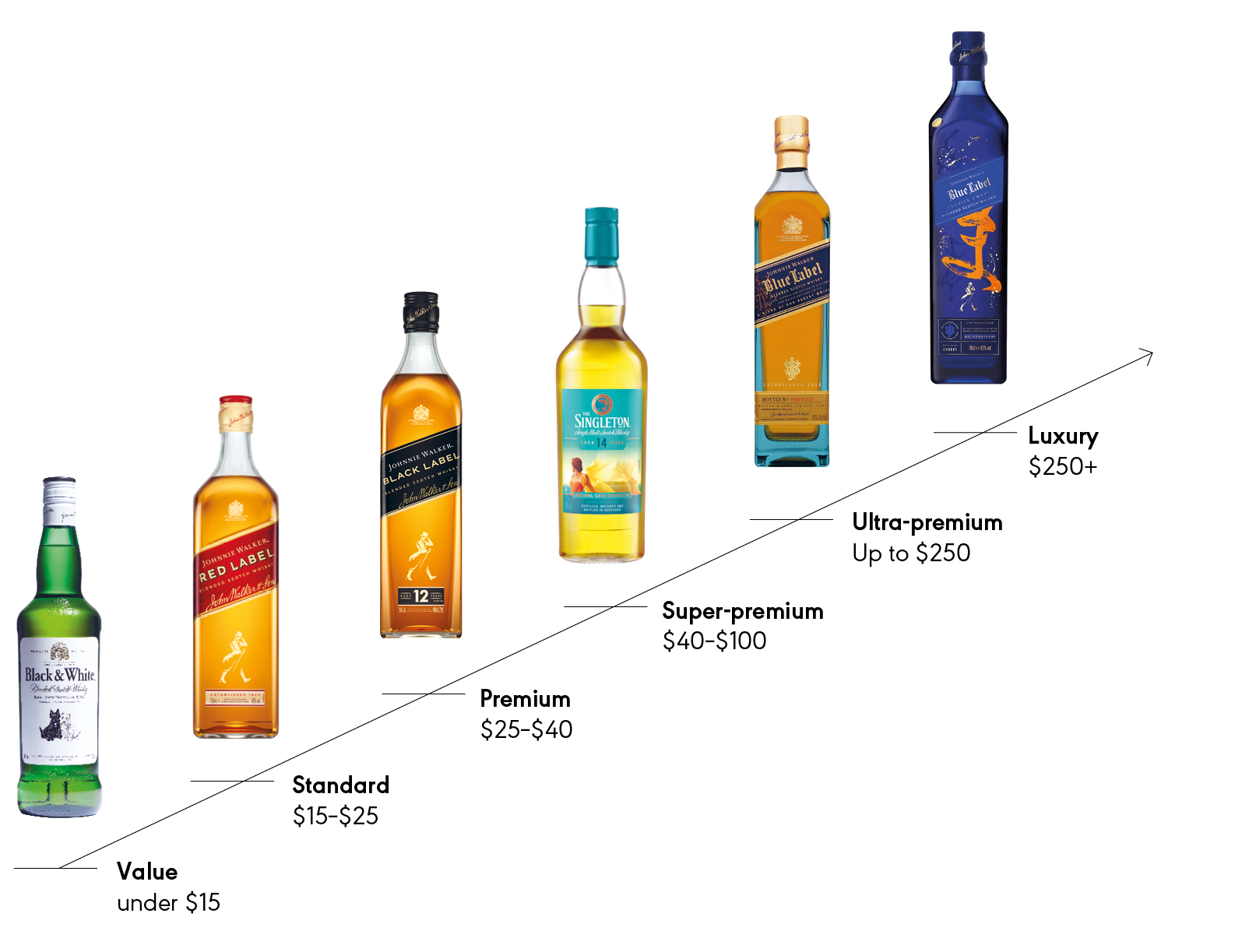

Diageo reported net sales | Our scotch portfolio price ladder provides consumer choice within our largest category(2) | |

(by price tier, fiscal 24) | ($) |

Luxury |

Ultra- premium |

Super- premium |

Premium |

Standard |

Value |

4% |

5% |

16% |

37% |

30% |

8% |

Strong and resilient market dynamics… | |

Total Beverage Alcohol (TBA) is a highly attractive and exciting consumer category. TBA is resilient and growing; and the spirits category is growing even faster. TBA has grown at 4.4% CAGR in the 10 years through to 2023, and international spirits has grown at 5.1% over the same period.(1) | |

1 | Consumers are choosing spirits |

Diageo sees a long-term trend of consumers choosing to switch to spirits from beer and wine. Spirits growth is supported by favourable population demographics, the increasing size of the middle class in key markets globally and strong premiumisation trends. These are expected to continue into the future. | |

2 | People are drinking better, not more |

Spirits' long-term value growth is also driven by premiumisation as consumers want to drink better, not more. In the last 10 years, premium and above spirits grew from 26% of category value to almost 35%. The super-premium plus price-tier has grown in value more than two times faster than other price tiers in the category. This price tier gained 700 basis points of share of international spirits retail sales value (RSV) since 2013.(1) | |

3 | Long runway for growth |

In 2021, we set out our ambition to grow TBA share by 50% from 4% to 6% by 2030. With 4.5% value share of TBA(1) currently, we have significant headroom for sustainable long-term growth. | |

aligned to our competitive advantages: | |

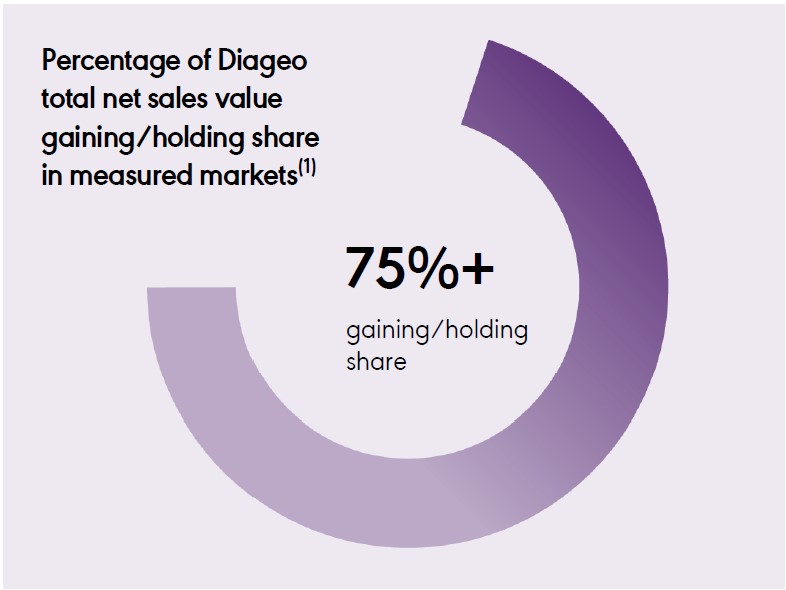

Leading world-class brands | |

•We have a proven track record in developing powerful global brands. For example, Johnnie Walker’s RSV has increased over 400% since 2002.(2) •Diageo brands have driven around 17% of total absolute dollar growth in the international spirits category since 2018.(1) •Our strategic M&A activities and reputation for active portfolio management position Diageo for sustainable long-term growth. | |

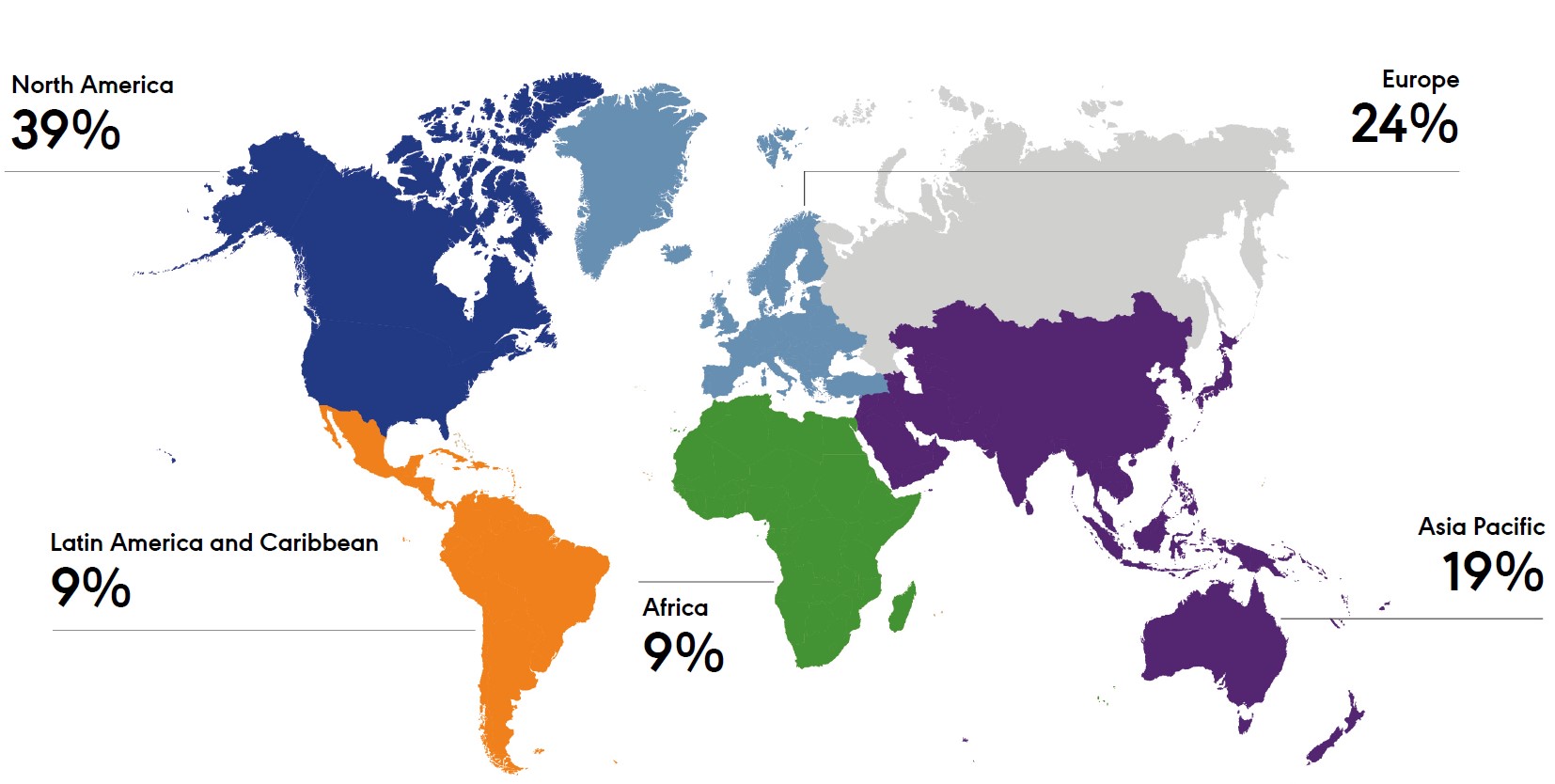

Advantaged geographic footprint | |

•Our geographic footprint gives us access to consumers in the world’s largest markets, such as the United States, as well as the vibrant markets of India and China. •Diageo’s geographic diversification supports resilient performance through global volatility. | |

Broad portfolio across price points | |

•Our advantaged portfolio enables trading up and down our extensive price ladder; whether our consumers are looking for a Smirnoff and soda or a Don Julio 1942 on the rocks, Diageo's portfolio offers consumer choice. •Our diverse and balanced portfolio enables us to respond quickly to emerging and growing category trends. | |

Diverse and talented workforce | |

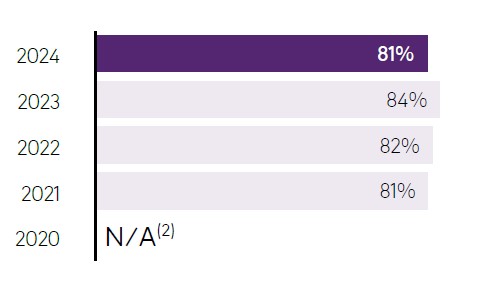

•Our Executive Committee combines home-grown talent with externally recruited leaders who bring invaluable market experience, a wealth of functional expertise and fresh perspectives. •Our talented management team and broader workforce enable us to respond flexibly and quickly to current and future challenges. •Our global employee survey, Your Voice, remains above external benchmarks with 81% engagement levels and 89% expressing pride in working for Diageo. | |

...positioning us to drive: | |

Continued discipline of growth algorithm | |

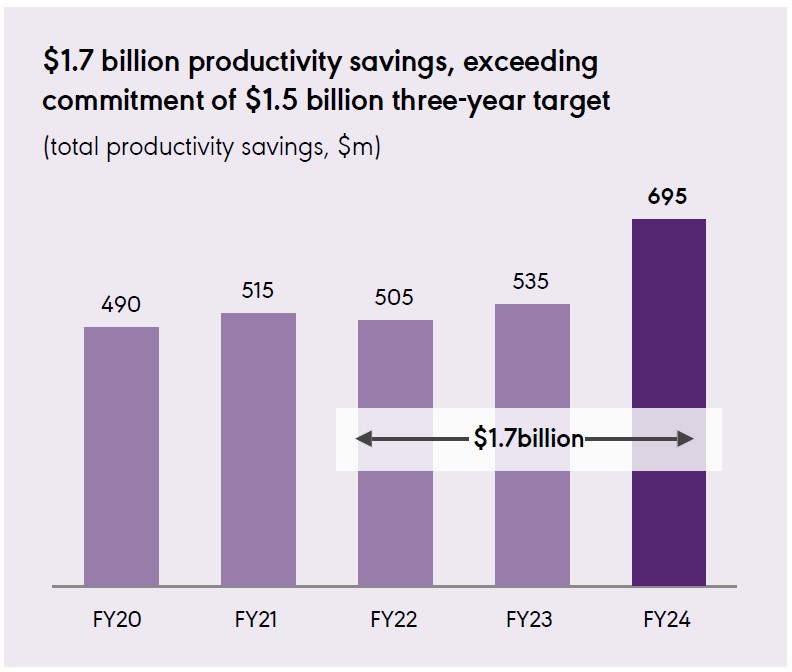

•Driving long-term sustainable growth is our priority, and we believe our growth algorithm continues to support this, through winning quality market share. •Price and mix, driven by long-term premiumisation and enabled by Revenue Growth Management, remain a consistent and core part of our top-line growth. •Since fiscal 18, we have generated annual savings of approximately $500 million through productivity savings, efficiencies and disciplined cost control and utilising our scale to fuel our investments. •We take the benefits of growth, productivity and operating leverage to reinvest smartly in brand building to drive quality market share – firmly balancing short-term share gains, while building for long-term sustainable growth. | |

A disciplined approach to capital allocation | |

•We prioritise organic investment for long-term growth: maturing stock (increased from $5.3 billion in fiscal 18 to $7.8 billion in fiscal 24) and capex (increased from $0.8-0.9 billion per annum fiscal 18-21 to $1.4-1.5 billion per annum fiscal 22-24, driven by capacity increases). •Active and disciplined portfolio management ($2.8 billion invested in acquisitions and $1.6 billion generated from disposals since fiscal 18). •We have grown our dividend year on year for 25 years (dating back to fiscal 2000). •Through fiscal 23, circa £25 billion has been returned to shareholders in dividends and share buybacks over the preceding 10 years. •We also returned $1 billion of excess capital, via share buybacks, during fiscal 24. | |

A robust strategy and clear ambition that will.... | |

Build towards the next phase of our ambition to achieve TBA share of 6% by 2030. Our strategy to unleash the power of our brands and portfolio includes: •Sustaining the momentum in our global brands of Guinness, Johnnie Walker and Don Julio while driving regional growth opportunities like Crown Royal in North America and accelerating malt whiskey in Asia Pacific. •Leading and shaping key consumer trends, including tapping into the convenience, moderation and with food occasions to recruit new consumers into new occasions at scale. •Continuing to focus on operational excellence, including strengthening our route-to-market and evolving our approach to A&P efficiency, while driving accelerated productivity and allocating resources with discipline. | |

Recommended final dividend per share | Total dividend per share(1) | ||

62.98c | 5% to 103.48c | ||

2023: 59.98c | 2023: 98.55c | ||

Total shareholder return (1 year) | Total shareholder return (10 year) | ||

(24)% | 6% | ||

2023: (2)% | 2023: 9% | ||

Statement on Section 172 of the Companies Act 2006 | ||||||

Section 172 of the Companies Act 2006 requires the Directors to promote the success of the company for the benefit of the members as a whole, having regard to the interests of stakeholders in their decision- making. In making decisions, the | Directors consider what is most likely to promote the success of the company for its shareholders in the long-term, as well as the interests of the group’s stakeholders. The Directors understand the importance of taking into account the views of stakeholders | and the impact of the company’s activities on local communities, the environment, including climate change, and the group’s reputation. Read more about how stakeholders were taken into account in decision-making on pages 165-171. | ||||

Reported volume movement | Organic net sales movement | |||

(5)% |  | (1)% |  | |

2023: (7)% | 2023: 7% | |||

Organic volume movement | Reported operating profit movement | |||

(4)% |  | 8% |  | |

2023: (1)% | 2023: (6)% | |||

Reported net sales movement | Organic operating profit movement | |||

(1)% |  | (5)% |  | |

2023: 0% | 2023: 7% | |||

What we do | 1. We source | 2. We innovate | 3. We make | ||

From smallholder farmers in Africa and Mexico, to multinational companies, we work with our suppliers to procure high-quality raw materials and services, with environmental sustainability in mind. Where it is right for our business, we grow and source locally. | Using our deep understanding of consumer trends and socialising occasions, we focus on driving sustainable innovation that provides new products and experiences for consumers; be that a non- alcoholic option or an offering that suits convenience or the on-trade. | We distil, brew and bottle our spirits and beer brands through a globally co- ordinated supply operation, working to the highest quality and manufacturing standards. We prioritise using local production where it is right for our business. |

Working in the interest of our stakeholders | People | |||||||

We want our people to be the best they can be. We offer a diverse and inclusive workplace with opportunities for development and progression. | ||||||||

Consumers | Customers | Suppliers | ||||||

We are passionate about the role our brands play in celebrations globally. We are committed to promoting moderation and reducing alcohol misuse. | We work closely with customers to build sustainable ways of working that help grow their businesses through great insight and execution. | We partner with suppliers to ensure long-term, mutually beneficial relationships. Respect for human rights is embedded throughout our global value chain. | ||||||

Communities | Investors | Governments and regulators | ||||||

We help build thriving communities by making lasting contributions where we live, work, source and sell. | We aim to maximise long- term investor returns through consistent, sustainable growth and a disciplined approach to capital allocation. | We advocate for laws or regulatory change where we think there is a positive impact on our business and a benefit for our key stakeholders. | ||||||

4. We transport | 5. We sell to customers | 6. We market to consumers | 7. We help consumers celebrate | |||

We move our products to where they need to be in the world; be that from a local distillery in market or, for example, shipping scotch. | We grow by working closely with our customers. Our global and local sales teams use our data, digital tools and insights to extend our sales reach, improve our execution and help generate value for us and for our customers. When our customers grow, we grow too. | We invest in world-class marketing to build vibrant brands that resonate with our consumers. To do this responsibly, we have our rigorous Diageo Marketing Code which guides everything we do. | We continually evolve our data tools to understand consumers’ attitudes and motivations. We convert this information into insights which enable us to respond with agility to our consumers’ interests and preferences. |

Creating value | |

Our business model allows us to create value across four main areas: | |

Financial – for our investors | |

Human – for our people, suppliers, customers and consumers | |

Social – for our communities | |

Natural – for our environment | |

PURPOSE | Celebrating life, every day, everywhere | ||||

AMBITION | To create one of the best performing, most trusted and respected, consumer products companies in the world | ||||

STRATEGY | Unleash the power of our brands and portfolio to lead and shape consumer trends executed with operational excellence | ||||

BRANDS AND PORTFOLIO | CONSUMER TRENDS | OPERATIONAL EXCELLENCE | |||

Whisk(e)y and tequila Winning local portfolio Guinness growth | Premiumisation Recruitment New occasions | Evolve brand building muscle Commercial excellence Everyday efficiency | |||

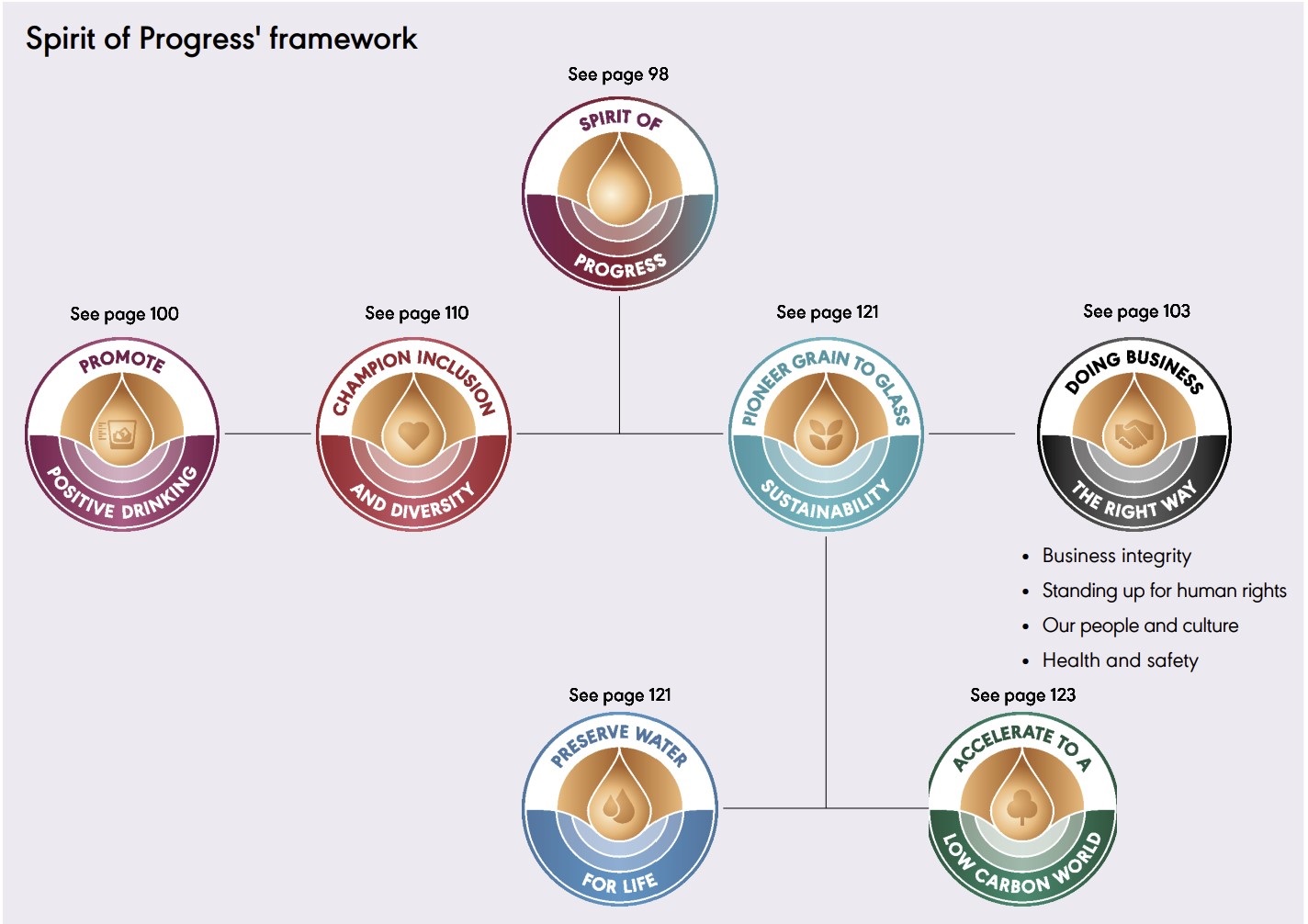

ENABLERS | Building a more Digital Diageo | Diverse and engaged talent with a focus on culture | ’Spirit of Progress’ and doing business the right way from grain-to-glass | ||

OUTCOMES | Achieve quality TBA share of 6% by 2030 | ||||

Efficient growth | Consistent value creation | Credibility and trust | Engaged people | |

Consistently grow organic net sales, grow operating profit, deliver strong free cash flow | Top-tier total shareholder returns, increase return on invested capital | Trusted by stakeholders for doing business the right way, from grain-to- glass | High-performing and engaged teams, continuous learning, inclusive culture |

STRATEGY | ||||||||

|  |  | ||||||

Unleash the power of our brands and portfolio… •To become the global leader in whisk(e)y and tequila. •To win with local portfolios rooted in local culture. •To ensure we continue to drive growth in Guinness, including 0.0. | to lead and shape consumer trends… •Premiumise the industry. •Recruit new consumers from across TBA. •Enter into new occasions. | executed with operational excellence •Evolving our brand building muscle through smarter A&P. •Delivering commercial excellence across all our channels. •Accelerating productivity via Revenue Growth Management and supply agility. | ||||||

Read more on page 28. | Read more on page 31. | Read more on page 33-34. | ||||||

ENABLERS | ||||||||

|  |  | ||||||

Building a more Digital Diageo We are upweighting investment to fund a holistic, prioritised programme of digitisation, underpinned by transformation of data, analytics and systems. | Diverse and engaged talent with a focus on culture We continue to develop our talent, ensuring they embody our evolved values and behaviours. | ’Spirit of Progress’ and doing business the right way from grain-to- glass This continues to underpin everything that we do. We have refreshed our flagship ’Spirit of Progress‘ programme to maximise the impact of its next phase of delivery. | ||||||

Read more on page 36. | Read more on page 37. | Read more on page 37. | ||||||

| 1 | Building a more Digital Diageo |

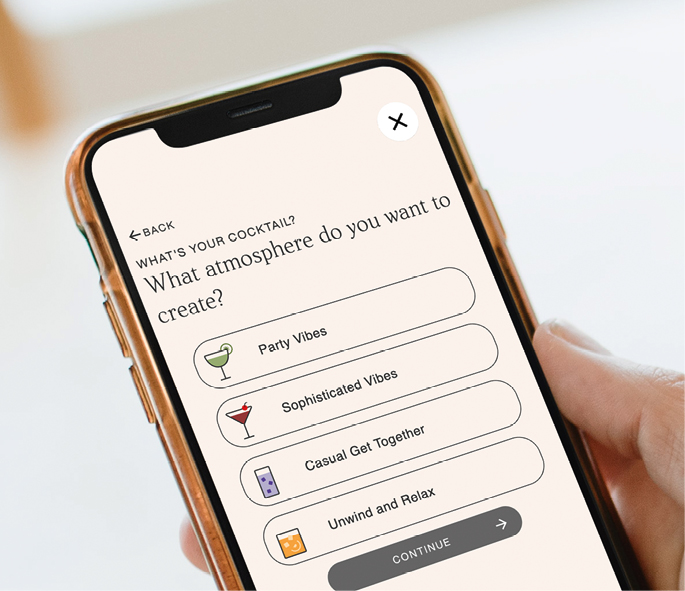

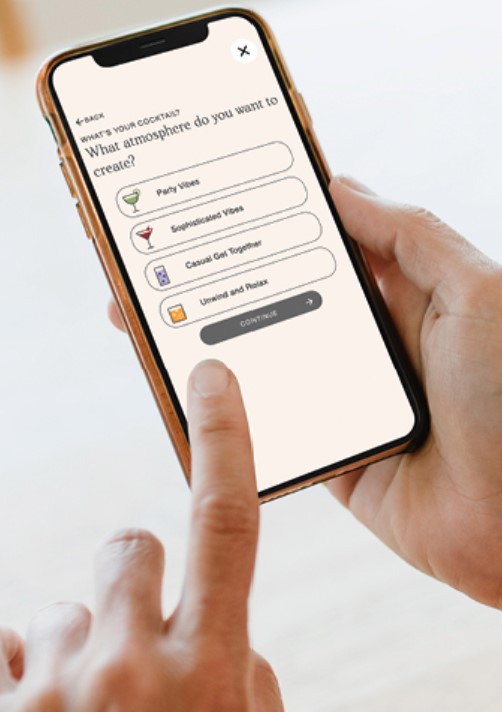

'What's Your Cocktail?' An AI platform pairing cocktails with food In May, we launched 'What’s Your Cocktail?', a generative AI-driven digital platform to recommend cocktail pairings with individual food preferences. The platform helps consumers demystify cocktails by asking the desired atmosphere of their event and favourite food flavours to ensure the perfect serve for every occasion. Whilst the platform is consumer-first, we are also benefiting by gathering millions of first-party consumer data points, which helps give our consumers exactly what they want. Digital planning tool delivering productivity wins in supply chain This year we implemented a new Advanced Planning Tool (OMP) across our tequila asset base. It monitors our end-to- end supply chain and gives us the ability to smoothly plan for and respond to volatile changes in product demand. For example, this fiscal we have seen accelerated demand for Don Julio Reposado. The OMP tool enabled us to quickly run scenarios, look into end-to-end demand and balance our inventory and capacity, allowing us to communicate more quickly and effectively with customers and our suppliers to fulfil that demand. | ||

2 | Diverse and engaged talent with a focus on culture | 3 | ’Spirit of Progress’ and doing business the right way from grain-to-glass | |

Diversity 40% of our Board and 46% of our leadership population, including our Executive Committee, are from an ethnically diverse background. We are proud to have reached our 45% ethnicity leadership representation ambition ahead of 2030. Engaged talent In the global employee survey, Your Voice, our results for the fiscal remained above external benchmarks with 81% engagement levels and 89% pride in working for Diageo. Culture To unleash greater speed and agility in our business, we are focusing strongly on culture and embedding four dial-up behaviours: external curiosity, efficient collaboration, experimentation and learning, and acting decisively. | Baileys Minis paper-based bottle trial In May, at the Time Out Festival in Barcelona, we launched a trial of a new innovation, the Baileys Minis paper-based bottle. We know our consumers are increasingly looking for sustainable packaging alternatives, whilst also expecting premium quality and design from our brands. These bottles are a step in our journey towards a more sustainable business. The Baileys Minis paper-based bottles are made with a dry moulded fibre bottle which is 90% paper, with a thin plastic liner and a foil seal. The development work behind these bottles is the result of strong collaboration across our Diageo teams worldwide, along with the help of valued external partners. This is further evidence of our dedication to progressing towards our ambition to accelerate to a low-carbon world. | |||

Reported measures |

Net sales growth (%) | Operating profit growth (%) | Basic earnings per share (cents) |

Definition | ||||

Sales growth after deducting excise duties. | Operating profit growth, including exceptional operating items. | Profit attributable to equity shareholders of the parent company, divided by the weighted average number of shares in issue. |

Non-GAAP measures |

Organic net sales growth (%)(1) | Organic operating profit growth (%)(1) | Earnings per share before exceptional items (cents)(1) | ||||||||

(0.6)% |  |  | (4.8)% |  |  | 179.6 |  |  | ||

Definition | |||||

Sales growth after deducting excise duties, excluding the impact of exchange rate movements, hyperinflation adjustment and acquisitions and disposals. | Organic operating profit growth is calculated on a constant currency basis, excluding the impact of exceptional items, certain fair value remeasurement, hyperinflation adjustment and acquisitions and disposals. | Profit before exceptional items attributable to equity shareholders of the parent company, divided by the weighted average number of shares in issue. | |||

Why we measure | |||||

This measure reflects our delivery of efficient growth and consistent value creation. Organic net sales growth is the result of the choices we make between categories and market participation, and reflects Diageo's ability to build brand equity, increase prices and grow market share. | The movement in operating profit measures our delivery of efficient growth and consistent value creation. Consistent operating profit growth is a business imperative, driven by investment choices, our focus on driving out costs across the business and improving mix. | Earnings per share reflects the profitability of the business and how effectively we finance our balance sheet. Eps measures our delivery of efficient growth in the year and consistent value creation over time. | |||

Performance | |||||

Reported net sales declined 1.4% due to an unfavourable foreign exchange impact, organic net sales decline and a negative impact from acquisitions and disposals, partially offset by hyperinflation adjustments. Organic net sales declined 0.6%. Positive price/mix of 2.9pps was more than offset by a 3.5% decline in volume, primarily driven by materially weaker performance in LAC, driven by fast- changing consumer sentiment and elevated inventory levels. A weaker consumer environment and the impact of lapping inventory replenishment in the prior year in North America also contributed to the decline. Excluding LAC, organic net sales grew 1.8%. | Reported operating profit grew 8.2%, primarily driven by the benefit from exceptional operating items, partially offset by a decrease in organic operating profit. Organic operating profit declined 4.8% as a result of the organic net sales decline, primarily due to a $302 million operating profit decline in LAC and a $142 million operating profit decline in North America. The decline was also driven by an increase in investments in strategic capabilities, including in digital and strengthening route-to- market, primarily in the US, and in marketing. | Basic eps decreased 23.1 cents, mainly driven by lower organic operating profit, higher finance charges and exceptional items, partially offset by lower tax and the impact of share buybacks. Basic eps before exceptional items decreased 16.9 cents. |

| More detail on page 44 |  | More detail on page 44 |  | More detail on page 46 |

Reported measures |

Net cash from operating activities ($ million) | Return on closing invested capital (%) |  | Remuneration | ||||||

| KPI: Key Performance Indicator |

Definition | ||||

Net cash from operating activities comprises the net cash flow from operating activities as disclosed on the face of the consolidated statement of cash flows. | Profit for the year divided by net assets at the end of the financial year. |

Non-GAAP measures |

Free cash flow ($ million)(1),(2) | Return on average invested capital (ROIC) (%) | Total shareholder return (TSR) (%) | ||||||||

2,609 |  |  | 15.8% |  | (24)% |  |  | |||

Definition | ||||

Free cash flow comprises the net cash flow from operating activities aggregated with the net cash expenditure paid for property, plant and equipment, and computer software. Definition of free cash flow has been redefined, see more details on page 46. | Profit before finance charges and exceptional items attributable to equity shareholders divided by average invested capital. Invested capital comprises net assets excluding net post- employment benefit assets/liabilities, net borrowings and non-controlling interests. Definition of return on average capital employed has been redefined, see more details on page 47. | Percentage growth in the value of a Diageo share (assuming all dividends and capital distributions are re-invested). | ||

Why we measure | ||||

Free cash flow is a key indicator of the financial management of the business. Free cash flow reflects the delivery of efficient growth and consistent value creation as it measures the cash generated by the business to fund payments to our shareholders and future growth. | ROIC is used by management to assess the return obtained from the group’s asset base. Over time, ROIC reflects consistent value creation, as the returns Diageo generates from its asset base are both reinvested in the business and used to generate returns for investors through dividends and return of capital programmes. | Diageo’s Directors have a fiduciary responsibility to maximise long-term value for shareholders. TSR measures consistent value creation as it reflects the returns Diageo has delivered to investors in the year and over time. We also monitor our relative TSR performance against our peers. | ||

Performance | ||||

Net cash from operating activities was $4,105 million, an increase of $469 million compared to fiscal 23. Free cash flow grew by $374 million to $2,609 million. Free cash flow growth was driven by strong working capital management and the positive impact of lapping one-off cash tax payments in the prior year. These favourable factors more than offset the negative impacts of lower operating profit and increased interest payments, attributable to the current higher interest rate environment. The increase in capital expenditure (capex) demonstrates our commitment to investing in the business for long-term sustainable growth. | ROIC decreased 255bps, mainly driven by lower operating profit, increased capex, maturing stock investment and continued portfolio optimisation through acquisitions and disposals. The decline was slightly offset by lower tax. | TSR was down 24% over the past 12 months driven by the lower year-on- year share price. |

| More detail on page 46 |  | More detail on page 47 |

Non-financial performance |

Positive drinking | Employee Engagement Index | Inclusion and diversity | ||||||||

|  | 81% |  |  |  | |||||

Number of people educated on the dangers of underage drinking through a Diageo supported education programme | 2.2m |

(2023: 1.9m) | |

Total to date: | |

5.9m(1) |

Percentage of female leaders globally | 44% |

(2023: 44%) | |

Percentage of ethnically diverse leaders globally | 46% |

(2023: 43%) |

Definition | ||||

Number of people educated on the dangers of underage drinking through a Diageo supported education programme. | Measured through our Your Voice survey; includes metrics for employee satisfaction, advocacy and pride.(3) | The percentage of women and the percentage of ethnically diverse individuals who are in Diageo leadership roles. | ||

Why we measure | ||||

We want to change the way the world drinks for the better by promoting moderation and addressing the harmful use of alcohol. We build credibility and trust by transparently reporting the total number of people educated on the dangers of underage drinking. This figure also demonstrates our commitment to engaging people on the dangers of harmful alcohol use. | Employee Engagement releases the full potential of our people and our business, and it’s a key enabler to our performance. The survey allows us to measure the extent to which employees believe we are living our values and is a measure of our culture. Reflecting on the results of our employee engagement level and taking action where needed each year helps us build credibility and trust with our people. | Nurturing an inclusive and diverse culture drives commercial performance and is the right thing to do. Transparently reporting the gender and ethnic diversity of our leadership cohort reflects our commitment to consistent value creation through our diverse workforce, building credibility and trust with our stakeholders and engaging with our people on inclusion and diversity. | ||

Performance | ||||

We delivered a significant increase in our reach, particularly for the LAC region. Globally, we educated 2.2m young people about the dangers of underage drinking. | This year 89% of our people completed our Your Voice survey. 81% were identified as engaged. 89% declared themselves proud to work for Diageo, 81% would recommend Diageo as a great place to work and 74% were extremely satisfied with Diageo as a place to work. | This year, 44% of our leadership roles were held by women, the same percentage as last year, and 46% of our leaders were ethnically diverse, compared with 43% last year. |

| More detail on page 100 |  | More detail on page 105 |  | More detail on pages 110-111 |

Non-financial performance |

Water efficiency(4) | Scope 1 and 2 greenhouse gas emissions(4) | |||||

Change vs baseline year | Change vs baseline year | |||||

(15.6)% |  |  | (23.8)% |  |  | |

Definition | ||

Percentage change in water efficiency across the company compared to fiscal 20 baseline. Refer to page 334 for how this metric is measured. | Percentage change in total direct and indirect greenhouse gas emissions (market/net based) compared to fiscal 20 baseline. | |

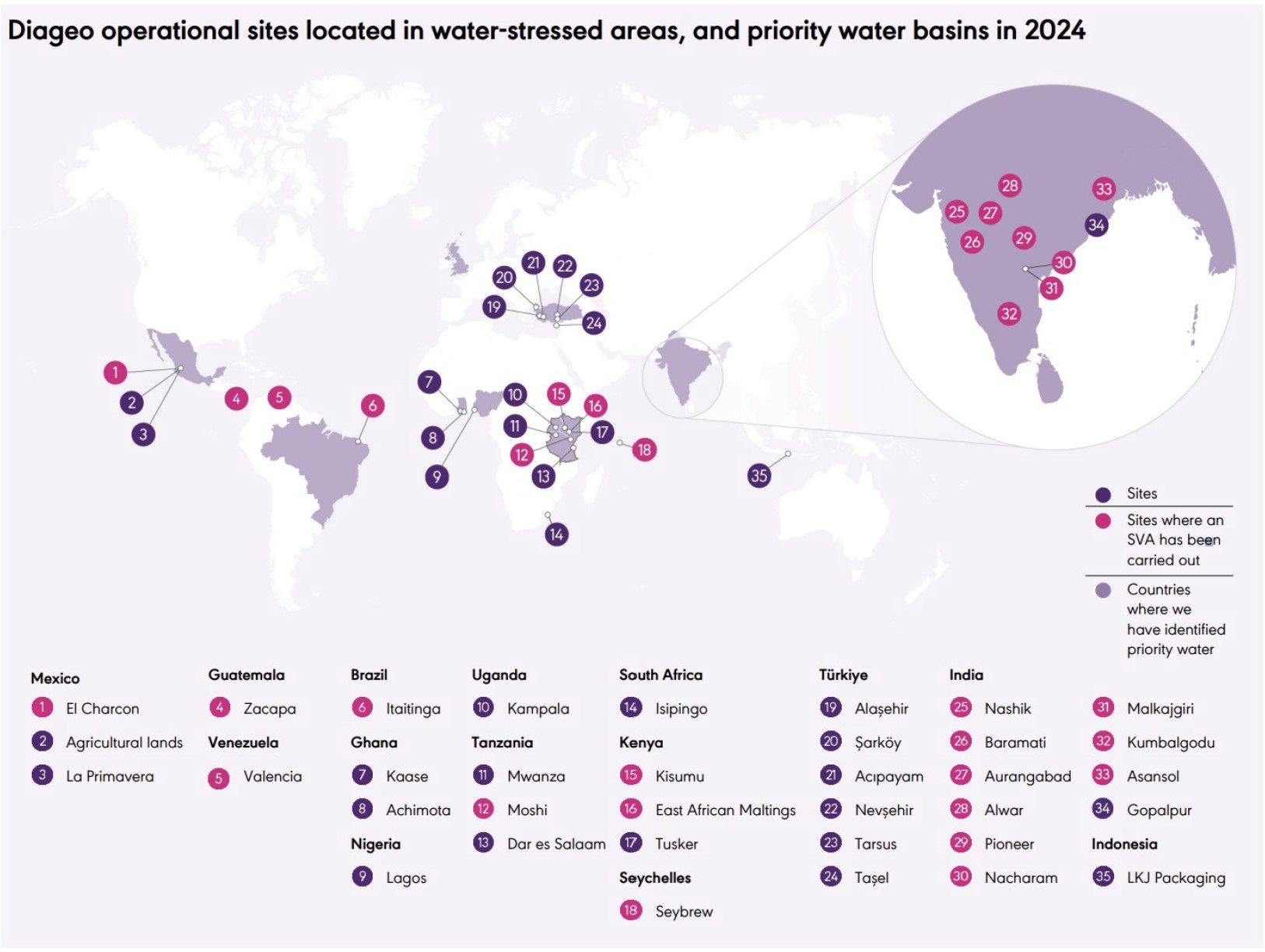

Why we measure | ||

Our water efficiency programme is critical to helping us to address water security, particularly in water-stressed areas. In addition to preserving our licence to operate, minimising water use within our own operations underpins our commitment to delivering long-term value by future-proofing our business against the impacts of a changing climate. It also helps to ensure this precious resource can continue to be shared with the communities we live and work amongst. | Mitigating our impact on climate change is a business imperative. Reporting in detail on our efforts to reduce Scope 1 and 2 greenhouse gas emissions, even when it is challenging to do so, demonstrates our commitment to reducing our contribution to global warming and helps build credibility and trust. This is an important area for our business and external stakeholders, supporting our commitment to consistent value creation by future-proofing our business. | |

Performance | ||

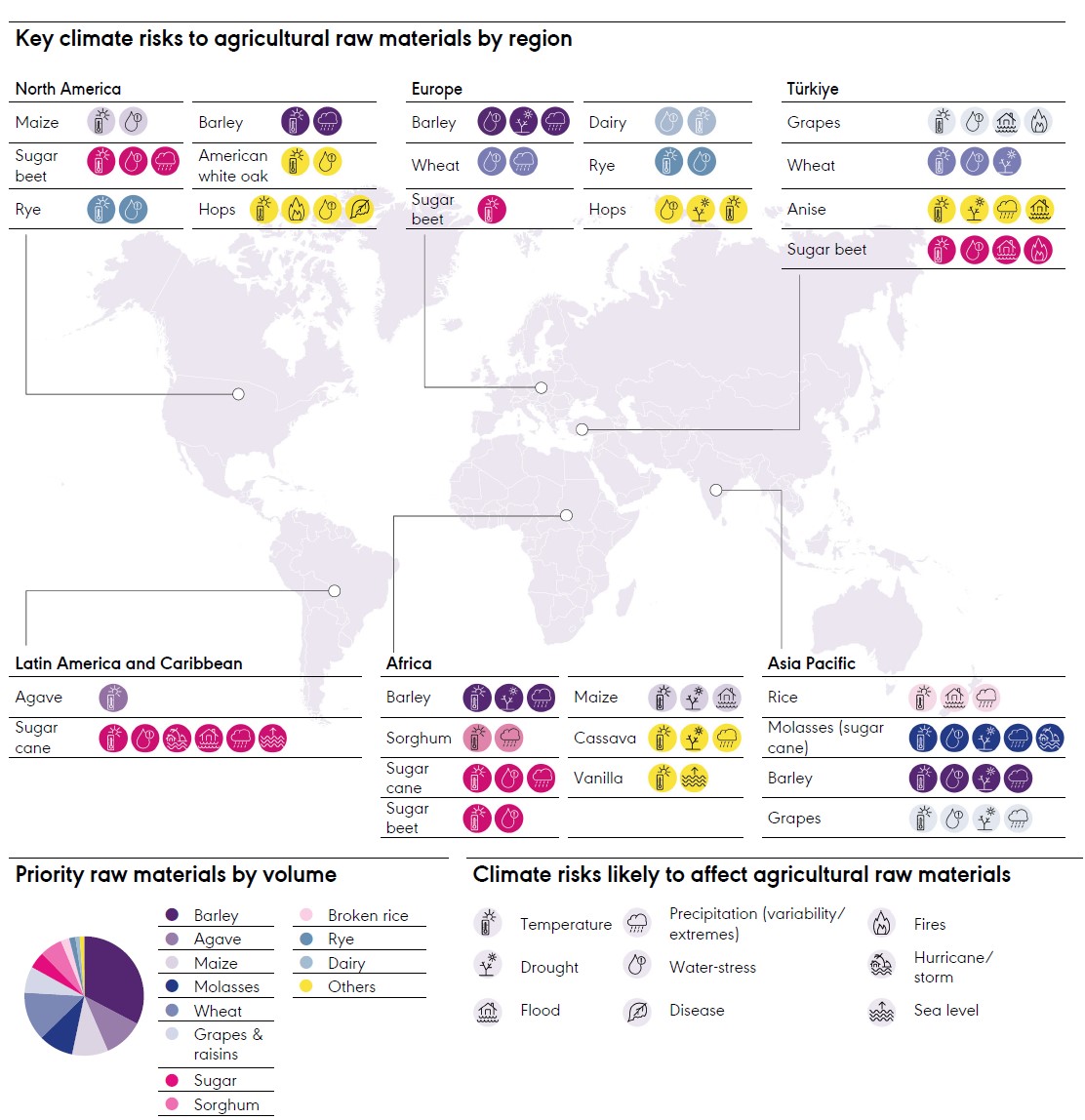

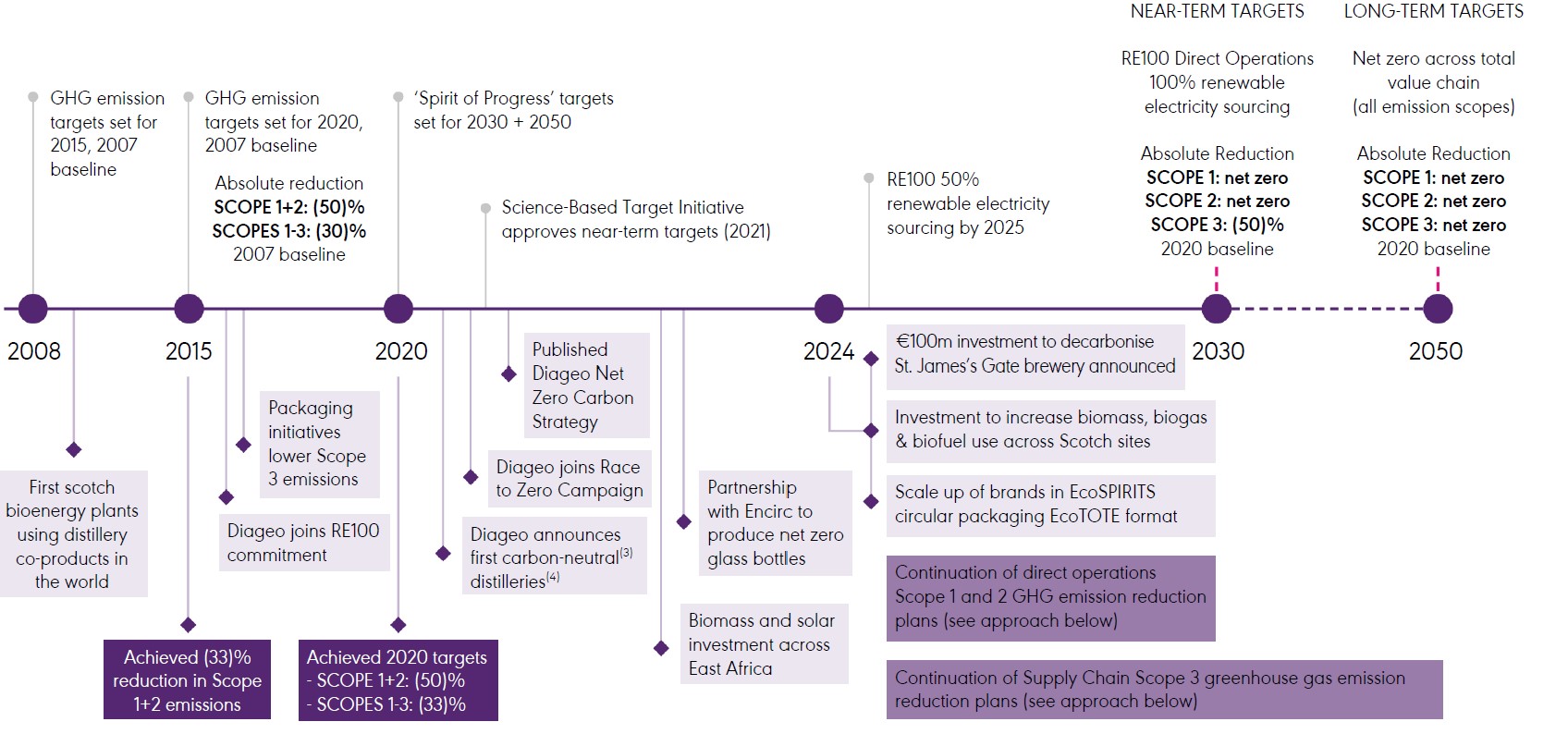

This year, our water efficiency across the company improved in total by 15.6% since our fiscal 20 baseline. The main drivers contributing to the strong performance in fiscal 24 were the continuous improvement initiatives in the water recovery plants at our East Africa sites and the optimisation of the reverse osmosis plant at our Cameronbridge site. | Our Scope 1 and 2 greenhouse gas emissions reduced in total by 23.8% from our fiscal 20 baseline. The main drivers contributing to the lower emissions are the increased use of on- site bioenergy (biomass, biogas and biofuel) across Africa, scotch and tequila markets and additional renewable electricity use, particularly in North America. |

| More detail on page 121-124 |  | More detail on page 125-128 |

Reported net sales growth | Net cash from operating activities | |||

(1)% |  | $4,105m |  | |

Organic net sales growth(1) | Free cash flow(1) | |||

(1)% |  | $2,609m |  | |

Reported operating profit growth | Return on closing invested capital | |||

8% |  | 34.5% |  | |

Organic operating profit growth(1) | Return on average invested capital(1) | |||

(5)% |  | 15.8% |  | |

Basic earnings per share | Total shareholder return | |||

173.2c |  | (24)% |  | |

Earnings per share before exceptional items(1) | ||||

179.6c |  | |||

Fiscal 24 | North America | Europe | Asia Pacific | Latin America and Caribbean | Africa |

Volume (EU million ) | 50.1 | 51.3 | 74.9 | 22.1 | 32.1 |

Reported net sales(1) ($ million) | 7,908 | 4,804 | 3,817 | 1,839 | 1,778 |

Reported operating profit(2) ($ million) | 3,039 | 1,257 | 1,438 | 502 | 131 |

Operating profit before exceptional items(3) ($ million) | 3,236 | 1,379 | 1,063 | 502 | 131 |

Water efficiency, percentage change compared to fiscal 20 baseline | 2% | (12)% | (38)% | 4% | (25)% |

Percentage change in total direct and indirect greenhouse gas emissions (market/net based) compared to fiscal 20 baseline | (32)% | 18% | (75)% | (59)% | (43)% |

Average number of employees(4) | 3,144 | 10,524 | 8,763 | 4,437 | 3,499 |

Location | Principal activities | Products | |

United Kingdom | distilling, bottling, warehousing, coopering | beer, scotch, gin, vodka, rum, ready to drink, non- alcoholic | |

Ireland | distilling, brewing, bottling, warehousing | beer, liqueur, Irish whiskey, non-alcoholic | |

Italy | distilling, bottling, warehousing | vodka, rum, ready to drink, non-alcoholic | |

Türkiye | distilling, bottling, warehousing | raki, vodka, gin, liqueur, wine | |

North America | distilling, bottling, warehousing | vodka, gin, rum, Canadian whisky, US whiskey, ready to drink | |

Brazil | distilling, bottling, warehousing | cachaça, vodka, ready to drink | |

Mexico | distilling, bottling, warehousing | tequila | |

East Africa | distilling, brewing, bottling, warehousing | beer, rum, vodka, gin, whisky, brandy, liqueur, ready to drink, bottled in East Africa (scotch) | |

Nigeria | distilling, brewing, bottling, warehousing | beer, rum, vodka, gin, ready to drink | |

South Africa | distilling, bottling, warehousing | rum, vodka, gin | |

ARM | distilling, brewing, bottling, warehousing | beer, vodka, gin, ready to drink | |

India | distilling, bottling, warehousing | rum, vodka, Indian whisky, gin, brandy, bottled in India (scotch) | |

Australia | distilling, bottling, warehousing | rum, vodka, gin, ready to drink | |

Greater China | distilling, warehousing | Chinese whisky, Chinese white spirits |

2023 re-presented(1) | Exchange | Acquisitions and disposals | Organic movement | Other(2) | 2024 | Reported movement % | ||

Net sales | 8,109 | 3 | 2 | (206) | — | 7,908 | (2) | |

Marketing | 1,631 | 1 | 5 | (10) | — | 1,627 | — | |

Operating profit before exceptional items | 3,222 | 160 | (10) | (142) | 6 | 3,236 | — | |

Exceptional operating items(3) | (118) | (197) | ||||||

Operating profit | 3,104 | 3,039 | (2) |

Organic volume movement | Reported volume movement | Organic net sales movement | Reported net sales movement | |

Markets and categories: | % | % | % | % |

North America(4) | (4) | (4) | (3) | (2) |

US Spirits(4) | (5) | (4) | (3) | (3) |

DBC USA(5) | 1 | 1 | 3 | 3 |

Canada | (5) | (4) | (2) | (3) |

Spirits(4) | (5) | (5) | (4) | (4) |

Beer | 3 | 3 | 5 | 5 |

Ready to drink | (8) | (8) | (3) | (3) |

Key brands(6): | ||||

Organic volume movement(7) | Organic net sales movement | Reported net sales movement | ||

% | % | % | ||

Crown Royal | — | (1) | (1) | |

Don Julio | 19 | 11 | 11 | |

Casamigos(8) | (16) | (21) | (22) | |

Smirnoff | (5) | (2) | (2) | |

Johnnie Walker | (7) | (10) | (10) | |

Captain Morgan | (10) | (6) | (6) | |

Guinness | 3 | 6 | 6 | |

Ketel One(9) | (4) | (5) | (5) | |

Baileys | (2) | — | — | |

Bulleit whiskey(10) | 6 | 12 | 12 | |

Buchanan's | 8 | 3 | 3 |

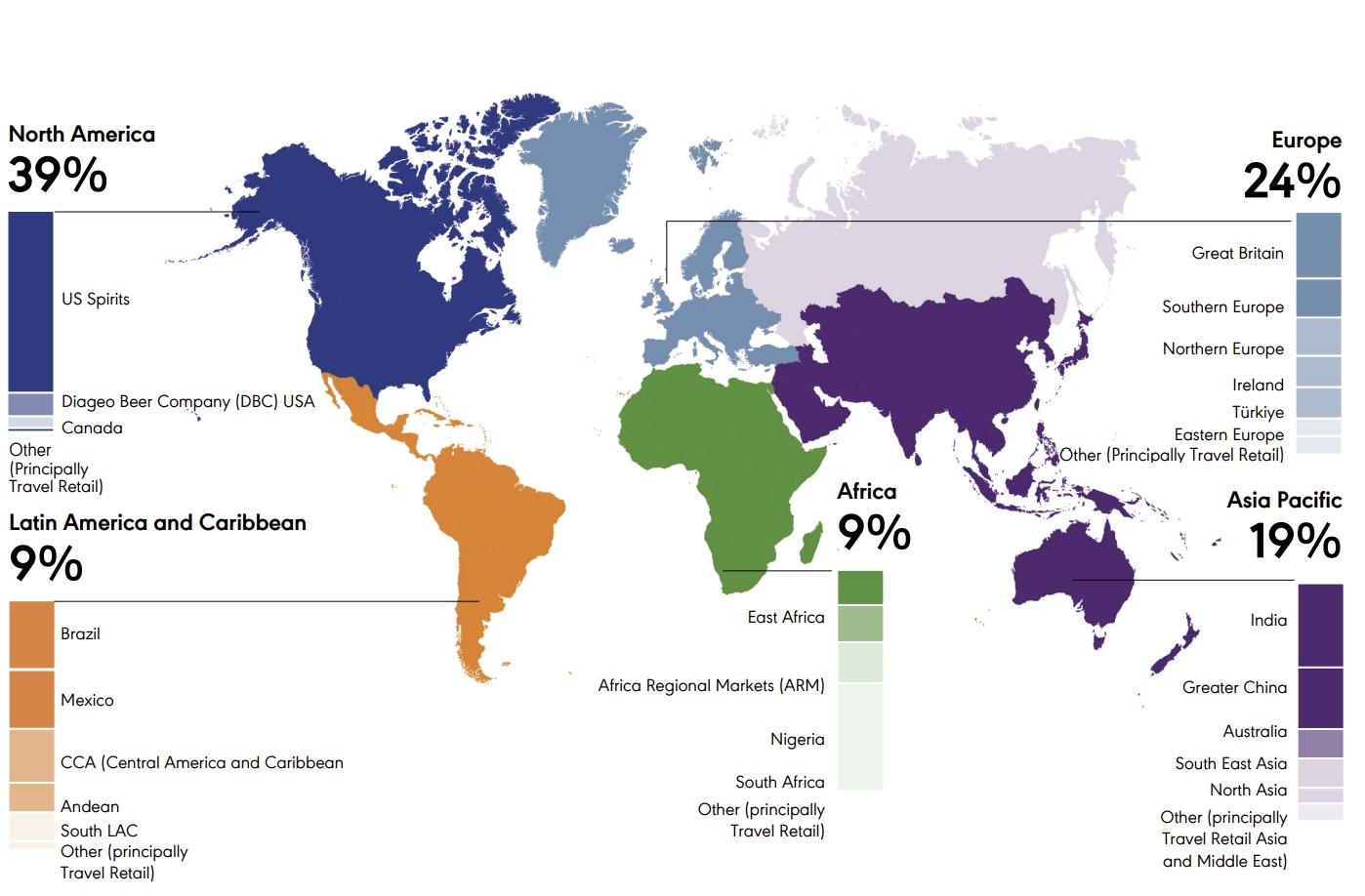

North America contributed | North America organic net sales declined | |

39% of Diageo reported net sales in fiscal 24 | 3% in fiscal 24 |

Reported net sales by market (%) |

Reported net sales by category (%) |

2023 re-presented(2) | Exchange | Reclassification | Acquisitions and disposals | Organic movement | Other(3) | Hyperinflation(1) | 2024 | Reported movement % | |

Net sales | 4,303 | (3) | 62 | 26 | 124 | — | 292 | 4,804 | 12 |

Marketing | 765 | 18 | 1 | 22 | 34 | — | 33 | 873 | 14 |

Operating profit before exceptional items | 1,312 | 24 | 47 | 3 | (15) | (3) | 11 | 1,379 | 5 |

Exceptional operating items(4) | (12) | (122) | |||||||

Operating profit | 1,300 | 1,257 | (6) |

Markets and categories: | Organic volume movement % | Reported volume movement % | Organic net sales movement % | Reported net sales movement % |

Europe(1) | (1) | — | 3 | 12 |

Great Britain(1) | (1) | — | 5 | 10 |

Southern Europe(1) | (2) | (8) | (2) | — |

Northern Europe(1) | (3) | (2) | (4) | — |

Ireland(1) | (2) | (1) | 7 | 11 |

Türkiye(1) | 4 | 4 | 31 | 59 |

Eastern Europe(1) | (6) | (5) | (7) | (3) |

Spirits(1) | (2) | (1) | (1) | 9 |

Beer | 8 | 8 | 18 | 23 |

Ready to drink(1) | (9) | (9) | (5) | (3) |

Key brands(2): | ||||

Organic volume movement(3) % | Organic net sales movement % | Reported net sales movement % | ||

Guinness | 11 | 22 | 27 | |

Johnnie Walker | 5 | 3 | 21 | |

Baileys | 5 | 6 | 10 | |

Smirnoff | (2) | — | 5 | |

Captain Morgan | (5) | (5) | — | |

Gordon's | (9) | (8) | (1) | |

Tanqueray | (8) | (9) | (4) | |

JεB | (3) | (6) | 3 | |

Europe contributed | Europe organic net sales grew | |

24% of Diageo reported net sales in fiscal 24 | 3% in fiscal 24 |

Reported net sales by market (%) |

Reported net sales by category (%) |

2023 re-presented(1) | Exchange | Reclassification | Acquisitions and disposals | Organic movement | 2024 | Reported movement % | |

Net sales | 3,841 | (30) | (62) | (96) | 164 | 3,817 | (1) |

Marketing | 655 | (11) | (1) | (8) | 16 | 651 | (1) |

Operating profit before exceptional items | 1,104 | (29) | (47) | (25) | 60 | 1,063 | (4) |

Exceptional operating items(2) | (581) | 375 | |||||

Operating profit | 523 | 1,438 | 175 |

Markets and categories: | Organic volume movement % | Reported volume movement % | Organic net sales movement % | Reported net sales movement % |

Asia Pacific(1) | 1 | (7) | 4 | (1) |

India(1) | 2 | (7) | 8 | 3 |

Greater China | 14 | 15 | 12 | 8 |

Australia | (7) | (6) | (8) | (9) |

South East Asia(1) | (9) | (8) | (8) | (4) |

Travel Retail Asia and Middle East | — | (28) | 10 | (3) |

North Asia | (12) | (13) | 3 | (17) |

Spirits(1) | 1 | (7) | 6 | 1 |

Beer | (2) | (3) | 4 | 2 |

Ready to drink | (16) | (16) | (14) | (16) |

Key brands(2): | ||||

Organic volume movement(3) | Organic net sales movement | Reported net sales movement | ||

% | % | % | ||

Johnnie Walker | (4) | 1 | — | |

Shui Jing Fang(4) | 32 | 27 | 23 | |

McDowell's | (2) | 4 | 2 | |

The Singleton | 14 | 12 | 10 | |

Royal Challenge | 11 | 16 | 14 | |

Guinness | (2) | 4 | 2 | |

Black & White | 20 | 24 | 21 | |

Smirnoff | 1 | (1) | (6) | |

Asia Pacific contributed | Asia Pacific organic net sales grew | |

19% of Diageo reported net sales of fiscal 24 | 4% in fiscal 24 |

Reported net sales by market (%) |

Reported net sales by category (%) |

2023 re-presented⁽¹⁾ | Exchange | Organic movement | Other (2) | 2024 | Reported movement % | |

Net sales | 2,159 | 118 | (459) | — | 1,839 | (15) |

Marketing | 355 | 21 | (70) | — | 306 | (14) |

Operating profit | 783 | 37 | (302) | (17) | 502 | (36) |

Markets and categories: | Organic volume movement % | Reported volume movement % | Organic net sales movement % | Reported net sales movement % |

Latin America and Caribbean | (16) | (16) | (21) | (15) |

Brazil | (10) | (10) | (18) | (15) |

Mexico | (25) | (25) | (30) | (24) |

CCA | (20) | (20) | (25) | (21) |

Andean | (18) | (18) | (17) | 19 |

South LAC | (18) | (18) | (9) | (13) |

Spirits | (16) | (16) | (23) | (16) |

Beer | 3 | 3 | 29 | 33 |

Ready to drink | — | — | (3) | (1) |

Key brands(1): | ||||

Organic volume movement(4) % | Organic net sales movement % | Reported net sales movement % | ||

Johnnie Walker | (12) | (17) | (12) | |

Buchanan’s | (18) | (28) | (15) | |

Don Julio | (28) | (37) | (30) | |

Old Parr | (15) | (25) | (14) | |

Smirnoff | (15) | (15) | (18) | |

Black & White | (25) | (30) | (22) | |

Baileys | (20) | (14) | (9) | |

White Horse | (2) | (11) | (10) | |

Latin America and Caribbean contributed | Latin America and Caribbean organic net sales declined | |

9% of Diageo reported net sales in fiscal 24 | 21% in fiscal 24 |

Reported net sales by market (%) |

Reported net sales by category (%) |

2023 re- presented⁽¹⁾ | Exchange | Reclassific ation | Acquisitions and disposals | Organic movement | Hyperinfla tion(2) | 2024 | Reported movement % | |

Net sales | 2,039 | (518) | — | — | 235 | 22 | 1,778 | (13) |

Marketing | 235 | (53) | (12) | (1) | 35 | 1 | 205 | (13) |

Operating profit before exceptional items | 289 | (222) | (11) | 86 | (11) | 131 | (55) | |

Exceptional operating items(3) | (55) | — | ||||||

Operating profit | 234 | 131 | (44) |

Organic volume movement | Reported volume movement | Organic net sales movement | Reported net sales movement | |

Markets and categories: | % | % | % | % |

Africa(1) | (6) | (2) | 12 | (13) |

East Africa | 1 | 1 | 9 | — |

Africa Regional Markets(1) | (6) | (2) | 6 | (26) |

Nigeria | (18) | (18) | 31 | (41) |

South Africa | (17) | 14 | (11) | 32 |

Spirits(1) | (16) | (9) | (2) | (4) |

Beer(1) | 4 | 4 | 19 | (16) |

Ready to drink(1) | 2 | 8 | 35 | (24) |

Key brands(2): | ||||

Organic volume movement(3) | Organic net sales movement | Reported net sales movement | ||

% | % | % | ||

Guinness | (1) | 16 | (33) | |

Senator | 26 | 29 | 15 | |

Malta Guinness | (3) | 44 | (22) | |

Johnnie Walker | (19) | (11) | (19) | |

Tusker | (6) | — | (7) | |

Serengeti | (1) | 4 | (3) | |

Smirnoff | (19) | (9) | (22) | |

Africa contributed | Africa organic net sales grew | |

9% of Diageo reported net sales in fiscal 24 | 12% in fiscal 24 |

Reported net sales by market (%) |

Reported net sales by category (%) |

Key categories: | Organic volume movement(1) % | Organic net sales movement % | Reported net sales movement % | Reported net sales by category % |

Spirits(2) | (5) | (4) | (2) | 78 |

Scotch | (7) | (10) | (6) | 24 |

Tequila | (4) | (7) | (7) | 11 |

Vodka(3)(4) | (9) | (7) | (6) | 9 |

Canadian whisky(5) | (2) | (1) | (1) | 6 |

Rum(4) | (11) | (6) | (2) | 5 |

Liqueurs | (2) | 2 | 3 | 5 |

Gin(4) | (10) | (8) | 2 | 5 |

IMFL whisky(5) | 5 | 10 | 2 | 4 |

Chinese white spirits(5) | 32 | 27 | 23 | 3 |

US whiskey(5) | (3) | 3 | 3 | 2 |

Beer | 5 | 14 | 3 | 16 |

Ready to drink | (7) | (1) | (10) | 4 |

Reported volume by category | Reported net sales by category | Reported marketing spend by category |

n | Scotch | n | Vodka | n | US whiskey | n | Canadian whisky | n | Rum | n | IMFL whisky |

n | Liqueurs | n | Gin | n | Tequila | n | Beer | n | Ready to drink | n | Other |

Key brands(1): | |||

Organic volume movement(2) % | Organic net sales movement % | Reported net sales movement % | |

Johnnie Walker | (5) | (6) | (2) |

Guinness | 5 | 15 | 6 |

Don Julio | 7 | 3 | 4 |

Crown Royal | — | (1) | (1) |

Smirnoff | (7) | (3) | (3) |

Baileys | (1) | 1 | 2 |

Casamigos(3) | (15) | (20) | (20) |

Captain Morgan | (7) | (5) | (4) |

Shui Jing Fang(4) | 32 | 27 | 23 |

Scotch malts | (9) | (14) | (14) |

McDowell's | (2) | 3 | 1 |

Buchanan’s | (9) | (15) | (7) |

Gordon's | (11) | (6) | 20 |

Tanqueray | (11) | (11) | (10) |

Ketel One(5) | (5) | (5) | (5) |

Bulleit whiskey(6) | 6 | 11 | 11 |

Cîroc vodka | (23) | (26) | (26) |

Old Parr | (13) | (21) | (12) |

Yenì Raki | (4) | 19 | 53 |

Black & White | (11) | (7) | (4) |

JεB | (8) | (10) | (5) |

Bundaberg | (3) | (7) | (9) |

Reported 2023 | Exceptional operating items (c) | Exchange (a) | Acquisitions and disposals (b) | Organic movement(2) | Fair value remeasure- ment (d) | Reclassifi- cation | Hyper- inflation(2) | Reported 2024 | |

Key financials - certain line items | re-presented(1) $ million | $ million | $ million | $ million | $ million | $ million | $ million | $ million | $ million |

Sales | 28,270 | — | (654) | (381) | 168 | — | — | 488 | 27,891 |

Excise duties | (7,715) | — | 230 | 313 | (297) | — | — | (153) | (7,622) |

Net sales | 20,555 | — | (424) | (68) | (129) | — | — | 335 | 20,269 |

Cost of sales | (8,289) | 23 | 388 | 5 | 25 | (16) | — | (207) | (8,071) |

Gross profit | 12,266 | 23 | (36) | (63) | (104) | (16) | — | 128 | 12,198 |

Marketing | (3,663) | — | 19 | (18) | (7) | — | 12 | (34) | (3,691) |

Other operating items | (3,056) | 799 | 9 | 38 | (193) | 2 | (12) | (93) | (2,506) |

Operating profit | 5,547 | 822 | (8) | (43) | (304) | (14) | — | 1 | 6,001 |

Other line items: | |||||||||

Non-operating items | 364 | (70) | |||||||

Taxation (e) | (1,163) | (1,294) |

Gains/ (losses) $ million | |

Translation impact | (37) |

Transaction impact | 29 |

Operating profit before exceptional items | (8) |

Net finance charges – translation impact | 22 |

Net finance charges – transaction impact | (24) |

Net finance charges(1) | (2) |

Associates – translation impact | 15 |

Profit before exceptional items and taxation | 5 |

Year ended 30 June 2024 | Year ended 30 June 2023 | |

Exchange rates | ||

Translation $1 = | £0.80 | £0.83 |

Transaction $1 = | £0.82 | £0.77 |

Translation $1 = | €0.93 | €0.96 |

Movements in net borrowings | 2024 | 2023 |

$ million | re-presented(1) $ million | |

Net borrowings at the beginning of the year | (19,582) | (17,107) |

Free cash flow (2) | 2,609 | 2,235 |

Movements in loans and other investments | (47) | (68) |

Acquisitions (3) | (6) | (404) |

Investment in associates (3) | (133) | (112) |

Sale of businesses and brands (4) | 87 | 559 |

Share buyback programme (5) | (987) | (1,673) |

Net sale of own shares for share schemes (6) | 21 | 36 |

Purchase of treasury shares in respect of subsidiaries | (10) | — |

Dividend paid to non-controlling interests | (117) | (117) |

Net movements in bonds (7) | 558 | 887 |

Purchase of shares of non-controlling interests (8) | (223) | (178) |

Net movements in other borrowings (9) | (106) | 69 |

Equity dividend paid | (2,242) | (2,065) |

Net decrease in cash and cash equivalents | (596) | (831) |

Net increase in bonds and other borrowings | (453) | (958) |

Exchange differences (10) | (199) | (646) |

Other non-cash items | (187) | (40) |

Net borrowings at the end of the year | (21,017) | (19,582) |

Movements in equity | 2024 | 2023 |

$ million | re-presented(1) $ million | |

Equity at the beginning of the year | 11,709 | 11,511 |

Adjustment to 2023 closing equity in respect of hyperinflation in Ghana (2) | 51 | — |

Adjusted equity at the beginning of the year | 11,760 | 11,511 |

Profit for the year | 4,166 | 4,479 |

Exchange adjustments (3) | (645) | (358) |

Remeasurement of post-employment benefit plans net of taxation | (61) | (562) |

Purchase of shares of non-controlling interests (4) | (223) | (178) |

Hyperinflation adjustments net of taxation (2) | 365 | 180 |

Associates' transactions with non-controlling interests | — | (8) |

Dividend declared to non-controlling interests | (121) | (117) |

Equity dividend declared | (2,243) | (2,071) |

Share buyback programme (5) | (997) | (1,543) |

Other reserve movements | 69 | 376 |

Equity at the end of the year | 12,070 | 11,709 |

30 June 2024 | 30 June 2023 | 30 June 2022 | |

$ million | re-presented $ million | re-presented $ million | |

Expiring within one year | 625 | 125 | 960 |

Expiring between one and two years | 1,040 | 625 | 125 |

Expiring after two years | 1,585 | 2,625 | 2,290 |

3,250 | 3,375 | 3,375 |

30 June 2024 | 30 June 2023 | 30 June 2022 | |

$ million | re-presented $ million | re-presented $ million | |

Net cash inflow from operating activities | 4,105 | 3,636 | 5,213 |

Net cash outflow from investing activities | (1,595) | (1,426) | (1,792) |

Net cash outflow from financing activities | (3,106) | (3,041) | (4,373) |

Net decrease in net cash and cash equivalents | (596) | (831) | (952) |

Exchange difference | (33) | (76) | (38) |

Reclassification to asset held for sale | (30) | — | — |

Net cash and cash equivalents at beginning of period | 1,768 | 2,675 | 3,665 |

Net cash and cash equivalents at end of period | 1,109 | 1,768 | 2,675 |

30 June 2024 | 30 June 2023 | 30 June 2022 | |

$ million | re-presented $ million | re-presented $ million | |

Overdrafts | (21) | (45) | (90) |

Other borrowings due within one year | (2,864) | (2,097) | (1,752) |

Borrowings due within one year | (2,885) | (2,142) | (1,842) |

Borrowings due between one and three years | (4,873) | (4,437) | (3,408) |

Borrowings due between three and five years | (4,222) | (3,620) | (3,177) |

Borrowings due after five years | (9,521) | (10,592) | (10,958) |

Fair value of foreign currency forwards and swaps | 334 | 436 | 430 |

Fair value of interest rate hedging instruments | (376) | (476) | (342) |

Lease liabilities | (604) | (564) | (575) |

Gross borrowings | (22,147) | (21,395) | (19,872) |

Offset by: | |||

Cash and cash equivalents | 1,130 | 1,813 | 2,765 |

Net borrowings | (21,017) | (19,582) | (17,107) |

Total | US dollar % | Sterling % | Euro % | Indian Rupee % | Chinese Yuan % | South Korean won % | Other % | |

Gross borrowings | (22,147) | 43.00% | 22.00% | 26.00% | —% | 4.00% | —% | 5.00% |

Cash and cash equivalents | 1,130 | 12.00% | 3.00% | 5.00% | 15.00% | 23.00% | 4.00% | 38.00% |

30 June 2024 | 30 June 2023 | 30 June 2022 | |

$ million | re-presented $ million | re-presented $ million | |

Issued | |||

€ denominated | 535 | 548 | 1,800 |

£ denominated | — | — | 1,171 |

$ denominated | 1,690 | 1,989 | — |

Repaid | |||

€ denominated | (1,167) | — | (1,060) |

$ denominated | (500) | (1,650) | (1,000) |

558 | 887 | 911 |

Payments due by period | |||||

As at 30 June 2024 | Less than 1 year $ million | 1-3 years $ million | 3-5 years $ million | More than 5 years $ million | Total $ million |

Long-term debt obligations | 2,388 | 4,992 | 4,258 | 9,812 | 21,450 |

Interest obligations | 791 | 1,043 | 789 | 1,866 | 4,489 |

Credit support obligations | 14 | — | — | — | 14 |

Purchase obligations | 2,413 | 1,009 | 389 | 37 | 3,848 |

Commitments for short-term leases and leases of low-value assets | 16 | 6 | 1 | — | 23 |

Provisions and other non-current payables | 101 | 225 | 187 | 192 | 705 |

Lease obligations | 114 | 178 | 117 | 310 | 719 |

Capital commitments | 780 | 3 | — | — | 783 |

Other financial liabilities | 198 | — | — | — | 198 |

Total | 6,815 | 7,456 | 5,741 | 12,217 | 32,229 |

Reported net sales growth 0.2% | Net cash from operating activities $3,636m | |

Organic net sales growth(1) 6.5% | Free cash flow(1)(2) $2,235m | |

Reported operating profit growth (5.9)% | Return on closing invested capital 38.3% | |

Organic operating profit growth(1) 7.0% | Return on average invested capital(1) 18.4% | |

Basic earnings per share 196.3 cents | Total shareholder return (2)% | |

Earnings per share before exceptional items(1) 196.5 cents |

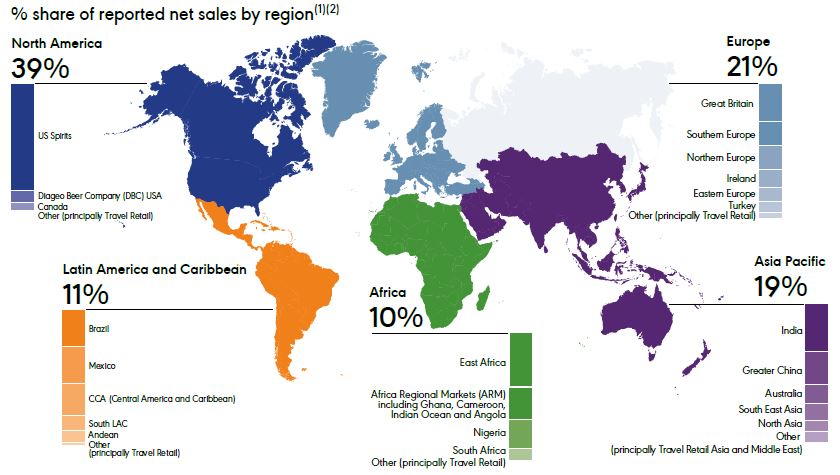

Our global reach | Our regional profile maximises the opportunity for growth in our sector. Where our products are sold each market is accountable for its own performance and driving growth. |

Fiscal 23 | North America | Europe | Asia Pacific | Latin America and Caribbean | Africa |

Volume (EUm) | 52.4 | 51.3 | 80.8 | 26.2 | 32.7 |

Reported net sales(1) ($ million) | 8,109 | 4,303 | 3,841 | 2,159 | 2,039 |

Reported operating profit(2) ($ million) | 3,104 | 1,300 | 523 | 783 | 234 |

Operating profit before exceptional items(3) ($ million) | 3,222 | 1,312 | 1,104 | 783 | 289 |

Water efficiency (litres per litre of product packaged) | 5.11 | 4.98 | 2.91 | 4.15 | 3.19 |

Total direct and indirect carbon emissions by weight (market/net based) (1,000 tonnes CO2e) | 83 | 194 | 9 | 26 | 89 |

Average number of employees(4) | 3,115 | 10,062 | 9,000 | 4,325 | 3,735 |

Location | Principal activities | Products | |

United Kingdom | distilling, bottling, warehousing, cooperage | beer, scotch, gin, vodka, rum, ready to drink, non- alcoholic | |

Ireland | distilling, brewing, bottling, warehousing | beer, liqueur, Irish whiskey, non-alcoholic | |

Italy | distilling, bottling, warehousing | vodka, rum, ready to drink, non-alcoholic | |

Türkiye | distilling, bottling, warehousing | raki, vodka, gin | |

North America | distilling, bottling, warehousing | vodka, gin, rum, Canadian whisky, US whiskey, ready to drink | |

Brazil | distilling, bottling, warehousing | cachaça, vodka, ready to drink | |

Mexico | distilling, bottling, warehousing | tequila | |

East Africa | distilling, brewing, bottling, packaging, warehousing | beer, rum, vodka, gin, whisky, brandy, liqueur | |

Nigeria | distilling, brewing, bottling, packaging | beer, rum, vodka, gin | |

South Africa | distilling, bottling, warehousing | rum, vodka, gin | |

ARM | distilling, brewing, bottling, warehousing | beer, vodka, gin | |

India | distilling, bottling, warehousing | rum, vodka, Indian-Made Foreign Liquor (IMFL), whisky, scotch, gin | |

Australia | distilling, bottling, warehousing | rum, vodka, gin, ready to drink |

2022 (re- presented) | Exchange | Acquisitions and disposals | Organic movement | Other(1) | 2023 (re- presented) | Reported movement (re- presented) | |

$ million | $ million | $ million | $ million | $ million | $ million | % | |

Net sales | 8,106 | (38) | 27 | 14 | — | 8,109 | — |

Marketing | 1,595 | (14) | 20 | 29 | 1 | 1,631 | 2 |

Operating profit before exceptional items | 3,268 | (34) | (15) | (76) | 79 | 3,222 | (1) |

Exceptional operating items(2) | (1) | (118) | |||||

Operating profit | 3,267 | 3,104 | (5) |

Organic volume movement | Reported volume movement | Organic net sales movement | Reported net sales movement (re-presented) | |

Markets and categories: | % | % | % | % |

North America(3) | (5) | (4) | — | — |

US Spirits(3) | (6) | (6) | (1) | — |

DBC USA(4) | (3) | (3) | 1 | 1 |

Canada | (2) | (2) | 4 | (2) |

Spirits(3) | (5) | (4) | — | — |

Beer | (2) | (2) | 2 | 1 |

Ready to drink | (11) | (11) | (16) | (18) |

Global giants, local stars and reserve(5) | Organic volume movement(6) % | Organic net sales movement % | Reported net sales movement (re-presented) % | |

Crown Royal | (12) | (10) | (10) | |

Don Julio | 8 | 13 | 13 | |

Casamigos(7) | 6 | 13 | 13 | |

Johnnie Walker | (5) | (10) | (11) | |

Smirnoff | (1) | 4 | 3 | |

Captain Morgan | (5) | (1) | (1) | |

Ketel One | (3) | — | — | |

Guinness | 4 | 9 | 8 | |

Baileys | (4) | 1 | 1 | |

Bulleit whiskey(8) | (8) | (6) | (6) | |

Buchanan's | — | 9 | 9 | |

North America contributed | North America organic net sales were flat in fiscal 23 | |

39% of Diageo reported net sales in fiscal 23 |

Reported net sales by market (%) |

Reported net sales by category (%) |

2022 (re- presented) | Exchange | Acquisitions and disposals | Organic movement | Other(2) | Hyperinfla tion(1) | 2023 (re- presented) | Reported movement | |

$ million | $ million | $ million | $ million | $ million | $ million | $ million | % | |

Net sales | 4,238 | (530) | (11) | 466 | — | 140 | 4,303 | 2 |

Marketing | 764 | (74) | 3 | 57 | — | 15 | 765 | — |

Operating profit before exceptional items | 1,345 | (144) | (43) | 138 | (14) | 30 | 1,312 | (2) |

Exceptional operating items(3) | (184) | (12) | ||||||

Operating profit | 1,161 | 1,300 | 12 |

Markets and categories | Organic volume movement % | Reported volume movement % | Organic net sales movement % | Reported net sales movement (re-presented) % |

Europe(1) | — | — | 11 | 2 |

Great Britain(1) | (8) | (8) | 7 | (4) |

Southern Europe(1) | 4 | 5 | 12 | 2 |

Northern Europe(1) | 8 | 6 | 11 | 1 |

Ireland(1) | 3 | 3 | 16 | 7 |

Eastern Europe(1) | (15) | (15) | (3) | (9) |

Türkiye(1) | 9 | 9 | 38 | 14 |

Spirits(1) | — | — | 10 | — |

Beer | 5 | 5 | 18 | 8 |

Ready to drink(1) | (2) | (2) | 10 | 1 |

Global giants and local stars(2) | Organic volume movement(3) % | Organic net sales movement % | Reported net sales movement (re-presented) % | |

Guinness | 6 | 20 | 9 | |

Johnnie Walker | 18 | 29 | 14 | |

Baileys | (3) | (1) | (9) | |

Smirnoff | (1) | 14 | 4 | |

Captain Morgan | — | 9 | (1) | |

Tanqueray | — | 6 | (3) | |

JεB | (7) | (1) | (8) | |

Yenì Raki | — | 7 | (6) |

Europe contributed | Europe organic net sales grew | |

21% of Diageo reported net sales in fiscal 23 | 11% in fiscal 23 |

Reported net sales by market (%) |

Reported net sales by category (%) |

2022 (re- presented) | Exchange | Acquisitions and disposals | Organic movement | 2023 (re- presented) | Reported movement (re- presented) | |

$ million | $ million | $ million | $ million | $ million | % | |

Net sales | 3,837 | (334) | (136) | 474 | 3,841 | — |

Marketing | 651 | (58) | — | 62 | 655 | 1 |

Operating profit before exceptional items | 947 | (83) | (28) | 268 | 1,104 | 17 |

Exceptional operating items(2) | (292) | (581) | ||||

Operating profit | 655 | 523 | (20) |

Markets and categories | Organic volume movement % | Reported volume movement % | Organic net sales movement % | Reported net sales movement (re-presented) % |

Asia Pacific(1) | 5 | (14) | 13 | — |

India(1) | 6 | (18) | 17 | 3 |

Greater China | (2) | (2) | (4) | (11) |

Australia | (10) | (10) | 2 | (5) |

South East Asia(1) | 20 | 20 | 33 | 23 |

North Asia | 6 | 6 | 15 | 2 |

Travel Retail Asia and Middle East | 38 | 38 | 67 | 49 |

Spirits(1)(2) | 6 | (15) | 14 | 1 |

Beer | 5 | 5 | 10 | 1 |

Ready to drink | (8) | (8) | 1 | (7) |

Global giants and local stars(2) | Organic volume movement(3) % | Organic net sales movement % | Reported net sales movement (re-presented) % | |

Johnnie Walker | 13 | 29 | 17 | |

Shui Jing Fang(4) | (15) | (14) | (21) | |

McDowell's | (1) | 4 | (4) | |

Guinness | 4 | 10 | 2 | |

The Singleton | 26 | 26 | 18 | |

Smirnoff | 8 | 15 | 8 | |

Windsor | 29 | 41 | 28 | |

Black & White | 28 | 36 | 25 |

Asia Pacific contributed | Asia Pacific organic net sales grew | |

19% of Diageo reported net sales in fiscal 23 | 13% in fiscal 23 |

Reported net sales by market (%) |

Reported net sales by category (%) |

2022 (re- presented) | Exchange | Acquisitions and disposals | Organic movement | Other(1) | 2023 (re- presented) | Reported movement (re- presented) | |

$ million | $ million | $ million | $ million | $ million | $ million | % | |

Net sales | 2,027 | (61) | 3 | 190 | — | 2,159 | 7 |

Marketing | 324 | (15) | 1 | 45 | — | 355 | 10 |

Operating profit | 712 | (24) | — | 83 | 12 | 783 | 10 |

Markets and categories | Organic volume movement % | Reported volume movement % | Organic net sales movement % | Reported net sales movement (re-presented) % |

Latin America and Caribbean(1) | (3) | (3) | 9 | 7 |

Brazil(2) | (1) | 3 | 8 | 16 |

Mexico(1) | (4) | (3) | 9 | 17 |

CCA | 1 | 1 | 14 | 9 |

South LAC(2) | (3) | (11) | 21 | (8) |

Andean(1) | (24) | (24) | (7) | (21) |

Spirits(1) | (3) | (3) | 11 | 8 |

Beer | 9 | 9 | 16 | 13 |

Ready to drink | (13) | (13) | (7) | (10) |

Global giants and local stars(3) | Organic volume movement(4) % | Organic net sales movement % | Reported net sales movement (re-presented) % | |

Johnnie Walker | 4 | 16 | 12 | |

Buchanan’s | (5) | 6 | — | |

Don Julio | 6 | 22 | 26 | |

Old Parr | 10 | 20 | 14 | |

Smirnoff | 3 | 18 | 12 | |

Black & White | (7) | 13 | 13 | |

Tanqueray | — | — | (5) | |

Baileys | (18) | (5) | (8) | |

Latin America and Caribbean contributed | Latin America and Caribbean organic net sales grew | |

11% of Diageo reported net sales in fiscal 23 | 9% in fiscal 23 |

Reported net sales by market (%) |

Reported net sales by category (%) |

2022 (re- presented) | Exchange | Acquisitions and disposals | Organic movement | 2023 (re- presented) | Reported movement (re- presented) | |

$ million | $ million | $ million | $ million | $ million | % | |

Net sales | 2,238 | (273) | (37) | 111 | 2,039 | (9) |

Marketing | 266 | (31) | (6) | 6 | 235 | (12) |

Operating profit before exceptional items | 419 | (192) | 13 | 49 | 289 | (31) |

Exceptional operating items(1) | — | (55) | ||||

Operating profit | 419 | 234 | (44) |

Organic volume movement | Reported volume movement | Organic net sales movement | Reported net sales movement (re-presented) | |

Markets and categories | % | % | % | % |

Africa(1) | (7) | (8) | 5 | (9) |

East Africa | (7) | (7) | (2) | (10) |

Nigeria | (4) | (4) | 11 | 1 |

Africa Regional Markets(1) | (1) | (9) | 22 | (14) |

South Africa | (18) | (18) | 1 | (13) |

Spirits(1) | (2) | (2) | 8 | (4) |

Beer(1) | (13) | (14) | 3 | (12) |

Ready to drink(1) | — | (4) | 11 | (5) |

Organic volume movement(3) | Organic net sales movement | Reported net sales movement (re-presented) | ||

Global giants and local stars(2) | % | % | % | |

Guinness | (8) | 7 | (8) | |

Johnnie Walker | 5 | 11 | (3) | |

Smirnoff | (23) | (6) | (18) | |

Other beer: | ||||

Malta Guinness | (7) | 22 | (8) | |

Senator | (17) | (4) | (14) | |

Tusker | (8) | (5) | (13) | |

Serengeti | (7) | (1) | (3) |

Africa contributed | Africa organic net sales grew | |

10% of Diageo reported net sales in fiscal 23 | 5% in fiscal 23 |

Reported net sales by market (%) |

Reported net sales by category (%) |

Key categories | Organic volume movement(1) % | Organic net sales movement % | Reported net sales movement (re-presented) % | Reported net sales by category (re-presented) % |

Spirits(2) | — | 6 | 1 | 78 |

Scotch | 2 | 12 | 5 | 25 |

Tequila | 10 | 19 | 19 | 12 |

Vodka(3)(4) | (3) | 1 | (3) | 9 |

Canadian whisky(5) | (10) | (9) | (10) | 6 |

Rum(4) | (7) | 2 | (2) | 5 |

Liqueurs | (4) | (1) | (7) | 5 |

Gin(4) | — | 5 | (2) | 5 |

IMFL whisky(5) | 8 | 15 | (10) | 4 |

Chinese white spirits(5) | (15) | (14) | (21) | 3 |

US whiskey(5) | (8) | (4) | (4) | 2 |

Beer | (7) | 9 | (2) | 15 |

Ready to drink | (6) | — | (7) | 4 |

Reported volume by category | Reported net sales by category | Reported marketing spend by category |

n | Scotch | n | Vodka | n | US whiskey | n | Canadian whisky | n | Rum | n | IMFL whisky |

n | Liqueurs | n | Gin | n | Tequila | n | Beer | n | Ready to drink | n | Other |

Global giants, local stars and reserve(1): | Organic volume movement(2) % | Organic net sales movement % | Reported net sales movement (re-presented) % |

Global giants | |||

Johnnie Walker | 9 | 15 | 7 |

Guinness | 1 | 16 | 5 |

Smirnoff | (2) | 8 | 3 |

Baileys | (5) | — | (5) |

Captain Morgan | (2) | 5 | — |

Tanqueray | (4) | 1 | (4) |

Local stars | |||

Crown Royal | (12) | (10) | (10) |

Buchanan’s | (3) | 7 | 4 |

McDowell's | (1) | 4 | (4) |

Shui Jing Fang(3) | (15) | (14) | (21) |

Old Parr | 9 | 18 | 12 |

Black & White | 2 | 20 | 16 |

JεB | (9) | (3) | (10) |

Yenì Raki | — | 8 | (6) |

Windsor | 29 | 41 | 28 |

Bundaberg | — | 18 | 9 |

Ypióca | (9) | 7 | 9 |

Reserve | |||

Don Julio | 11 | 20 | 19 |

Casamigos(4) | 7 | 15 | 15 |

Scotch malts | 3 | 16 | 7 |

Ketel One(5) | (3) | 1 | — |

Bulleit whiskey(6) | (9) | (6) | (6) |

Cîroc vodka | (23) | (23) | (25) |

Key financials - certain line items | 30 June 2022 (re- presented) $ million | Exceptional operating items (c) $ million | Exchange (a) $ million | Acquisitions and disposals (b) $ million | Organic movement(1) $ million | Fair value remeasurement (d) $ million | Hyperinflation(1) $ million | 30 June 2023 (re-presented) $ million |

Sales | 29,751 | — | (2,122) | (916) | 1,461 | — | 96 | 28,270 |

Excise duties | (9,235) | — | 876 | 762 | (162) | — | 44 | (7,715) |

Net sales | 20,516 | — | (1,246) | (154) | 1,299 | — | 140 | 20,555 |

Cost of sales | (7,923) | (80) | 378 | 113 | (699) | 7 | (85) | (8,289) |

Gross profit | 12,593 | (80) | (868) | (41) | 600 | 7 | 55 | 12,266 |

Marketing | (3,616) | — | 193 | (21) | (203) | (1) | (15) | (3,663) |

Other operating items | (3,080) | (209) | 157 | (19) | 34 | 71 | (10) | (3,056) |

Operating profit | 5,897 | (289) | (518) | (81) | 431 | 77 | 30 | 5,547 |

Other line items: | ||||||||

Non-operating items | (88) | 364 | ||||||

Taxation (e) | (1,398) | (1,163) |

Gains/ (losses) (re-presented) $ million | |

Translation impact | (395) |

Transaction impact | (123) |

Operating profit before exceptional items | (518) |

Net finance charges – translation impact | 29 |

Net finance charges – transaction impact | 8 |

Net finance charges | 37 |

Associates – translation impact | (37) |

Profit before exceptional items and taxation | (518) |

Year ended 30 June 2023 | Year ended 30 June 2022 | |

Exchange rates | ||

Translation $1 = | £0.83 | £0.75 |

Transaction $1 = | £0.77 | £0.78 |

Translation $1 = | €0.96 | €0.89 |

Movements in net borrowings | 2023 | 2022 |

re-presented $ million | re-presented $ million | |

Net borrowings at the beginning of the year | (17,107) | (16,832) |

Free cash flow (1) | 2,235 | 3,779 |

Movements in loans and other investments | (68) | (96) |

Acquisitions (2) | (404) | (278) |

Investment in associates (2) | (112) | (86) |

Sale of businesses and brands (3) | 559 | 102 |

Share buyback programme (4) | (1,673) | (2,985) |

Net sale of own shares for share schemes (5) | 36 | 24 |

Purchase of treasury shares in respect of subsidiaries | — | (20) |

Dividends paid to non-controlling interests | (117) | (108) |

Net movements in bonds (6) | 887 | 911 |

Purchase of shares of non-controlling interests (7) | (178) | — |

Net movements in other borrowings (8) | 69 | 105 |

Equity dividend paid | (2,065) | (2,300) |

Net decrease in cash and cash equivalents | (831) | (952) |

Net increase in bonds and other borrowings | (958) | (1,022) |

Exchange differences (9) | (646) | 1,967 |

Other non-cash items (10) | (40) | (268) |

Net borrowings at the end of the year | (19,582) | (17,107) |

Movements in equity | 2023 (re-presented) $ million | 2022 (re-presented) $ million |

Equity at the beginning of the year | 11,511 | 11,719 |

Adjustment to 2021 closing equity in respect of hyperinflation in Türkiye (1) | — | 349 |

Adjusted equity at the beginning of the year | 11,511 | 12,068 |

Profit for the year | 4,479 | 4,410 |

Exchange adjustments (2) | (358) | (583) |

Remeasurement of post employment benefit plans net of taxation | (562) | 661 |

Purchase of shares of non-controlling interests (3) | (178) | — |

Hyperinflation adjustments net of taxation (1) | 180 | 344 |

Associates' transactions with non-controlling interests | (8) | — |

Dividend to non-controlling interests | (117) | (95) |

Equity dividend declared | (2,071) | (2,286) |

Share buyback programme (4) | (1,543) | (3,004) |

Other reserve movements | 376 | (4) |

Equity at the end of the year | 11,709 | 11,511 |

Promote positive drinking We want to change the way people drink – for the better. This is why we promote moderate drinking and invest in education programmes to discourage the harmful use of alcohol. |

Tackling underage drinking through SMASHED | ||||

Target by 2030 Scale up our SMASHED partnership and educate 10 million young people, parents and teachers on the dangers of underage drinking | Number of people educated on the dangers of underage drinking through a Diageo- supported education programme in fiscal 24 | |||

2.2m | ||||

n | 2030 Target | 10m | ||

n | 2023 progress to date | 3.7m | ||

n | 2024 progress to date | 5.9m | ||

Changing attitudes to drink driving | ||||

Target by 2030 Extend our UNITAR partnership and promote changes in attitudes to drink driving, reaching five million people | Number of people educated about the dangers of drink driving in fiscal 24 | |||

1.0m | ||||

n | 2030 Target | 5m | ||

n | 2023 progress to date | 1.2m | ||

n | 2024 progress to date | 2.2m | ||

Incidents of non-compliance concerning marketing communications – fiscal 24(1) | |||

Country | Body | Industry complaints upheld | Complaints about Diageo brands upheld |

United States | Distilled Spirits Council of the United States | 2 | 1 |

Australia | ABAC Scheme | 33 | 0 |

United Kingdom | Advertising Standards Authority | 0 | 0 |

Portman Group | 18 | 0 | |

Republic of Ireland | Advertising Standards Authority for Ireland | 3 | 0 |

Doing business the right way We want to do business in the right way every day, everywhere. We expect all stakeholders, including our people and suppliers, to demonstrate integrity, live our values, and behave in an ethical way as set out in our Code of Business Conduct. | ||

Our people and culture: The key to winning Our talented and diverse workforce, together with our people’s passion for our brands and unique culture continues to be a competitive advantage for our business, enabling our people to perform at their best. |

Region(2) | Men | % | Women | % | Not declared(3) | % | Total |

North America | 1,844 | 59% | 1,286 | 41% | 14 | — | 3,144 |

Europe | 5,972 | 57% | 4,538 | 43% | 14 | — | 10,524 |

Asia Pacific | 5,797 | 66% | 2,965 | 34% | 1 | — | 8,763 |

Latin America and Caribbean | 2,225 | 64% | 1,272 | 36% | 2 | — | 3,499 |

Africa | 2,761 | 62% | 1,675 | 38% | 1 | — | 4,437 |

Diageo (total) | 18,599 | 61% | 11,736 | 39% | 32 | — | 30,367 |

Role | Men | % | Women | % | Not declared(3) | % | Total |

Executive(4) | 7 | 54% | 6 | 46% | 0 | — | 13 |

Senior manager(5) | 320 | 56% | 252 | 44% | 1 | — | 573 |

Line manager(6) | 2,414 | 64% | 1,330 | 35% | 7 | — | 3,751 |

Supervised employee(7) | 15,858 | 61% | 10,148 | 39% | 24 | — | 26,030 |

Diageo (total) | 18,599 | 61% | 11,736 | 39% | 32 | — | 30,367 |

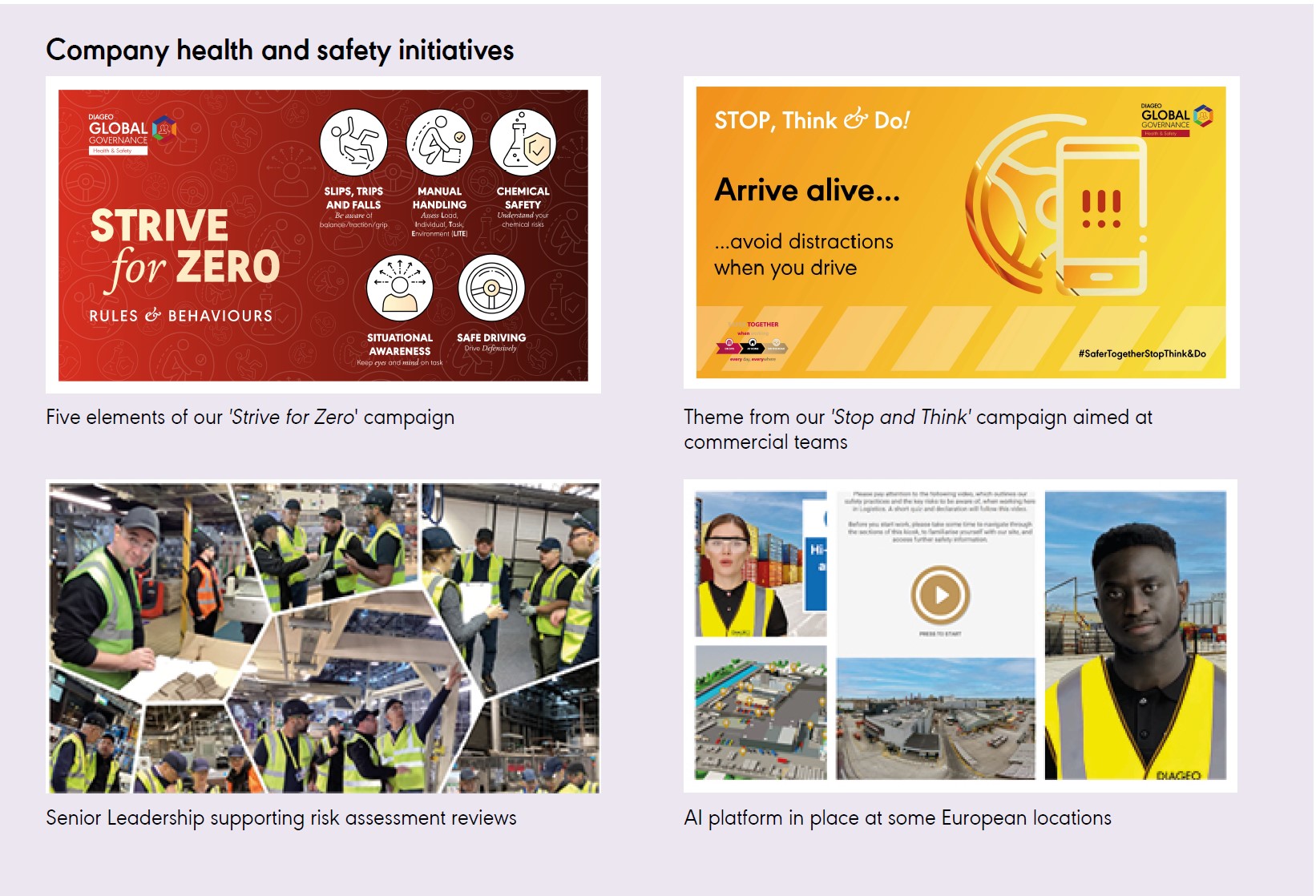

Health and safety We prioritise the health and safety of our people throughout our value chain to ensure everyone is safe when working on- site, at home, on the road, every day, everywhere. |

Champion inclusion and diversity Championing inclusion and diversity is at the heart of what we do, and is crucial to our purpose of ‘celebrating life, every day, everywhere’. | ||

Gender representation of our leadership(1), (3) | |||||

Role | Men | % | Women | % | Total |

Leadership population(2) | 327 | 56% | 258 | 44% | 585(3) |

Ethnic representation of our leadership(1), (4) | |||||||||

Role | Ethnically diverse | % | Non- ethnically diverse | % | Decline to self- identify | % | Not disclosed | % | Total |

Leadership population(2) | 259 | 46% | 270 | 47% | 19 | 3% | 20 | 4% | 568 |

Building a thriving and inclusive hospitality industry | ||||