Operating and Financial Review

1 Our business

3

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number: |

(ABN 49 004 028 077) |

(Exact name of registrant as specified in its charter) |

VICTORIA, STRALIA |

(Jurisdiction of incorporation or organisation) |

VICTORIA STRALIA (Address of principal executive offices) |

BHP GROUP LIMITED RALIA TELEPHONE AUSTRALIA 1300 55 47 57TELEPHONE INTERNATIONAL + FACSIMILE + (Name, telephone, email and/or facsimile number and address of company contact person) |

Title of each class |

Trading symbol(s) |

Name of each exchange on which registered | ||

| * | Evidenced by American Depositary Receipts. Each American Depositary Receipt represents two ordinary shares of BHP Group Limited. |

| ** | Not for trading, but only in connection with the listing of the American Depositary Shares. |

BHP Group Limited | ||

Fully Paid Ordinary Shares |

| ☒ | Accelerated filer | ☐ | ||||

| Non-accelerated filer | ☐ | Emerging growth company | ||||

U.S. GAAP ☐ |

Other ☐ |

1 |

References in this Annual Report to a ‘joint venture’ are used for convenience to collectively describe assets that are not wholly owned by BHP. Such references are not intended to characterise the legal relationship between the owners of the asset. |

| Item Number |

Description |

Report section reference | ||||

| 1. |

Identity of Directors, Senior Management and Advisors |

Not applicable | ||||

| 2. |

Offer Statistics and Expected Timetable |

Not applicable | ||||

| 3. |

Key Information |

|||||

| A | [Reserved] | — | ||||

| B | Capitalization and indebtedness | Not applicable | ||||

| C | Reasons for the offer and use of proceeds | Not applicable | ||||

| D | Risk factors | 9.1 | ||||

| 4. |

Information on the Company |

|||||

| A | History and development of the company | Cover page, Company details, Chair’s review, Chief Executive Officer’s review, Operating and Financial Review 1 to 10, Additional information 2, 4 to 9.4 | ||||

| B | Business overview | Operating and Financial Review 1 to 5, 10, Additional information 2, 4 to 8, 9.3, 9.8 and Note 1 to the Financial Statements | ||||

| C | Organizational structure | Additional information 9.3 and Note 28 to the Financial Statements | ||||

| D | Property, plants and equipment | Operating and Financial Review 3, 5.1, 5.2, 7 to 10, Additional information 2, 4 to 6 and Notes 11, 15 and 21 to the Financial Statements | ||||

| 4A. |

Unresolved Staff Comments |

None | ||||

| 5. |

Operating and Financial Review and Prospects |

|||||

| A | Operating results | Operating and Financial Review 4, 10, Additional information 9.8 | ||||

| B | Liquidity and capital resources | Operating and Financial Review 4, Financial Statements 1.4, Notes 11, 20 to 23 and 37 to the Financial Statements | ||||

| C | Research and development, patents and licenses, etc. | Operating and Financial Review 3, 5 to 10, Directors’ Report 10, Additional information 2, 5, 6 and Notes 11 and 15 to the Financial Statements | ||||

| D | Trend information | Chair’s review, Chief Executive Officer’s review, Operating and Financial Review 1 to 5, 7, 9, 10, Additional information 2, 4 to 7 | ||||

| E | Critical Accounting Estimates | IFRS is applied in the Financial Statements as issued by the IASB | ||||

| 6. |

Directors, Senior Management and Employees |

|||||

| A | Directors and senior management | Governance 4.1, 6.1, Directors’ Report 2.1 | ||||

| B | Compensation | Remuneration Report | ||||

| C | Board practices | Governance 4.1, 4.6, 5.2, 5.4, Remuneration Report | ||||

| D | Employees | Operating and Financial Review 6, Additional information 7 | ||||

| E | Share ownership | Remuneration Report, Directors’ Report 3, 4 and Notes 16, 17 and 25 to the Financial Statements | ||||

| 7. |

Major Shareholders and Related Party Transactions |

|||||

| A | Major shareholders | Additional information 9.5 | ||||

| B | Related party transactions | Remuneration Report and Notes 24 and 31 to the Financial Statements | ||||

| C | Interests of experts and counsel | Not applicable | ||||

| 8. |

Financial Information |

|||||

| A | Consolidated Statements and Other Financial Information | Operating and Financial Review 8, Additional information 8, 9.6, Financial Statements beginning on page F-1 in this Annual Report and Financial Statements 1A | ||||

| B | Significant Changes | Note 33 to the Financial Statements | ||||

| 9. |

The Offer and Listing |

|||||

| A | Offer and listing details | Additional information 9.2 | ||||

| B | Plan of distribution | Not applicable | ||||

| C | Markets | Additional information 9.2 | ||||

| D | Selling shareholders | Not applicable | ||||

| E | Dilution | Not applicable | ||||

| F | Expenses of the issue | Not applicable | ||||

| 10. |

Additional Information |

|||||

| A | Share capital | Not applicable | ||||

| B | Memorandum and articles of association | Additional information 9.3, 9.4 | ||||

| C | Material contracts | Not applicable | ||||

| D | Exchange controls | Additional information 9.8 | ||||

| E | Taxation | Additional information 9.9 | ||||

| F | Dividends and paying agents | Not applicable | ||||

| G | Statement by experts | Not applicable | ||||

| H | Documents on display | Additional information 9.4 | ||||

| I | Subsidiary information | Note 28 to the Financial Statements and Exhibit 8.1 | ||||

| 11. |

Quantitative and Qualitative Disclosures About Market Risk |

Note 23 to the Financial Statements | ||||

| 12. |

Description of Securities Other than Equity Securities |

|||||

| A | Debt Securities | Not applicable | ||||

| B | Warrants and Rights | Not applicable | ||||

| C | Other Securities | Not applicable | ||||

| D | American Depositary Shares | Additional information 9.7 and Exhibit 2.1 | ||||

| 13. |

Defaults, Dividend Arrearages and Delinquencies |

There have been no defaults, dividend arrearages or delinquencies | ||||

| 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds |

|||||

| A | Additional information 9.3, 9.4 and Exhibits 1.1 and 2.1 | |||||

| B | Not applicable | |||||

| C | Not applicable | |||||

| D | Not applicable | |||||

| E | Not applicable | |||||

| 15. |

Controls and Procedures |

Governance 7.2 and Financial Statements 1A | ||||

| 16A. |

Audit committee financial expert |

Governance 5.2 | ||||

| 16B. |

Code of Ethics |

Governance 8.1 | ||||

| 16C. |

Principal Accountant Fees and Services |

Governance 7.2 and Note 34 to the Financial Statements | ||||

| 16D. |

Exemptions from the Listing Standards for Audit Committees |

Not applicable | ||||

| 16E. |

Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

Directors’ Report 3 | ||||

| 16F. |

Change in Registrant’s Certifying Accountant |

Not applicable | ||||

| 16G. |

Corporate Governance |

Governance | ||||

| 16H. |

Mine Safety Disclosure |

Not applicable | ||||

| 16I. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

Not applicable | ||||

| 17. |

Financial Statements |

Not applicable | ||||

| 18. |

Financial Statements |

Financial Statements begin on page F-1 in this Annual Report | ||||

| 19. |

Exhibits |

Exhibits | ||||

| • | Our people start each day with a sense of purpose and end the day with a sense of accomplishment. |

| • | Our teams are inclusive and diverse. |

| • | Our communities, customers and suppliers value their relationships with us and are better off for our presence. |

| • | Our asset portfolio is world class and sustainably developed. |

| • | Our operational discipline and financial strength enables our future growth. |

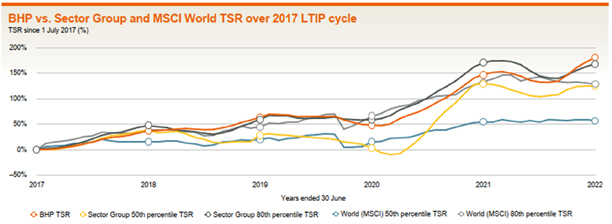

| • | Our shareholders receive a superior return on their investment. |

| • | Our commodities support continued economic growth and decarbonisation. |

| 1 | ||||||

| 2 | ||||||

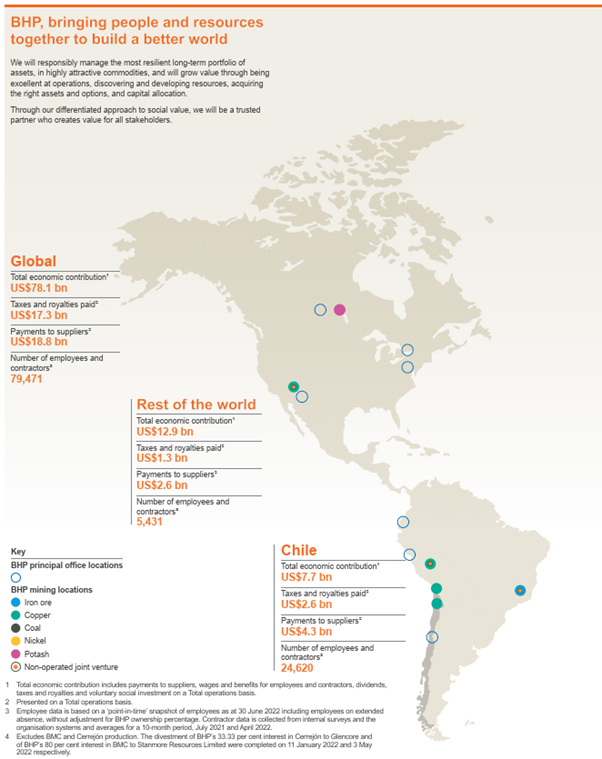

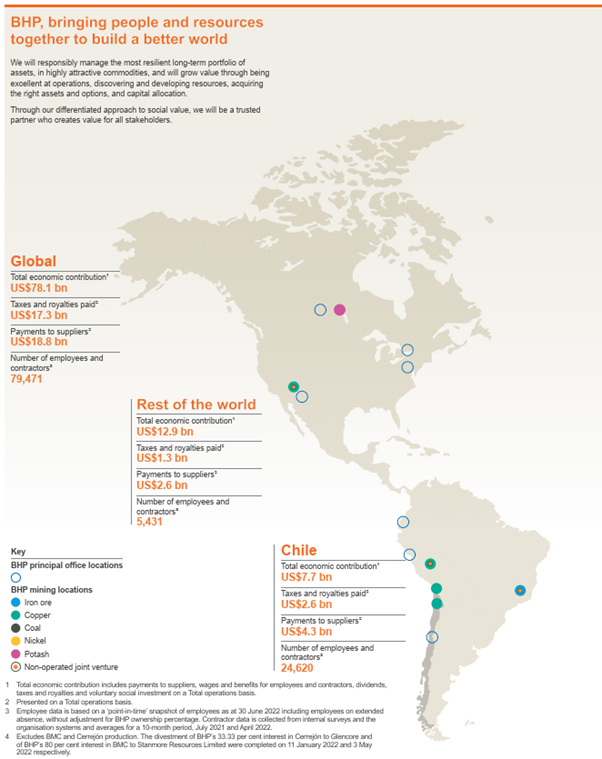

| 1 | Our business | 3 | ||||

| 2 | Delivering value | 5 | ||||

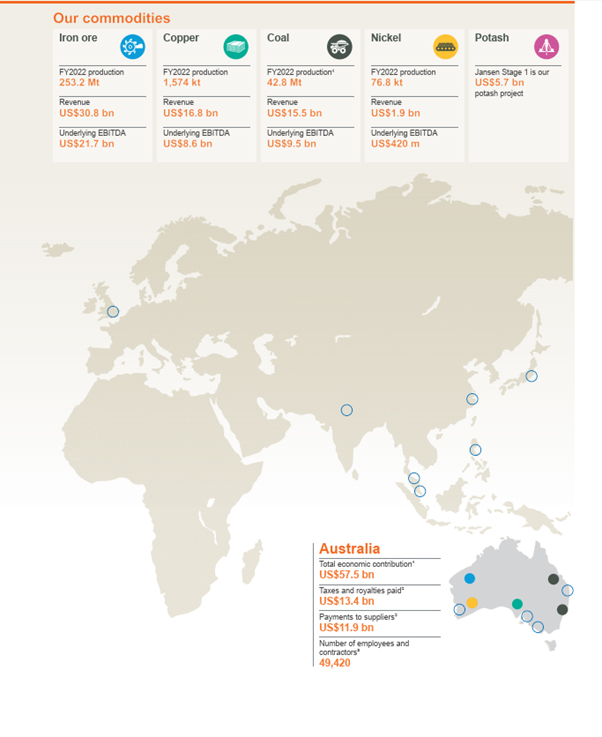

| 2.1 | Our business model | 5 | ||||

| 2.2 | How we create and grow value | 7 | ||||

| 3 | Positioning for the future | 13 | ||||

| 4 | Financial review | 16 | ||||

| 4.1 | Group overview | 16 | ||||

| 4.2 | Key performance indicators | 17 | ||||

| 4.3 | Financial results | 19 | ||||

| 4.4 | Debt and sources of liquidity | 22 | ||||

| 5 | Our assets | 25 | ||||

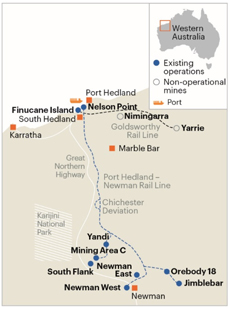

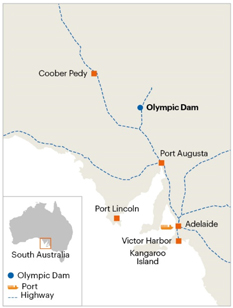

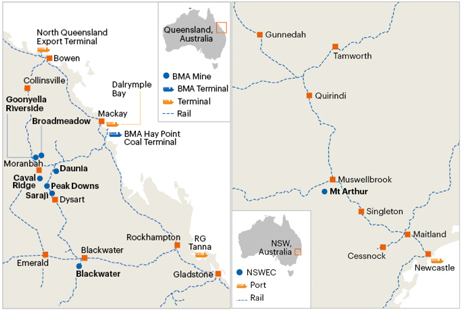

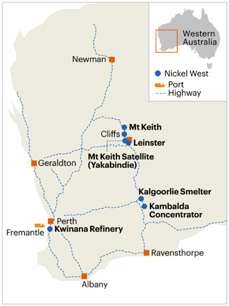

| 5.1 | Minerals Australia | 25 | ||||

| 5.2 | Minerals Americas | 30 | ||||

| 5.3 | Commercial | 34 | ||||

| 6 | People and culture | 35 | ||||

| 7 | Sustainability | 40 | ||||

| 7.1 | Our sustainability approach | 40 | ||||

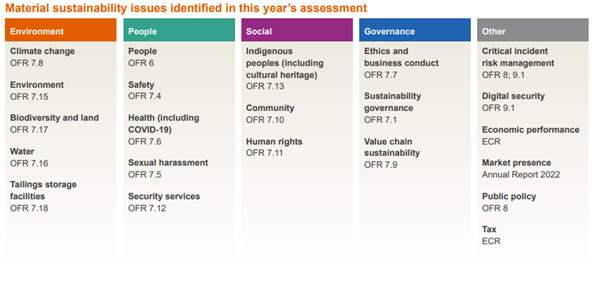

| 7.2 | Our material sustainability issues | 42 | ||||

| 7.3 | Our sustainability performance: Non-financial key performance indicators | 43 | ||||

| 7.4 | Safety | 45 | ||||

| 7.5 | Sexual harassment | 47 | ||||

| 7.6 | Health | 50 | ||||

| 7.7 | Ethics and business conduct | 54 | ||||

| 7.8 | Climate change | 56 | ||||

| 7.9 | Value chain sustainability | 68 | ||||

| 7.10 | Community | 70 | ||||

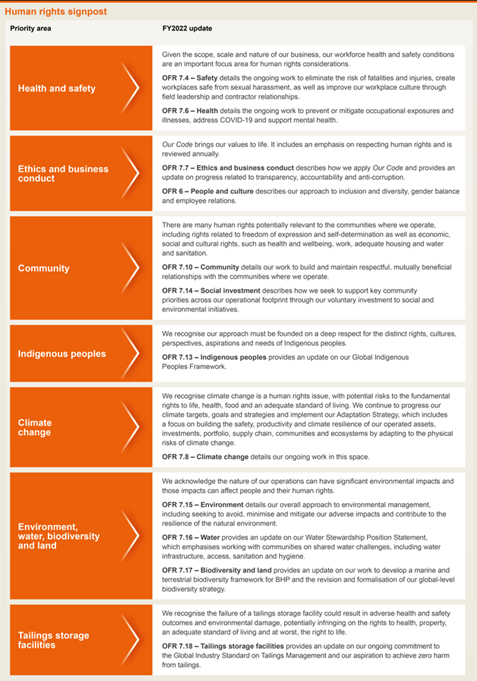

| 7.11 | Human rights | 72 | ||||

| 5 | Board Committees | 133 | ||||

| 5.1 | Nomination and Governance Committee | 133 | ||||

| 5.2 | Risk and Audit Committee | 134 | ||||

| 5.3 | Sustainability Committee | 135 | ||||

| 5.4 | Remuneration Committee | 136 | ||||

| 6 | Management | 137 | ||||

| 6.1 | Executive Leadership Team | 137 | ||||

| 6.2 | Senior management succession | 138 | ||||

| 6.3 | Performance evaluation of executives | 138 | ||||

| 7 | Risk management and assurance | 138 | ||||

| 7.1 | Risk management governance structure | 138 | ||||

| 7.2 | External audit and financial reporting | 139 | ||||

| 8 | Culture and conduct | 141 | ||||

| 8.1 | Our Code of Conduct and Our Charter | 141 | ||||

| 8.2 | Culture | 141 | ||||

| 8.3 | BHP’s EthicsPoint | 141 | ||||

| 8.4 | Diversity | 141 | ||||

| 9 | Shareholder and stakeholder engagement | 142 | ||||

| 10 | Market disclosure | 143 | ||||

| 11 | US requirements | 143 | ||||

| 1 | Review of operations, principal activities and state of affairs | 144 | ||||

| 2 | Directors | 144 | ||||

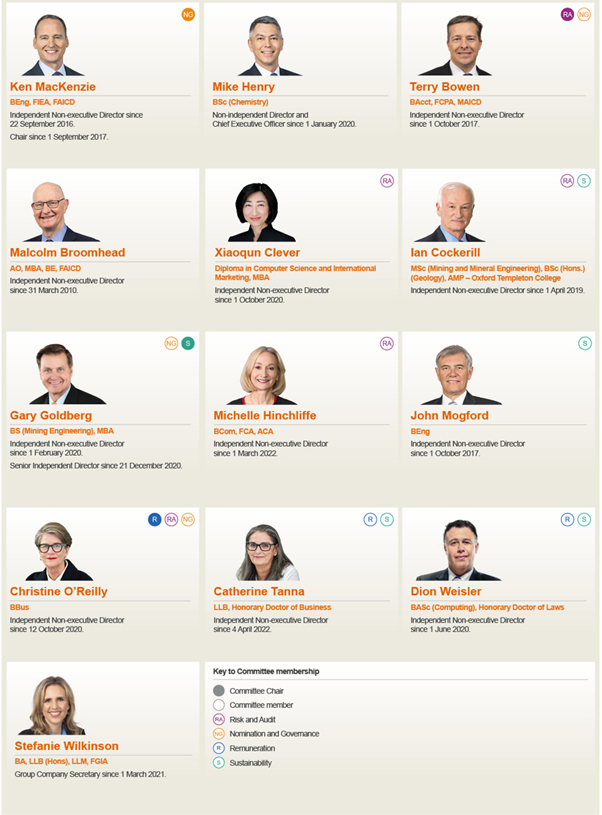

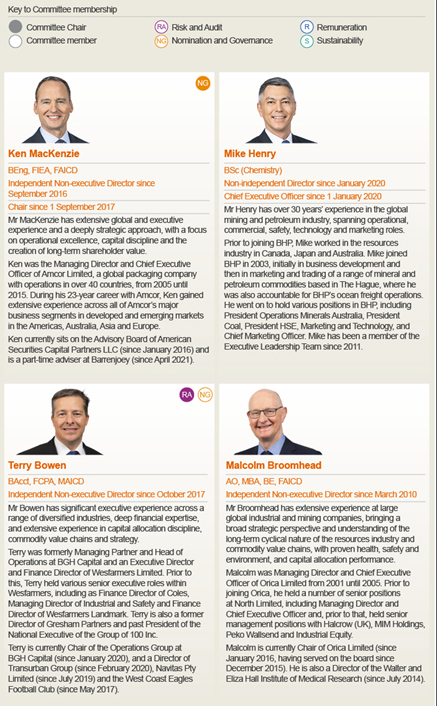

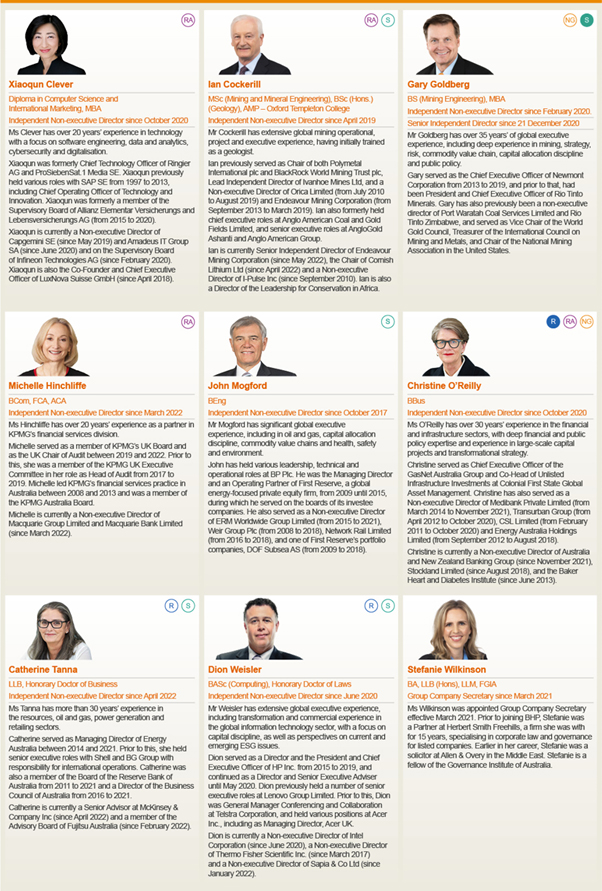

| 2.1 | Biographical details | 144 | ||||

| 2.2 | Director attendances at meetings | 145 | ||||

| 3 | Share capital and buy-back programs | 146 | ||||

| 4 | Share interests | 146 | ||||

| 5 | Secretaries | 147 | ||||

| 6 | Indemnities and insurance | 147 | ||||

| 7 | Dividends | 148 | ||||

| 8 | Auditors | 148 | ||||

| 9 | Non-audit services | 148 | ||||

| 1 | Financial information summary | 173 | ||||

| 2 | Information on mining operations | 174 | ||||

| 3 | Financial information by commodity | 193 | ||||

| 4 | Production | 196 | ||||

| 5 | Mineral resources and mineral reserves | 198 | ||||

| 6 | Major projects | 224 | ||||

| 7 | People – performance data | 225 | ||||

| 8 | Legal proceedings | 226 | ||||

9 |

231 | |||||

| 9.1 | History and development | 231 | ||||

| 9.2 | Markets | 231 | ||||

| 9.3 | Organisational structure | 231 | ||||

| 9.4 | Constitution | 232 | ||||

| 9.5 | Share ownership | 236 | ||||

| 9.6 | Dividends | 238 | ||||

| 9.7 | American Depositary Receipts fees and charges | 238 | ||||

| 9.8 | Government regulations | 239 | ||||

| 9.9 | Taxation | 242 | ||||

| 10 | Glossary | 247 | ||||

| 263 | ||||||

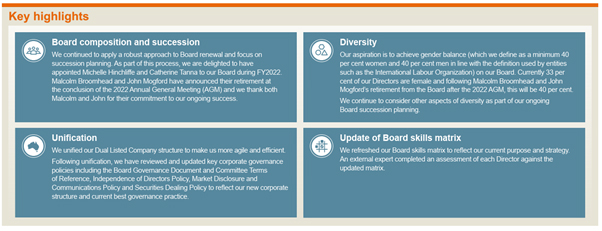

| • | unified our dual listed company structure under a single parent company listed on the Australian Securities Exchange |

| • | merged our Petroleum business with Woodside to create a top 10 energy provider and provide shareholders with further choice as to their exposure to oil and gas |

| • | simplified the coal portfolio through the sale of our interests in Cerrej ó |

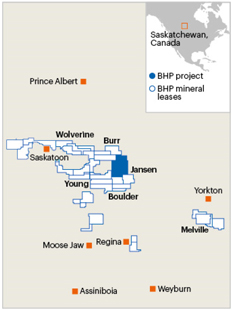

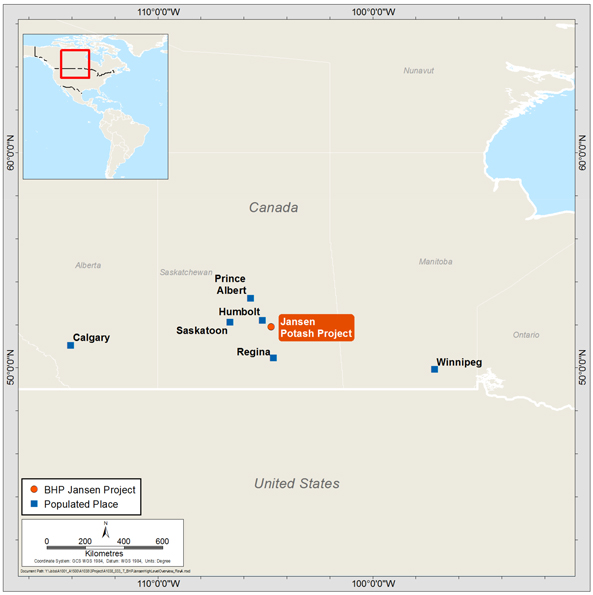

| • | approved an investment of US$5.7 billion in our Jansen Potash Project in Canada, marking BHP’s entry into a new commodity which provides shareholders with exposure to the growing population megatrend |

| • | We are committed to continuous improvement and we strive to operate more reliably and productively than our competitors. Being the best operator will help us safely generate better return on capital employed and outcompete others for new opportunities. |

| • | We have delivered strong and consistent results and returns through our portfolio and operating discipline. We achieved net operating cashflow on a Total operations basis of US$32.2 billion in FY2022, above US$15 billion for the sixth consecutive year. |

| • | We believe our focus on social value will lead to us being the partner of choice with communities, governments, suppliers, and customers. We seek respectful, mutually beneficial relationships with the communities where we operate and the suppliers, customers and governments we interact with. Our experience has been that engaging with those around us creates optionality, stronger relationships and access to more diverse thinking. It helps us be more creative and to find different ways to problem solve. It also means we are better able to see things coming towards us and can act pre-emptively. Aligning strongly with partners can prevent issues or delays with projects and, if issues do arise, means we are better able to collectively work on solutions. |

| • | We assess and rank decarbonisation projects across our operated assets through our Capital Allocation Framework (CAF). During FY2022, we integrated our 1.5°C Paris-aligned scenario into our strategy and capital allocation process, helping to ensure our capital expenditure plans are not misaligned with the Paris Agreement’s aim to pursue efforts to limit global warming to 1.5°C. |

| • | We recruit and retain the best people and empower them to run our operations safely and productively. We promote an inclusive and diverse environment where safety and wellbeing are the highest priorities, invest in development programs to build capability and improve performance and offer competitive remuneration. We invest in technology to manage risk, streamline processes and improve productivity. |

| • | The combination of our people, strategy and operational systems will help us to outperform our competitors and attract a lower cost of capital, while our CAF helps us make better use of this capital. |

| • | We remain on track to achieve our aspirational goal for a gender-balanced employee workforce globally by FY2025 . |

| • | We made progress during FY2022 against targets for increased Indigenous employment in our Minerals Australia operations, Minerals Americas operations in Chile and our Jansen Potash Project in Canada. |

1 |

Based on published C1 unit costs of major iron ore producers. There may be differences in the manner that third parties calculate or report unit costs data compared to BHP, which means that third-party data may not be comparable to our data. |

2 |

For more information refer to OFR 7.8. |

3 |

Based on ownership interest. Peers include: Anglo American, Antofagasta, Codelco, First Quantum Minerals, Freeport, Glencore, Rio Tinto, Southern Copper and Teck. Source peers: Wood Mackenzie Ltd, Q1 2022. |

4 |

Based on ownership interest. Source peers: MinEx Consulting. |

| • | Serve our customers |

| • | Pursue operating perfection |

| • | Empower our people |

| • | maintain safe, predictable and productive operations |

| • | drive productivity improvements, with an emphasis on automation and real-time, data-driven insights and decision-making |

| • | help drive inclusion and diversity by providing greater opportunities for roles that were traditionally labour intensive |

| • | unlock the next stage of value growth at BHP, from realising greater margins at our existing operations to finding new assets |

| • | improve sustainability outcomes through innovation |

| • | We continued to automate our global trucking fleets. At South Flank we began to automate our fleet of 41 Komatsu haul trucks in the June 2022 quarter, with the program expected to be completed within 18 months. We continued deployment at Goonyella Riverside (expected to be completed by the end of December 2022) and completed the rollout at Daunia. We also commenced autonomous drilling at Spence. We expect to commence the rollout of automated trucks at Spence in FY2023. |

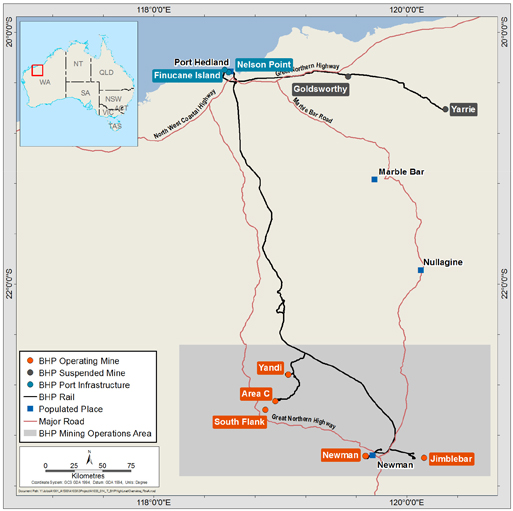

| • | We began testing two automated shiploaders at the Port Hedland export facility in Western Australia. In what we believe is a world first, 3D laser scan technology has been used in the A$50 million project. We intend to fully automate eight shiploaders by FY2024. The project is expected to enable an increase in production of more than 1 million tonnes of iron ore each year through greater precision, reduced spillage, faster load times and equipment optimisation. |

| • | Our in-house Grade Adjustment Model has been introduced at multiple WAIO sites and is expected to enable a US$22.8 million annual revenue uplift at WAIO. The model uses machine learning to target a reduction in iron ore grade variability across the supply chain. It uses data sources that capture movements of ore to map the iron ore grade coming from the mine to the iron grade shipped at port. |

| • | Through our Maintenance and Engineering Centre of Excellence, we continued the rollout of our Total Equipment Strategies (TES), which were initially applied to our mobile fleets and have been extended to our fixed plant. These strategies use mathematical analysis of breakdowns, maintenance patterns and original equipment manufacturer recommendations to recalibrate our maintenance programs to increase availability and reliability, and reduce maintenance costs and inventory values. For example, at our Newman iron ore operation in Western Australia, the mobile TES project for CAT 6060 excavators helped to extend the average equipment life by 40 per cent and delivered an availability uplift of 2 per cent. The outcome is 3.5 years of extra life which has helped to achieve capital productivity by deferral of US$120 million of capital expenditure over five years. |

| • | We have set GHG emissions reduction targets and goals (that are described in OFR 7.8) and our Climate Transition Action Plan 2021 (CTAP) received majority approval from shareholders in the ‘Say on Climate’ advisory vote at our 2021 Annual General Meetings. |

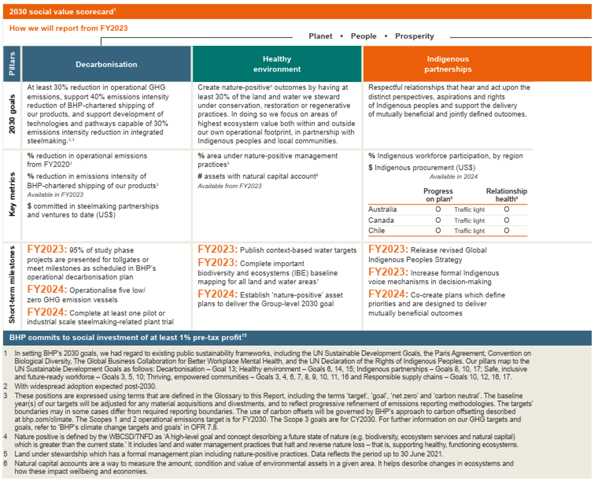

| • | We are working to create nature-positive 4 outcomes through the new goal we have set to have at least 30 per cent of the land and water we steward under conservation, restoration or regenerative practices by 2030. For more information refer to 2030 social value scorecard below and OFR 7.15. |

| • | We are working to transition our operations to renewable electricity. For more information, refer to OFR 5.1 and 7.8. |

| • | We are working with suppliers to drive innovation by participating in initiatives such as Komatsu’s GHG Alliance, which aims to develop commercially viable zero-GHG emissions haul trucks. For more information refer to OFR 7.8. |

| • | Our spend with Indigenous businesses increased by 75 per cent to US$149.9 million in FY2022 and the number of Indigenous vendors engaged rose by 53 per cent to 148. WAIO announced its intention to more than double its spend with Indigenous vendors to more than US$300 million by the end of FY2024. For more information refer to OFR 7.13. |

| • | We completed our most recent five-year sustainability targets in FY2022. Highlights included three years fatality-free, a reduction in the total number of workers exposed to our most material occupational exposures by 68 per cent, social investment of US$681.4 million over five years and a 29 per cent reduction in freshwater withdrawal volumes from our adjusted FY2017 baseline. For more information refer to OFR 7.3 and 7.8. |

| • | Our Chilean operations Escondida and Spence, and Olympic Dam in Australia were awarded the Copper Mark during FY2022 recognising responsible production practices. For more information on our social value performance refer to OFR 7. |

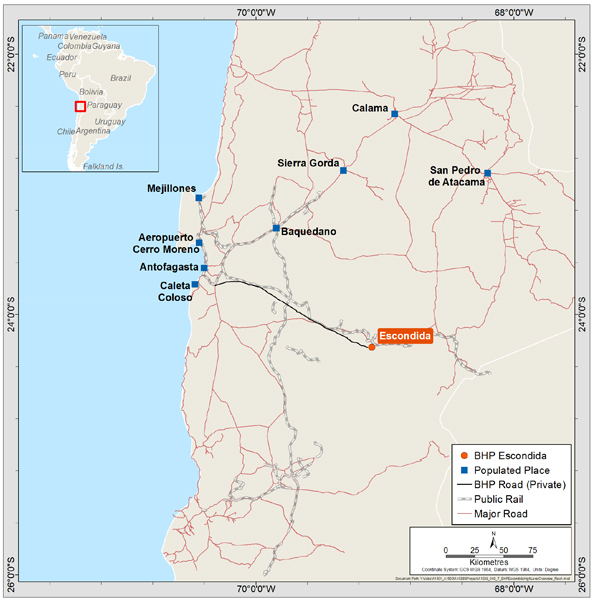

| • | This includes 27 billion tonnes of ore at an average grade of 0.52 per cent at Escondida, where we are targeting an annual average of 1.2 million tonnes (Mt) of copper production over the medium term, a 20 per cent increase on Escondida’s FY2022 production of 1 Mt. |

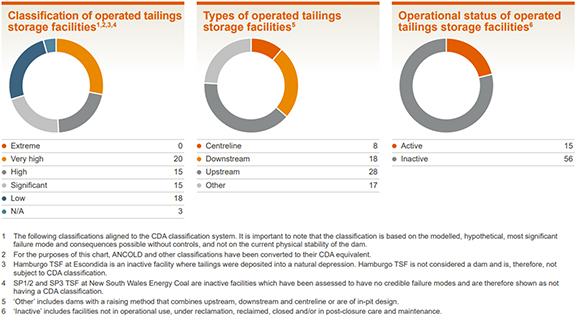

| • | On the basis that tailings storage facility anomalies are resolved, production at Spence is expected to reach and average approximately 270 kilotonnes per annum (ktpa) of production for four years (including cathodes) following the completion of Spence Growth Option (SGO) plant modifications. This will be supported by capital expenditure of approximately US$100 million, which is planned for the SGO plant modifications and these are currently planned to be completed in CY2023, with further studies ongoing for additional capacity uplift. |

| • | At Olympic Dam, we have improved operating stability over time. Smelter operations have been strong following our planned major smelter maintenance, completed in January 2022. The next major rebuild is not expected for six years. |

| • | Our nickel sulphate plant at Nickel West delivered first crystals in October 2021, allowing us to add further value to our nickel production. We intend to capitalise on the expected ongoing global demand for nickel for the electric vehicle industry, as the method we use to produce nickel sulphate results in a product we believe is ideal for battery production. |

| • | We continue to explore ways to increase the scale of Nickel West. |

| • | We have secured an increase to our WAIO iron ore environmental licence to expand port operations up to 330 million tonnes per annum (Mtpa) subject to the outcomes of a standard appeals process. |

| • | The ramp up of WAIO’s US$3.6 billion South Flank mine is ahead of schedule and we have revised our medium term production guidance to more than 300 Mtpa. We are assessing expansion alternatives to take us toward 330 Mtpa of production. |

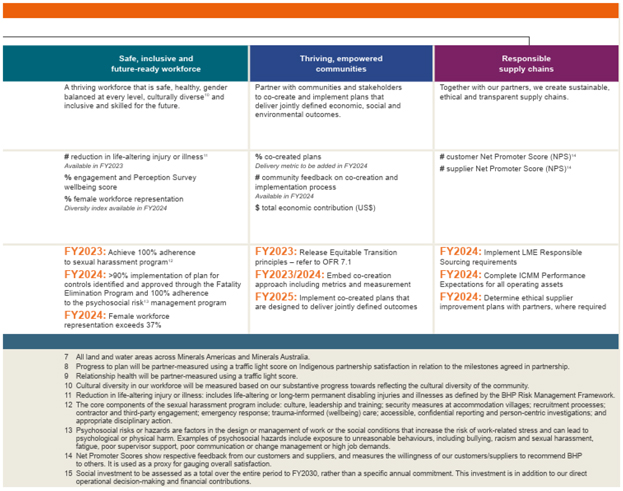

1 |

Based on ownership interest. Peers include: Anglo American, Antofagasta, Codelco, First Quantum Minerals, Freeport, Glencore, Rio Tinto, Southern Copper, and Teck. Source peers: Wood Mackenzie Ltd, Q1 2022. |

2 |

Based on ownership interest. Source peers: MinEx Consulting. |

| Year ended 30 June |

2022 US$M |

2021 US$M |

2020 US$M |

|||||||||

| Greenfield exploration |

77 |

54 | 44 | |||||||||

| Resources assessment |

179 |

138 | 132 | |||||||||

| |

|

|

|

|

|

|||||||

| Total metals exploration and assessment |

256 |

192 | 176 | |||||||||

| |

|

|

|

|

|

|||||||

| Year ended 30 June |

2022 US$M |

2021 US$M |

2020 US$M |

|||||||||

| Exploration expense |

||||||||||||

| Copper |

85 |

53 | 54 | |||||||||

| Iron Ore |

54 |

55 | 47 | |||||||||

| Coal |

6 |

7 | 9 | |||||||||

| Group and unallocated items 1 |

54 |

19 | 13 | |||||||||

| |

|

|

|

|

|

|||||||

| Total Group |

199 |

134 | 123 | |||||||||

| |

|

|

|

|

|

|||||||

1 |

Group and unallocated items includes functions, other unallocated operations, including Potash, Nickel West and legacy assets (previously disclosed as closed mines in the Petroleum reportable segment), and consolidation adjustments. |

| Year ended 30 June US$M |

2022 |

2021 | ||||||

| Consolidated Income Statement (Financial Statements 1.1) |

||||||||

| Revenue 1 |

65,098 |

56,921 | ||||||

| Profit/(loss) after taxation from Continuing operations 1 |

22,400 |

13,676 | ||||||

| Profit/(loss) after taxation from Continuing and Discontinued operations attributable to BHP shareholders |

30,900 |

11,304 | ||||||

| Dividends per ordinary share – paid during the period (US cents) |

350.0 |

156.0 | ||||||

| Dividends per ordinary share – determined in respect of the period (US cents) |

325.0 |

301.0 | ||||||

| In specie dividend on merger of Petroleum with Woodside (US cents) |

386.4 |

– | ||||||

| Basic earnings/(loss) per ordinary share (US cents) |

610.6 |

223.5 | ||||||

| Consolidated Balance Sheet (Financial Statements 1.3) |

||||||||

| Total assets |

95,166 |

108,927 | ||||||

| Net assets |

48,766 |

55,605 | ||||||

| Consolidated Cash Flow Statement (Financial Statements 1.4) |

||||||||

| Net operating cash flows |

32,174 |

27,234 | ||||||

| Capital and exploration expenditure 2 |

7,545 |

7,120 | ||||||

| Other financial information (OFR 11) |

||||||||

| Net debt |

333 |

4,121 | ||||||

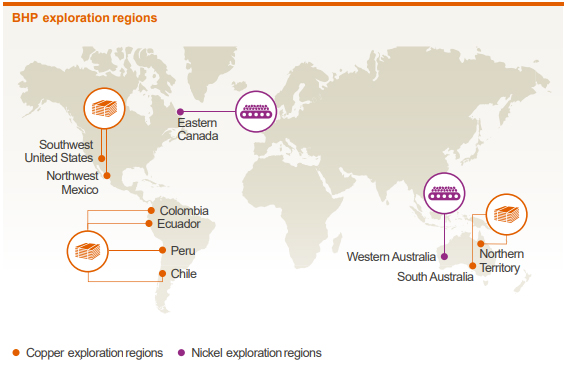

| Underlying attributable profit |

23,815 |

17,077 | ||||||

| Underlying attributable profit – Continuing operations 1 |

21,319 |

16,985 | ||||||

| Underlying EBITDA 1 |

40,634 |

35,073 | ||||||

| Underlying basic earnings per share (US cents) |

470.6 |

337.7 | ||||||

| Underlying basic earnings per share – Continuing operations (US cents) 1 |

421.2 |

335.9 | ||||||

| Underlying return on capital employed (per cent) |

48.7 |

32.5 | ||||||

1 |

Comparative periods have been adjusted for the effects of applying IFRS 5 ‘Non-current Assets Held for Sale and Discontinued Operations’ and discloses them on the same basis as the current period figures. For more information refer to Financial Statements note 27 ‘Discontinued operations’. |

2 |

Includes US$1,434 million related to Discontinued operations (FY2021: US$1,316 million). |

1 |

Includes data for Continuing and Discontinued operations for the financial years being reported. |

2 |

Excludes data from Discontinued operations for the financial years being reported. |

3 |

For more information on non-IFRS financial information refer to OFR 11. |

| Profit |

Earnings |

Cash |

Returns |

|||||||||||||||||||||||||||||

US$M |

US$M |

US$M |

US$M |

|||||||||||||||||||||||||||||

| Measure: |

Profit after taxation from Continuing and Discontinued operations |

|

33,055 |

Profit after taxation from Continuing and Discontinued operations |

33,055 |

Net operating cash flows from Continuing operations |

29,285 |

Profit after taxation from Continuing and Discontinued operations |

|

33,055 |

||||||||||||||||||||||

| Made up of: |

Profit after taxation | |

Profit after taxation | |

Cash generated by the Group’s consolidated operations, after dividends received, interest, proceeds and settlements of cash management-related instruments, taxation and royalty-related taxation. It excludes cash flows relating to investing and financing activities | |

Profit after taxation | | ||||||||||||||||||||||||

| Adjusted for: |

Exceptional items before taxation |

|

620 |

|

Exceptional items before taxation |

|

620 |

|

Net operating cash flows from Discontinued operations |

|

2,889 |

|

Exceptional items after taxation |

|

|

(7,085 |

) | |||||||||||||||

| Net finance costs excluding exceptional items from Discontinued operations | |

159 |

||||||||||||||||||||||||||||||

| Tax effect of exceptional items | 454 |

Tax effect of exceptional items | 454 |

Net finance costs excluding exceptional items from Continuing operations | |

679 |

||||||||||||||||||||||||||

| Exceptional items after tax attributable to non-controlling interests |

– |

Depreciation and amortisation excluding exceptional items | 5,683 |

Income tax expense on net finance costs | (287 |

) | ||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||||||

| Exceptional items attributable to BHP shareholders – Continuing operations | 1,074 |

Impairments of property, plant and equipment, financial assets and intangibles excluding exceptional items |

515 |

Profit after taxation excluding net finance costs and exceptional items | |

26,521 |

| |||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||||||

| Exceptional items attributable to BHP shareholders – Discontinued operations | (8,159 |

) |

Net finance costs excluding exceptional items from Continuing operations | 679 |

Net assets at the beginning of period | 55,605 |

||||||||||||||||||||||||||

| Profit after taxation from Continuing and Discontinued operations attributable to non-controlling interests |

(2,155 |

) |

Taxation expense excluding exceptional items | 10,283 |

Net debt at the beginning of period | 4,121 |

||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||||||

| Profit after taxation from Discontinued operations (including exceptional items) | (10,655 |

) |

Capital employed at the beginning of period | 59,726 |

||||||||||||||||||||||||||||

| Net assets at the end of period | 48,766 |

|||||||||||||||||||||||||||||||

| Net debt at the end of period | 333 |

|||||||||||||||||||||||||||||||

| |

|

|||||||||||||||||||||||||||||||

| Capital employed at the end of period | 49,099 |

|||||||||||||||||||||||||||||||

| Average capital employed | 54,413 |

|||||||||||||||||||||||||||||||

| To reach our KPIs |

Underlying attributable profit |

|

23,815 |

|

Underlying EBITDA |

|

40,634 |

|

Net operating cash flows |

|

32,174 |

|

Underlying return on capital employed |

|

48.7% |

| ||||||||||||||||

| Why do we use it? |

Underlying attributable profit allows the comparability of underlying financial performance by excluding the impacts of exceptional items. |

|

Underlying EBITDA is used to help assess current operational profitability excluding the impacts of sunk costs (ie. depreciation from initial investment). It is a measure that management uses internally to assess the performance of the Group’s segments and make decisions on the allocation of resources. |

|

Net operating cash flows provide insights into how we are managing costs and increasing productivity across BHP. |

|

Underlying return on capital employed is an indicator of the Group’s capital efficiency. It is provided on an underlying basis to allow comparability of underlying financial performance by excluding the impacts of exceptional items. |

| ||||||||||||||||||||||||

| Year ended 30 June |

2022 US$M |

2021 US$M Restated |

2020 US$M Restated |

|||||||||

| Continuing operations |

||||||||||||

| Revenue 1 |

65,098 |

56,921 | 38,924 | |||||||||

| Other income |

1,398 |

380 | 720 | |||||||||

| Expenses excluding net finance costs |

(32,371 |

) |

(30,871 | ) | (25,453 | ) | ||||||

| Loss from equity accounted investments, related impairments and expenses |

(19 |

) |

(915 | ) | (508 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Profit from operations |

34,106 |

25,515 | 13,683 | |||||||||

| |

|

|

|

|

|

|||||||

| Net finance costs |

(969 |

) |

(1,223 | ) | (858 | ) | ||||||

| Total taxation expense |

(10,737 |

) |

(10,616 | ) | (4,197 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Profit after taxation from Continuing operations |

22,400 |

13,676 | 8,628 | |||||||||

| |

|

|

|

|

|

|||||||

| Discontinued operations |

||||||||||||

| Profit/(loss) after taxation from Discontinued operations |

10,655 |

(225 | ) | 108 | ||||||||

| |

|

|

|

|

|

|||||||

| Profit after taxation from Continuing and Discontinued operations |

33,055 |

13,451 | 8,736 | |||||||||

| |

|

|

|

|

|

|||||||

| Attributable to non-controlling interests |

2,155 |

2,147 | 780 | |||||||||

| Attributable to BHP shareholders |

30,900 |

11,304 | 7,956 | |||||||||

| |

|

|

|

|

|

|||||||

1 |

Includes the sale of third-party products. |

US$M |

||||||

Underlying EBITDA for year ended 30 June 2021 (Restated) |

35,073 |

|||||

| Net price impact: |

||||||

| Change in sales prices |

6,594 |

Higher average realised prices for metallurgical coal, thermal coal, copper and nickel, partially offset by lower average realised prices for iron ore. | ||||

| Price-linked costs |

(1,047 |

) |

Increased royalties reflecting higher realised prices for metallurgical coal and thermal coal and higher third-party concentrate purchase costs reflecting higher nickel prices, partially offset by lower royalties for iron ore. | |||

5,547 |

||||||

| Change in volumes |

(1,212 |

) |

Lower volumes across our operations associated with the impacts of COVID-19 (US$952 million), lower volumes at Olympic Dam as a result of the planned major smelter maintenance campaign, lower copper concentrator feed grade at Escondida, lower BMA volumes due to significant wet weather impacts, and lower volumes at Nickel West due to an unplanned smelter outage in the June 2022 quarter. This was partially offset by higher concentrate sales at Spence reflecting the continued ramp up of the Spence Growth Option and favourable weather compared to the prior year at WAIO. | |||

| Change in controllable cash costs | (540 |

) |

Higher costs across our operations due to the impacts of COVID-19 (US$277 million) reported as an exceptional item last year, higher costs at WAIO due to South Flank operational ramp-up expenditure and higher rail maintenance costs. Higher costs at Escondida due to an increase in material mined and workforce bonus payments for a new collective bargaining agreement. Higher costs at Spence due to a ramp-up of concentrate volumes, and a prior year one-off gain due to the cancellation of power contracts at Escondida and Spence. This was partially offset by favourable inventory movements at Olympic Dam, Nickel West, Escondida and Spence, and lower costs at BMA due to cost efficiency initiatives. | |||

| Change in other costs: | ||||||

| Exchange rates |

1,180 |

Impact of movements in the Australian dollar and Chilean peso against the US dollar. | ||||

| Inflation |

(867 |

) |

Impact of inflation on the Group’s cost base. | |||

| Fuel, energy, and consumable price movements |

(660 |

) |

Predominantly higher diesel and acid prices. | |||

| Non-cash |

(3 |

) |

||||

(350 |

) |

|||||

| Asset sales | 2 |

|||||

| Ceased and sold operations | 1,668 |

Reflects the contribution of BMC prior to divestment and a decrease in costs related to the closure and rehabilitation provision for closed mines of US$297 million compared with the prior year. | ||||

| Other items | 446 |

Other includes higher recovery of freight costs caused by movements in the freight index on consecutive voyage charter (CVC) voyages and higher average realised sales prices received by Antamina, partially offset by the write-off of iron ore dormant stockpiles. | ||||

Underlying EBITDA for year ended 30 June 2022 |

40,634 |

|||||

1 |

For information on the method of calculation of the principal factors that affect Underlying EBITDA, refer to OFR 11.2. |

| Year ended 30 June |

2022 US$M |

2021 US$M Restated |

2020 US$M Restated |

|||||||||

| Net operating cash flows from Continuing operations |

29,285 |

25,883 | 14,685 | |||||||||

| Net operating cash flows from Discontinued operations |

2,889 |

1,351 | 1,021 | |||||||||

| |

|

|

|

|

|

|||||||

| Net operating cash flows |

32,174 |

27,234 | 15,706 | |||||||||

| |

|

|

|

|

|

|||||||

| Net investing cash flows from Continuing operations |

(4,973 |

) |

(6,325 | ) | (6,583 | ) | ||||||

| Net investing cash flows from Discontinued operations |

(904 |

) |

(1,520 | ) | (1,033 | ) | ||||||

| Net cash completion payment on merger of Petroleum with Woodside |

(683 |

) |

– | – | ||||||||

| Cash and cash equivalents disposed on merger of Petroleum with Woodside |

(399 |

) |

– | – | ||||||||

| |

|

|

|

|

|

|||||||

| Net investing cash flows |

(6,959 |

) |

(7,845 | ) | (7,616 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net financing cash flows from Continuing operations |

(22,734 |

) |

(17,884 | ) | (9,713 | ) | ||||||

| Net financing cash flows from Discontinued operations |

(33 |

) |

(38 | ) | (39 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net financing cash flows |

(22,767 |

) |

(17,922 | ) | (9,752 | ) | ||||||

| |

|

|

|

|

|

|||||||

| Net increase/(decrease) in cash and cash equivalents |

2,448 |

1,467 | (1,662 | ) | ||||||||

| |

|

|

|

|

|

|||||||

| Net increase/(decrease) in cash and cash equivalents from Continuing operations |

1,578 |

1,674 | (1,611 | ) | ||||||||

| Net increase/(decrease) in cash and cash equivalents from Discontinued operations |

1,952 |

(207 | ) | (51 | ) | |||||||

| Net cash completion payment on merger of Petroleum with Woodside |

(683 |

) |

– | – | ||||||||

| Cash and cash equivalents disposed on merger of Petroleum with Woodside |

(399 |

) |

– | – | ||||||||

| |

|

|

|

|

|

|||||||

| • | a strong balance sheet through the cycle |

| • | diversification of funding sources |

| • | maintain borrowings and excess cash predominantly in US dollars |

1 |

We use non-IFRS financial information to reflect our underlying financial performance. For a discussion on the non-IFRS financial information we use refer to OFR 11. For the definition and method of calculation of non-IFRS financial information, refer to OFR 11.1. For the composition of net debt refer to Financial Statements note 20 ‘Net debt’. |

Facility available 2022 US$M |

Drawn 2022 US$M |

Undrawn 2022 US$M |

Facility available 2021 US$M |

Drawn 2021 US$M |

Undrawn 2021 US$M |

|||||||||||||||||||

| Revolving credit facility 1 |

5,500 |

– |

5,500 |

5,500 | – | 5,500 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total financing facility |

5,500 |

– |

5,500 |

5,500 | – | 5,500 | ||||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

1 |

During the year we completed a one-year extension of the facility which is now due to mature on 10 October 2026. The committed US$5.5 billion revolving credit facility operates as a back-stop to the Group’s uncommitted commercial paper program. The combined amount drawn under the facility or as commercial paper will not exceed US$5.5 billion. As at 30 June 2022, US$ nil commercial paper was drawn (FY2021: US$ nil), therefore US$5.5 billion of committed facility was available to use (FY2021: US$5.5 billion). A commitment fee is payable on the undrawn balance and interest is payable on any drawn balance comprising a reference rate plus a margin. The agreed margins are typical for a credit facility extended to a company with the Group’s credit rating. |

| Year ended 30 June |

2022 US$M |

2021 US$M |

||||||||||||||

| Net debt at the beginning of the financial year |

(4,121 |

) |

(12,044 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Net operating cash flows |

32,174 |

27,234 | ||||||||||||||

| Net investing cash flows |

(6,959 |

) |

(7,845 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Free cash flow – Total operations |

25,215 |

19,389 | ||||||||||||||

| |

|

|

|

|||||||||||||

| Carrying value of interest bearing liability net repayments |

2,227 |

7,433 | ||||||||||||||

| Net settlements of interest bearing liabilities and debt related instruments |

(2,474 |

) |

(7,424 | ) | ||||||||||||

| Dividends paid |

(17,851 |

) |

(7,901 | ) | ||||||||||||

| Dividends paid to non-controlling interests |

(2,540 |

) |

(2,127 | ) | ||||||||||||

| Other financing activities 1 |

(149 |

) |

(234 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Other cash movements |

(20,787 |

) |

(10,253 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Fair value adjustment on debt (including debt related instruments) 2 |

5 |

58 | ||||||||||||||

| Foreign exchange impacts on cash (including cash management related instruments) |

27 |

(1 | ) | |||||||||||||

| Lease additions |

(736 |

) |

(1,079 | ) | ||||||||||||

| Divestment and demerger of subsidiaries and operations |

492 |

– | ||||||||||||||

| Others |

(428 |

) |

(191 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Non-cash movements |

(640 |

) |

(1,213 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

| Net debt at the end of the financial year |

(333 |

) |

(4,121 | ) | ||||||||||||

| |

|

|

|

|||||||||||||

1 |

Other financing activities mainly comprises purchases of shares by Employee Share Option Plan trusts of US$149 million (FY2021: US$234 million). |

2 |

The Group hedges against the volatility in both exchange and interest rates on debt, and also exchange on cash, with associated movements in derivatives reported in Other financial assets/liabilities as effective hedged derivatives (cross currency and interest rate swaps), in accordance with accounting standards. For more information refer to Financial Statements note 23 ‘Financial risk management’. |

| • | embedding flexibility into the way we work |

| • | encouraging and working with our supply chain partners to support our commitment to inclusion and diversity |

| • | uncovering and taking steps to mitigate potential bias in our systems, policies and processes, and in behaviours through the Respectful Behaviour campaign |

| • | ensuring our workplaces are safe for and attractive to a diverse range of people |

| • | continued market mapping to proactively target people or groups of people not actively looking to work for BHP or our industry |

| • | implemented a ‘Tell Us About You’ survey, our first self-identification survey to measure the rich diversity of our workforce |

| • | integrated inclusive leadership capabilities at all levels of our leadership learning curriculum |

| • | embedded the Ways of Working Framework to guide employees and leaders to ‘Work where you get great outcomes’ |

| • | launched Phase 3 of the Respectful Behaviour campaign to reinforce our zero tolerance of sexual harassment, racism and bullying including global ‘Stop for Safety’ sessions for all employees and contractors |

1 |

Based on a ‘point-in-time’ |

2022 |

2021 | 2020 | ||||||||||

| Female employees |

12,674 |

11,868 | 9,961 | |||||||||

| Male employees |

26,536 |

27,953 | 27,557 | |||||||||

| Female people leaders |

1,695 |

1,439 | 1,157 | |||||||||

| Male people leaders |

4,380 |

4,276 | 4,002 | |||||||||

| Female Executive Leadership Team members |

5 |

5 | 4 | |||||||||

| Male Executive Leadership Team members |

5 |

5 | 6 | |||||||||

| Female Board members |

4 |

4 | 3 | |||||||||

| Male Board members |

8 |

8 | 9 | |||||||||

1 |

Based on a ‘point-in-time’ |

2 |

For FY2022, this does not include employees who left BHP via the merger of BHP Petroleum and Woodside (approximately 1,000 employees) or the sale of BHP Mitsui Coal to Stanmore Resources (approximately 500 employees). |

| Location |

Period |

Target (%) |

30 June 2022 (%) |

|||||||

| Minerals America operations employees in Chile |

By the end of FY2026 | 10.0 |

8.7 |

|||||||

| Minerals Australia operations employees in Australia 2 |

By the end of FY2025 | 8.0 |

8.3 |

|||||||

| Jansen Potash Project and operation employees in Canada 3 |

By the end of FY2027 | 20.0 |

7.2 |

|||||||

1 |

Point in time data at 30 June 2022. |

2 |

Indigenous employee representation overall in Australia as at 30 June 2022 was 7.4 per cent including Minerals Australia operations, 8.3 per cent Indigenous, and non-operational locations, 2.5 per cent Indigenous. |

3 |

Indigenous workforce representation at Potash Jansen Project and operations of 20.7 per cent includes employees, 7.2 per cent Indigenous, and contractors, 23.8 per cent Indigenous. |

| • | creating relations with our workforce based on a culture of trust and cooperation |

| • | negotiating where there are requirements to collectively bargain (and recognising the rights of our workforce to collectively bargain) |

| • | closing out agreements with our workforce in South America and Australia, with no lost time due to industrial action, to the extent possible |

| • | ensuring we comply with legal obligations and regional labour regulations |

| • | BHP Iron Ore Pty Ltd commenced bargaining in January 2022 for the BHPIO Locomotive Drivers Agreement 2022, which is ongoing. |

| • | OS MCAP Pty Ltd recommenced bargaining in December 2022 for the Operations Services Production Agreement 2018, which is ongoing. |

| • | OS ACPM Pty Ltd recommenced bargaining in December 2022 for the Operations Services Maintenance Agreement 2018, which is ongoing. |

| • | BHP Coal Pty Ltd commenced bargaining in February 2021 for the BMA Enterprise Agreement 2021, which is ongoing. |

| • | BM Alliance Coal Operations Pty Ltd commenced bargaining in June 2022 for the BMACO Broadmeadow Mine Agreement 2022, which is ongoing. |

| • | Escondida: O&M union N°1 of 2,333 employees signed in August 2021 for 36 months. |

| • | Cerro Colorado: O&M union N°1 of 705 employees signed in September 2021 for 36 months. |

1 |

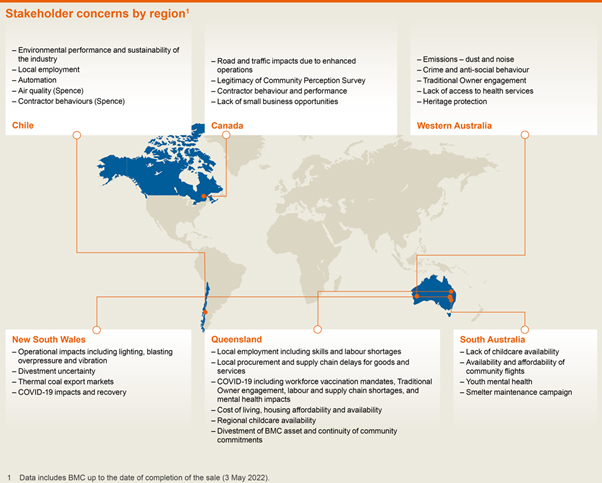

To date, our voluntary social investment has been calculated as 1 per cent of the average of the previous three years’ pre-tax profit. For FY2023–FY2030, our social investment will be assessed as a total over the seven-year goals period to FY2030, rather than calculated as an average of the previous three years’ pre-tax profit. |

2 |

These include our Indigenous Peoples Framework, Social Value Framework, Inclusion and Diversity Statement, Climate Change Strategy, approach to the environment, Closure Strategy, Human Rights Policy Statement, and approach to community engagement. |

| • | Recognise our responsibility to our workforce – where a major change in our business is expected to affect our workforce, we will engage in meaningful dialogue and support those impacted. |

| • | Create opportunity for meaningful engagement and co-designed processes – we will seek to develop relationships with stakeholders and partners, including government, local businesses, community members, suppliers, Indigenous peoples and workers, that support understanding of the issues and co-creation of solutions. We will communicate transparently on the types of changes the business needs to make and enable active participation of those most impacted. |

| • | Recognise the impacts associated with gender, land connectedness and social and economic vulnerability – we will not assume all people are affected similarly. We will seek to understand how impacts may be differently experienced, including for Indigenous peoples, and recognise that plans and solutions must take into account the particular strengths of each community and tackle the unique impacts they experience. |

| • | Recognise that the economic, social and environmental dimensions of sustainable development are interrelated – we will aim to avoid or mitigate adverse environmental impacts of change and transitions, while pursuing opportunities to build climate resilience and environmentally sustainable communities. |

1 |

Our sustainability standards index is included in our ESG Standards and Databook, available at bhp.com/sustainability. |

2 |

Certain information has been omitted from this report for the purposes of US reporting. |

1 |

‘Material’ in this context refers to the materiality of a risk under BHP’s Risk Framework. For information on our Risk Framework refer to OFR 9. |

| People |

Target |

FY2022 result |

Year-on-year | |||||

| Zero work-related fatalities | Zero work-related fatalities and there was a 30 per cent decrease in the high-potential injury frequency rate from FY2021. High-potential injury trends remain a primary focus to assess progress against our most important safety objective, eliminating fatalities. | FY2018 1 FY2019 2 FY2020 FY2021 FY2022 3 |

2 1 0 0 0 | |||||

| Year-on-year 4 per million hours worked |

An increase in total recordable injury frequency (TRIF) of 8 per cent from FY2021. This shift was influenced by COVID-19 through an 8 per cent reduction in hours worked between the first and second halves of FY2022. TRIF has decreased by 9 per cent since FY2018. |

FY2018 1 FY2019 2 FY2020 FY2021 FY2022 3 |

4.4 4.7 4.2 3.7 4.0 | |||||

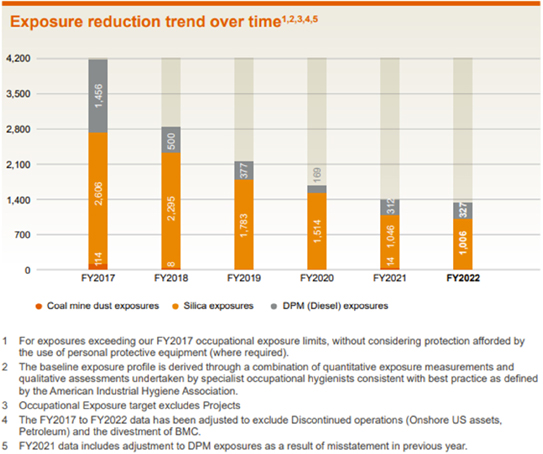

| 50 per cent reduction in the number of workers potentially exposed 5 to our most material exposures of diesel particulate matter, respirable silica and coal mine dust compared to our FY20176 baseline by FY2022 |

We exceeded our target by reducing the total number of workers potentially exposed to our most material exposures by 68 per cent compared to our adjusted FY2017 6 |

Adjusted FY2017 baseline 6 FY2018 6 FY2019 6 FY2020 6 FY2021 6,7 FY2022 6 |

4,176 2,803 2,160 1,683 1,372 1,333 | |||||

| Society |

Zero significant community events 8 |

No significant community events resulting from BHP operated activities were recorded in FY2022 | FY2018 FY2019 FY2020 FY2021 FY2022 3 |

0 0 0 0 0 | ||||

| Not less than 1 per cent of pre-tax profits 9 invested in community programs that contribute to the quality of life in the communities where we operate and support the achievement of the UN Sustainable Development Goals10 |

Social investment of US$681.4 million over five years | FY2018 1 FY2019 11 FY2020 FY2021 FY2022 3 |

US$77.1 million US$93.5 million US$149.6 million US$174.8 million US$186.4 million | |||||

| By FY2022, implement our Indigenous Peoples Strategy across all our operated assets through the development of Regional Indigenous Peoples Plans |

Regional Indigenous People Plans have been implemented across Australia (Reconciliation Action Plan (RAP)) and North and South America | |||||||

| Environment |

Zero significant environmental events 8 |

No significant environmental events resulting from BHP operated activities were recorded in FY2022 | FY2018 FY2019 FY2020 FY2021 FY2022 3 |

0 0 0 0 0 | ||||

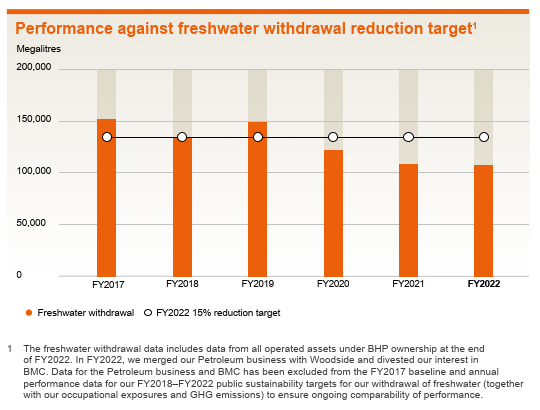

| Reduce FY2022 withdrawal of freshwater 12 by 15 per cent from FY2017 levels |

Exceeded our target, with a 29 per cent reduction in freshwater withdrawal volumes compared to our adjusted FY2017 baseline 13 |

Adjusted FY2017 baseline 13 FY2018 13 FY2019 13 FY2020 13 FY2021 13 FY2022 13 |

152,249 ML 133,265 ML 149,237 ML 122,331 ML 108,440 ML 107,398 ML | |||||

| By FY2022, improve marine and terrestrial biodiversity outcomes by: • developing a framework to evaluate and verify the benefits of our actions, in collaboration with others • contributing to the management of areas of national or international conservation significance exceeding our disturbed land footprint (‘area conserved’ target) |

Biodiversity framework was developed with the support of Conservation International and Proteus, a cross-sector partnership between the UN Environment Programme World Conservation Monitoring Centre (UNEP WCMC) and business ‘Area conserved’ target has been met by our operational and voluntary conservation investments over the target period, given BHP’s FY2022 total disturbed land footprint was 149,312 hectares. |

Year-on-year The total land set aside for conservation on land on which we operate and other land we steward was 65,870 hectares in FY2022. In addition to these conservation areas, we made several voluntary investments over the target period, of which an area of 4,465,260 hectares contributed to achievement of the ‘area conserved’ target. | ||||||

1 |

FY2018 data includes Continuing and Discontinued operations (Onshore US assets). |

2 |

FY2019 data includes Discontinued operations (Onshore US assets) to 28 February 2019 and Continuing operations. |

3 |

FY2022 data includes the operated assets in our Petroleum business up to the date of the merger with Woodside (1 June 2022) and BMC up to the date of completion of the sale (3 May 2022). |

4 |

The sum of (fatalities + lost-time cases + restricted work cases + medical treatment cases) multiplied by 1 million/actual hours worked by our employees and contractors. Stated in units of per million hours worked. We adopt the US Government’s Occupational Safety and Health Administration Guidelines for the recording and reporting of occupational injuries and illnesses. |

5 |

For exposures exceeding our FY2017 baseline occupational exposure limits, without considering protection afforded by the use of personal protective equipment (where required). The baseline exposure profile (as at 30 June 2017) is derived through a combination of quantitative exposure measurements and qualitative assessments undertaken by specialist occupational hygienists consistent with best practice as defined by the American Industrial Hygiene Association. |

6 |

The FY2017 baseline has been adjusted for Discontinued operations (Onshore US assets and Petroleum) and the divestment of BMC. These adjustments have also been applied to FY2018-FY2022 emissions stated in this table to aid comparability. |

7 |

As of FY2021, the Occupational Exposure Limit for Coal was reduced to 1.5 mg/m3 compared to 2.0 mg/m3 in previous years. |

8 |

A significant event resulting from BHP operated activities is one with an actual severity rating of four or above, based on our internal severity rating scale (tiered from one to five by increasing severity) as defined in our mandatory minimum performance requirements for risk management. |

9 |

To date, our voluntary social investment has been calculated as 1 per cent of the average of the previous three years’ pre-tax profit. For FY2023–FY2030, our social investment will be assessed as a total over the seven-year goals period to FY2030, rather than calculated as an average of the previous three years’ pre-tax profit. |

10 |

Expenditure includes BHP’s equity share for operated and non-operated joint ventures, and comprises cash, administrative costs, including costs to facilitate the operation of the BHP Foundation. |

11 |

FY2019 data includes Discontinued operations (Onshore US assets) to 31 October 2018 and Continuing operations. |

12 |

‘Withdrawal’ is defined as water withdrawn and intended for use (in accordance with ‘Water Reporting Good Practice Guide’, ICMM (2021)). ‘Fresh water’ is defined as waters other than seawater, wastewater from third parties and hypersaline groundwater. Freshwater withdrawal also excludes entrained water that would not be available for other uses. These exclusions have been made to align with the target’s intent to reduce the use of freshwater sources subject to competition from other users or the environment. |

13 |

The FY2017 baseline has been adjusted to account for: the materiality of the strike affecting water withdrawals at Escondida in FY2017 and improvements to water balance methodologies at WAIO and BMA, exclusion of hypersaline, wastewater, entrainment, supplies from desalination and removal of data for Discontinued operations (Onshore US assets, Petroleum) and BMC. These adjustments have also been applied to FY2018-FY2022 freshwater withdrawal stated in this table to aid comparability. |

| • | no fatalities at BHP |

| • | a decrease of 30 per cent in the high-potential injury frequency rate from FY2021. The highest number of events with potential for one or more fatalities was related to vehicle and mobile equipment accidents. High-potential injury trends remain a primary focus to assess progress against our most important safety objective, eliminating fatalities |

| • | an increase in total recordable injury frequency (TRIF) of 8 per cent from FY2021. This shift was influenced by COVID-19 through an 8 per cent reduction in hours worked between the first and second halves of FY2022. TRIF has decreased by 9 per cent since FY2018. The highest number of injuries was related to slips, trips and falls for both employees and contractors |

| • | a consistent application of field leadership activities, which occurred at a sustainable frequency rate of 9,341 activities per million hours worked with over 1,517,117 activities completed and more than 68,000 employees and contractors participating in the program at least once. Scheduled activities compared to non-scheduled activities increased by 46 per cent from FY2021 and coaching increased by 6 per cent |

| • | one safety fine at our operated assets |

| Year ended 30 June |

2022 |

2021 | 2020 | |||||||||

| High-potential injuries |

23 |

33 | 42 | |||||||||

| Employees | Contractors | |||||||

| High-potential injury frequency 3 |

0.03 | 0.03 | ||||||

| Year ended 30 June |

2022 |

2021 | 2020 | |||||||||

| Total recordable injury frequency 4 |

4.0 |

3.7 | 4.2 | |||||||||

| Employees | Contractors | |||||||

| Total recordable injury frequency 3 |

0.77 | 0.82 | ||||||

1 |

Data includes BMC up to the date of completion of the sale (3 May 2022) and operated assets in our Petroleum business up to the date of the merger with Woodside (1 June 2022) |

2 |

High-potential injury includes injuries with fatality potential. The basis of calculation was revised in FY2020 from event count to injury count as part of a safety reporting methodology improvement. |

3 |

Employee and contractor frequency per 200,000 hours worked. |

4 |

Combined employee and contractor frequency per 1 million hours worked. |

| • | Fatality Elimination Program |

| • | Integrated Contractor Management Program |

| • | Field Leadership Program |

| • | developed five-year fatality elimination roadmap guidelines, including the recommended sequencing of strengthened controls based on effort, cost and near miss reduction impact |

| • | updated the Our Requirements for Safety |

| • | created the ‘Control Shift’ methodology for assets to replicate FEL processes for specific risks not considered within our top 10 risks (i.e. vehicle and mobile equipment, dropped object, electrical, lifting, geotechnical failure, entanglement/crushing, energy release, loss of containment, fire/explosion, fall from height) |

| • | created an online dashboard to enhance local implementation plans, providing global visibility of challenges, similarities and differences, thereby assisting assets with their implementation |

| • | published technical bulletins related to FEL controls to provide detailed implementation guidance based on site experience and lessons learnt |

| • | undertook a human performance benchmarking study to identify the latest developments and best practices in the field of human behaviour |

| • | developed the scope of work library as an online resource containing best practice examples for different types of contractor engagements |

| • | created contract execution plans as a means of applying the Our Requirements for Contractor Management |

| • | established an integration stream ensuring enhancements are holistic and cover functional interactions |

| • | undertook assurance and audit activities across BHP including contractor engagements |

| • | implemented a contractor perception survey that runs in parallel with our internal survey. The survey highlighted some results on the experience of our contractor workforce consistent with the internal survey and other areas of focus |

| • | determined organisational design changes to improve contract ownership and management practices |

| • | commenced deployment of a technology solution which supports an enterprise-wide approach to contractor on-boarding and management |

| • | enhanced the efficiency and effectiveness of supervisor time in the field by integrating the BHP Operating System (BOS) process confirmation and field leadership planned task observation processes into a planned task confirmation |

| • | continued to improve the quality of field leadership activities by increasing coaching and delivery of field leadership engagements |

| • | conducted field leadership activities to support the verification of risks that have the potential to result in fatalities across our operated assets |

| • | embedded the global, standardised field leadership procedure designed to increase the effectiveness of field leadership activities across the business |

| • | conducted field leadership on COVID-19 controls, designed to sustain effectiveness within the changing environment |

| • | 37 involved non-consensual kissing or touching of a sexual nature, which includes a broad range of behaviour of varying severity. None of these cases involved non-consensual penetration or intercourse, however we recognise that this conduct can occur and has occurred in the past |

| • | 66 involved other forms of sexual harassment, including inappropriate comments of a sexual nature, unwelcome gestures or comments, sending inappropriate text messages or images, or other unwanted advances or invitations |

| • | Of these 103 substantiated cases, in 101 cases the individual responsible has had their employment terminated (or they have been removed from site if a contractor), they have resigned or are otherwise no longer working at BHP. |

1 |

‘Sexual harassment’ is, as defined in the Respect@Work report, an unwelcome sexual advance, unwelcome request for sexual favours or other unwelcome conduct of a sexual nature, which makes a person feel offended, humiliated and/or intimidated, where a reasonable person would anticipate that reaction in the circumstances. Sexual harassment encompasses a range of conduct including displaying sexually graphic images, sexually suggestive comments, suggestive or inappropriate looks, gestures or staring, non-consensual touching or acts of a sexual nature and sexual assault. |

2 |

EthicsPoint is our confidential reporting tool. It is accessible to all, including external stakeholders and the public, to report conduct that may be unethical, illegal or inconsistent with Our Code of Conduct |

3 |

This does not include investigations that are currently in progress. |

| • | engaged and learnt from external experts who reviewed the controls we have in place and advised on best practice in preventing sexual harassment, and minimising further harm when responding to sexual harassment |

| • | engaged Kristen Hilton (former Victorian Equal Opportunity and Human Rights Commissioner) to provide expert guidance on our prevention and response framework |

| • | conducted a sexual harassment audit across Minerals Americas further to the FY2021 sexual harassment audit conducted across Minerals Australia |

| • | contributed to knowledge sharing with other industry participants in relation to addressing sexual harassment, and considered broader learnings from external reports such as the Australian Human Rights Commission’s Respect@Work: Sexual Harassment National Inquiry Report and the Report into Workplace Culture at Rio Tinto by Elizabeth Broderick & Co |

| • | worked with our contracting and supplier organisations to address sexual harassment, including collaboration on response protocols, joint training sessions and knowledge sharing |

| • | undertook a series of listening workshops |

| • | focusing on increasing female leader representation across our operations |

| • | continuous improvement across our suite of controls |

| • | engaging with our people, encouraging and empowering them to take action as active bystanders and enhance capability |

| • | encouraging increased reporting |

| • | enhancing our approach to supporting impacted persons to thrive at BHP and have successful careers with us |

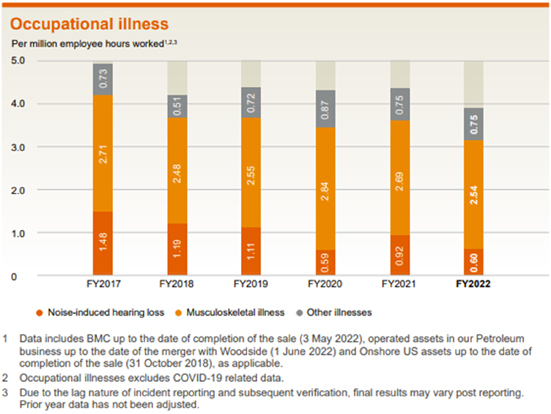

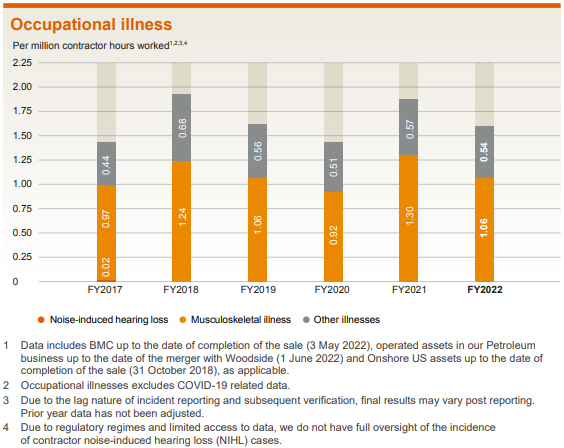

1 |

An illness that occurs as a consequence of work-related activities or exposure. |

1 |

For exposures exceeding our FY2017 occupational exposure limits, without considering protection afforded by the use of personal protective equipment (where required). |

1 |

The baseline exposure profile is derived through a combination of quantitative exposure measurements and qualitative assessments undertaken by specialist occupational hygienists consistent with best practice as defined by the American Industrial Hygiene Association. |

2 |

Occupational Exposure target excludes Projects. |

3 |

The FY2017 to FY2022 data has been adjusted to exclude Discontinued operations (Onshore US assets, Petroleum) and the divestment of BMC. |

4 |

FY2021 data includes adjustment to DPM exposures as a result of misstatement in previous year. |

1 |

CMDLD is the name given to the lung diseases related to exposure to coal mine dust and includes coal workers’ pneumoconiosis, silicosis, mixed dust pneumoconiosis and chronic obstructive pulmonary disease. |

2 |

Cases reported to DNRME are not an indication of work relatedness. BHP evaluates each case for work relatedness and where identified, the case will be included in occupational illness reporting. |

1 |

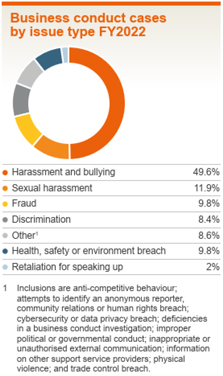

Information is available at bhp.com/our-approach/our-company/our-code-of-conduct/ |

2 |

Some EthicsPoint reports are enquiries, or are not related to business conduct concerns, or are a duplicate of an existing report. |

3 |

This excludes reports not containing a business conduct concern and excludes reports logged by leaders on behalf of others. Case classification is made at the time of the report. |

4 |

The calculation is based on reports received and completed in FY2022, containing one or more substantiated allegations. Not all reports resulted in a finding. This can occur if there is insufficient information, the respondent is not able to be identified, was previously terminated, or that the impacted person did not wish to proceed. |

| • | a medium-term target to reduce operational GHG emissions by at least 30 per cent from FY2020 levels by FY2030 |

| • | a long-term goal to achieve net zero operational GHG emissions by 2050 |

| • | We are pursuing the long-term goal of net zero Scope 3 GHG emissions by 2050. Achievement of this goal is uncertain, particularly given the challenges of a net zero pathway for our customers in steelmaking, and we cannot ensure the outcome alone. To progress towards this goal: 2 |

| • | We will target net zero by 2050 for the operational GHG emissions of our direct suppliers. 3 |

| • | We will target net zero by 2050 for GHG emissions from all shipping of BHP products. |

| • | We will continue to partner with customers and others to try to accelerate the transition to carbon neutral steelmaking and other downstream processes. |

| • | Our 2030 goals are to: |

| • | support industry to develop technologies and pathways capable of 30 per cent emissions intensity reduction in integrated steelmaking, with widespread adoption expected post 2030 |

| • | support 40 per cent emissions intensity reduction of BHP-chartered shipping of BHP products |

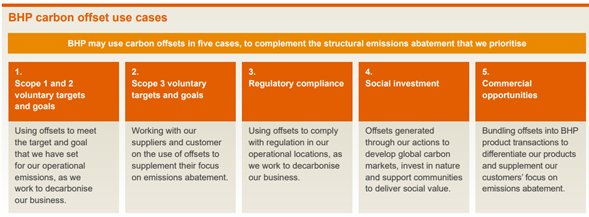

1 |

These positions are expressed using terms that are defined in the Glossary to this Report, including the terms ‘target’, ‘goal’, ‘net zero’ and ‘carbon neutral’. The baseline year(s) of our targets will be adjusted for any material acquisitions and divestments, and to reflect progressive refinement of emissions reporting methodologies. The targets’ boundaries may in some cases differ from required reporting boundaries. The use of carbon offsets will be governed by BHP’s approach to carbon offsetting described at bhp.com/climate. |

2 |

The targets are referable to a FY2020 baseline year. Our ability to achieve the targets is subject to the widespread availability of carbon neutral solutions to meet our requirements, including low/zero-emissions technologies, fuels, goods and services. |

3 |

Operational GHG emissions of our direct suppliers means the Scope 1 and Scope 2 emissions of our direct suppliers included in BHP’s Scope 3 reporting categories of purchased goods and services (including capital goods), fuel- and energy-related activities, business travel and employee commuting. |

| Targets |

FY2022 progress | |

| Short-term: |

We have achieved and exceeded our FY2022 target on the basis of significant progress securing renewable energy supply via PPAs, notably in Minerals Americas, with Escondida and Spence mostly supplied by renewable energy for their electricity in the first half of CY2022. | |

| Medium-term: |

| Targets and goals |

FY2022 progress | |

| Steelmaking 2030 goal: |

• Announced a Memorandum of Understanding (MOU) for up to US$10 million investment with POSCO in October 2021 to jointly study optimising coal/coke quality for low-carbon blast furnace operation and Carbon Capture Utilisation and Storage (CCUS).• This, together with MOUs announced in FY2021, provides up to US$75 million for steel decarbonisation partnerships with four key customers representing approximately 12 per cent of reported global steel production. For more information refer to our steel decarbonisation framework in Value chain GHG emissions. • Commenced feasibility studies with Baowu, HBIS, JFE, into CCUS and Direct Reduced Iron (DRI) technologies, use of hydrogen in steelmaking, and iron ore blends suitable for DRI production. • Invested US$11 million in venture investments in electrolysis technology companies Electrasteel and Boston Metal. | |

| Maritime 2030 goal: BHP-chartered shipping of BHP products.Target: |

• In May 2022, we joined the First Mover’s Coalition as a member in the shipping sector, on the basis of committing that 10 per cent of BHP’s products shipped to our customers, on our time charter vessels, will be on vessels using zero emissions fuels by 2030. 1 • Formed a consortium with Rio Tinto, Oldendorff, Star Bulk, and the Global Maritime Forum to analyse and support the potential to develop an iron ore maritime green corridor, fuelled by green ammonia. • Chartered the world’s first LNG-fuelled Newcastlemax bulk carriers to transport iron ore from Western Australia to Asia for five years. The fuel, along with improved efficiency of the vessel design, is expected to significantly reduce GHG emissions intensity per voyage. | |

| Commitment |

FY2022 progress | |

| Assessing capital alignment with a 1.5ºC world – our approach to strategy and operational and commercial decision-making in consideration of a range of different global, sectoral and regional scenarios, including a 1.5ºC outcome |

• The impact of our 1.5°C Paris-aligned scenario on portfolio value was assessed and reviewed against the portfolio mix and major capital allocation decisions. All investment decisions now require an assessment of viability under our 1.5°C scenario. Work continues to determine future climate requirements for planning and capital allocation processes. | |

| Climate policy engagement – including our strengthened approach to industry associations to ensure our review identifies areas of inconsistency with the Paris Agreement |

• We plan to publish our next formal industry association review in the second half of CY2022. • As part of our normal practice, we intend to analyse the industry association reviews published by our peers and relevant material published by civil society groups and other stakeholders, with the goal of strengthening our own review methodology, where possible. | |

| Just transition – our approach to dealing with the challenges associated with the transition of our communities and workforce as assets come to the end of their operating life |

• We have set out our Equitable Change and Transition Position establishing our approach to changes and transitions in our communities. Refer to OFR 7.1. | |

1 |

Subject to the availability of technology, supply, safety standards, and the establishment of reasonable thresholds for price premiums. |

| • | Transition risks low-carbon economy. For more information refer to Transition risks. |

| • | Physical risks |

1 |

Central Energy View reflects, and is periodically updated to respond to, existing policy trends and commitments. Lower Carbon View accelerates decarbonisation trends and policies, particularly in easier-to-abate |

2 |

This scenario aligns with the aims of the Paris Agreement and requires steep global annual emissions reduction, sustained for decades, to stay within a 1.5°C carbon budget. 1.5°C is above pre-industrial levels. For more information about the assumptions, outputs and limitations of our 1.5°C Paris-aligned scenario, refer to the BHP Climate Change Report 2020 available at bhp.com. |

3 |

There are inherent limitations with scenario analysis and it is difficult to predict which, if any, of the scenarios might eventuate. Scenarios do not constitute definitive outcomes for us. Scenario analysis relies on assumptions that may or may not be, or prove to be, correct and may or may not eventuate, and scenarios may be impacted by additional factors to the assumptions disclosed. |

1 |

The first seven risks in the table were selected based on the number of operated assets that identified them as material in accordance with BHP’s Risk Framework and the average Maximum Foreseeable Loss severity rating assigned to each. The absence of a tick means either the risk was identified at the asset, but not rated as material under our Risk Framework, or that it was not identified for that asset. Legacy assets and non-operated joint ventures have been excluded from the analysis. Legacy assets are to be included in the risk evaluations planned for FY2023. The eighth risk in the table is a collation of material value chain risks with implications across the regions; its position in the table does not indicate its level of potential impact relative to the other risks. |

| Minerals Australia |

Minerals Americas |

|||||||||||||||||

| Risk description |

BMA |

NSWEC |

Nickel West |

Olympic Dam |

WAIO |

Escondida |

Jansen |

Pampa Norte |

Risk management 1 | |||||||||

| Geotechnical instability and erosion of tailings storage facility (TSF) landforms and structures under conditions of extreme rainfall, leading to TSF failure |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |

✓ |