|

(Mark One)

|

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR SECTION 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

OR

|

||

|

|

|

|

|

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the fiscal year ended

|

||

|

|

|

|

|

OR

|

||

|

|

|

|

|

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

For the transition period from to

|

||

|

|

|

|

|

OR

|

||

|

|

|

|

|

|

|

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

|

|

The

|

|

☒

|

☐ Accelerated filer

|

☐ Non-accelerated filer

|

|

|

☒

|

☐ International Financial Reporting Standards as issued by the International Accounting Standards Board

|

☐ Other

|

|

Page | |

| 4 | |

| 4 | |

| 5 | |

| 7 | |

| 7 | |

| 7 | |

| 7 | |

| 7 | |

| 7 | |

| 7 | |

| 7 | |

| 38 | |

| 38 | |

| 38 | |

| 53 | |

| 54 | |

| 54 | |

| 54 | |

| 59 | |

| 61 | |

| 64 | |

| 64 | |

| 64 | |

| 65 | |

| 65 | |

| 67 | |

| 72 | |

| 81 | |

| 82 | |

| 82 |

| 82 | |

| 82 | |

| 84 | |

| 84 | |

| 84 | |

| 84 | |

| 85 | |

| 85 | |

| 85 | |

| 85 | |

| 85 | |

| 85 | |

| 85 | |

| 85 | |

| 85 | |

| 85 | |

| 85 | |

| 86 | |

| 88 | |

| 88 | |

| 97 | |

| 97 | |

| 97 | |

| 97 | |

| 97 |

| 97 | |

| 97 | |

| 98 | |

| 98 | |

| 98 | |

| 98 | |

| 98 | |

| 98 | |

| 99 | |

| 99 | |

| 99 | |

| 100 | |

| 101 | |

| 101 | |

| 101 | |

| 101 | |

| 102 | |

| 102 | |

| 103 | |

| 103 | |

| 103 | |

| 103 | |

| 106 | |

|

F-1 |

| ● |

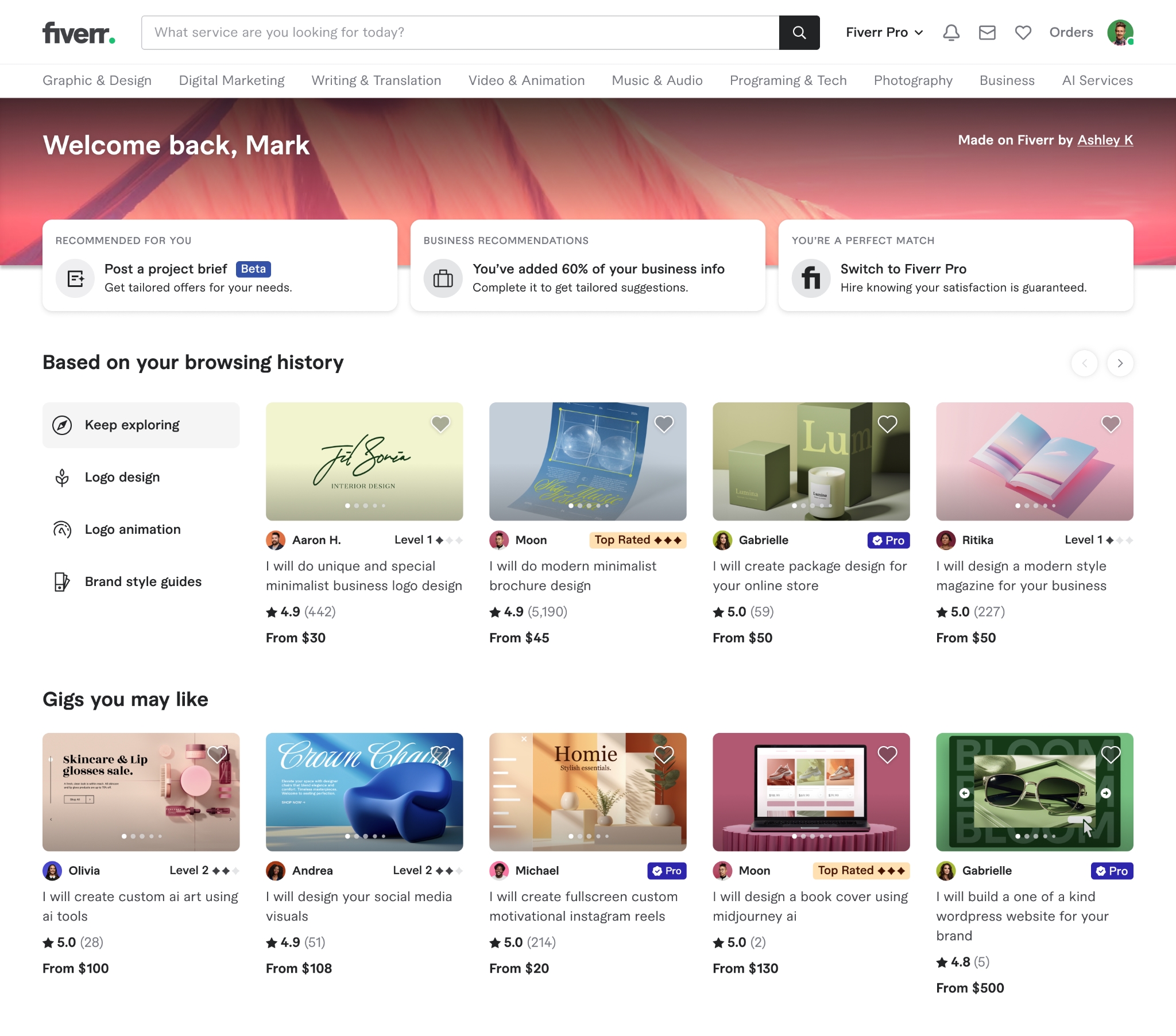

“Annual active buyers” as of any given date means buyers who have ordered a Gig on our marketplace within the last 12-month

period, irrespective of cancellations. |

| ● |

“Buyers” means users who purchase digital services. |

| ● |

“Gig” or “Gigs” means the services offered on the Fiverr marketplace. |

| ● |

“Marketplace Gross Merchandise Value” or “GMV” means the total value of transactions ordered through

our marketplace, excluding value added tax, goods and services tax, service chargebacks and refunds. |

| ● |

“Sellers” or “freelancers” means users who offer Gigs or digital services. |

| ● |

“Annual spend per buyer” as of any given date is calculated by dividing our GMV within the last 12-month period by the

number of annual active buyers as of such date. |

| ● |

“Marketplace take rate” for a given period means marketplace revenue for such period divided by GMV for such period.

|

| ● |

adverse macroeconomic conditions can materially adversely affect the Company’s business, results of operations and financial

condition, due to impacts on consumer and business spending and demand for our services; |

| ● |

our growth mainly depends on our ability to attract and retain a large community of buyers and freelancers, and the loss of our buyers

and freelancers, or failure to attract new buyers and freelancers, could materially and adversely affect our business; |

| ● |

we have incurred net losses in the past, and we may not be able to generate sufficient revenue to maintain profitability or positive

net cash flow generated by operating activities; |

| ● |

if we fail to maintain and enhance our brand, our business, results of operations and prospects may be materially and adversely affected;

|

| ● |

if the market for freelancers and the services they offer is not sustained or develops more slowly than we expect, our growth may

slow or stall; |

| ● |

if traffic to our websites declines for any reason, our growth may slow or stall; |

| ● |

if we fail to maintain and improve the quality of our platform, we may not be able to attract and retain buyers and freelancers;

|

| ● |

we face significant competition, which may cause us to suffer from a weakened market position that could materially and adversely

affect our results of operations; |

| ● |

we or our third-party partners may experience a security breach, including unauthorized parties obtaining access to our users’

personal or other data, or any other data privacy or data protection compliance issue; |

| ● |

changes in laws or regulations relating to data privacy, data protection, or cybersecurity or any actual or perceived failure by

us to comply with such laws and regulations or our privacy policies, could materially and adversely affect our business; |

| ● |

evolving privacy laws and regulations related to cross-border data transfer restrictions and data localization requirements may limit

the use and adoption of our services, expose us to liability or otherwise adversely affect our business; |

| ● |

our business may suffer if we do not successfully manage our current and potential future growth; |

| ● |

our user growth and engagement on mobile devices are dependent on decisions and developments in the mobile device industry over which

the Company has no control; |

| ● |

we have a limited operating history under our current platform and pricing model, which makes it difficult to evaluate our business

and prospects and increases the risks associated with your investment, and any future changes to our pricing model could materially and

adversely affect our business; |

| ● |

errors, defects or disruptions in our platform could diminish our brand, subject us to liability, and materially and adversely affect

our business, prospects, financial condition and results of operations; |

| ● |

our platform contains open source software components, and failure to comply with the terms of the underlying licenses could restrict

our ability to market or operate our platform; |

| ● |

expansion into markets outside the United States is important to the growth of our business, and if we do not manage the business

and economic risks of international expansion effectively, it could materially and adversely affect our business and results of operations;

|

| ● |

if we are unable to maintain and expand our scale of operations and generate a sufficient amount of revenue to offset the associated

fixed and variable costs, our results of operations may be materially and adversely affected; |

| ● |

our operating results may fluctuate from quarter to quarter, which makes our future results difficult to predict; |

| ● |

our business is subject to a variety of laws and regulations, both in the United States and internationally, many of which are evolving;

|

| ● |

any actual or perceived failure to comply with evolving regulatory frameworks around the development and use of AI could adversely

affect our business, results of operations, and financial condition; and |

| ● |

competition for highly skilled technical and other personnel is intense, and as a result we may fail to attract, recruit, retain

and develop qualified employees, which could materially and adversely impact our business, financial condition and results of operations.

|

|

A. |

[Reserved] |

|

B. |

Capitalization and Indebtedness |

|

C. |

Reasons for the Offer and Use of Proceeds |

|

D. |

Risk Factors |

| ● |

traditional contingent workforce and staffing service providers and other outsourcing providers; |

| ● |

online freelancer platforms that serve a diverse range of skill categories; |

| ● |

other online and offline providers of products and services that allow freelancers to find work or to advertise their services, including

personal and professional social networks, employment marketplaces, recruiting websites, job boards, classified ads and other traditional

means of finding work; |

| ● |

software and business services companies focused on talent acquisition, management or staffing management products and services;

|

| ● |

businesses that provide specialized, professional services, including consulting, accounting, marketing and information technology

services; and |

| ● |

software companies focused on providing technological solutions driven by AI. |

| ● |

recruiting and retaining talented and capable employees and contractors outside of Israel and the United States, and maintaining

our company culture across all of our offices; |

| ● |

recruiting and retaining contractors in Ukraine, which is currently affected by the war with Russia; |

| ● |

providing our platform and operating our business across a significant distance, in different languages and among different cultures,

including the potential need to modify our platform and features to ensure that they are culturally appropriate and relevant in different

countries; |

| ● |

compliance with applicable international laws and regulations, including laws and regulations with respect to privacy, data protection,

consumer protection and unsolicited email, and the risk of penalties to our users and individual members of management or employees if

our practices are deemed to be out of compliance; |

| ● |

operating in jurisdictions that do not protect intellectual property rights to the same extent as does the United States; |

| ● |

compliance by us and our business partners with anti-corruption laws, import and export control laws, tariffs, trade barriers, economic

sanctions and other regulatory limitations on our ability to provide our platform in certain international markets; |

| ● |

political and economic instability; |

| ● |

fluctuations in currency exchange rates; |

| ● |

double taxation of our international earnings and potentially adverse tax consequences due to changes in the income and other tax

laws of Israel, the United States or the international jurisdictions in which we operate; and |

| ● |

higher costs of doing business internationally, including increased accounting, travel, infrastructure and legal compliance costs.

|

| ● |

our ability to maintain and grow our community of users; |

| ● |

the demand for and types of skills and services that are offered on our platform by freelancers; |

| ● |

spending patterns of buyers, including whether those buyers who use our platform frequently, or for larger services, reduce their

spend or stop using our platform; |

| ● |

seasonal spending patterns by buyers or work patterns by freelancers and seasonality in the labor market; |

| ● |

fluctuations in the prices that freelancers charge buyers on our platform; |

| ● |

changes to our pricing model; |

| ● |

our ability to introduce new features and services and enhance our existing platform and our ability to generate significant revenue

from new features and services; |

| ● |

our ability to respond to competitive developments, including pricing changes and the introduction of new products and services by

our competitors; |

| ● |

the impact of outages of our platform and associated reputational harm; |

| ● |

changes to financial accounting standards and the interpretation of those standards that may affect the way we recognize and report

our financial results; |

| ● |

increases in, and timing of, operating expenses that we may incur to grow and expand our business and to remain competitive;

|

| ● |

costs related to the acquisition of businesses, talent, technologies, or intellectual property, including potentially significant

amortization costs and possible impairments; |

| ● |

security or data privacy breaches and associated remediation costs; |

| ● |

litigation, adverse judgments, settlements, or other litigation-related costs; |

| ● |

changes in the common law, statutory, legislative, or regulatory environment, such as with respect to privacy and data protection,

wage and hour regulations, worker classification (including classification of independent contractors or similar service providers and

classification of employees as exempt or non-exempt), internet regulation, payment processing, global trade, or tax requirements;

|

| ● |

fluctuations in currency exchange rates, inflation and interest rates; |

| ● |

general economic and political conditions and government regulations in the countries where we currently have significant numbers

of users, or where we currently operate or may expand in the future; |

| ● |

catastrophic or geopolitical events in countries where we currently have significant numbers of users, or where we currently operate,

which could lead to power and Internet shortages, that could prevent users from the ability to use our platform; |

| ● |

geopolitical risks such as the wars between Israel and its neighboring countries and regions and between Russia and Ukraine; and

|

| ● |

pandemics, epidemics or global health emergencies. |

| ● |

we may be held liable for the unauthorized use of an account holder’s credit card or bank account number and required by card

issuers or banks to pay a chargeback or return fee, and if our chargeback or return rate becomes excessive, credit card networks may also

require us to pay fines or other fees; |

| ● |

we may be subject to additional risk and liability exposure, including negligence, fraud or other claims, if employees or third-party

service providers misappropriate user information for their own gain or facilitate the fraudulent use of such information; |

| ● |

bad actors may use our platform, including our payment processing and disbursement methods, to engage in unlawful or fraudulent conduct,

such as money laundering, terrorist financing, fraudulent sale of services, breaches of security, leakage of data, piracy or misuse of

software and other copyrighted or trademarked content, and other misconduct; |

| ● |

users of our platform who are subjected or exposed to the unlawful or improper conduct of other users or other third parties, including

law enforcement, may seek to hold us responsible for the conduct of other users and may lose confidence in our platform, decrease or cease

to use our platform, seek to obtain damages and costs, or impose fines and penalties; |

| ● |

if, for example, freelancers misstate their qualifications or location, provide misinformation, perform services they are not qualified

or authorized to provide, or produce insufficient or defective work product or work product with a viral or other harmful effect, users

or other third parties may seek to hold us responsible for the freelancers’ acts or omissions and may lose confidence in our platform,

decrease or cease use of our platform, or seek to obtain damages and costs; and |

| ● |

we may suffer reputational damage as a result of the occurrence of any of the above. |

| ● |

our payment partners may be unable to effectively accommodate changing service needs, such as those which could result from rapid

growth or higher volume and the fact that some of our payment partners have a limited operating history; |

| ● |

our payment partners could choose to terminate or not renew their agreements with us or only be willing to renew on different or

less advantageous terms; |

| ● |

our payment partners could reduce the services provided to us, cease doing business with us, or cease doing business altogether;

|

| ● |

our payment partners could be subject to delays, limitations or closures of their own businesses, networks or systems, causing them

to be unable to process payments or disburse funds for certain periods of time; or |

| ● |

we may be forced to cease doing business with payment processors if card association operating rules, certification requirements

and laws, regulations or rules governing electronic funds transfers to which we are subject to change or are interpreted to make it difficult

or impossible for us to comply. |

|

● |

Israeli corporate law regulates mergers and requires that a tender offer be effected when more than a specified

percentage of shares in a company are purchased; | |

|

● |

Israeli corporate law does not provide for shareholder action by written consent, thereby requiring all

shareholder actions to be taken at a general meeting of shareholders; | |

|

● |

our amended and restated articles of association divide our directors into three classes, each of which

is elected once every three years; | |

|

● |

our amended and restated articles of association generally require a vote of the holders of a majority

of our outstanding ordinary shares entitled to vote present and voting on the matter at a general meeting of shareholders (referred to

as simple majority), and the amendment of a limited number of provisions, such as the provision dividing our directors into three classes,

requires a vote of the holders of at least 65% of the total voting power of our shareholders; | |

|

● |

our amended and restated articles of association do not permit a director to be removed except by a vote

of the holders of at least 65% of the total voting power of our shareholders and any amendment to such provision requires the approval

of at least 65% of the total voting power of our shareholders; and | |

|

● |

our amended and restated articles of association provide that director vacancies may be filled by our board

of directors. |

|

● |

actual or anticipated fluctuations in our results of operations; | |

|

● |

variance in our financial performance from the expectations of market analysts; | |

|

● |

announcements by us or our competitors of significant business developments, changes in service provider

relationships, acquisitions or expansion plans; | |

|

● |

short selling activities; | |

|

● |

changes in our marketplace take rate; | |

|

● |

our involvement in litigation; | |

|

● |

our sale of ordinary shares or other securities in the future; | |

|

● |

market conditions in our industry; | |

|

● |

changes in key personnel; | |

|

● |

the trading volume of our ordinary shares; | |

|

● |

changes in the estimation of the future size and growth rate of our markets; and | |

|

● |

general economic and market conditions, including the wars between Israel and its neighboring countries

and regions and between Russia and Ukraine. |

|

A. |

History and Development of the Company |

|

B. |

Business Overview |

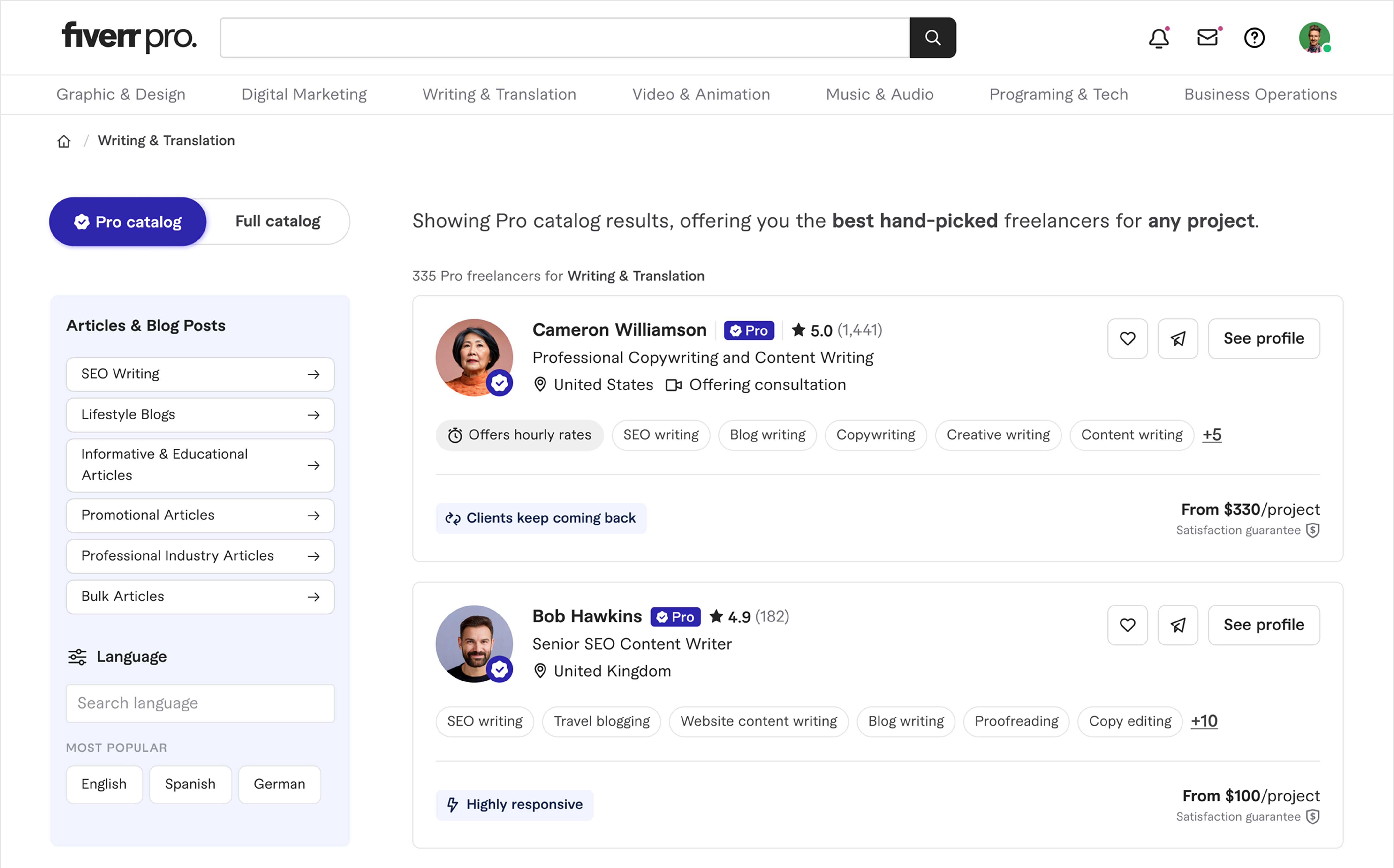

| ● |

traditional contingent workforce and staffing service providers and other outsourcing providers; |

| ● |

online freelancer platforms that serve a diverse range of skill categories; |

| ● |

other online and offline providers of products and services that allow freelancers to find work or to advertise their services, including

personal and professional social networks, employment marketplaces, recruiting websites, job boards, classified ads and other traditional

means of finding work; |

| ● |

software and business services companies focused on talent acquisition, management, invoicing, or staffing management products and

services; |

| ● |

businesses that provide specialized, professional services, including consulting, accounting, marketing and information technology

services; and |

| ● |

software companies focused on providing technological solutions driven by AI. |

| ● |

Creating fair economic and social opportunities: fostering a level playing field and providing economic and business opportunities

for talent across the world; |

| ● |

Marketplace integrity and ethics: holding high standards for quality and integrity in our marketplace; |

| ● |

Empowering our people: building an inclusive workforce and company culture; and |

| ● |

Climate change: reducing the carbon footprint by enabling remote work and driving responsible resource use. |

| ● |

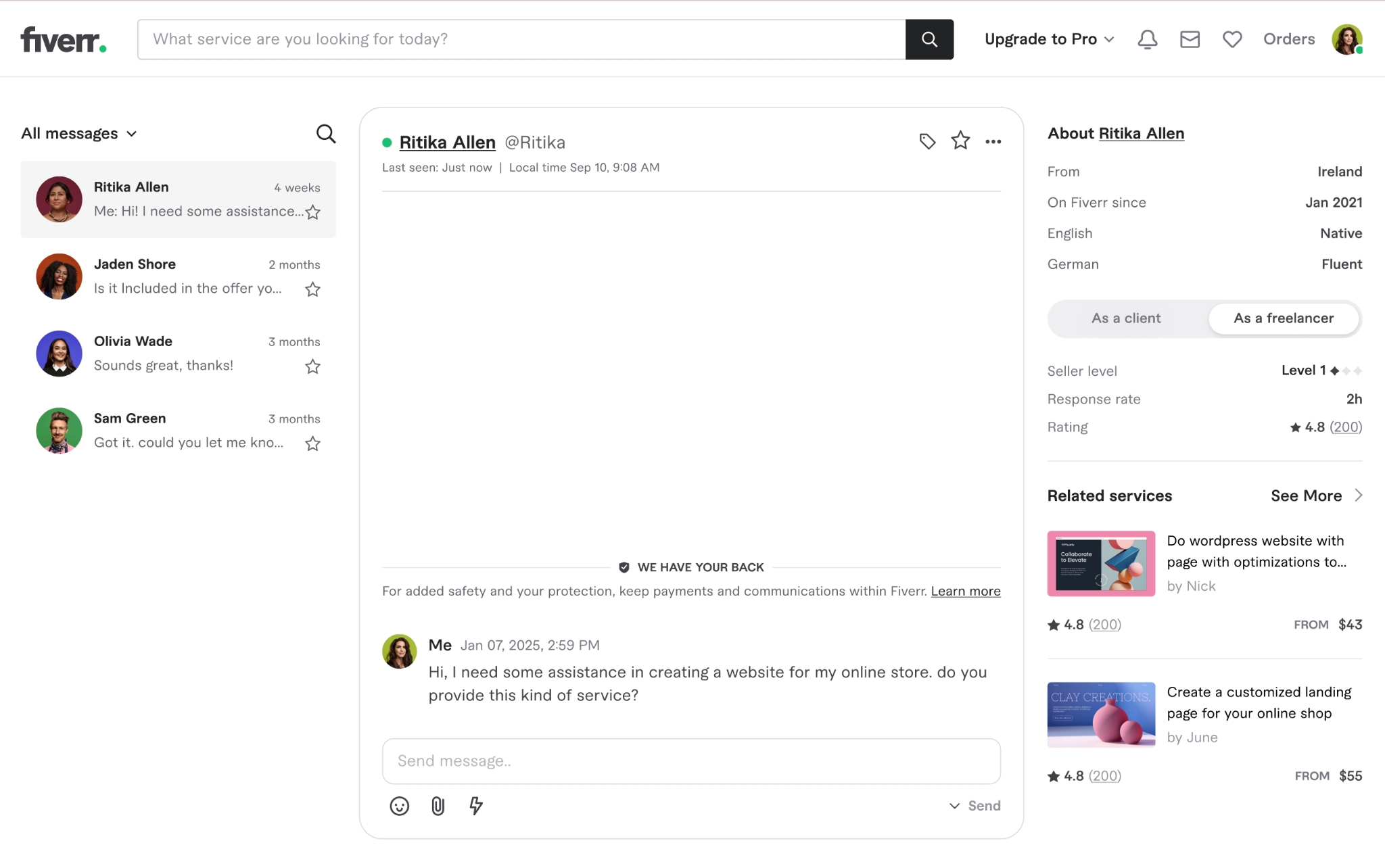

“Annual active buyers” means buyers who have ordered a Gig on the marketplace

within the last 12-month period, irrespective of cancellations. An increase or decrease in the number of annual active buyers is a key

indicator of our ability to attract and engage buyers. |

| ● |

“Annual spend per buyer” is calculated by dividing our GMV within the last 12-month

period by the number of annual active buyers as of such date. Annual spend per buyer is a key indicator of our buyers’ purchasing

patterns and is impacted by an increase in our number of annual active buyers, buyers purchasing from more than one category, an increase

in average price per purchase and our ability to acquire buyers with a higher lifetime value. |

|

As of December 31, |

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

Annual active buyers (in thousands) |

3,630 |

4,027 |

4,201 |

|||||||||

|

Annual spend per buyer |

$ |

302 |

$ |

278 |

$ |

261 |

||||||

|

2024 |

2023 |

2022 |

||||||||||

|

(in thousands) |

||||||||||||

|

U.S |

$ |

191,705 |

$ |

178,450 |

$ |

172,704 |

||||||

|

Europe |

104,319 |

95,593 |

84,484 |

|||||||||

|

Asia Pacific |

60,912 |

54,400 |

48,585 |

|||||||||

|

Rest of the world |

30,959 |

29,664 |

28,153 |

|||||||||

|

Israel |

3,586 |

3,268 |

3,440 |

|||||||||

|

Total |

$ |

391,481 |

$ |

361,375 |

$ |

337,366 |

||||||

|

|

2024

|

2023 |

2022

|

|||||||||

|

(in thousands) |

||||||||||||

|

Marketplace Revenue |

$ |

303,069 |

$ |

306,981 |

$ |

296,263 |

||||||

|

Services Revenue |

88,412 |

54,394 |

41,103 |

|||||||||

|

Total |

$ |

391,481 |

$ |

361,375 |

$ |

337,366 |

||||||

|

Year ended December 31, |

||||||||

|

2024 |

2023 |

|||||||

|

(in thousands) |

||||||||

|

Revenue |

$ |

391,481 |

$ |

361,375 |

||||

|

Cost of revenue |

70,566 |

61,846 |

||||||

|

Gross profit |

320,915 |

299,529 |

||||||

|

Operating expenses: |

||||||||

|

Research and development |

90,241 |

90,720 |

||||||

|

Sales and marketing |

171,678 |

161,208 |

||||||

|

General and administrative |

74,814 |

62,710 |

||||||

|

Total operating expenses |

336,733 |

314,638 |

||||||

|

Operating loss |

(15,818 |

) |

(15,109 |

) | ||||

|

Financial income (expenses), net |

27,706 |

20,163 |

||||||

|

Income before taxes on income |

11,888 |

5,054 |

||||||

|

Tax benefit (taxes on income) |

6,358 |

(1,373 |

) | |||||

|

Net Income |

$ |

18,246 |

$ |

3,681 |

||||

|

Year ended December 31, |

||||||||

|

2024 |

2023 |

|||||||

|

(as a% of revenue) |

||||||||

|

Revenue |

100.0 |

% |

100.0 |

% | ||||

|

Cost of revenue |

18.0 |

17.1 |

||||||

|

Gross profit |

82.0 |

82.9 |

||||||

|

Operating expenses: |

||||||||

|

Research and development |

23.1 |

25.1 |

||||||

|

Sales and marketing |

43.8 |

44.6 |

||||||

|

General and administrative |

19.1 |

17.4 |

||||||

|

Total operating expenses |

86.0 |

87.1 |

||||||

|

Operating loss |

(4.0 |

) |

(4.2 |

) | ||||

|

Financial income (expenses), net |

7.0 |

5.6 |

||||||

|

Income before taxes on income |

3.0 |

1.4 |

||||||

|

Tax benefit (taxes on income) |

1.6 |

(0.4 |

) | |||||

|

Net income |

4.6 |

% |

1.0 |

% | ||||

|

Year ended December 31, |

||||||||

|

2024 |

2023 |

|||||||

|

(in thousands) |

||||||||

|

Net cash provided by operating activities |

$ |

83,068 |

$ |

83,186 |

||||

|

Net cash provided by (used in) investing activities |

$ |

(23,818 |

) |

$ |

9,776 |

|||

|

Net cash provided by (used in) financing activities |

$ |

(104,222 |

) |

$ |

2,852 |

|||

|

Name |

Position | |

|

Executive Officers |

||

|

Micha Kaufman |

Founder, Chief Executive Officer, Chairperson of the Board | |

|

Ofer Katz |

President and Chief Financial Officer | |

|

Hila Klein |

Chief Operating Officer | |

|

Matti Yahav |

Chief Marketing Officer | |

|

Sharon Steiner |

Chief Human Resources Officer | |

|

Yossi Levin |

Chief Technology Officer | |

|

Directors |

||

|

Adam Fisher |

Director | |

|

Yael Garten |

Director | |

|

Ron Gutler |

Director | |

|

Gili Iohan |

Director | |

|

Jonathan Kolber |

Director | |

|

Nir Zohar |

Director |

| ● |

at least a majority of the shares held by all shareholders who are not controlling shareholders and do not have a personal interest

in such matter, present and voting at such meeting, have voted in favor of the compensation package, excluding abstentions; or |

| ● |

the total number of shares of non-controlling shareholders and shareholders who do not have a personal interest in such matter, who

vote against the compensation package does not exceed two percent (2%) of the aggregate voting rights in the Company. |

|

Lead

Independent Director or Chairperson |

Member |

|||||||

|

Board of Directors |

$ |

50,000 |

$ |

35,000 |

||||

|

Lead Independent Director or Chairperson |

Member |

|||||||

|

Audit Committee |

$ |

20,000 |

$ |

10,000 |

||||

|

Compensation Committee |

$ |

15,000 |

$ |

7,500 |

||||

|

Nominating and ESG Committee |

$ |

8,000 |

$ |

4,000 |

||||

|

Other Committee as Authorized by the Board of Directors |

$ |

8,000 |

$ |

4,000 |

||||

| C. |

Board Practices |

| ● |

the Class I directors are Jonathan Kolber and Yael Garten and their terms expire at our annual general meeting of shareholders to

be held in 2026; |

| ● |

the Class II directors are Adam Fisher and Nir Zohar, and their terms expire at our annual meeting of shareholders to be held in

2027; and |

| ● |

the Class III directors are Micha Kaufman, Ron Gutler and Gili Iohan, and their terms expire at our annual meeting of shareholders

to be held in 2025. |

| ● |

at least a majority of the shares of non-controlling shareholders and shareholders that do not have a personal interest in the approval

voted at the meeting in favor (disregarding abstentions); or |

| ● |

the total number of shares of non-controlling shareholders and shareholders who do not have a personal interest in such appointment

voting against such appointment does not exceed two percent (2%) of the aggregate voting rights in the company. |

| ● |

retaining and terminating our independent auditors, subject to the ratification of the board of directors, and in the case of retention,

to that of the shareholders; |

| ● |

pre-approving of audit and non-audit services and related fees and terms, to be provided by the independent auditors; |

| ● |

overseeing the accounting and financial reporting processes of our company, the audits of our financial statements, the effectiveness

of our internal control over financial reporting and making such reports as may be required of an audit committee under the rules and

regulations promulgated under the Exchange Act; |

| ● |

overseeing the Company policies with respect to risk assessment and risk management, including with respect to financial, privacy

and data protection, information security and cybersecurity related risks, and review contingent liabilities and risks that may be material

to the Company; |

| ● |

reviewing with management and our independent auditor our annual, semi-annual and quarterly financial statements prior to publication

or filing (or submission, as the case may be) to the SEC; |

| ● |

recommending to the board of directors the retention and termination of the internal auditor, and the internal auditor’s engagement

fees and terms, in accordance with the Companies Law, as well as reviewing and approving the yearly or periodic work plan proposed by

the internal auditor; |

| ● |

reviewing with our general counsel and/or external counsel, as deemed necessary, legal and regulatory matters that could have a material

impact on the financial statements; |

| ● |

Receiving reports of suspected irregularities in our business administration, inter alia, by members of the Company’s management,

legal counsel, the independent or internal auditor, and suggesting corrective measures to the board of directors; |

| ● |

reviewing policies and procedures with respect to transactions (other than transactions related to the compensation or terms of services)

between the Company and officers and directors, or affiliates of officers or directors, or transactions that are not in the ordinary course

of the Company’s business and deciding whether to approve such acts and transactions if so required under the Companies Law; and

|

| ● |

establishing and overseeing procedures and policies for the handling of employees’ complaints as to the management of our business

and the protection to be provided to such employees. |

| ● |

recommending to the board of directors with respect to the approval of the compensation policy for office holders and, once every

three years, regarding any extensions to a compensation policy that was adopted for a period of more than three years; |

| ● |

reviewing the implementation of the compensation policy and periodically recommending to the board of directors with respect to any

amendments or updates of the compensation policy; |

| ● |

resolving whether or not to approve arrangements with respect to the terms of office and employment of office holders; and

|

| ● |

exempting, under certain circumstances, a transaction with our chief executive officer from the approval of the general meeting of

our shareholders. |

| ● |

recommending to our board of directors for its approval a compensation policy in accordance with the requirements of the Companies

Law as well as other compensation policies, incentive-based compensation plans and equity-based compensation plans, and overseeing the

development and implementation of such policies and recommending to our board of directors any amendments or modifications the committee

deems appropriate, including as required under the Companies Law; |

| ● |

reviewing and approving the granting of options and other incentive awards to the chief executive officer and other executive officers,

including reviewing and approving corporate goals and objectives relevant to the compensation of our chief executive officer and other

executive officers, including evaluating their performance in light of such goals and objectives; |

| ● |

overseeing and periodically reviewing with management our strategies, policies and practices with respect to human capital management

and management development, including with respect to matters such as diversity, equity, and inclusion; workplace environment and culture;

employee engagement and effectiveness; and talent recruitment, development, and retention; |

| ● |

approving and exempting certain transactions regarding office holders’ compensation pursuant to the Companies Law; |

| ● |

administering our equity-based compensation plans, including without limitation, approving the adoption of such plans, amending and

interpreting such plans and the awards and agreements issued pursuant thereto, and making awards to eligible persons under the plans and

determining the terms of such awards; and |

| ● |

administering and overseeing the Company’s compliance with the compensation recovery policy required by the SEC and NYSE rules.

|

| ● |

such majority includes at least a majority of the shares held by shareholders who are not controlling shareholders and shareholders

who do not have a personal interest in such compensation policy and who are present, in person or by proxy, and voting (excluding abstentions);

or |

| ● |

the total number of shares of non-controlling shareholders and shareholders who do not have a personal interest in the compensation

policy and who vote against the policy does not exceed two percent (2%) of the aggregate voting rights in the Company. |

| ● |

the education, skills, experience, expertise and accomplishments of the relevant office holder; |

| ● |

the office holder’s position, responsibilities and prior compensation agreements with him or her; |

| ● |

the ratio between the cost of the terms of employment of an office holder and the cost of the employment of other employees of the

company, including employees employed through contractors who provide services to the company, in particular the ratio between such cost

to the average and median salary of such employees of the company, as well as the impact of disparities between them on the work relationships

in the company; |

| ● |

if the terms of employment include variable components—the possibility of reducing variable components at the discretion of

the board of directors and the possibility of setting a limit on the value of non-cash variable equity-based components; and |

| ● |

if the terms of employment include severance compensation—the term of employment or office of the office holder, the terms

of his or her compensation during such period, the company’s performance during such period, his or her individual contribution

to the achievement of the company goals and the maximization of its profits and the circumstances under which he or she is leaving the

company. |

| ● |

with regards to variable components: |

| ● |

with the exception of office holders who report directly to the chief executive officer, determining the variable components on long-term

performance basis and on measurable criteria; however, the company may determine that an immaterial part of the variable components of

the compensation package of an office holder shall be awarded based on non-measurable criteria, if such amount is not higher than three

monthly salaries per annum, while taking into account such office holder’s contribution to the company; |

| ● |

the ratio between variable and fixed components, as well as the limit of the values of variable components at the time of their payment,

or in the case of equity-based compensation, at the time of grant; |

| ● |

a condition under which the office holder will return to the company, according to conditions to be set forth in the compensation

policy, any amounts paid as part of his or her terms of employment, if such amounts were paid based on information later discovered to

be wrong, and such information was restated in the company’s financial statements; |

| ● |

the minimum holding or vesting period of variable equity-based components to be set in the terms of office or employment, as applicable,

while taking into consideration long-term incentives; and |

| ● |

a limit to retirement grants. |

| ● |

overseeing and assisting our board in reviewing and recommending nominees for election as directors; |

| ● |

assessing the performance of the members of our board of directors; |

| ● |

establishing and maintaining effective corporate governance policies and practices, including, but not limited to, ESG policies,

programs and strategies, and developing and recommending to our board of directors a set of corporate governance guidelines applicable

to our company; and |

| ● |

overseeing the Company’s risks, strategies, policies, programs and practices related to environmental, social and governance

(ESG) matters. |

| ● |

an amendment to the company’s articles of association; |

| ● |

an increase of the company’s authorized share capital; |

| ● |

a merger; or |

| ● |

interested party transactions that require shareholders’ approval. |

| ● |

financial liability imposed on him or her in favor of another person pursuant to a judgment, settlement or arbitrator’s award

approved by a court. However, if an undertaking to indemnify an office holder with respect to such liability is provided in advance, then

such an undertaking must be limited to events which, in the opinion of the board of directors, can be foreseen based on the company’s

activities when the undertaking to indemnify is given, and to an amount or according to criteria determined by the board of directors

as reasonable under the circumstances, and such undertaking shall detail the above-mentioned events and amount or criteria; |

| ● |

reasonable litigation expenses, including attorneys’ fees, incurred by the office holder (1) as a result of an investigation

or proceeding instituted against him or her by an authority authorized to conduct such investigation or proceeding, provided that (i)

no indictment was filed against such office holder as a result of such investigation or proceeding; and (ii) no financial liability, such

as a criminal penalty, was imposed upon him or her as a substitute for the criminal proceeding as a result of such investigation or proceeding

or, if such financial liability was imposed, it was imposed with respect to an offense that does not require proof of criminal intent

and (2) in connection with a monetary sanction; |

| ● |

reasonable litigation expenses, including attorneys’ fees, incurred by the office holder or imposed by a court in proceedings

instituted against him or her by the company, on its behalf or by a third-party or in connection with criminal proceedings in which the

office holder was acquitted or as a result of a conviction for an offense that does not require proof of criminal intent; and |

| ● |

expenses, including reasonable litigation expenses and legal fees, incurred by an office holder in relation to an administrative

proceeding instituted against such office holder, or certain compensation payments made to an injured party imposed on an office holder

by an administrative proceeding, pursuant to certain provisions of the Israeli Securities Law, 1968, or the Israeli Securities Law.

|

| ● |

a breach of the duty of loyalty to the company, to the extent that the office holder acted in good faith and had a reasonable basis

to believe that the act would not prejudice the company; |

| ● |

a breach of the duty of care to the company or to a third-party, including a breach arising out of the negligent conduct of the office

holder; |

| ● |

a financial liability imposed on the office holder in favor of a third-party; |

| ● |

a financial liability imposed on the office holder in favor of a third-party harmed by a breach in an administrative proceeding;

and |

| ● |

expenses, including reasonable litigation expenses and legal fees, incurred by the office holder as a result of an administrative

proceeding instituted against him or her pursuant to certain provisions of the Israeli Securities Law. |

| ● |

a breach of the duty of loyalty, except to the extent that the office holder acted in good faith and had a reasonable basis to believe

that the act would not prejudice the company; |

| ● |

a breach of the duty of care committed intentionally or recklessly, excluding a breach arising out of the negligent conduct of the

office holder; |

| ● |

an act or omission committed with intent to derive illegal personal benefit; or |

| ● |

a fine, monetary sanction or forfeit levied against the office holder. |

| D. |

Employees |

|

|

As of December 31, |

|||||||||||

|

|

2024(*) |

|

2023(*) |

|

2022(*) |

| ||||||

|

|

||||||||||||

|

Total Employees |

762 |

775 |

739 |

|||||||||

|

Located in Israel |

637 |

623 |

575 |

|||||||||

|

Located in the United States |

118 |

144 |

157 |

|||||||||

|

Located in Europe |

7 |

8 |

7 |

|||||||||

|

In Research and Development |

369 |

332 |

295 |

|||||||||

|

In Marketing |

157 |

204 |

198 |

|||||||||

|

In General and Administration |

109 |

111 |

125 |

|||||||||

|

In Customer Care |

127 |

128 |

121 |

|||||||||

| E. |

Share Ownership |

| F. |

Disclosure of a Registrant’s Action to Recover Erroneously Awarded Compensation. |

| A. |

Major Shareholders |

| ● |

each person or entity known by us to own beneficially more than 5% of our outstanding shares; |

| ● |

each of our directors and executive officers individually; and |

| ● |

all of our executive officers and directors as a group. |

|

Name of beneficial owner |

Number |

% |

||||||

|

Principal Shareholders |

||||||||

|

Wellington Management Group LLP(1)

|

2,880,478 |

8.0 |

% | |||||

|

Directors and Executive Officers |

||||||||

|

Micha Kaufman(2)

|

3,025,305 |

8.2 |

% | |||||

|

Ofer Katz(3) |

572,433 |

1.6 |

% | |||||

|

Hila Klein |

* |

* |

||||||

|

Gali Arnon |

* |

* |

||||||

|

Matti Yahav |

* |

* |

||||||

|

Sharon Steiner |

* |

* |

||||||

|

Yossi Levin |

* |

* |

||||||

|

Adam Fisher |

* |

* |

||||||

|

Yael Garten |

* |

* |

||||||

|

Ron Gutler |

* |

* |

||||||

|

Gili Iohan |

* |

* |

||||||

|

Jonathan Kolber(4)

|

2,633,612 |

7.3 |

% | |||||

|

Nir Zohar |

* |

* |

||||||

|

All executive officers and directors as a group (13 persons) |

6,972,802 |

18.4 |

% | |||||

|

(1) |

Based solely on a Schedule 13G filed on November 11, 2024, Wellington

Management Group LLP, Wellington Group Holdings LLP and Wellington Investment Advisors Holdings LLP have shared voting power over 2,245,842

ordinary shares, and shared dispositive power over 2,880,478 ordinary shares. Wellington Management Company LLP has shared voting power

over 2,222,367 ordinary shares, and shared dispositive power over 2,801,932 ordinary shares. The address of the reporting persons is c/o

Wellington Management Company LLP, 280 Congress Street, Boston, MA 02210. |

| (2) |

Based on information available to us, Mr. Kaufman holds 1,895,525 ordinary shares directly, 1,129,779 ordinary shares underlying

options that are currently exercisable within 60 days of February 17, 2025, at a weighted-average exercise price of $66.30, which expire

between 2025 and 2030. |

| (3) |

Based on information available to us, Mr. Katz holds 306,903 ordinary shares directly, 262,269 ordinary shares underlying options

that are currently exercisable within 60 days of February 17, 2025, at a weighted-average exercise price of $78.19, which expire between

2027 and 2030, and 3,258 restricted share units that shall vest within 60 days of February 17, 2025. |

| (4) |

Based on information reported on a Schedule 13G/A filed on January 11, 2021 and information available to us, Mr. Kolber’s holdings

represent (a) 509,835 ordinary shares held by Mr. Kolber directly, (b) 1,939,665 ordinary shares held by Anfield Ltd., over which Mr.

Kolber has sole voting power, and (c) 184,112 ordinary shares held by Artemis Asset Holding Limited, on behalf of the Jonathan Kolber

Bare Trust, of which Mr. Kolber is the sole beneficiary. Mr. Kolber may be deemed to have beneficial ownership of all of these ordinary

shares, and his business address is 12 Abba Even Blvd, Herzliya, Israel 4672530. |

| B. |

Related Party Transactions |

| C. |

Interests of Experts and Counsel |

| A. |

Consolidated Statements and Other Financial Information |

| B. |

Significant Changes |

| A. |

Offer and Listing Details |

| B. |

Plan of Distribution |

| C. |

Markets |

| D. |

Selling Shareholders |

| E. |

Dilution |

| F. |

Expenses of the Issue |

| A. |

Share Capital |

| B. |

Memorandum and Articles of Association |

| ● |

amendments to our articles of association; |

| ● |

appointment, termination or the terms of service of our auditors; |

| ● |

appointment of external directors (if applicable); |

| ● |

approval of certain related party transactions; |

| ● |

increases or reductions of our authorized share capital; |

| ● |

a merger; and |

| ● |

the exercise of our board of director’s powers by a general meeting, if our board of directors is unable to exercise its powers

and the exercise of any of its powers is required for our proper management. |

| C. |

Material Contracts |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| ● |

| D. |

Exchange Controls |

| E. |

Taxation |

| ● |

amortization of the cost of purchased patent, rights to use a patent, and know how, which are used for the development or advancement

of the Industrial Enterprise, over an eight-year period, commencing on the year in which such rights were first exercised; |

| ● |

under limited conditions, an election to file consolidated tax returns with controlled Israeli Industrial Companies; and |

| ● |

expenses related to a public offering are deductible in equal amounts over three years commencing on the year of the offering.

|

| ● |

The expenditures are approved by the relevant Israeli government ministry, and the Israeli Innovation Authority; |

| ● |

The research and development must be for the promotion of the company; and |

| ● |

The research and development are carried out by or on behalf of the company seeking such tax deduction. |

| ● |

banks, financial institutions or insurance companies; |

| ● |

real estate investment trusts or regulated investment companies; |

| ● |

dealers or brokers; |

| ● |

traders that elect to mark to market; |

| ● |

tax exempt entities or organizations; |

| ● |

holders subject to alternative minimum tax; |

| ● |

“individual retirement accounts” and other tax deferred accounts; |

| ● |

certain former citizens or long term residents of the United States; |

| ● |

persons that are resident or ordinarily resident in or have a permanent establishment in a jurisdiction outside the United States;

|

| ● |

persons that acquired our ordinary shares pursuant to the exercise of any employee share option or otherwise as compensation for

the performance of services; |

| ● |

persons holding our ordinary shares as part of a “hedging,” “integrated” or “conversion” transaction

or as a position in a “straddle” for U.S. federal income tax purposes; |

| ● |

partnerships or other pass through entities and persons holding the ordinary shares through partnerships or other pass through entities;

|

| ● |

persons whose functional currency for U.S. federal income tax purposes is not the U.S. dollar; |

| ● |

persons holding ordinary shares in connection with a trade or business outside the United States; |

| ● |

holders of Convertible Notes or ordinary shares acquired upon a conversion of Convertible Notes; or |

| ● |

holders that own directly, indirectly or through attribution 10% or more of the total voting power or value of all of our outstanding

shares. |

| ● |

an individual who is a citizen or resident of the United States; |

| ● |

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the

laws of the United States or any state thereof, including the District of Columbia; |

| ● |

an estate the income of which is subject to U.S. federal income taxation regardless of its source; or |

| ● |

a trust if such trust has validly elected to be treated as a United States person for U.S. federal income tax purposes or if (1)

a court within the United States is able to exercise primary supervision over its administration and (2) one or more United States persons

have the authority to control all of the substantial decisions of such trust. |

| F. |

Dividends and Paying Agents |

| G. |

Statement by Experts |

| H. |

Documents on Display |

| I. |

Subsidiary Information |

| J. |

Annual Report to Securities Holders |

|

2024 |

2023 |

|||||||

|

(in thousands) |

||||||||

|

Audit Fees |

$ |

770 |

$ |

701 |

||||

|

Tax Fees |

437 |

430 |

||||||

|

Audit-related fees |

160 |

6 |

||||||

|

Total |

$ |

1,367 |

$ |

1,137 |

||||

|

Period |

(a) Total Number of Shares (or Units) Purchased (1) |

(b) Average Price Paid per Share (or Unit) |

(c) Total Number of Shares (or Units) Purchased as Part of Publicly Announced Plans

or Programs |

(d) Maximum Number (or Approximate Dollar Value) of Shares (or Units) that May Yet Be

Purchased Under the Plans or Programs |

||||||||||||

|

January 1 – January 31 |

__ |

__ |

__ |

__ |

||||||||||||

|

February 1 – February 29 |

__ |

__ |

__ |

__ |

||||||||||||

|

March 1 – March 31 |

__ |

__ |

__ |

__ |

||||||||||||

|

April 1 – April 30 |

__ |

__ |

__ |

__ |

||||||||||||

|

May 1 – May 31 |

1,697,771 |

$ |

25.02 |

1,697,771 |

$ |

57,522,865 |

||||||||||

|

June 1 – June 30 |

1,522,475 |

$ |

23.75 |

1,522,475 |

$ |

21,358,129 |

||||||||||

|

July 1 – July 31 |

919,171 |

$ |

23.23 |

919,171 |

$ |

2,556 |

||||||||||

|

August 1 - August 31 |

__ |

__ |

__ |

__ |

||||||||||||

|

September 1 - September 30 |

__ |

__ |

__ |

__ |

||||||||||||

|

October 1 – October 31 |

__ |

__ |

__ |

__ |

||||||||||||

|

November 1- November 30 |

__ |

__ |

__ |

__ |

||||||||||||

|

December 1 – December 31 |

__ |

__ |

__ |

__ |

||||||||||||

|

Total |

4,139,417 |

$ |

24.16 |

4,139,417 |

$ |

2,556 |

||||||||||

| ● |

risk assessments designed to help identify material cybersecurity risks to our critical systems, information, networks, products, platform, services, and our broader enterprise IT environment;

|

| ● |

a security team principally responsible for managing (1) our cybersecurity risk assessment processes, (2) our security controls, and (3) our response to cybersecurity incidents;

|

| ● |

the use of external service providers, where appropriate, to assess, test or otherwise assist with aspects of our security controls;

|

| ● |

cybersecurity awareness training of our employees, incident response personnel, and senior management, including real-time problem-solving challenges in a safe environment that mimic cybersecurity incidents;

|

| ● |

a cybersecurity incident response plan that includes procedures for responding to cybersecurity incidents; and

|

| ● |

|

|

Incorporation by Reference

|

||||||

|

Exhibit No.

|

Description

|

Form

|

File No.

|

Exhibit No.

|

Filing Date

|

Filed /

Furnished |

|

6-K

|

001-38929

|

99.1

|

10/27/2023

|

|||

|

|

||||||

|

|

|

|

|

* |

||

|

|

||||||

|

20-F

|

001-38929

|

4.1

|

2/17/2022

|

|||

|

|

||||||

|

|

*

|

|||||

|

|

||||||

|

F-1

|

333-231533

|

10.3

|

5/16/2019

|

|||

|

|

||||||

|

F-1

|

333-231533

|

10.4

|

5/16/2019

|

|||

|

|

||||||

|

F-1

|

333-231533

|

10.5

|

5/16/2019

|

|||

|

|

||||||

|

F-1

|

333-231533

|

10.6

|

5/16/2019

|

|||

|

|

||||||

|

F-1

|

333-231533

|

10.7

|

5/16/2019

|

|||

|

|

||||||

|

F-1/A

|

333-231533

|

10.8

|

6/3/2019

|

|||

|

|

||||||

|

S-8

|

333-248580

|

99.1

|

9/3/2020

|

|||

|

|

||||||

|

20-F

|

001-38929

|

4.10

|

2/18/21

|

|||

|

6-K

|

001-38929

|

4.1

|

10/13/2020

|

|||

|

6-K

|

001-38929

|

4.2

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.1

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.2

|

10/13/2020

|

|||

|

6-K

|

001-38929

|

10.3

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.4

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.5

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.6

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.7

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.8

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.9

|

10/13/2020

|

|||

|

|

||||||

|

6-K

|

001-38929

|

10.10

|

10/13/2020

|

|

|

|

|

|

*

|

||

|

|

*

|

|||||

|

|

|

|

|

|

||

|

|

|

|

|

*

|

||

|

|

|

|

|

|

||

|

|

|

|

|

*

|

||

|

|

|

|

|

|

||

|

|

|

|

|

**

|

||

|

|

|

|

|

|

||

|

|

|

|

|

**

|

||

|

|

|

|

|

|

||

|

|

|

|

|

*

|

||

|

|

|

|

|

|

||

|

20-F |

001-38929 |

97.1 |

2/22/2024 |

|

||

|

|

|

|

|

|

||

|

101.INS

|

Inline XBRL Instance Document – the instance document appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document.

|

|

|

|

|

*

|

|

|

|

|

|

|

||

|

101.SCH

|

Inline XBRL Taxonomy Extension Schema Document.

|

|

|

|

|

*

|

|

|

|

|

|

|

||

|

101.CAL

|

Inline XBRL Taxonomy Extension Calculation Linkbase Document.

|

|

|

|

|

*

|

|

|

|

|

|

|

||

|

101.DEF

|

Inline XBRL Taxonomy Definition Linkbase Document.

|

|

|

|

|

*

|

|

|

|

|

|

|

||

|

101.LAB

|

Inline XBRL Taxonomy Extension Label Linkbase Document.

|

|

|

|

|

*

|

|

|

|

|

|

|

||

|

101.PRE

|

Inline XBRL Taxonomy Extension Presentation Linkbase Document

|

|

|

|

|

*

|

|

|

|

|

|

|

||

|

104

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101)

|

|

|

|

|

*

|

| * |

Filed herewith.

|

| ** |

Furnished herewith.

|

| † |

Indicates management contract or compensatory plan or arrangement.

|

|

|

FIVERR INTERNATIONAL LTD.

|

||

|

|

|

|

|

|

Date: February 19, 2025

|

By:

|

/s/ Micha Kaufman

|

|

|

|

Name:

|

Micha Kaufman

|

|

|

|

Title:

|

Chief Executive Officer

|

|

|

|

|

|

|

|

Date: February 19, 2025

|

By:

|

/s/ Ofer Katz

|

|

|

|

Name:

|

Ofer Katz

|

|

|

|

Title:

|

President and Chief Financial Officer

|

|

106

|

|

Page

|

|

Report of Independent Registered Public Accounting Firm (PCAOB ID

|

F-2

|

|

F-5

|

|

|

F-6

|

|

|

F-7

|

|

|

F-8

|

|

|

F-9

|

|

|

F-10- F-39

|

|

Description of the Matter

|

As disclosed in Note 2v to the consolidated financial statements, the Company's revenue is mainly derived from marketplace commissions paid by buyers and sellers. The Company’s revenue recognition process involves several applications responsible for the initiation, processing and recording of transactions, and the calculation of revenue is in accordance with the Company’s accounting policy. The processing and recognition of revenue are highly automated and involve capturing and processing significant volumes of data.

|

|

Auditing the Company’s marketplace commission revenue was challenging and complex due to the high volume of individually-low-monetary-value transactions and the dependency on multiple applications, some of which are custom-made for the Company’s business, and data sources associated with the revenue recognition process. Given the complex automated systems utilized to capture, process, and ultimately record revenues, performing procedures to audit revenues from marketplace commission required a high degree of auditor judgment and extensive audit effort.

|

|

How We Addressed the Matter in Our Audit

|

We obtained an understanding, evaluated the design, and tested the operating effectiveness of internal controls over the Company’s revenue recognition process in the Company's core platform as it related to marketplace commission. For example, with the assistance of IT professionals, we tested the controls over the initiation and recognition of transactions. We also tested the controls related to the key application interfaces between the Company’s self-developed systems, which included controls related to access to the relevant applications and data, changes to the relevant systems and interfaces, as well as controls over the configuration of the relevant applications.

|

|

Our substantive audit procedures included, among others, testing the completeness and accuracy of the underlying data within the Company’s accounting system, performing, with the assistance of our IT professionals, a recalculation of marketplace commission revenue recorded through the Company's core platform, and comparing the results to the Company’s recorded revenues. We performed, on a sample basis, transactions testing by agreeing the amounts recognized in the accounting system to third-party documentation. We also evaluated the Company’s disclosures included in Note 2v to the consolidated financial statements.

|

|

Description of the Matter

|

As disclosed in Note 3 to the consolidated financial statements, during 2024, the Company completed the acquisition of Auto DS Ltd. (Auto DS) for a total consideration of $55.6 million, which included a contingent consideration liability (the "earn-out") of $14.1 million (the “Auto DS Acquisition”). The Auto DS Acquisition was accounted for as a business combination.

|

|

Auditing the Company's accounting for the Auto DS Acquisition was complex due to the significant estimations required by management to determine the fair value of certain identified intangible assets, principally consisting of technology of $26.5 million, and the fair value of the earn-out of $14.1 million. The significant estimation uncertainty was primarily due to the complexity of the valuation models used by management to measure the fair value of the technology and the earn-out and the sensitivity of the respective fair values to changes in the significant underlying assumptions.

The Company used a multi-period excess earnings method to measure the technology. The significant assumptions used to estimate the value of the technology included certain assumptions that form the basis of the forecasted results (e.g., revenue growth rates, EBITDA margins and discount rate). These significant assumptions are forward looking and could be affected by future economic and market conditions.

The Company used a Monte Carlo simulation to measure the earn-out. The significant assumptions used in the Monte Carlo simulation included volatility and projected financial information. These significant assumptions are forward looking and could be affected by future economic and market conditions.

|

|

How We Addressed the Matter in Our Audit

|

We obtained an understanding, evaluated the design and tested the operating effectiveness of the internal controls over the Company’s accounting of the Auto DS Acquisition. This included testing controls over the estimation process supporting the recognition and measurement of the technology and the earn-out, and management's judgment and evaluation of underlying assumptions and estimates with regards to the fair values of the technology and the earn-out.

|

|

To test the Company’s estimated fair value of the technology and the earn-out, our audit procedures included, among others, involving our internal valuation specialists to assist in evaluating the Company's selection of the valuation methodologies and significant assumptions used by the Company. We tested the completeness and accuracy of the underlying data supporting the significant assumptions and estimates. We compared revenue growth rates and EBITDA margins to historical financial information, comparable companies and market and economic trends. We also performed a sensitivity analysis of revenue growth rates, EBITDA margins, discount rate and volatility to evaluate the change in the fair value resulting from changes in these significant assumptions. In addition, we evaluated the appropriateness of the related disclosures in relation to the Auto DS acquisition.

|

|

/s/

A Member of EY Global

|

|

Tel-Aviv,

February 19, 2025

|

|

|

December 31,

|

|||||||

|

|

2024

|

2023

|

||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash and cash equivalents

|

$

|

|

$

|

|

||||

|

Marketable securities

|

|

|

||||||

|

User funds

|

|

|

||||||

|

Short-term bank deposits

|

|

|

||||||

|

Restricted deposit

|

|

|

||||||

|

Other receivables

|

|

|

||||||

|

Total current assets

|

|

|

||||||

|

Long-term assets:

|

||||||||

|

Marketable securities

|

|

|

||||||

|

Property and equipment, net

|

|

|

||||||

|

Operating lease right-of-use assets

|

|

|

||||||

|

Intangible assets, net

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Other non-current assets

|

|

|

||||||

|

Total long-term assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||

|

Current liabilities:

|

||||||||

|

Trade payables

|

$

|

|

$

|

|

||||

|

User accounts

|

|

|

||||||

|

Deferred revenue

|

|

|

||||||

|

Other account payables and accrued expenses

|

|

|

||||||

|

Operating lease liabilities

|

|

|

||||||

|

Convertible notes, net

|

|

|

||||||

|

Total current liabilities

|

|

|

||||||

|

Long-term liabilities:

|

||||||||

|

Convertible notes, net

|

|

|

||||||

|

Operating lease liabilities

|

|

|

||||||

|

Other non-current liabilities

|

|

|

||||||

|

Total long-term liabilities

|

|

|

||||||

|

Total liabilities

|

$

|

|

$

|

|

||||

|

Commitments and contingencies (see note 13)

|

||||||||

|

Shareholders’ equity:

|

||||||||

|

Shares authorized:

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Accumulated deficit

|

(

|

)

|

(

|

)

|

||||

|

Accumulated other comprehensive income (loss)

|

|

(

|

)

|

|||||

|

Total shareholders’ equity

|

|

|

||||||

|

Total liabilities and shareholders’ equity

|

$

|

|

$

|

|

||||

|

|

Year ended December 31,

|

|||||||||||

|

|

2024

|

2023

|

2022

|

|||||||||

|

Revenue

|

$

|

|

$

|

|

$

|

|

||||||

|

Cost of revenue

|

|

|

|

|||||||||

|

Gross profit

|

|

|

|

|||||||||

|

Operating expenses:

|

||||||||||||

|

Research and development

|

|

|

|

|||||||||

|

Sales and marketing

|

|

|

|

|||||||||

|

General and administrative

|

|

|

|

|||||||||

|

Impairment of intangible assets

|

|

|

|

|||||||||

|

Total operating expenses

|

|

|

|

|||||||||

|

Operating loss

|

(

|

)

|

(

|

)

|

(

|

)

|

||||||

|

Financial income (expenses), net

|

|

|

|

|||||||||

|

Income (loss) before taxes on income

|

|

|

(

|

)

|

||||||||

|

Tax benefit (taxes on income)

|

|

(

|

)

|

(

|

)

|

|||||||

|

Net income (loss)

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

Basic net income (loss) per share attributable to ordinary shareholders

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

Basic weighted average ordinary shares

|

|

|

|

|||||||||

|

Diluted net income (loss) per share attributable to ordinary shareholders

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

Diluted weighted average ordinary shares

|

|

|

|

|||||||||

|

|

Year ended

December 31, |

|||||||||||

|

|

2024

|

2023

|

2022

|

|||||||||

|

Net income (loss)

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

Marketable securities:

|

||||||||||||

|

Unrealized gain (loss)

|

|

|

(

|

)

|

||||||||

|

Derivatives:

|

||||||||||||

|

Unrealized income (loss)

|

|

(

|

)

|

(

|

)

|

|||||||

|

Amounts reclassified from accumulated other comprehensive income (loss)

|

(

|

)

|

|

|

||||||||

|

Other comprehensive income (loss), net of taxes of $

|

|

|

(

|

)

|

||||||||

|

Comprehensive income (loss)

|

$

|

|

$

|

|

$

|

(

|

)

|

|||||

|

|

Number of

ordinary shares and protected ordinary shares |

Share capital

and additional paid-in capital |

Accumulated

deficit |

Accumulated

other comprehensive income (loss) |

Total

shareholders’ equity |

|||||||||||||||

|

Balance as of December 31, 2021

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

|||||||||

|

Share-based compensation

|

-

|

|

|

|

|

|||||||||||||||

|

Exercise of share options, vested RSUs and ESPP

|

|

|

|

|

|

|||||||||||||||

|

Cumulative effect of adopting ASU 2020-06

|

-

|

(

|

)

|

|

|

(

|

)

|

|||||||||||||

|

Net loss

|

-

|

|

(

|

)

|

|

(

|

)

|

|||||||||||||

|

Other comprehensive loss, net

|

-

|

|

|

(

|

)

|

(

|

)

|

|||||||||||||

|

Balance as of December 31, 2022

|

|

$

|

|

$

|

(

|

)

|

$

|

(

|

)

|

$

|

|

|||||||||

|