| | | | | | | | | | | |

REPORT TO SHAREHOLDERS | | |

| Year ended December 31, 2024 | |

| | | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS | |

| | | |

| | | |

| Table of Contents | | | |

| | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | |

| | | |

| | | |

Basis of Presentation

The following Management's Discussion and Analysis ("MD&A") of the financial and operating results of Pembina Pipeline Corporation ("Pembina" or the "Company") is dated February 27, 2025, and is supplementary to, and should be read in conjunction with, Pembina's audited consolidated financial statements as at and for the year ended December 31, 2024 ("Consolidated Financial Statements"). The Consolidated Financial Statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board, using the accounting policies described in Note 3 of the Consolidated Financial Statements. All dollar amounts contained in this MD&A are expressed in Canadian dollars unless otherwise noted. For further details on Pembina and Pembina's significant assets, including definitions for capitalized terms used herein and not otherwise defined, refer to Pembina's annual information form ("AIF") for the year ended December 31, 2024. Additional information about Pembina filed with Canadian and U.S. securities commissions, including quarterly and annual reports, annual information forms (filed with the U.S. Securities and Exchange Commission under Form 40-F) and management information circulars, can be found online at www.sedarplus.ca, www.sec.gov and through Pembina's website at www.pembina.com. Information contained in or otherwise accessible through Pembina's website does not form part of this MD&A and is not incorporated into this document by reference.

Abbreviations

For a list of abbreviations that may be used in this MD&A, refer to the Abbreviations section of this MD&A.

Non-GAAP and Other Financial Measures

Pembina has disclosed certain financial measures and ratios within this MD&A that management believes provide meaningful information in assessing Pembina's underlying performance, but which are not specified, defined or determined in accordance with the Canadian generally accepted accounting principles ("GAAP") and which are not disclosed in Pembina's Consolidated Financial Statements. Such non-GAAP financial measures and non-GAAP ratios do not have any standardized meaning prescribed by IFRS and may not be comparable to similar financial measures or ratios disclosed by other issuers. Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A for additional information regarding these non-GAAP measures and non-GAAP ratios.

Risk Factors and Forward-Looking Information

Management has identified the primary risk factors that could have a material impact on the financial results and operations of Pembina. Such risk factors are described in the "Risk Factors" section of this MD&A and are also included in Pembina's AIF. The Company's financial and operational performance is potentially affected by a number of factors, including, but not limited to, the factors described within the "Forward-Looking Statements & Information" section of this MD&A. This MD&A contains forward-looking statements based on Pembina's current expectations, estimates, projections and assumptions. This information is provided to assist readers in understanding the Company's future plans and expectations and may not be appropriate for other purposes.

Pembina Pipeline Corporation 2024 Annual Report 1

1. ABOUT PEMBINA

Pembina Pipeline Corporation is a leading energy transportation and midstream service provider that has served North America's energy industry for more than 70 years. Pembina owns an extensive network of strategically-located assets, including hydrocarbon liquids and natural gas pipelines, gas gathering and processing facilities, oil and natural gas liquids infrastructure and logistics services, and an export terminals business. Through our integrated value chain, we seek to provide safe and reliable energy solutions that connect producers and consumers across the world, support a more sustainable future and benefit our customers, investors, employees and communities. For more information, please visit www.pembina.com.

Pembina's Purpose and Strategy

We deliver extraordinary energy solutions so the world can thrive.

Pembina will build on its strengths by continuing to invest in and grow the core businesses that provide critical transportation and midstream services to help ensure reliable and secure energy supply. Pembina will capitalize on exciting opportunities to leverage its assets and expertise into new service offerings that enable the transition to a lower-carbon economy. In continuing to meet global energy demand and its customers' needs, while ensuring Pembina's long-term success and resilience, the Company has established four strategic priorities:

1.To be resilient, we will sustain, decarbonize, and enhance our businesses. This priority is focused on strengthening and growing our existing franchise and demonstrating environmental leadership.

2.To thrive, we will invest in the energy transition to improve the basins in which we operate. We will prioritize lighter commodities as we continue to invest in new infrastructure and expand our portfolio to include new businesses associated with lower-carbon commodities.

3.To meet global demand, we will transform and export our products. We will continue our focus on supporting the transformation of Western Canadian Sedimentary Basin commodities into higher margin products and enabling more coastal egress.

4.To set ourselves apart, we will create a differentiated experience for our stakeholders. We remain committed to delivering excellence for our four key stakeholder groups meaning that:

a.Employees say we are the 'employer of choice' and value our safe, respectful, collaborative, and inclusive work culture.

b.Communities welcome us and recognize the net positive impact of our social and environmental commitment.

c.Customers choose us first for reliable and value-added services.

d.Investors receive sustainable industry-leading total returns.

2 Pembina Pipeline Corporation 2024 Annual Report

Alliance/Aux Sable Acquisition

On April 1, 2024, Pembina completed the acquisition of Enbridge Inc.'s ("Enbridge") interests in the Alliance, Aux Sable, and NRGreen joint ventures (the "Acquirees") for an aggregate purchase price of $2.8 billion, net of $327 million of assumed debt, representing Enbridge's proportionate share of the indebtedness of Alliance (the "Alliance/Aux Sable Acquisition" or the "Acquisition"). Pursuant to the Acquisition, Pembina acquired all equity interests in Alliance, Aux Sable's Canadian operations, and NRGreen businesses, and an 85.4 percent interest in Aux Sable's U.S. operations. The accounting for the results of the Acquirees changed from the equity method of accounting to being fully consolidated and incorporated into Pembina's financial results commencing April 1, 2024. Following the Acquisition, Alliance and NRGreen are fully consolidated into the financial results of the Pipelines Division, while Aux Sable is reported within the Facilities Division and Marketing & New Ventures Division. Refer to Note 5 to the Consolidated Financial Statements for more information. On August 1, 2024, Pembina acquired the remaining 14.6 percent interest in Aux Sable's U.S. operations from certain subsidiaries of The Williams Companies for U.S. $160 million.

The Alliance/Aux Sable Acquisition was funded through a combination of: (i) the net proceeds of Pembina's bought deal offering of 29.9 million subscription receipts (the "Subscription Receipt Offering"), which closed on December 19, 2023; (ii) a portion of the net proceeds of the offering of $1.8 billion aggregate principal amount of senior unsecured medium-term notes (the "January MTN Offering"), which closed on January 12, 2024; and (iii) amounts drawn under Pembina's credit facilities and cash on hand. Refer to the "Share Capital" and "Liquidity & Capital Resources – Financing Activity" sections of this MD&A for additional information.

The Cedar LNG Project

On June 25, 2024, the Haisla Nation and Pembina, partners in Cedar LNG Partners LP ("Cedar LNG"), announced a positive Final Investment Decision ("FID") in respect of the Cedar LNG project (the "Cedar LNG Project"), a floating liquefied natural gas facility located in Kitimat, British Columbia, Canada, within the traditional territory of the Haisla Nation. Refer to the "Segment Results – Marketing & New Ventures Division – Projects & New Developments" section of this MD&A for additional information.

Pembina Pipeline Corporation 2024 Annual Report 3

2. FINANCIAL & OPERATING OVERVIEW

Consolidated Financial Overview for the Three Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2024 | 2023 | Change | |

Revenue(1) | 2,145 | | 1,836 | | 309 | | |

Net revenue(1)(2) | 1,383 | | 1,142 | | 241 | | |

| | | | |

Gross profit | 1,024 | | 850 | | 174 | | |

Adjusted EBITDA(2) | 1,254 | | 1,033 | | 221 | | |

| | | | |

Earnings | 572 | | 698 | | (126) | | |

Earnings per common share – basic and diluted (dollars) | 0.92 | | 1.21 | | (0.29) | | |

| | | | |

| Cash flow from operating activities | 902 | | 880 | | 22 | | |

Cash flow from operating activities per common share – basic (dollars) | 1.55 | | 1.60 | | (0.05) | | |

Adjusted cash flow from operating activities(2) | 922 | | 747 | | 175 | | |

Adjusted cash flow from operating activities per common share – basic (dollars)(2) | 1.59 | | 1.36 | | 0.23 | | |

| Capital expenditures | 242 | | 177 | | 65 | | |

| | | | |

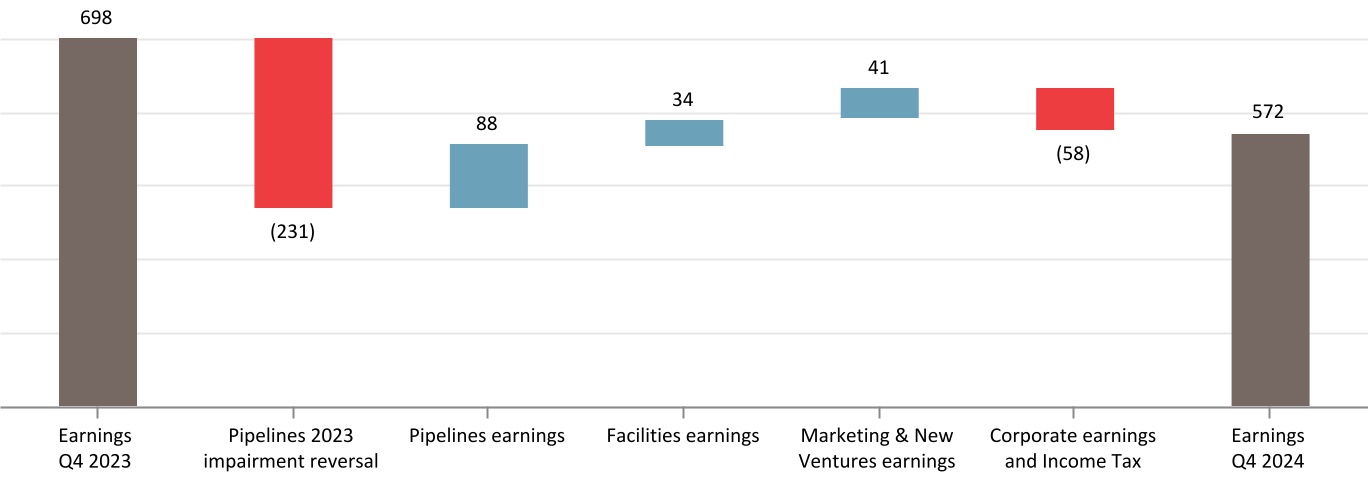

Change in Earnings ($ millions)

Results Overview

Earnings in the fourth quarter of 2024 decreased by $126 million compared to the prior period, which included the reversal of impairment related to the reactivation of the Nipisi Pipeline. Other significant factors impacting the quarter by segment include:

•Pipelines: Positive impacts from the Alliance/Aux Sable Acquisition, partially offset by lower net revenue on the Cochin Pipeline.

•Facilities: Positive impacts from Pembina acquiring a controlling ownership interest in Aux Sable following the Acquisition, and higher share of profit from equity accounted investees ("Share of Profit") from PGI largely due to higher contributions from certain PGI assets and unrealized gains on interest rate derivative financial instruments.

•Marketing & New Ventures: Higher net revenue driven by higher NGL margins, and the Acquisition, as well as higher Share of Profit from Cedar LNG largely due to unrealized gains on interest rate derivative financial instruments. This was partially offset by unrealized losses on risk management and physical derivative contracts in the quarter compared to gains in the fourth quarter of 2023.

•Corporate and Income Tax: Higher income tax expense, driven by the recognition of deferred tax assets in the fourth quarter of 2023, which lowered income tax expense in 2023, partially offset by lower consolidated earnings. Additionally, higher net finance costs, largely due to higher interest expense, were largely offset by lower incentive costs.

Additional factors impacting the segments are discussed in the table below and in the "Segment Results" section of this MD&A.

4 Pembina Pipeline Corporation 2024 Annual Report

| | | | | | |

Changes in Results for the Three Months Ended December 31 |

Net revenue(1)(2) | | $241 million increase, largely due to the Acquisition, in which Pembina acquired a controlling ownership interest in Alliance and Aux Sable, resulting in a change from equity accounting to being fully consolidated on April 1, 2024. Refer to the "About Pembina – Alliance/Aux Sable Acquisition" section of this MD&A. The fourth quarter of 2024 includes $306 million in consolidated net revenue related to Alliance and Aux Sable as wholly-owned entities. In addition, the Marketing & New Ventures Division saw increased net revenue from contracts with customers, largely due to higher NGL margins. There was also higher net revenue in the Pipelines Division, related to the timing of capital recovery recognition on certain Pipelines assets ($23 million).

These results were partially offset by unrealized losses on crude oil-based and NGL-based derivatives in the fourth quarter of 2024, compared to gains in the fourth quarter of 2023, and lower realized gains on crude oil-based derivatives. Additionally, on the Cochin Pipeline, net revenue decreased by $40 million due to lower tolls on new contracts ($33 million), which replaced long-term contracts that expired in mid-July 2024, and lower interruptible demand during the period resulting from a narrower condensate price differential between western Canada and the U.S. Gulf Coast. |

| | |

| Operating expenses | | $53 million increase, primarily due to operating expenses from Alliance and Aux Sable now being fully consolidated, combined with higher integrity spending and higher recoverable geotechnical costs on certain Pipelines assets, partially offset by lower recoverable power costs. The fourth quarter of 2024 includes $52 million in operating expenses related to Alliance and Aux Sable as wholly-owned entities. |

| | |

| | |

| | |

| Cash flow from operating activities | | $22 million increase, primarily driven by an increase in earnings adjusted for items not involving cash, partially offset by the change in non-cash working capital. Additionally, lower distributions from equity accounted investees and higher net interest paid, both largely a result of the Acquisition, further offset the increase. |

Adjusted cash flow from operating activities(2) | | $175 million increase, primarily due to the same items impacting cash flow from operating activities, discussed above, excluding the change in non-cash working capital, combined with lower accrued share-based payment expense, partially offset by higher current income tax expense. |

Adjusted EBITDA(2) | | $221 million increase, largely due to approximately $105 million related to Pembina's increased ownership interest in the Acquirees and approximately $50 million from improved NGL margins and asset performance in the Acquirees, as well as higher NGL margins in the NGL marketing business and lower incentives costs. Additionally, there was higher net revenue of $37 million related to the timing of capital recovery recognition on certain Pipelines assets and at PGI, and higher contributions from PGI, largely due to higher revenue associated with the oil batteries acquired from Veren Inc. ("Veren") in the fourth quarter of 2024 and higher volumes at certain PGI assets.

These results were partially offset by lower net revenue on the Cochin Pipeline, combined with lower realized gains on crude oil-based derivatives. |

| | |

(1) Comparative 2023 period has been adjusted. See "Accounting Policies & Estimates – Change in Accounting Policies" and Note 4 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

Pembina Pipeline Corporation 2024 Annual Report 5

Consolidated Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2024 | 2023 | Change | |

Revenue(1) | 7,384 | | 6,331 | | 1,053 | | |

Net revenue(1)(2) | 4,776 | | 3,973 | | 803 | | |

| | | | |

Gross profit | 3,316 | | 2,840 | | 476 | | |

Adjusted EBITDA(2) | 4,408 | | 3,824 | | 584 | | |

| | | | |

Earnings | 1,874 | | 1,776 | | 98 | | |

Earnings per common share – basic (dollars) | 3.00 | | 3.00 | | — | | |

Earnings per common share – diluted (dollars) | 3.00 | | 2.99 | | 0.01 | | |

| Cash flow from operating activities | 3,214 | | 2,635 | | 579 | | |

Cash flow from operating activities per common share – basic (dollars) | 5.61 | | 4.79 | | 0.82 | | |

Adjusted cash flow from operating activities(2) | 3,265 | | 2,646 | | 619 | | |

Adjusted cash flow from operating activities per common share – basic (dollars)(2) | 5.70 | | 4.81 | | 0.89 | | |

| Capital expenditures | 955 | | 606 | | 349 | | |

| | | | |

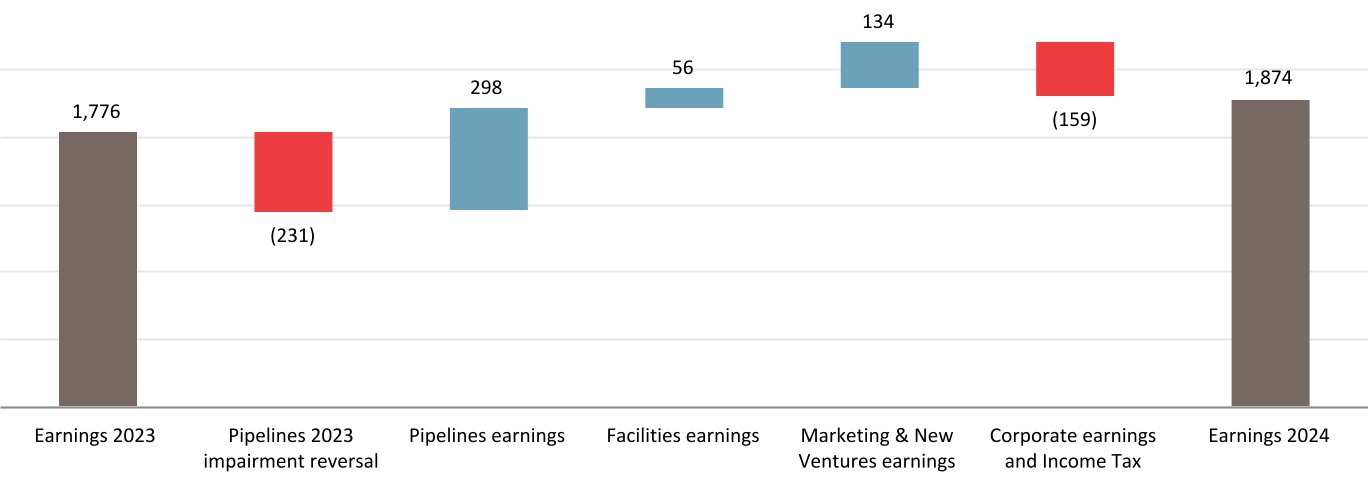

Change in Earnings ($ millions)

Results Overview

Earnings during 2024 increased by $98 million compared to the prior year, which included the reversal of impairment related to the reactivation of the Nipisi Pipeline. Other significant factors impacting the period by segment include:

•Pipelines: Positive impacts from the Alliance/Aux Sable Acquisition, and the 2024 period not being impacted by the Northern Pipeline system outage and the wildfires in Alberta and British Columbia that affected 2023. Additionally, there were higher net revenues due to increased volumes on certain Pipelines assets and contractual inflation adjustments on tolls. These were partially offset by the reversal of impairment related to the Nipisi Pipeline reactivation, and lower net revenue on the Cochin Pipeline.

•Facilities: Positive impacts from Pembina acquiring a controlling ownership interest in Aux Sable following the Acquisition and the 2024 period not being impacted by the Northern Pipeline system outage that affected 2023, partially offset by a gain on the recognition of a finance lease included in other income in 2023.

•Marketing & New Ventures: Positive impacts from higher NGL margins and the Acquisition, higher Share of Profit from Cedar LNG, and higher other income due to gains related to Pembina's financial assurances assumed by Cedar LNG. These factors were partially offset by losses on risk management and physical derivative contracts, which included larger unrealized losses and realized losses in the period, compared to realized gains in 2023.

•Corporate and Income Tax: Higher interest expense, and higher acquisition and integration costs, were partially offset by the net impact of the deferred tax recovery recognized from the Acquisition and the loss on Acquisition recognized during the second quarter of 2024, combined with lower general & administrative costs.

Additional factors impacting the segments are discussed in the table below and in the "Segment Results" section of this MD&A.

6 Pembina Pipeline Corporation 2024 Annual Report

| | | | | | |

Changes in Results for the 12 Months Ended December 31 |

Net revenue(1)(2) | | $803 million increase, largely due to the Acquisition, in which Pembina acquired a controlling ownership interest in Alliance and Aux Sable. The 2024 period includes $851 million in consolidated net revenue related to Alliance and Aux Sable as wholly-owned entities. Additionally, there were higher net revenues in the Pipelines and Facilities Divisions due to higher volumes compared to 2023, which was impacted by the Northern Pipeline system outage and the wildfires. Higher contracted volumes primarily on the Peace Pipeline system, contractual inflation adjustments on tolls, the reactivation of the Nipisi Pipeline, and higher net revenue largely related to the timing of capital recovery recognition on certain Pipelines assets ($23 million), further contributed to the increase. Higher net revenue in the Marketing & New Ventures Division was driven by higher NGL margins and the impacts of the Acquisition, as well as lower unrealized losses on NGL-based derivatives.

These results were partially offset by lower revenue from risk management and physical derivative contracts due to larger unrealized losses on renewable power purchase agreements, combined with realized losses on NGL-based derivatives and unrealized losses on crude oil-based derivatives in 2024, compared to gains in 2023. Lower operating recoveries were largely related to lower power costs in the Pipelines and Facilities Divisions. Additionally, on the Cochin Pipeline, there was lower net revenue due to lower tolls on new contracts ($54 million), which replaced long-term contracts that expired in mid-July 2024, lower volumes from a contracting gap from mid-July to August 1, 2024 associated with the return of line fill to certain customers, and lower interruptible demand during the year resulting from a narrower condensate price differential between western Canada and the U.S. Gulf Coast. This is combined with a nine-day unplanned outage at Aux Sable in July 2024 ($13 million) which also partially offset the increase in net revenue. |

| | |

| Operating expenses | | $151 million increase, primarily due to operating expenses from Alliance and Aux Sable now being fully consolidated, combined with higher recoverable geotechnical costs and higher integrity spending. The 2024 period includes $159 million in consolidated operating expenses related to Alliance and Aux Sable as wholly-owned entities. These increases were partially offset by lower recoverable power costs, and lower costs in the Pipelines Division in 2024 compared to 2023, as 2023 was impacted by the Northern Pipeline system outage. |

| | |

| Cash flow from operating activities | | $579 million increase, primarily driven by an increase in earnings adjusted for items not involving cash, the change in non-cash working capital, and an increase in payments collected through contract liabilities. This is partially offset by lower distributions from equity accounted investees and higher net interest paid, both largely a result of the Acquisition, as well as higher taxes paid and share-based payments. |

Adjusted cash flow from operating activities(2) | | $619 million increase, primarily due to the same items impacting cash flow from operating activities, discussed above, excluding the change in non-cash working capital, taxes paid, and share-based payments, combined with lower current income tax expense. The increase was partially offset by higher accrued share-based payment expense, distributions to non-controlling interest, and higher preferred dividends paid. |

Adjusted EBITDA(2) | | $584 million increase, largely due to approximately $230 million related to Pembina's increased ownership interest in the Acquirees and approximately $210 million from improved NGL margins and asset performance in the Acquirees. Additional contributors included higher net revenue and volumes on certain of Pembina's Pipelines and Facilities assets compared to 2023, which was affected by the Northern Pipeline system outage and the wildfires, as well as higher NGL margins in the NGL marketing business and increased marketed volumes in the Marketing & New Ventures Division. Higher adjusted EBITDA from PGI also contributed to the increase, largely due to higher revenue associated with the oil batteries acquired from Veren in the fourth quarter of 2024 and higher volumes at certain PGI assets. Other factors included higher contracted volumes on the Peace Pipeline system, contractual inflation adjustments on tolls, the reactivation of the Nipisi Pipeline, and a $37 million increase in net revenue related to the timing of capital recovery recognition on certain Pipelines assets and at PGI.

These results were partially offset by realized losses on NGL-based derivatives compared to gains in 2023, and lower net revenue on the Cochin Pipeline, combined with a change to other expense in the Facilities Division, compared to other income in 2023, which included a gain on the recognition of a finance lease, and a nine-day unplanned outage at Aux Sable in July 2024. |

| | |

(1) Comparative 2023 period has been adjusted. See "Accounting Policies & Estimates – Change in Accounting Policies" and Note 4 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

Pembina Pipeline Corporation 2024 Annual Report 7

3. SEGMENT RESULTS

Business Overview

The Pipelines Division provides customers with pipeline transportation, terminalling, and storage in key market hubs in Canada and the United States for crude oil, condensate, natural gas liquids and natural gas. The Pipelines Division manages pipeline transportation capacity of 3.0 mmboe/d(1) and above ground storage capacity of approximately 10 mmbbls(1) within its conventional, oil sands and heavy oil, and transmission assets. The conventional assets include strategically located pipelines and terminalling hubs that gather and transport light and medium crude oil, condensate and natural gas liquids from western Alberta and northeast British Columbia to downstream pipelines and processing facilities in the Edmonton, Alberta area. The oil sands and heavy oil assets transport heavy and synthetic crude oil produced within Alberta to the Edmonton, Alberta area and offer associated storage and terminalling. The transmission assets transport natural gas, ethane and condensate throughout Canada and the United States on long haul pipelines linking various key market hubs. In addition, the Pipelines Division assets provide linkages to Pembina's Facilities Division assets across North America, enhancing flexibility and optionality in our customer service offerings. Together, these assets supply products from hydrocarbon producing regions to refineries, fractionators and market hubs in Alberta, British Columbia, and Illinois, as well as other regions throughout North America.

The Facilities Division includes infrastructure that provides Pembina's customers with natural gas, condensate and NGL services. Through its wholly-owned assets and its interest in PGI, Pembina's natural gas gathering and processing facilities are strategically positioned in active, liquids-rich areas of the WCSB and Williston Basin and may be serviced by the Company's other businesses. Pembina provides sweet and sour gas gathering, compression, condensate stabilization, and both shallow cut and deep cut gas processing services with a total capacity of approximately 6.7 bcf/d(1) for its customers. Condensate and NGL extracted at virtually all Canadian-based facilities have access to transportation on Pembina's pipelines. In addition, all NGL transported along the Alliance Pipeline are extracted through the Channahon Facility at the terminus. The Facilities Division includes approximately 430 mbpd(1) of NGL fractionation capacity, 21 mmbbls(1) of cavern storage capacity, various oil batteries, associated pipeline and rail terminalling facilities and a liquefied propane export facility on Canada's West Coast. These facilities are accessible to Pembina's other strategically-located assets and pipeline systems, providing customers with flexibility and optionality to access a comprehensive suite of services to enhance the value of their hydrocarbons. In addition, Pembina owns a bulk marine import/export terminal in Vancouver, British Columbia.

The Marketing & New Ventures Division leverages Pembina's integrated value chain and existing network of pipelines, facilities, and energy infrastructure assets to maximize the value of hydrocarbon liquids and natural gas originating in the basins where the Company operates. Pembina pursues the creation of new markets, and further enhances existing markets, to support both the Company's and its customers' business interests. In particular, Pembina seeks to identify opportunities to connect hydrocarbon production to new demand locations through the development of infrastructure.

Within the Marketing & New Ventures Division, Pembina undertakes value-added commodity marketing activities, including buying and selling products (natural gas, ethane, propane, butane, condensate, crude oil, electricity, and carbon credits), commodity arbitrage, and optimizing storage opportunities. The marketing business enters into contracts for capacity on both Pembina's and third-party infrastructure, handles proprietary and customer volumes and aggregates production for onward sale. Through this infrastructure capacity, including Pembina's Prince Rupert Terminal, as well as utilizing the Company's expansive rail fleet and logistics capabilities, Pembina's marketing business adds incremental value to the commodities by accessing high value markets across North America and globally.

The Marketing & New Ventures Division is also responsible for the development of new large-scale, or value chain extending projects, including those that provide enhanced access to global markets and support a transition to a lower-carbon economy. The Marketing & New Ventures Division includes Pembina's interest in the Cedar LNG Project, a liquified natural gas ("LNG") export facility currently under construction. Additionally, Pembina is pursuing opportunities associated with low-carbon commodities and large-scale greenhouse gas ("GHG") emissions reductions.

(1)Net capacity.

8 Pembina Pipeline Corporation 2024 Annual Report

Financial and Operational Overview by Division

| | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 |

| 2024 | 2023 |

($ millions, except where noted) | Volumes(1) | Earnings (Loss) | | | Adjusted EBITDA(2) | Volumes(1) | Earnings (Loss) | | | Adjusted EBITDA(2) |

| Pipelines | 2,790 | | 534 | | | | 686 | | 2,652 | | 677 | | | | 617 | |

| Facilities | 877 | | 177 | | | | 373 | | 801 | | 143 | | | | 324 | |

Marketing & New Ventures | 349 | | 245 | | | | 234 | | 299 | | 204 | | | | 173 | |

| Corporate | — | | (212) | | | | (39) | | — | | (209) | | | | (81) | |

| | | | | | | | | | |

| Income tax expense | — | | (172) | | | | — | | — | | (117) | | | | — | |

| Total | | 572 | | | | 1,254 | | | 698 | | | | 1,033 | |

| | | | | | | | | | |

| |

| | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| 12 Months Ended December 31 |

| 2024 | 2023 |

($ millions, except where noted) | Volumes(1) | Earnings (Loss) | | | Adjusted EBITDA(2) | Volumes(1) | Earnings (Loss) | | | Adjusted EBITDA(2) |

| Pipelines | 2,711 | | 1,907 | | | | 2,533 | | 2,538 | | 1,840 | | | | 2,234 | |

| Facilities | 837 | | 666 | | | | 1,347 | | 768 | | 610 | | | | 1,213 | |

Marketing & New Ventures | 327 | | 569 | | | | 724 | | 271 | | 435 | | | | 597 | |

| Corporate | — | | (1,422) | | | | (196) | | — | | (696) | | | | (220) | |

| | | | | | | | | | |

| Income tax expense/recovery | — | | 154 | | | | — | | — | | (413) | | | | — | |

| Total | | 1,874 | | | | 4,408 | | | 1,776 | | | | 3,824 | |

| | | | | | | | | | |

| |

| | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

(1) Volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition. Volumes for Pipelines and Facilities divisions are revenue volumes, which are physical volumes plus volumes recognized from take-or-pay commitments. Volumes for Marketing & New Ventures are marketed crude and NGL volumes.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

Equity Accounted Investees Overview by Division

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 |

| | | | |

| 2024 | 2023 |

| ($ millions, except where noted) | Share of profit | Adjusted EBITDA(4) | Contributions | Distributions(5) | Volumes(6) | Share of profit | Adjusted EBITDA(4) | Contributions | Distributions(5) | Volumes(6) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Pipelines(1) | — | | — | | — | | — | | — | | 31 | | 76 | | 19 | | 79 | | 142 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Facilities(2) | 59 | | 195 | | — | | 131 | | 358 | | 48 | | 183 | | — | | 123 | | 356 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Marketing & New Ventures(3) | 74 | | — | | — | | — | | — | | 15 | | 21 | | 183 | | 25 | | 35 | |

| Total | 133 | | 195 | | — | | 131 | | 358 | | 94 | | 280 | | 202 | | 227 | | 533 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 12 Months Ended December 31 |

| | | | |

| 2024 | 2023 |

| ($ millions, except where noted) | Share of profit | Adjusted EBITDA(4) | Contributions | Distributions(5) | Volumes(6) | Share of profit (loss) | Adjusted EBITDA(4) | Contributions | Distributions(5) | Volumes(6) |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Pipelines(1) | 42 | | 88 | | 5 | | 80 | | 37 | | 109 | | 281 | | 20 | | 279 | | 140 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Facilities(2) | 231 | | 717 | | 124 | | 515 | | 358 | | 233 | | 671 | | 33 | | 470 | | 351 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Marketing & New Ventures(3) | 55 | | 39 | | 242 | | 31 | | 9 | | (26) | | 58 | | 218 | | 70 | | 34 | |

| Total | 328 | | 844 | | 371 | | 626 | | 404 | | 316 | | 1,010 | | 271 | | 819 | | 524 | |

(1) Pipelines includes Alliance and Grand Valley. Pembina owned a 50 percent interest in Alliance up to the closing of the Alliance/Aux Sable Acquisition on April 1, 2024. Refer to the "About Pembina – Alliance/Aux Sable Acquisition" and "Abbreviations" sections of this MD&A for more information.

(2) Facilities includes PGI and Fort Corp.

(3) Marketing and New Ventures includes Aux Sable, Cedar LNG, and ACG. Pembina owned approximately a 42.7 percent ownership in Aux Sable's U.S operations and a 50 percent ownership in Aux Sable's Canadian operations up to the closing of the Alliance/Aux Sable Acquisition on April 1, 2024. Refer to the "About Pembina – Alliance/Aux Sable Acquisition" and "Abbreviations" sections of this MD&A for more information.

(4) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(5) Distributions exclude returns of capital. In 2024, Pembina received an incremental $63 million from Cedar LNG as a return of capital (2023: $61 million from PGI).

(6) Volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

In 2024, contributions in the Facilities Division were made to PGI to partially fund growth capital projects and the previously announced acquisition of midstream assets. Contributions in Marketing & New Ventures in 2024 were made to Cedar LNG to fund the Cedar LNG Project. Refer to the "Segment Results – Marketing & New Ventures Division – Projects & New Developments" sections of this MD&A for additional information.

Pembina Pipeline Corporation 2024 Annual Report 9

Pipelines

Financial Overview for the Three Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2024 | 2023 | Change | |

| | | | |

| | | | |

| | | | |

Pipelines revenue(1) | 948 | | 737 | | 211 | | |

Cost of goods sold(1) | 5 | | 11 | | (6) | | |

Net revenue(1)(2) | 943 | | 726 | | 217 | | |

Operating expenses(1) | 231 | | 171 | | 60 | | |

| Depreciation and amortization included in gross profit | 147 | | 110 | | 37 | | |

| Share of profit from equity accounted investees | — | | 31 | | (31) | | |

| Gross profit | 565 | | 476 | | 89 | | |

| Earnings | 534 | | 677 | | (143) | | |

Adjusted EBITDA(2) | 686 | | 617 | | 69 | | |

Volumes(3) | 2,790 | | 2,652 | | 138 | | |

| | | | | | |

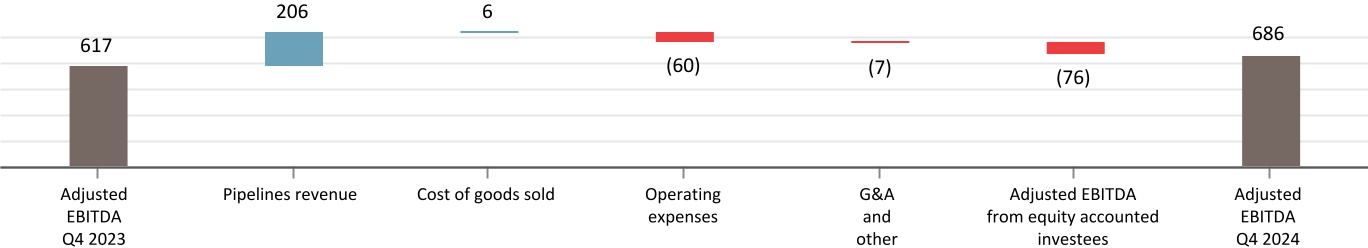

| Change in Results | | |

| | |

| | |

| | |

Net revenue(1)(2) | | Higher largely due to the Acquisition, in which Pembina acquired a controlling ownership interest in Alliance. The fourth quarter of 2024 includes $227 million in net revenue related to Alliance as a wholly-owned entity. Additionally, higher revenue related to the timing of capital recovery recognition on certain Pipelines assets ($23 million), and increasing volumes on the Nipisi Pipeline following its reactivation in October 2023, also contributed to the increase in net revenue. These increases were partially offset by lower net revenue on the Cochin Pipeline due to lower tolls on new contracts ($33 million), which replaced long-term contracts that expired in mid-July 2024, and lower interruptible demand during the period resulting from a narrower condensate price differential between western Canada and the U.S. Gulf Coast. Net revenues on the Peace Pipeline system were consistent as higher contracted volumes and contractual inflation adjustments on tolls were largely offset by earlier recognition of take-or-pay deferred revenue during the first half of 2024, as well as net loss allowance. |

| | |

Operating expenses(1) | | Increase largely due to the Acquisition. The fourth quarter of 2024 includes $54 million in operating expenses related to Alliance as a wholly-owned entity. |

| Depreciation and amortization included in gross profit | | Higher largely due to the Acquisition, combined with the reactivation of the Nipisi Pipeline, partially offset by fewer asset retirements compared to the fourth quarter of 2023. |

| Share of profit from equity accounted investees | | Following the Acquisition on April 1, 2024, the results from Alliance are no longer accounted for in Share of Profit and are now being fully consolidated. |

| Earnings | | Decrease largely due to the reversal of impairment related to the reactivation of the Nipisi Pipeline which increased revenue in the fourth quarter of 2023 by $231 million, combined with lower net revenue on the Cochin Pipeline. This was partially offset by the net impacts of the Acquisition, higher revenue related to the timing of capital recovery recognition on certain Pipelines assets, and increasing volumes on the Nipisi Pipeline following its reactivation in October 2023. |

Adjusted EBITDA(2) | | Increase largely due to the net impacts of the Acquisition, combined with higher revenue related to the timing of capital recovery recognition on certain Pipelines assets, higher adjusted EBITDA from Alliance driven by higher demand on seasonal contracts, and increasing volumes on the Nipisi Pipeline following its reactivation in October 2023. This was partially offset by lower net revenue on the Cochin Pipeline. |

Volumes(3) | | Higher largely due to the Acquisition, discussed above, combined with the reactivation of the Nipisi Pipeline. The increase was partially offset by lower volumes on the Peace Pipeline system due to earlier recognition of take-or-pay deferred revenue in the first half of 2024, which more than offset the increase from higher contracted volumes. Additionally, lower volumes on the Cochin Pipeline were largely due to lower interruptible demand during the period resulting from a narrower condensate price differential between western Canada and the U.S. Gulf Coast. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 6 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

10 Pembina Pipeline Corporation 2024 Annual Report

Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2024 | 2023 | Change | |

| | | | |

| | | | |

| | | | |

Pipelines revenue(1) | 3,386 | | 2,707 | | 679 | | |

Cost of goods sold(1) | 40 | | 17 | | 23 | | |

Net revenue(1)(2) | 3,346 | | 2,690 | | 656 | | |

Operating expenses(1) | 832 | | 695 | | 137 | | |

| Depreciation and amortization included in gross profit | 557 | | 414 | | 143 | | |

| Share of profit from equity accounted investees | 42 | | 109 | | (67) | | |

| Gross profit | 1,999 | | 1,690 | | 309 | | |

| Earnings | 1,907 | | 1,840 | | 67 | | |

Adjusted EBITDA(2) | 2,533 | | 2,234 | | 299 | | |

Volumes(3) | 2,711 | | 2,538 | | 173 | | |

| | | | | | |

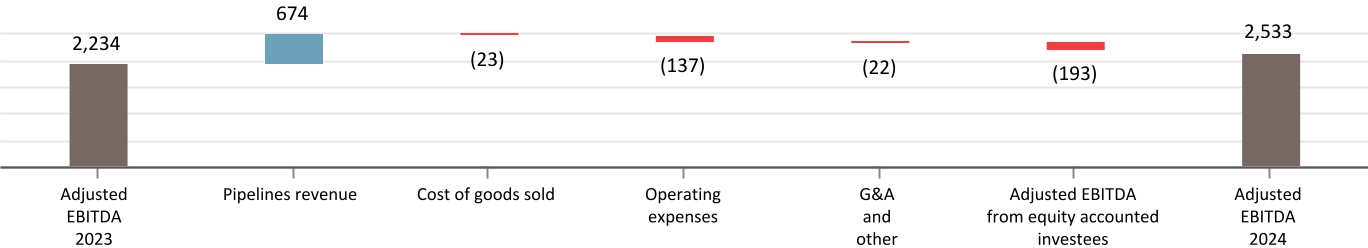

| Change in Results | | |

| | |

| | |

| | |

Net revenue(1)(2) | | Higher largely due to the Acquisition, in which Pembina acquired a controlling ownership interest in Alliance. The 2024 period includes $622 million in net revenue related to Alliance as a wholly-owned entity. Also contributing to the increase in net revenue were contractual inflation adjustments on tolls, higher volumes compared to 2023, which was impacted by the Northern Pipeline system outage and the wildfires, and higher contracted volumes on the Peace Pipeline system. The reactivation of the Nipisi Pipeline, and higher net revenue related to the timing of capital recovery recognition on certain Pipelines assets ($23 million) also contributed to the increase. These factors were partially offset by lower net revenue on the Cochin Pipeline due to lower tolls on new contracts ($54 million), which replaced long-term contracts that expired in mid-July 2024, lower volumes from a contracting gap from mid-July to August 1, 2024 associated with the return of line fill to certain customers, and lower interruptible demand during the period resulting from a narrower condensate price differential between western Canada and the U.S. Gulf Coast. Lower recoverable power costs and project costs also contributed to the decrease in net revenue. |

| | |

Operating expenses(1) | | Increase largely due to the Acquisition, discussed above, higher recoverable geotechnical costs, and higher integrity spending. The 2024 period includes $156 million in operating expenses related to Alliance as a wholly-owned entity. These increases are partially offset by lower recoverable power costs resulting from a lower power pool price, and lower costs as 2023 was impacted by the Northern Pipeline system outage. |

Depreciation and amortization included in gross profit | | Higher largely due to the Acquisition, discussed above, combined with the reactivation of the Nipisi Pipeline, partially offset by fewer asset retirements in 2024 compared to 2023. |

Share of profit from equity accounted investees | | Following the Acquisition on April 1, 2024, the results from Alliance are no longer accounted for in Share of Profit and are now being fully consolidated. |

| Earnings | | Higher largely due to the net impacts of the Acquisition, and no impacts in 2024 from the Northern Pipeline system outage and the wildfires, which affected 2023. Higher net revenue and volumes, primarily on the Peace Pipeline system and on the Nipisi Pipeline, contractual inflation adjustments on tolls, and higher net revenue related to the timing of capital recovery recognition on certain Pipelines assets also contributed to the increase. These results were partially offset by the reversal of impairment related to the reactivation of the Nipisi Pipeline in the fourth quarter of 2023 ($231 million), and lower net revenue and volumes on the Cochin Pipeline in 2024. |

Adjusted EBITDA(2) | | Increase largely due to the same factors impacting earnings, discussed above, excluding the reversal of impairment. Higher demand on seasonal contracts also contributed to higher adjusted EBITDA from Alliance. |

Volumes(3) | | Higher largely due to the Acquisition, and the reactivation of the Nipisi Pipeline, combined with higher volumes compared to 2023 which was impacted by the Northern Pipeline system outage and the wildfires, and higher volumes on the Peace Pipeline system due to higher contracted volumes. The increase was partially offset by lower volumes on the Cochin Pipeline resulting from a contracting gap from mid-July to August 1, 2024 associated with the return of line fill to certain customers, and lower interruptible demand resulting from a narrower condensate price differential between western Canada and the U.S. Gulf Coast. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 6 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation 2024 Annual Report 11

Financial and Operational Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 | 12 Months Ended December 31 |

| | |

| 2024 | 2023 | 2024 | 2023 |

| ($ millions, except where noted) | Volumes(1) | Earnings | Adjusted EBITDA(2) | Volumes(1) | Earnings | Adjusted EBITDA(2) | Volumes(1) | Earnings | Adjusted EBITDA(2) | Volumes(1) | Earnings | Adjusted EBITDA(2) |

Pipelines(3) | | | | | | | | | | | | |

| Conventional | 1,034 | | 322 | | 374 | | 1,054 | | 311 | | 370 | | 1,001 | | 1,153 | | 1,374 | | 968 | | 1,085 | | 1,296 | |

| Transmission | 720 | | 160 | | 224 | | 590 | | 117 | | 189 | | 687 | | 592 | | 865 | | 586 | | 421 | | 702 | |

| Oil Sands & Heavy Oil | 1,036 | | 53 | | 89 | | 1,008 | | 251 | | 60 | | 1,023 | | 166 | | 298 | | 984 | | 341 | | 243 | |

| General & administrative | — | | (1) | | (1) | | — | | (2) | | (2) | | — | | (4) | | (4) | | — | | (7) | | (7) | |

| Total | 2,790 | | 534 | | 686 | | 2,652 | | 677 | | 617 | | 2,711 | | 1,907 | | 2,533 | | 2,538 | | 1,840 | | 2,234 | |

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's conventional, transmission and oil sands and heavy oil assets within the Pipelines Division. Refer to Pembina's AIF for the year ended December 31, 2024.

Projects & New Developments(1)

Pipelines continues to focus on the execution of various system expansions. The projects in the following table were placed into service in 2024.

| | | | | |

| Significant Projects | In-service Date |

Phase VIII Peace Pipeline Expansion | May 2024 |

| NEBC MPS Expansion | November 2024 |

|

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2024 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

12 Pembina Pipeline Corporation 2024 Annual Report

Facilities

Financial Overview for the Three Months Ended December 31

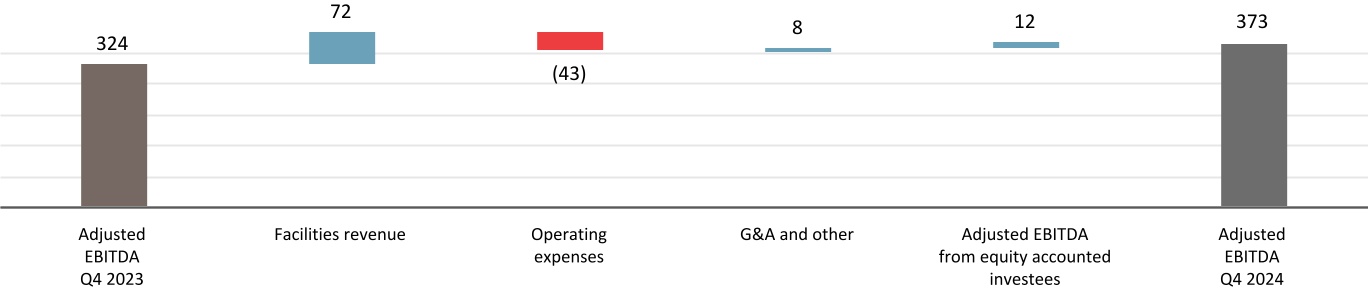

Results of Operations | | | | | | | | | | | | |

| ($ millions, except where noted) | 2024 | 2023 | Change | |

| | | | |

| | | | |

Facilities revenue(1) | 320 | | 248 | | 72 | | |

| | | | |

| | | | |

Operating expenses(1) | 138 | | 95 | | 43 | | |

Depreciation and amortization included in gross profit | 55 | | 46 | | 9 | | |

Share of profit from equity accounted investees | 59 | | 48 | | 11 | | |

| Gross profit | 186 | | 155 | | 31 | | |

| Earnings | 177 | | 143 | | 34 | | |

Adjusted EBITDA(2) | 373 | | 324 | | 49 | | |

Volumes(3) | 877 | | 801 | | 76 | | |

| | | | | | |

| Changes in Results | | |

| | |

| | |

Revenue(1) | | Increase largely due to Pembina acquiring a controlling ownership interest in Aux Sable, pursuant to the Alliance/Aux Sable Acquisition on April 1, 2024. The fourth quarter of 2024 includes $82 million in revenue related to Aux Sable as a wholly-owned entity. |

Operating expenses(1) | | Increase largely due to the Acquisition, discussed above. The fourth quarter of 2024 includes $50 million in operating expenses related to Aux Sable as a wholly-owned entity. |

| | |

Share of profit from equity accounted investees | | Increase due to higher contributions from certain PGI assets, driven by higher revenue associated with the oil batteries acquired from Veren in the fourth quarter of 2024, higher volumes at certain PGI assets, and the timing of revenue recognition on capital recoveries ($14 million). Additionally, PGI recognized unrealized gains on interest rate derivative financial instruments in the fourth quarter of 2024 compared to losses in the fourth quarter of 2023. These results were partially offset by higher income tax expense and higher other expense related to asset disposals. |

| Earnings | | Increase largely due to the net impacts of the Acquisition, and higher Share of Profit from PGI, discussed above. |

Adjusted EBITDA(2) | | Higher largely due to the net impacts of the Acquisition, discussed above, and higher net revenue from PGI, driven by higher revenue associated with the oil batteries acquired from Veren in the fourth quarter of 2024, higher volumes at certain PGI assets, and the timing of revenue recognition on capital recoveries. Included in adjusted EBITDA is $193 million (2023: $179 million) related to PGI. |

| | |

Volumes(3) | | Increase primarily due to the volumes now being recognized at Aux Sable following the Acquisition. Volumes at PGI were consistent with prior period as higher interruptible and contracted volumes on certain PGI assets were largely offset by contract expirations in 2024. Volumes include 358 mboe/d (2023: 356 mboe/d) related to PGI. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 6 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation 2024 Annual Report 13

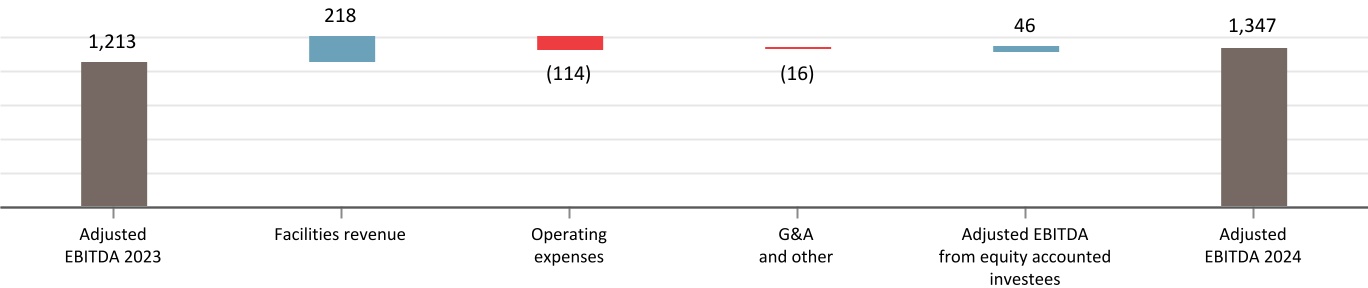

Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

($ millions, except where noted) | 2024 | 2023 | Change | |

| | | | |

| | | | |

Facilities revenue(1) | 1,127 | | 909 | | 218 | | |

| | | | |

| | | | |

Operating expenses(1) | 474 | | 360 | | 114 | | |

Depreciation and amortization included in gross profit | 183 | | 159 | | 24 | | |

Share of profit from equity accounted investees | 231 | | 233 | | (2) | | |

| Gross profit | 701 | | 623 | | 78 | | |

| Earnings | 666 | | 610 | | 56 | | |

Adjusted EBITDA(2) | 1,347 | | 1,213 | | 134 | | |

Volumes(3) | 837 | | 768 | | 69 | | |

| | | | | | |

| Changes in Results | | |

| | |

| | |

Revenue(1) | | Increase largely due to Pembina acquiring a controlling ownership interest in Aux Sable, pursuant to the Alliance/Aux Sable Acquisition on April 1, 2024. The 2024 period includes $223 million in revenue related to Aux Sable as a wholly-owned entity. Additionally, there were no impacts in 2024 from the Northern Pipeline system outage that affected the same period in 2023, which further contributed to the increase in revenue. These increases were partially offset by lower recoverable power and fuel costs primarily at the Redwater Complex. |

Operating expenses(1) | | Increase largely due to the Acquisition, discussed above, partially offset by lower recoverable power and fuel costs. The 2024 period includes $136 million in operating expenses related to Aux Sable as a wholly-owned entity. |

| Depreciation and amortization included in gross profit | | Higher largely due to the Acquisition, discussed above. |

| | |

| | |

Share of profit from equity accounted investees | | Consistent with prior period. Higher contributions from certain PGI assets, driven by higher revenue associated with the oil batteries acquired from Veren in the fourth quarter of 2024, higher volumes, and the timing of revenue recognition on capital recoveries ($14 million), which were more than offset by higher income tax expense and larger unrealized losses recognized by PGI on interest rate derivative financial instruments in 2024 compared to the same period in 2023. |

| Earnings | | Increase largely due to the net impacts of the Acquisition, and no impacts in 2024 from the Northern Pipeline system outage. The increase was partially offset by a $16 million gain on the recognition of a finance lease included as other income in 2023. |

Adjusted EBITDA(2) | | Increase largely due to the net impacts of the Acquisition, and higher adjusted EBITDA from PGI, largely due to higher revenue associated with the oil batteries acquired from Veren in the fourth quarter of 2024, higher volumes at certain PGI assets, and the timing of revenue recognition on capital recoveries. Additionally, there were no impacts in 2024 from the Northern Pipeline system outage, which affected 2023. These increases were partially offset by a $16 million gain on the recognition of a finance lease included as other income in 2023. Included in adjusted EBITDA is $709 million (2023: $657 million) related to PGI. |

Volumes(3) | | Increase primarily due to the volumes now being recognized at Aux Sable following the Acquisition, and higher volumes compared to 2023, which was impacted by the Northern Pipeline system outage, combined with higher interruptible and contracted volumes on certain PGI assets. These increases were partially offset by lower volumes largely due to a planned outage and a rail strike at the Redwater Complex in the third quarter of 2024, resulting in volume curtailments. Volumes include 358 mboe/d (2023: 351 mboe/d) related to PGI. |

Change in Adjusted EBITDA ($ millions)(1)(2)

(1) Includes inter-segment transactions. See Note 6 to the Consolidated Financial Statements.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

14 Pembina Pipeline Corporation 2024 Annual Report

Financial and Operational Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 | 12 Months Ended December 31 |

| 2024 | 2023 | 2024 | 2023 |

| ($ millions, except where noted) | Volumes(1) | Earnings | Adjusted EBITDA(2) | Volumes(1) | Earnings | Adjusted EBITDA(2) | Volumes(1) |

Earnings | Adjusted EBITDA(2) | Volumes(1) | Earnings | Adjusted EBITDA(2) |

Facilities(3) | | | | | | | | | | | | |

| Gas Services | 597 | | 77 | | 222 | | 602 | | 57 | | 203 | | 598 | | 300 | | 818 | | 584 | | 285 | | 755 | |

| NGL Services | 280 | | 100 | | 151 | | 199 | | 87 | | 122 | | 239 | | 367 | | 530 | | 185 | | 327 | | 460 | |

| General & administrative | — | | — | | — | | — | | (1) | | (1) | | — | | (1) | | (1) | | — | | (2) | | (2) | |

| Total | 877 | | 177 | | 373 | | 801 | | 143 | | 324 | | 837 | | 666 | | 1,347 | | 768 | | 610 | | 1,213 | |

(1) Revenue volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's gas services and NGL services assets within the Facilities operating segment. For a description of Pembina's gas and NGL assets, refer to Pembina's AIF for the year ended December 31, 2024.

Pembina Pipeline Corporation 2024 Annual Report 15

Projects & New Developments(1)

Facilities continues to build-out its natural gas and NGL processing and fractionation assets to service customer demand. The following outlines the projects and new developments within Facilities:

| | | | | | | | |

| RFS IV | | |

Capital Budget: $525 million | In-service Date(2): First half of 2026 | Status: On time, on updated budget |

RFS IV is a 55,000 bpd propane-plus fractionator at the existing Redwater fractionation and storage complex (the "Redwater Complex"). The project includes additional rail loading capacity and will leverage the design, engineering, and operating best practices of the existing facilities at the Redwater Complex. With the addition of RFS IV, the fractionation capacity at the Redwater Complex will total 256,000 bpd. As previously announced, the estimated project cost has been revised to $525 million (previously $460 million), reflecting project scope changes as well as higher equipment, material and labour costs in light of growing Alberta construction activity. Pembina has entered into a lump-sum engineering, procurement and construction agreement in respect of the project, for more than 70 percent of the project cost. Fabrication and construction activities continued for the facility in the fourth quarter of 2024, while piling and foundation work was completed for both the facility and infrastructure. |

| | | | | | | | |

| Wapiti Expansion | | |

Capital Budget: $140 million (net to Pembina) | In-service Date(2): First half of 2026 | Status: On time, on budget |

PGI is developing an expansion that will increase natural gas processing capacity at the Wapiti Plant by 115 mmcf/d (gross to PGI). The expansion opportunity is driven by strong customer demand supported by growing Montney production and is fully underpinned by long-term, take-or-pay contracts. The project includes a new sales gas pipeline and other related infrastructure. During the fourth quarter of 2024, engineering and equipment fabrication progressed and early works construction commenced. |

| | | | | | | | |

| K3 Cogeneration Facility | | |

Capital Budget: $70 million (net to Pembina) | In-service Date(2): First half of 2026 | Status: On time, on budget |

PGI is developing a 28 MW cogeneration facility at its K3 Plant, which is expected to reduce overall operating costs by providing power and heat to the gas processing facility, while reducing customers' exposure to power prices. The K3 Cogeneration Facility is expected to fully supply the K3 Plant's power requirements, with excess power sold to the grid at market rates. Further, through the utilization of the cogeneration waste heat and the low-emission power generated, the project is expected to contribute to a reduction in annual emissions compliance costs at the K3 Plant. During the fourth quarter of 2024, early works construction commenced. |

Pembina announced the closing of PGI's acquisition of a 50 percent working interest in Whitecap Resources Inc.'s ("Whitecap") 15-07 Kaybob Complex effective December 31, 2024. Concurrent with the acquisition, PGI agreed to support future infrastructure development for Whitecap's Lator area development, including a new battery and gathering laterals (the "Lator Infrastructure"), which PGI will own. PGI anticipates funding up to $400 million ($240 million net to Pembina) for the battery and gathering laterals within the first phase of the Lator Infrastructure, with all gas volumes flowing to PGI's Musreau facility upon startup in late 2026/early 2027, supporting long-term plant utilization.

Pembina announced the closing of PGI's transaction with Veren, which includes the acquisition of Veren's Gold Creek and Karr area oil batteries and support for future infrastructure development effective October 9, 2024. As part of the transaction, PGI committed to fund capital up to $300 million ($180 million net to Pembina) for future battery and gathering infrastructure in the Gold Creek and Karr areas.

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2024 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

(2) Subject to environmental and regulatory approvals. See the "Forward-Looking Statements & Information" section of this MD&A.

16 Pembina Pipeline Corporation 2024 Annual Report

Marketing & New Ventures

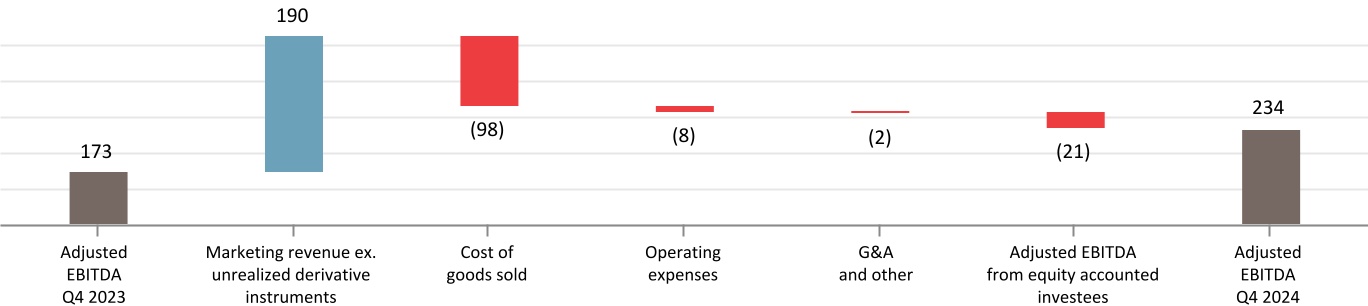

Financial Overview for the Three Months Ended December 31

Results of Operations | | | | | | | | | | | | |

| ($ millions, except where noted) | 2024 | 2023 | Change | |

Marketing revenue(1)(2) | 1,133 | | 1,030 | | 103 | | |

Cost of goods sold(1)(2) | 919 | | 821 | | 98 | | |

Net revenue(1)(2)(3) | 214 | | 209 | | 5 | | |

Operating expenses(2) | 12 | | 4 | | 8 | | |

| Depreciation and amortization included in gross profit | 17 | | 12 | | 5 | | |

| Share of profit from equity accounted investees | 74 | | 15 | | 59 | | |

| Gross profit | 259 | | 208 | | 51 | | |

| Earnings | 245 | | 204 | | 41 | | |

Adjusted EBITDA(3) | 234 | | 173 | | 61 | | |

Crude oil sales volumes(4) | 96 | | 82 | | 14 | | |

NGL sales volumes(4) | 252 | | 217 | | 35 | | |

| | | | | | |

| Change in Results | | |

| | |

| | |

Net revenue(1)(2)(3) | | Consistent with prior period. Higher NGL net revenue from contracts with customers was largely due to higher NGL margins and the Acquisition, in which Pembina acquired a controlling ownership interest in Aux Sable. The fourth quarter of 2024 includes $49 million in net revenue related to Aux Sable as a wholly-owned entity. Net revenue from crude oil sales was largely consistent with prior period as higher volumes were partially offset by lower prices.

Higher NGL net revenue from contracts with customers was offset by lower revenue from risk management and physical derivative contracts largely due to unrealized losses on crude oil-based and NGL-based derivatives compared to gains in the fourth quarter of 2023, combined with lower realized gains on crude oil-based derivatives, primarily due to changes in pricing. The fourth quarter of 2024 includes unrealized losses on commodity-related derivatives of $41 million (2023: $46 million gain) and realized gains on commodity-related derivatives of $52 million (2023: $66 million gain). |

| | |

| | |

| | |

| | |

| Share of profit from equity accounted investees | | Increase largely due to unrealized gains on interest rate derivative financial instruments recognized by Cedar LNG, which were entered into in the third quarter of 2024, partially offset by foreign exchange losses. Share of Profit in the fourth quarter of 2023 relates to the results from Aux Sable. Following the Acquisition on April 1, 2024, the results from Aux Sable are no longer accounted for in Share of Profit and are now being fully consolidated. |

| Earnings | | Increase primarily due to higher Share of Profit from Cedar LNG and higher net revenue from contracts with customers, which were largely offset by lower revenue from risk management and physical derivative contracts, discussed above. |

Adjusted EBITDA(3) | | Higher largely due to higher NGL margins and the impacts of the Acquisition, partially offset by lower realized gains on commodity-related derivatives, discussed above. |

Crude oil sales volumes(4) | | Primarily higher due to increased blending opportunities driven by favorable price differentials in the fourth quarter of 2024 compared to the fourth quarter of 2023. |

NGL sales volumes(4) | | Increase primarily due to higher ethane, propane, and butane sales largely due to the increase in Pembina's ownership interest in Aux Sable. |

Change in Adjusted EBITDA ($ millions)(1)(2)(3)

(1) Comparative 2023 period has been adjusted. See "Accounting Policies & Estimates – Change in Accounting Policies" and Note 4 to the Consolidated Financial Statements.

(2) Includes inter-segment transactions. See Note 6 to the Consolidated Financial Statements.

(3) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(4) Marketed crude and NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

Pembina Pipeline Corporation 2024 Annual Report 17

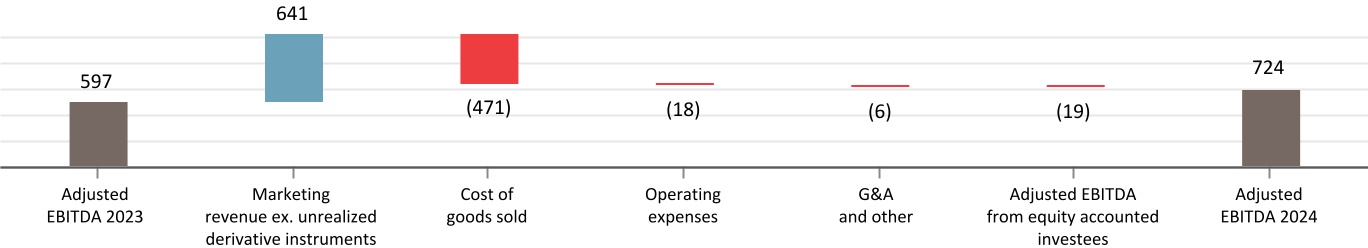

Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions, except where noted) | 2024 | 2023 | Change | |

Marketing revenue(1)(2) | 3,796 | | 3,293 | | 503 | | |

Cost of goods sold(1)(2) | 3,198 | | 2,736 | | 462 | | |

Net revenue(1)(2)(3) | 598 | | 557 | | 41 | | |

Operating expenses(2) | 25 | | 7 | | 18 | | |

| Depreciation and amortization included in gross profit | 64 | | 46 | | 18 | | |

| Share of profit (loss) from equity accounted investees | 55 | | (26) | | 81 | | |

| Gross profit | 564 | | 478 | | 86 | | |

| Earnings | 569 | | 435 | | 134 | | |

Adjusted EBITDA(3) | 724 | | 597 | | 127 | | |

Crude oil sales volumes(4) | 99 | | 86 | | 13 | | |

NGL sales volumes(4) | 228 | | 185 | | 43 | | |

| | | | | | |

| Change in Results | | |

| | |

| | |

Net revenue(1)(2)(3) | | Higher net NGL revenue from contracts with customers was largely due to higher NGL margins and the Acquisition, in which Pembina acquired a controlling ownership interest in Aux Sable, and a cost recovery related to a storage insurance settlement recognized in the third quarter of 2024. These increases were partially offset by a nine-day unplanned outage at Aux Sable in July 2024 ($13 million). The 2024 period includes $139 million in net revenue related to Aux Sable as a wholly-owned entity. Net revenue from crude oil sales was largely consistent with prior period.

Lower revenue from risk management and physical derivative contracts was primarily due to larger unrealized losses on renewable power purchase agreements largely due to a decline in forward power prices, combined with unrealized losses on crude oil-based derivatives and realized losses on NGL-based derivatives in 2024, compared to gains in 2023. These results were partially offset by lower unrealized losses on NGL-based derivatives, and larger realized gains on crude oil-based derivatives. The 2024 period includes unrealized losses on commodity-related derivatives of $170 million (2023: $32 million loss) and realized gains on commodity-related derivatives of $241 million (2023: $315 million gain). |

Operating expenses(1) | | Increase due to certain freight costs previously included in cost of goods sold. |

| | |

| | |

| Share of profit (loss) from equity accounted investees | | Increase largely due to unrealized gains on interest rate derivative financial instruments recognized by Cedar LNG, which were entered into in the third quarter of 2024, as well as strong results from Aux Sable in the first quarter of 2024, partially offset by foreign exchange losses in Cedar LNG. Following the Acquisition on April 1, 2024, the results from Aux Sable are no longer accounted for in Share of Profit and are now being fully consolidated. The loss in 2023 largely relates to provisions recognized by Aux Sable. |

| Depreciation and amortization included in gross profit | | Increase largely due to a change in the expected useful life of certain intangible assets. |

| Earnings | | Increase largely due to higher Share of Profit, higher net revenue,discussed above, and gains associated with the derecognition of the provision related to financial assurances provided by Pembina which were assumed by Cedar LNG following the positive FID in June 2024, partially offset by higher depreciation. |

Adjusted EBITDA(3) | | Increase mainly from higher NGL margins and the Acquisition, partially offset by realized losses on NGL-based derivatives in 2024 compared to gains in 2023, and the nine-day unplanned outage at Aux Sable in July 2024. |

Crude oil sales volumes(4) | | Primarily higher due to increased blending opportunities driven by favorable price differentials in 2024 compared to the same period in 2023. |

NGL sales volumes(4) | | Increase primarily due to higher ethane, propane, and butane sales largely due to the increase in Pembina's ownership interest in Aux Sable, and the impact of lower supply volumes from the Redwater Complex in 2023 due to the impacts of the Northern Pipeline system outage. |

Change in Adjusted EBITDA ($ millions)(1)(2)(3)

(1) Comparative 2023 period has been adjusted. See "Accounting Policies & Estimates – Change in Accounting Policies" and Note 4 to the Consolidated Financial Statements.

(2) Includes inter-segment transactions. See Note 6 to the Consolidated Financial Statements.

(3) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(4) Marketed crude and NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

18 Pembina Pipeline Corporation 2024 Annual Report

Financial and Operational Overview

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3 Months Ended December 31 | 12 Months Ended December 31 |

| 2024 | 2023 | 2024 | 2023 |

| ($ millions, except where noted) | Volumes(1) | Earnings | Adjusted EBITDA(2) | Volumes(1) | Earnings (loss) | Adjusted EBITDA(2) | Volumes(1) | Earnings | Adjusted EBITDA(2) | Volumes(1) | Earnings (loss) | Adjusted EBITDA(2) |

Marketing & New Ventures(3) | | | | | | | | | | | | |

| Marketing | 349 | | 174 | | 237 | | 299 | | 206 | | 174 | | 327 | | 510 | | 731 | | 271 | | 465 | | 625 | |

New Ventures(4) | — | | 71 | | (3) | | — | | (2) | | (1) | | — | | 59 | | (7) | | — | | (30) | | (28) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Total | 349 | | 245 | | 234 | | 299 | | 204 | | 173 | | 327 | | 569 | | 724 | | 271 | | 435 | | 597 | |

(1) Marketed crude and NGL volumes in mboe/d. See the "Abbreviations" section of this MD&A for definition.

(2) Refer to the "Non-GAAP & Other Financial Measures" section of this MD&A.

(3) Includes values attributed to Pembina's marketing activities and new ventures projects within the Marketing & New Ventures operating segment. For further details on Pembina's marketing activities and projects, refer to Pembina's AIF for the year ended December 31, 2024.

(4) All New Ventures projects have not yet commenced operations and therefore have no volumes.

Pembina Pipeline Corporation 2024 Annual Report 19

Projects & New Developments(1)

The New Ventures group is responsible for the development of new large-scale, or value chain extending projects, including those that provide enhanced access to global markets and support a transition to a lower-carbon economy. Currently, Pembina is pursuing opportunities associated with LNG, low-carbon commodities, and large-scale GHG emissions reductions.

Cedar LNG

In June 2024, Pembina and its partner, the Haisla Nation, announced a positive FID in respect of the Cedar LNG Project, a 3.3 mtpa floating LNG facility in Kitimat, British Columbia, within the traditional territory of the Haisla Nation. The Cedar LNG Project will provide a valuable outlet for WCSB natural gas to access global markets and is expected to achieve higher prices for Canadian producers and enhance global energy security. Given that it will be a floating LNG facility, manufactured in the controlled conditions of a shipyard, it is expected that the Cedar LNG Project will have lower construction and execution risk. Further, powered by BC Hydro, the Cedar LNG Project is expected to be one of the lowest emissions LNG facilities in the world.

Cedar LNG has secured a 20-year take-or-pay, fixed toll contract with ARC Resources Ltd. ("ARC") for 1.5 mtpa of LNG. As part of the arrangement with ARC, ARC will supply Cedar LNG with approximately 200 MMcf/d of natural gas to be transported via the Coastal GasLink Pipeline from its production base in the Montney. Pembina has also entered into an agreement with Cedar LNG for 1.5 mtpa of capacity on the same terms as ARC. In late 2024, Pembina initiated remarketing discussions with a broad range of potential customers, including both LNG portfolio players and Canadian producers. Pembina has received non-binding proposals covering well in excess of its contracted capacity and is in the process of shortlisting preferred counterparties to transition to definitive agreements.

The Cedar LNG Project has an estimated cost of approximately U.S.$3.4 billion (gross), including U.S.$2.3 billion (gross), or approximately 70 percent of the estimated cost, for the floating LNG production unit, which is being constructed under a fixed-price, lump-sum agreement with Samsung Heavy Industries and Black & Veatch, and U.S.$1.1 billion (gross) related to onshore infrastructure, owner's costs, commissioning and start-up costs, financial assurances during construction, and other costs. The total cost of the Cedar LNG Project, including approximately U.S.$0.6 billion (gross) of interest during construction and transaction costs, is expected to be approximately U.S.$4.0 billion (gross). Site clearing and civil works on the marine terminal site commenced in the third quarter of 2024 and construction of the floating LNG facility is expected to begin in mid-2025. The anticipated in-service date of the Cedar LNG Project is in late 2028.

Alberta Carbon Grid

Pembina and TC Energy have formed a partnership to develop the Alberta Carbon Grid, a carbon transportation and sequestration platform. Alberta Carbon Grid completed the appraisal well drilling, logging and testing, with well data that was incorporated into a detailed subsurface model confirming the sequestration capability. Alberta Carbon Grid continues commercial conversations with potential customers and refining the project scope.

(1) For further details on Pembina's significant assets, including definitions for capitalized terms used herein that are not otherwise defined, refer to Pembina's AIF for the year ended December 31, 2024 filed at www.sedarplus.ca (filed with the U.S. Securities and Exchange Commission at www.sec.gov under Form 40-F) and on Pembina's website at www.pembina.com.

20 Pembina Pipeline Corporation 2024 Annual Report

Corporate and Income Tax

Financial Overview for the Three Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions) | 2024 | 2023 | Change | |

| | | | |

| | | | |

Revenue(1) | 11 | 12 | | (1) | | |

| General and administrative | 67 | | 103 | (36) | | |

| Other expense | 8 | | 6 | | 2 | | |

| | | | |

| Net finance costs | 151 | 111 | 40 | | |

| | | | |

| | | | |

| | | | |

| Earnings (loss) | (212) | | (209) | | (3) | | |

Adjusted EBITDA(2) | (39) | | (81) | | 42 | | |

| Income tax expense | 172 | | 117 | | 55 | | |

| | | | | | |

| Change in Results | | |

Revenue(1) | | Consistent with prior period. Relates primarily to fixed fee income related to shared service agreements with PGI. |

| General and administrative | | Decrease largely due to lower incentives costs, primarily driven by the change in Pembina's share price in the fourth quarter of 2024 compared to the fourth quarter of 2023. |

| | |

| | |

| Net finance costs | | Increase largely due to higher interest expense on long-term debt due to a combination of additional borrowing following the Acquisition, and higher interest rates. |

| Earnings (loss) | | Consistent with prior period, as higher net finance costs were largely offset by lower incentives costs. |

Adjusted EBITDA(2) | | Increase largely due to lower incentives costs, discussed above. |

| Income tax expense | | Increase largely due to the recognition of deferred tax assets in the fourth quarter of 2023, which lowered income tax expense in 2023, partially offset by lower earnings. |

| | |

Financial Overview for the 12 Months Ended December 31

Results of Operations

| | | | | | | | | | | | |

| ($ millions) | 2024 | 2023 | Change | |

| | | | |

| | | | |

Revenue(1) | 45 | 47 | | (2) | | |

General and administrative | 305 | 314 | (9) | | |

| Other expense | 35 | | 6 | | 29 | | |

| Loss on Alliance/Aux Sable Acquisition | 616 | — | | 616 | | |

| Net finance costs | 518 | 425 | 93 | | |

| Earnings (loss) | (1,422) | | (696) | | (726) | | |

Adjusted EBITDA(2) | (196) | | (220) | | 24 | | |

| | | | |

| | | | |

| Income tax (recovery) expense | (154) | | 413 | | (567) | | |

| | | | | | |

| Change in Results | | |

Revenue(1) | | Consistent with prior period. Relates primarily to fixed fee income related to shared service agreements with PGI. |

| General and administrative | | Decrease largely due to lower consulting fees and lower incentives costs, partially offset by higher salaries and wages, and higher information technology-related maintenance costs. |

| Other expense | | Increase largely due to higher acquisition fees and integration costs related to the Alliance/Aux Sable Acquisition. |

| Loss on Alliance/Aux Sable Acquisition | | $616 million loss recognized from the deemed disposition of Pembina's previous investments in the Acquirees following the Acquisition, offset by a $626 million deferred tax recovery recognized from the Acquisition, resulting in a net gain of $10 million. Refer to Note 4 and Note 5 to the Consolidated Financial Statements for further details. |

| Net finance costs | | Increase largely due to higher interest expense on long-term debt due to a combination of additional borrowing following the Acquisition, and higher interest rates, partially offset by higher interest income. |

| Earnings (loss) | | Decrease largely due to the loss recognized on the Acquisition, higher net finance costs, and higher acquisition fees and integration costs related to the Acquisition, partially offset by lower general & administrative costs. |

Adjusted EBITDA(2) | | Increase largely due to lower general & administrative costs, discussed above. |