3

Management report |

INTRODUCTION

Company overview

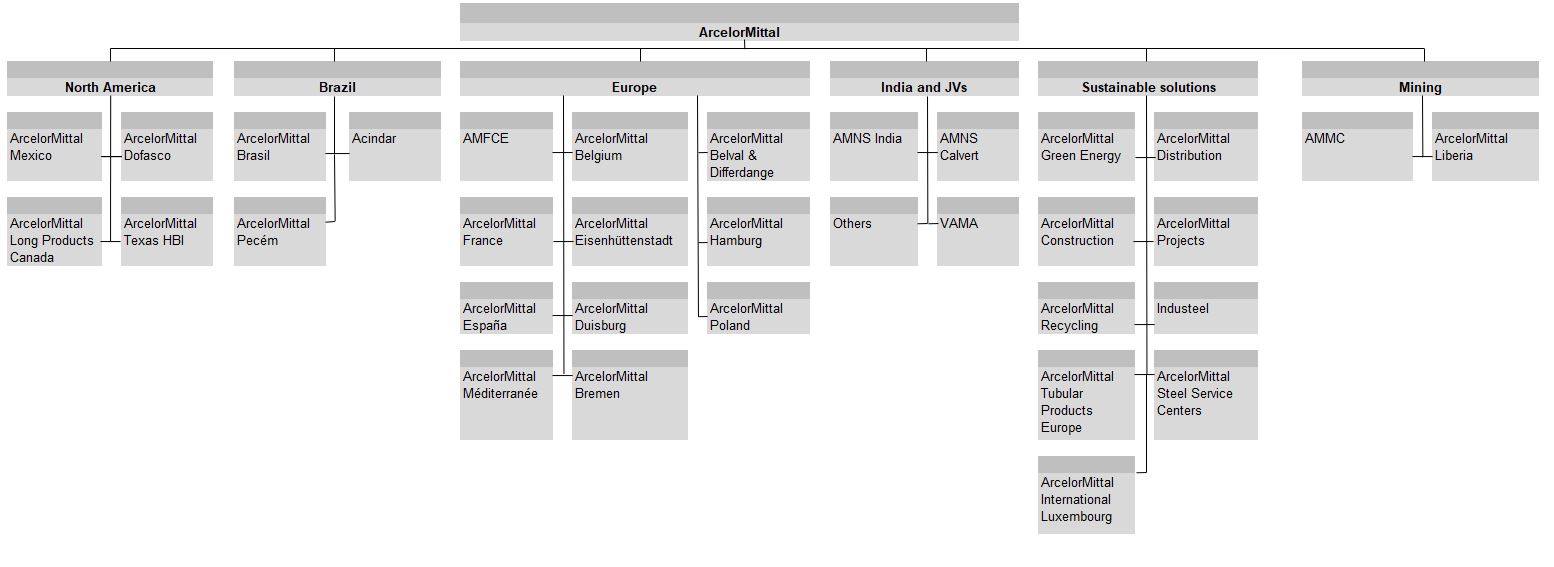

ArcelorMittal is one of the world’s leading integrated steel and

mining companies. ArcelorMittal is the largest steel producer in

Europe and among the largest in the Americas, and a growing

presence in Asia including India through its joint venture AMNS

India.

*Iron ore production includes production from ArcelorMittal Mining Canada G.P.

and ArcelorMittal Infrastructure G.P. ("AMMC"), ArcelorMittal Liberia and captive

mines.

ArcelorMittal has steel-making operations in 15 countries,

including 36 integrated and mini-mill steel-making facilities. As of

December 31, 2024, ArcelorMittal had approximately 125,416

employees.

ArcelorMittal produces a broad range of high-quality finished

and semi-finished steel products ("semis"). Specifically,

ArcelorMittal produces flat products, including sheet and plate,

and long products, including bars, rods and structural shapes. It

also produces pipes and tubes for various applications.

ArcelorMittal sells its products primarily in local markets and to a

diverse range of customers in approximately 129 countries,

including the automotive, appliance, engineering, construction

and machinery industries. ArcelorMittal’s mining operations

produce various types of mining products including iron ore

lump, fines, concentrate, pellets and sinter feed.

As a global steel producer, the Company is able to meet the

needs of different markets. Steel consumption and product

requirements clearly differ between developed markets and

developing markets. Steel consumption in developed economies

is weighted towards flat products and a higher value-added mix,

while developing markets utilize a higher proportion of long

products and commodity grades. To meet these diverse needs,

the Company maintains a high degree of product diversification

and seeks opportunities to increase the proportion of higher

value-added products in its product mix.

History and development of the Company

ArcelorMittal results from the merger in 2007 of its predecessor

companies Mittal Steel Company N.V. and Arcelor, each of

which had grown through acquisitions over many years. Since

its creation ArcelorMittal has experienced periods of external

growth as well as consolidation and deleveraging (including

through divestment).

ArcelorMittal's success is built on its core values of safety,

sustainability, quality and leadership and the entrepreneurial

boldness that has empowered its emergence as the first truly

global steel and mining company. Acknowledging that a

combination of structural issues and macroeconomic conditions

will continue to challenge returns in its sector, the Company has

adapted its footprint to the new demand realities, redoubled its

efforts to control costs and repositioned its operations with a

view toward outperforming its competitors. ArcelorMittal’s

research and development capability is strong and includes

several major research centers as well as strong academic

partnerships with universities and other scientific bodies.

Against this backdrop, ArcelorMittal's strategy is to leverage four

distinctive attributes that will enable it to capture leading

positions in the most attractive areas of the steel industry’s

value chain, from mining at one end to distribution and first-

stage processing at the other: global scale and scope; superior

technical capabilities; a diverse portfolio of steel and related

businesses, one of which is mining; and financial capabilities.

The Company’s strategy is further detailed under “Business

overview—Business strategy”.

ArcelorMittal’s steel-making operations have a high degree of

geographic diversification. In 2024, approximately 38%

of its crude steel was produced in the Americas, approximately

53% was produced in Europe and approximately 9% was

produced in other countries, such as South Africa and Ukraine.

In addition, ArcelorMittal’s sales of steel products are spread

over both developed and developing markets, which have

different consumption characteristics. ArcelorMittal’s mining

operations, including captive mines are present in North

America, South America, Africa and Europe. Captive mines are

integrated into the Company's global steel-making facilities.

Competitive strengths

The Company believes that the following factors contribute to

ArcelorMittal’s success in the global steel and mining industry:

Market leader in steel. ArcelorMittal had annual achievable

production capacity of approximately 76.7 million tonnes of